Get the free Form D: What is it?Portland, Oregon Securities Lawyers

Get, Create, Make and Sign form d what is

Editing form d what is online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form d what is

How to fill out form d what is

Who needs form d what is?

What is Form ? Understanding SEC Filing for Capital Raising

Understanding SEC Form

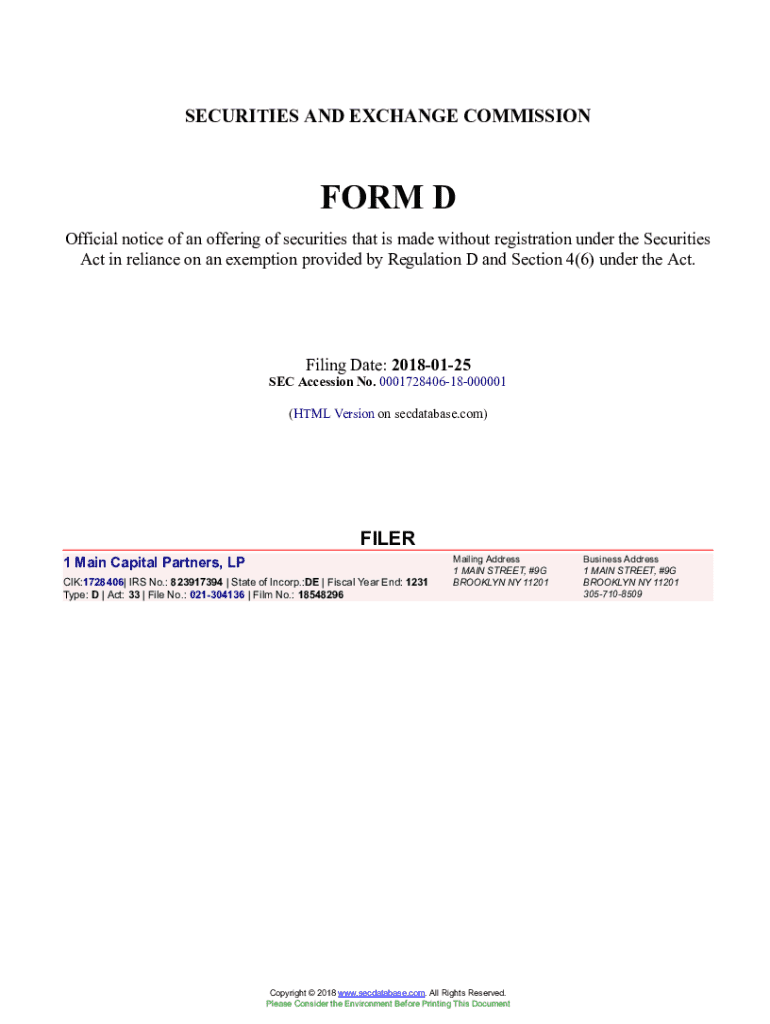

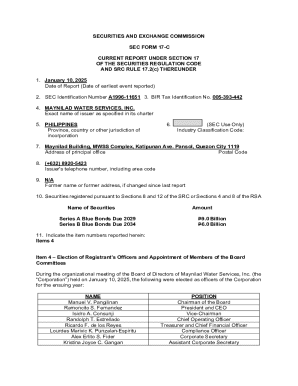

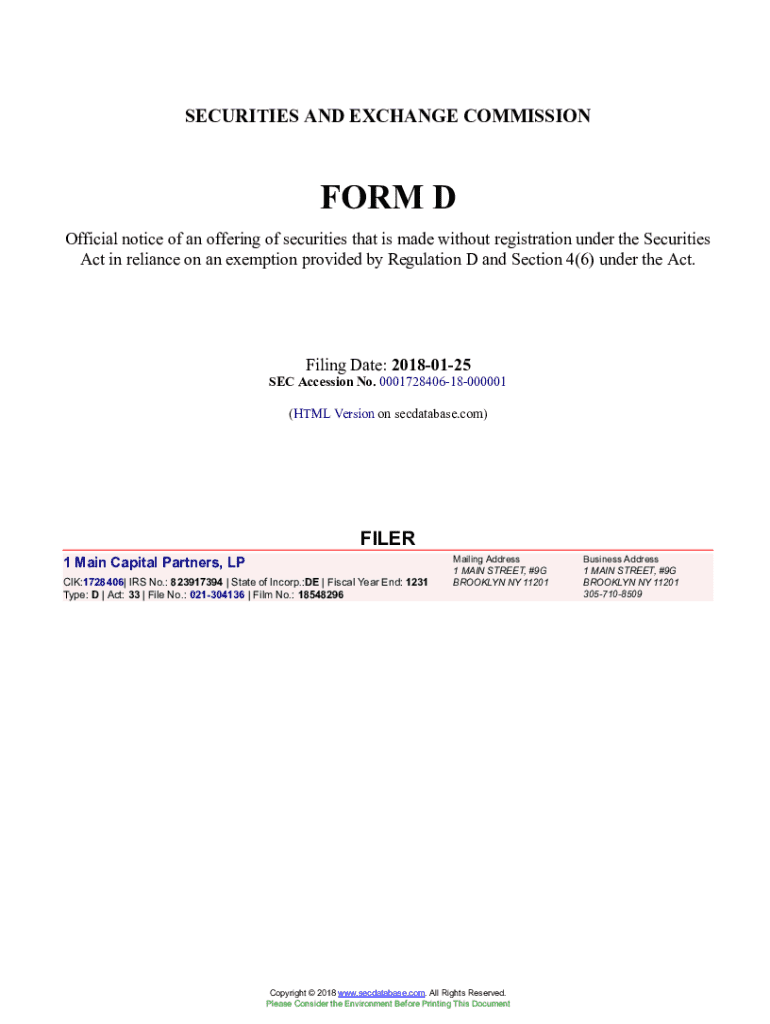

SEC Form D is a crucial document for private companies and startups seeking to raise capital through the sale of securities. It serves as a notice of exempt offerings that provides the Securities and Exchange Commission (SEC) with essential information about the offering. Form D allows companies to bypass the lengthy and complex process typically required by the SEC for public offerings, enabling them to access funding more efficiently.

The primary purpose of Form D is to inform the SEC and state regulators about the details of a private placement transaction. This form is particularly important for startups and private companies, as it allows them to raise funds from accredited investors without undergoing the full registration process required for public securities offerings.

In essence, Form D acts as a bridge for companies to connect with investors while ensuring regulatory compliance. By understanding what Form D entails, companies can better navigate the capital-raising landscape and utilize this instrument effectively.

The context of Form

The Securities and Exchange Commission (SEC) was established to protect investors, maintain fair and orderly markets, and promote capital formation. Within this regulatory framework, Form D fits as a streamlined vehicle for exempt offerings under Regulation D. By allowing companies to file Form D, the SEC aims to facilitate access to capital, particularly for smaller companies with limited resources.

Historically, Form D has evolved alongside changes in market dynamics and investor needs. Initially introduced to simplify the fundraising process, it has undergone revisions to better serve the needs of a diverse range of companies. The evolution of Form D reflects the SEC's commitment to balancing investor protection with the need to promote efficient capital formation.

Understanding the context of Form D is essential for companies looking to navigate the regulatory environment effectively. It establishes a framework within which businesses can operate while staying compliant with securities laws.

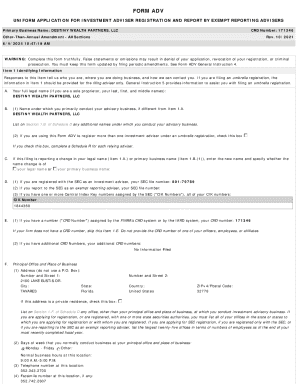

