Get the free CT-183/184-I - Tax.NY.gov.

Get, Create, Make and Sign ct-183184-i - taxnygov

Editing ct-183184-i - taxnygov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-183184-i - taxnygov

How to fill out ct-183184-i - taxnygov

Who needs ct-183184-i - taxnygov?

Understanding the CT-183184- - Taxnygov Form: A Comprehensive Guide

Overview of CT-183184-

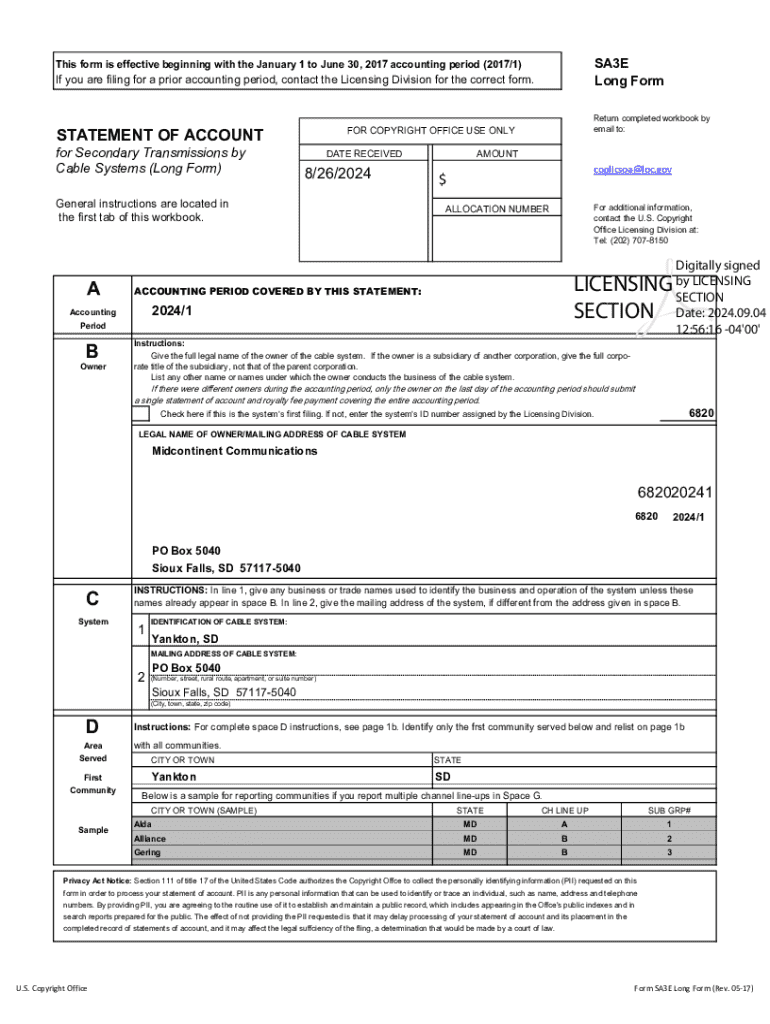

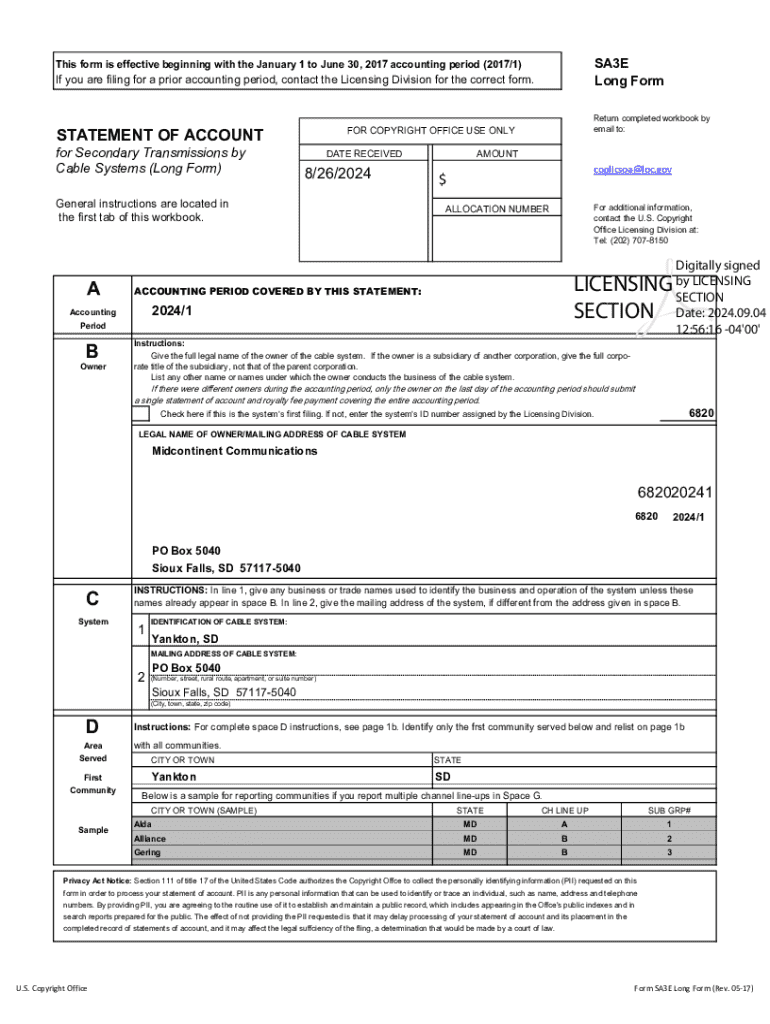

The CT-183184-I form, also known as the New York State Corporation Franchise Tax Return for utilities, is a pivotal document designed for use by corporations operating within sectors such as telecommunications and transportation. This form serves as a report detailing a corporation's income, deductions, and tax liabilities, ensuring compliance with New York State's taxation laws.

