Get the free SEC Form 13F-HR Filing List - Quarterly Institutional Holdings ...

Get, Create, Make and Sign sec form 13f-hr filing

Editing sec form 13f-hr filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 13f-hr filing

How to fill out sec form 13f-hr filing

Who needs sec form 13f-hr filing?

Everything You Need to Know About SEC Form 13F-HR Filing Form

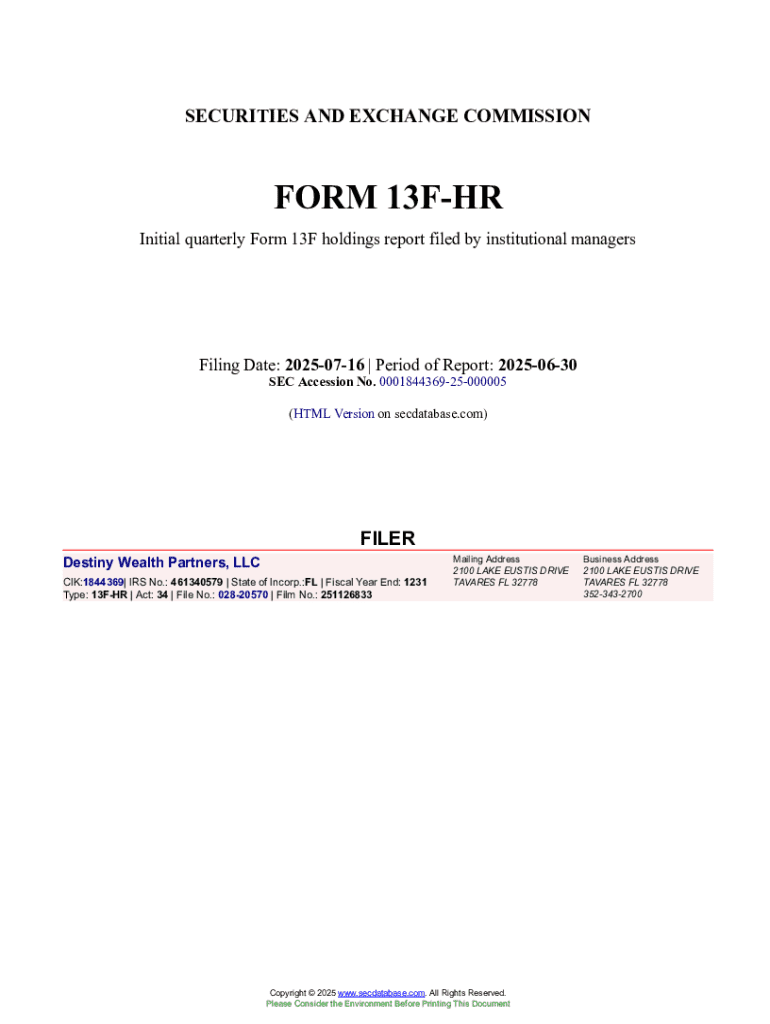

Understanding SEC Form 13F

SEC Form 13F is a crucial financial reporting form which institutional investment managers are required to file with the Securities and Exchange Commission (SEC) under Section 13(f) of the Securities Exchange Act of 1934. This form offers a snapshot of the securities held in institutional investment portfolios and is a key resource for tracking investment managers' holdings.

The primary purpose of SEC Form 13F is to enhance transparency in institutional investment activities, allowing market participants to assess the investment strategies of large players in the market. By combining public accessibility with detailed insights, the form serves as an important tool for analysts, investors, and regulators.

Who is required to file Form 13F?

Not all investment managers need to file SEC Form 13F. The requirement specifically applies to institutional investment managers whose discretion over client assets exceeds $100 million. These managers can range from large hedge funds to mutual funds and some pension plans, each managing large portfolios that warrant regulatory oversight.

Understanding the criteria for filing is essential for compliance and operational integrity. If a firm meets the $100 million threshold, it is required by law to file Form 13F quarterly. Organizations that do not meet this threshold, such as smaller advisors who manage fewer assets, are exempt from submitting this form.