The Form filing process

Filing Form D involves a series of requirements and steps to ensure compliance with SEC regulations. Primarily, companies must disclose specific information about the offering, such as the amount of money being raised, the type of investors being targeted, and any relevant terms of the offering. The filing must be completed within 15 days after the first sale of securities in the offering.

Key timelines for Form D submissions are critical, particularly given the pressures of fundraising. Companies must be diligent about ensuring that their filings align with their offering schedule to maintain transparency with investors. It is also important to note that not all companies are required to file Form D; it primarily applies to those seeking to make exempt offerings.

Steps in the filing process

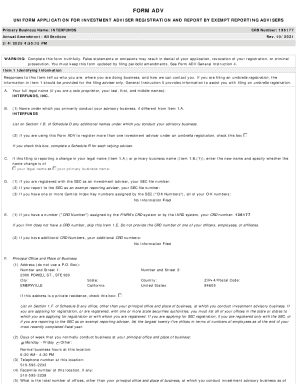

To successfully navigate the filing of Form D, companies should follow a structured approach divided into several preparatory steps. First, it's essential to identify whether the offering qualifies for an exemption under Regulation D. This involves understanding the nature of the securities being offered, as well as the types of investors eligible to participate.

Once qualification is confirmed, the next step involves gathering the necessary documentation, which typically includes financial records, a description of the company and its operations, and details of the offering. Having solid documentation ensures accuracy and completeness in reporting. At this stage, companies should also familiarize themselves with each section of Form D.

Filling out Form D entails completing various sections that require specific information about the offering, such as the amount of securities being offered, the date of the first sale, and information about the company. Each section should be approached meticulously, ensuring that details are accurately filled out to avoid compliance issues.

After preparing the form, companies must choose a submission method. Form D can be filed electronically through the SEC's EDGAR system or via paper filing. Each method has its advantages and requirements, and best practices suggest confirming receipt after submission to ensure compliance.

Best practices for completing Form

Completing Form D accurately is paramount, as inaccuracies can lead to compliance issues and potential scrutiny from regulators. To avoid common pitfalls, companies should double-check all entries for correctness and ensure that they have all required documentation before starting the form.