For taxpayers and corporate entities, understanding the CT-183184-I form is crucial. Not only does it facilitate proper tax reporting, but it also helps in claiming applicable tax credits and deductions. Missing or incorrect submissions can lead to penalties or delays. Key deadlines for filing are typically set for the 15th day of the fourth month after the end of the corporation's tax year, necessitating careful planning.

Who needs to file CT-183184-?

The CT-183184-I form must be filed by various entities, including corporations primarily engaged in telecommunication services, trucking corporations, and entities operating in the transportation business. These corporations are mandated to file this form to report their franchise tax obligations.

Exemptions exist for certain taxpayer categories, including some not-for-profit organizations or entities that fall under specific tax exemption statutes. Hence, it’s vital for corporations and their tax professionals to fully understand the eligibility criteria before filing.

Preparation steps for completing CT-183184-

Preparation is key when approaching the CT-183184-I form. Start by gathering necessary information, including financial statements, prior year tax returns, and any relevant tax credit forms. This foundational documentation is critical for accurately reporting operating revenue and calculating deducible amounts.

Understanding the structure of the CT-183184-I form is essential. The form is divided into various sections that guide taxpayers through the complex reporting requirements, ensuring smooth completion.

Detailed instructions for filling out CT-183184-

Completing the CT-183184-I form involves several critical steps, each broken down into sections. In Section A, you will provide Entity Identification which includes your corporation’s name, address, and Employer Identification Number (EIN).

Next, in Section B, focus on Income Reporting, detailing your total receipts and operating revenue. Remember, accurate reporting of revenue is vital for your tax calculations.

Section C deals with Deductions and Credits, allowing you to list any applicable deductions that lower your taxable income. Finally, in Section D, you will document Payments and Refunds which outlines any payments made in advance or any expected tax refunds.

Common pitfalls include misreporting income levels, failing to claim eligible deductions, or neglecting submission deadlines. Ensuring thoroughness in each section can prevent unnecessary delays or audits.

Editing and reviewing the CT-183184-

Before submitting your CT-183184-I form, it’s imperative to edit and review your entries for accuracy. Small mistakes can lead to significant issues. Utilize pdfFiller's editing tools to scrutinize each section of the form, ensuring that values entered conform to corporate records.

Conducting a comprehensive review might involve cross-verifying the financial data with your accounting department or systems. Pay particular attention to numeric values in the Income Reporting and Deductions sections to avoid discrepancies.

Signing and submitting CT-183184-

After finalizing your CT-183184-I form, signing is the next step. You can opt for traditional signatures or eSignatures, which provide a faster processing avenue. ESignatures offer the benefit of streamlined submission, especially when dealing with time-sensitive filings.

Using pdfFiller, you can easily electronic sign your document by following a simple step-by-step guide that ensures all authorized parties can sign without delay. Submission methods vary; you may choose electronic submission for faster processing or traditional mailing, which involves printing and sending the form via postal services.

Managing your CT-183184- submission

Once you submit your CT-183184-I form, it's essential to keep track of its status. pdfFiller provides a feature allowing users to track submissions, facilitating convenient follow-up if inquiries arise. Should there be a requirement to amend your form after submission, maintaining a copy for reference becomes invaluable.

Understand that the Department of Taxation and Finance may respond with requests for additional information or clarifications. Always keep lines of communication open to ensure any follow-up requirements are promptly addressed.

Utilizing pdfFiller for the CT-183184- process

pdfFiller is equipped with features that greatly enhance the CT-183184-I process. It offers cloud-based access, making it convenient for users to work on their forms from anywhere, and its collaborative tools allow for smooth teamwork if multiple individuals are involved in the form preparation.

Moreover, pdfFiller's document storage solutions let you organize all tax forms in one place, significantly reducing the stress associated with tax season. The enhanced user experience provided by pdfFiller means you can complete your applications efficiently, freeing up time for other critical business operations.

Frequently asked questions about CT-183184-

As users navigate the CT-183184-I form, several common questions may arise. Many are concerned about the consequences of late submissions or the processes involved if one needs to amend a filed form. Knowing where to seek help is equally crucial for clarity.

Stay updated on changes to CT-183184-

Tax laws and forms are subject to changes. Keeping abreast of updates regarding CT-183184-I is essential for maintaining compliance. Users can access updates through pdfFiller’s platform, which offers current information on tax law adjustments and form requirements.

Regularly consult the New York State Department of Taxation and Finance's website or pdfFiller’s resources to ensure that your understanding of the CT-183184-I form is current. This proactive approach aids corporations in avoiding unnecessary penalties and ensures accurate filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct-183184-i - taxnygov in Gmail?

Where do I find ct-183184-i - taxnygov?

How do I fill out the ct-183184-i - taxnygov form on my smartphone?

What is ct-183184-i - taxnygov?

Who is required to file ct-183184-i - taxnygov?

How to fill out ct-183184-i - taxnygov?

What is the purpose of ct-183184-i - taxnygov?

What information must be reported on ct-183184-i - taxnygov?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.