Types of Form 13F filings

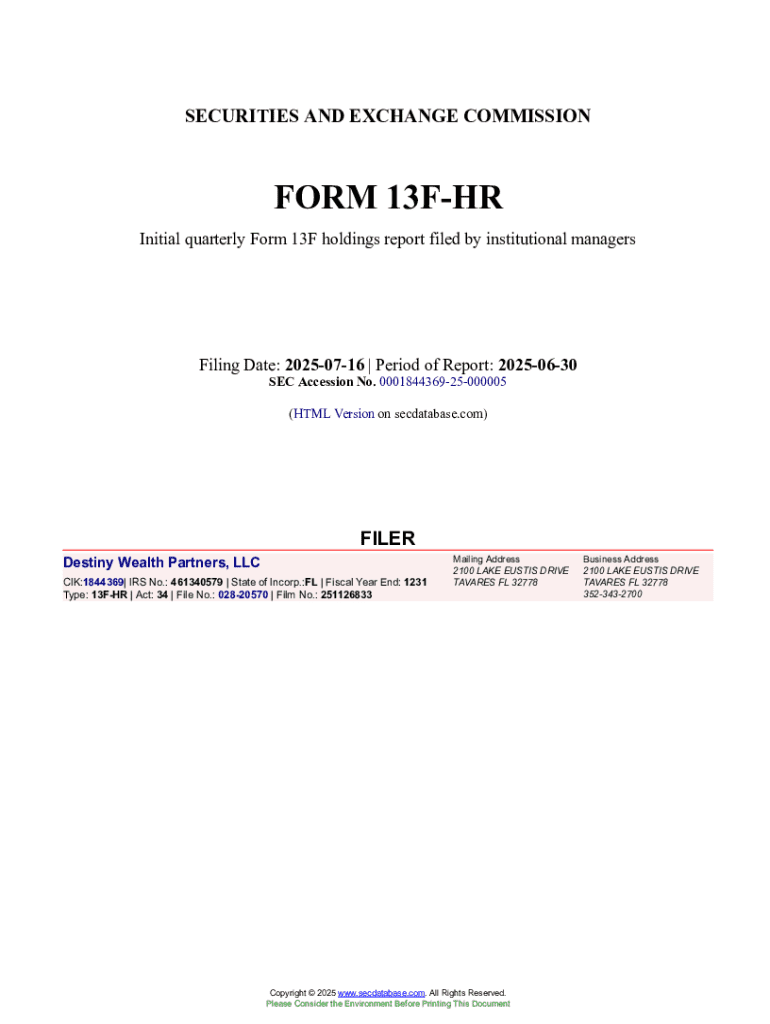

Institutional investment managers utilize two types of filings under SEC Form 13F: the 13F-HR and the 13F-NT. The 13F-HR is the traditional filing that documents all reportable securities held in the manager's portfolio, while the 13F-NT is a notice that indicates no reportable securities exist for the specified reporting period.

Choosing between these filing types depends on whether the investment manager has reportable securities to disclose. For managers with holdings exceeding the reporting thresholds, the 13F-HR is required. Conversely, if there are no holdings to report, the 13F-NT can be submitted to maintain compliance while simplifying the filing process.

Essential components of Form 13F

Filing SEC Form 13F involves mandatory disclosure of various critical information. First, the form requires details about the filing institutional investment manager, including their name, address, and SEC file number. Accurate data entry is crucial because incorrect information can lead to compliance issues.

A significant part of the filing involves listing the specific reportable securities held in the investment portfolio. These must be formatted according to SEC guidelines, including a description of the securities, their class, and their pertinent details such as CUSIP number and fair market value. Managers must ensure that the securities included meet the reportable threshold, which typically involves those with a market value of over $200,000 or exceeding 10,000 shares.

Filing deadlines for Form 13F

Timely submission of SEC Form 13F is not only a regulatory requirement but also a critical component of maintaining institutional credibility. The form must be filed within 45 days after the end of each quarter, specifically on the 15th day of the month after the quarter ends. For example, filings for the first quarter must be submitted by May 15.

Late filings can result in various consequences, including fines and potential reputational damage. Therefore, institutional managers must prioritize adherence to these deadlines to uphold compliance and foster transparency with stakeholders.

Filing formats and submission methods

SEC Form 13F must be submitted electronically through the SEC's EDGAR system, which requires a standardized formatting approach. Investment managers must ensure their documents are in the proper format as misformatted submissions may be rejected. Adopting best practices for document preparation and submission is crucial to avoid compliance setbacks.

Utilizing electronic filing tools, such as pdfFiller, simplifies the submission process. By leveraging these tools, managers can enhance accuracy in formatting and ease the overall filing burden. This modern technology reduces the likelihood of errors and enables collaboration throughout the filing process, streamlining communication and review cycles.

Managing your SEC Form 13F filings with pdfFiller

Managing SEC Form 13F filings can be streamlined with tools like pdfFiller. This platform enables institutional managers to automate various aspects of their filing process, ensuring documents are correctly formatted, signed, and stored securely. By utilizing pdfFiller, users can navigate the interface to better manage their filings, collaborate with teams, and enhance overall document handling.

Editing and customizing your Form 13F is made straightforward with pdfFiller's advanced features. Managers can efficiently add eSignatures, modify content, and work collectively with team members throughout the filing process. Furthermore, secure cloud storage provided by pdfFiller ensures that submitted documents are easily retrievable and safeguarded against loss.

Tips for efficient filing and management

Organizing financial data prior to filing Form 13F can significantly enhance efficiency. Investment managers should keep a systematic approach to collect accurate data about securities and their values. Implementing a proactive filing strategy involves using templates and auto-fill features available in pdfFiller, enabling a streamlined reporting process that saves time and minimizes errors.

Regular updates to the filing records are crucial for maintaining compliance. As market conditions and holdings can frequently shift, ensuring that your filings reflect the current status is vital. By routinely reviewing and updating Form 13F data, institutional managers can avoid surprises and ensure adherence to SEC requirements.

Monitoring and following up after filing

After submitting SEC Form 13F, it is crucial to monitor the status of the submission. Institutional managers can track whether their filings were accepted or if there are any required amendments. In case of discrepancies or needed corrections, amendments to the filing can be made, ensuring compliance is consistently upheld.

Best practices for documentation include maintaining a record of all submissions and communications with the SEC. This diligence could prove invaluable in case of future audits or inquiries, where having clear records aids in demonstrating compliance and thoroughness in financial reporting.

Common questions about SEC Form 13F

It is common to have questions regarding SEC Form 13F, especially around compliance and audit processes. For example, managers might wonder what actions to take if contacted by the SEC regarding a filing. Understanding how to communicate effectively during these situations is key to managing compliance risks.

Moreover, handling audits related to Form 13F can feel daunting. However, having a well-documented filing history and a systematized record-keeping approach helps ease the audit process. Managers should utilize resources and tools, like pdfFiller, to stay updated on evolving filing requirements and regulatory changes to maintain compliance effortlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the sec form 13f-hr filing electronically in Chrome?

Can I create an eSignature for the sec form 13f-hr filing in Gmail?

How do I fill out sec form 13f-hr filing using my mobile device?

What is sec form 13f-hr filing?

Who is required to file sec form 13f-hr filing?

How to fill out sec form 13f-hr filing?

What is the purpose of sec form 13f-hr filing?

What information must be reported on sec form 13f-hr filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.