Ensuring compliance with state regulations is also critical, as various states have their own reporting requirements. This necessitates a thorough understanding of the jurisdictions in which the company will be operating. Additionally, companies should avoid oversights in detail while maintaining transparency and accuracy in their reporting.

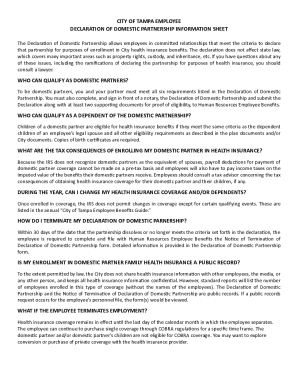

SEC Form reporting and compliance requirements

Filing Form D does not mark the end of compliance obligations. Companies must be diligent in their ongoing reporting and compliance requirements, including updating Form D if there are significant developments or changes in the offering. This might include amendments related to the amount raised, changes in the business model, or alterations in the terms of the offering.

Non-compliance with Form D filing can lead to sanctions or penalties, which highlight the importance of remaining vigilant about regulatory requirements. As a key document in the investment landscape, companies must prioritize maintaining compliance to foster trust with investors and ensure successful fundraising.

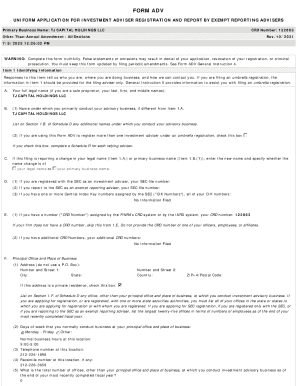

Differences between Form and other SEC filings

When comparing Form D to other SEC filings, such as Regulation A and Regulation Crowdfunding (Reg CF), the distinctions become clear. While Form D is primarily utilized for private placements, Regulation A offers a pathway for companies to raise larger amounts of capital from the general public with less stringent tests on investor qualifications.

Reg CF, similar to Form D, creates opportunities for raising smaller amounts but is designed for crowdfunding campaigns rather than private placements. Each of these options presents unique benefits and limitations, impacting investor relations and outreach strategies.

What makes Form D unique is its focus on exempt offerings, allowing companies to quickly access capital without extensive disclosures. Understanding these differences can significantly impact a company’s funding strategy and investor engagement effort.

Exploring investment opportunities and capital-raising strategies

Companies can leverage Form D to strategically target investment opportunities, building relationships with accredited and institutional investors. Understanding the types of investors who are interested in private placements is essential for anyone filing Form D. Investors typically seek opportunities that align with their portfolio strategies and risk profiles.

Case studies of successful fundraising through Form D reveal common elements: concise communication of value propositions, investor-focused materials, and diligent follow-ups. Companies that effectively communicate their growth prospects and potential returns are more likely to attract the right investors.

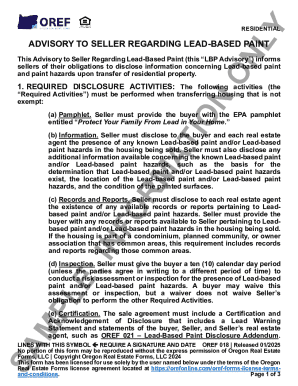

Navigating exempt offerings and private placements

Exempt offerings, such as those detailed in Form D, provide a route for private companies to raise capital with fewer regulatory hurdles. These offerings can range from equity to debt securities, allowing for flexibility in how capital is raised. Understanding these nuances is crucial for structuring private placements that meet the needs of both the company and its investors.

Structuring these private placements requires careful consideration of the terms and conditions presented in the offerings. Benefits of utilizing Form D for capital raising include faster access to capital, less formal scrutiny than public offerings, and the opportunity to establish firm investor relationships. However, companies must also be aware of the associated risks, such as the potential for limited investor outreach compared to broader campaigns.

Conclusion of Form insights

Understanding Form D is critical for companies wanting to navigate the capital-raising landscape effectively. As an essential tool for private placements, it allows businesses to raise capital while ensuring compliance with regulatory frameworks. Companies are encouraged to leverage available tools, such as pdfFiller, to streamline their document management process, improve accuracy, and ensure timely filings.

Staying informed about these procedures will ultimately enhance a company’s ability to engage with investors and achieve its financial objectives. By maintaining a proactive approach to compliance, companies can reduce risks and position themselves for success in the dynamic world of capital raising.

Interactive tools and resources

Utilizing interactive tools can significantly ease the Form D filing process. With resources like an interactive Form D PDF filling tool, companies can efficiently complete necessary documentation. Collaborative templates for document management also streamline communication among teams, ensuring accuracy and compliance.

Additionally, setting calendar reminders for filing deadlines and key events in the filing process helps safeguard against potential oversights. Companies can utilize these tools not only to enhance their compliance measures but also to ensure a smoother experience in managing their capital-raising efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form d what is directly from Gmail?

How can I send form d what is for eSignature?

How can I edit form d what is on a smartphone?

What is Form D?

Who is required to file Form D?

How to fill out Form D?

What is the purpose of Form D?

What information must be reported on Form D?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.