Get the free indiana bill of sale template

Get, Create, Make and Sign indiana bill of sale

Editing indiana bill of sale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indiana bill of sale

How to fill out indiana bill of sale

Who needs indiana bill of sale?

Understanding the Indiana Bill of Sale Form

Understanding the Indiana Bill of Sale

A Bill of Sale is a legally binding document that serves as proof of the transaction between a buyer and a seller. In Indiana, this form is particularly important as it includes critical details about the sale of personal property, such as vehicles or real estate. Utilizing an Indiana Bill of Sale protects both parties by outlining the specifics of the agreement, including purchase price and item description.

The importance of this document extends beyond mere formality; it provides clear evidence of ownership transfer, which is often necessary for registering vehicles or transferring real estate titles. Furthermore, the Bill of Sale acts as a legal safeguard against future disputes concerning the transaction, thus becoming a crucial part of the sales process.

The legal implications of a Bill of Sale are significant since it may be required during various official processes. Failing to document the sale properly can lead to ownership disputes, tax complications, or issues in registering the vehicle or property. Therefore, understanding the Indiana Bill of Sale is essential for anyone looking to transact in personal property.

When is a Bill of Sale necessary in Indiana?

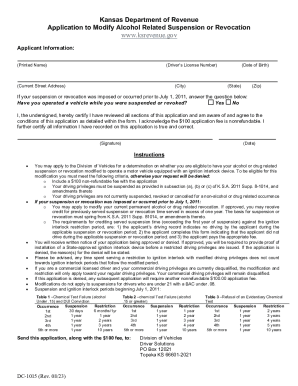

In Indiana, a Bill of Sale is necessary in several situations. Primarily, it is essential for transactions involving vehicles, boats, trailers, and other movable property. Additionally, it is also recommended when selling personal items such as firearms, machinery, or even real estate. The Bill of Sale acts as an official record that the sale has been conducted, making it easier to establish ownership.

When it comes to property transfer, the Bill of Sale plays a pivotal role in ensuring that both buyers and sellers are protected throughout the transaction process. It not only confirms the sale but also protects against potential legal issues that might arise later. For example, without it, a seller could potentially face disputes over whether the item was indeed sold or under what conditions.

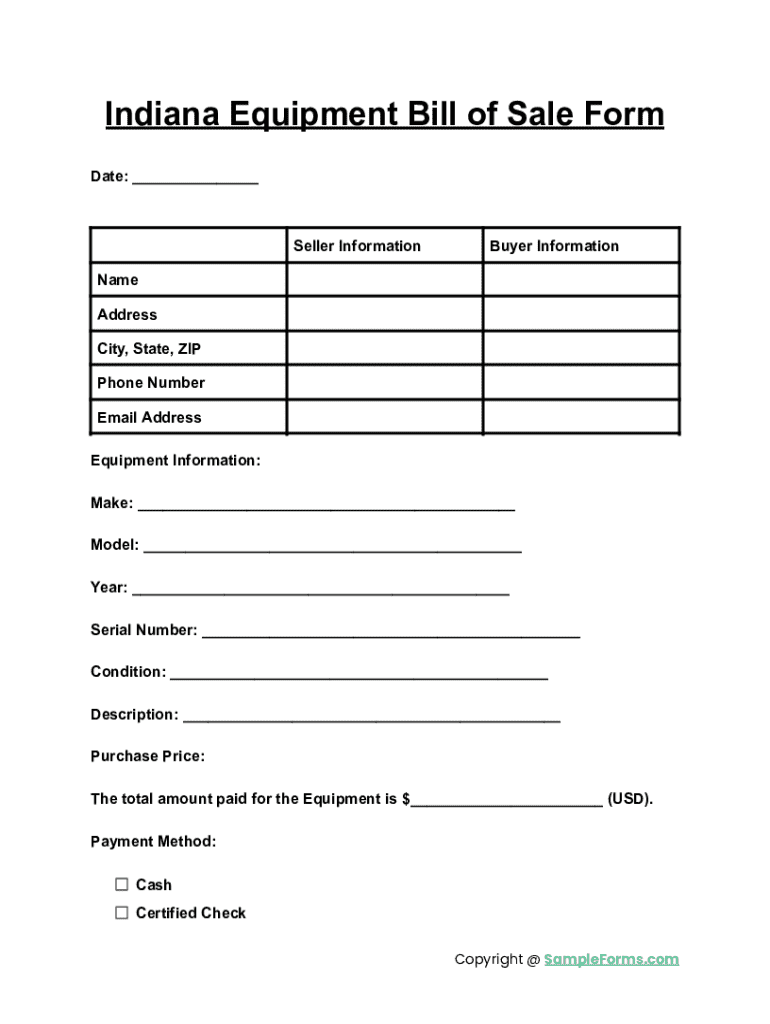

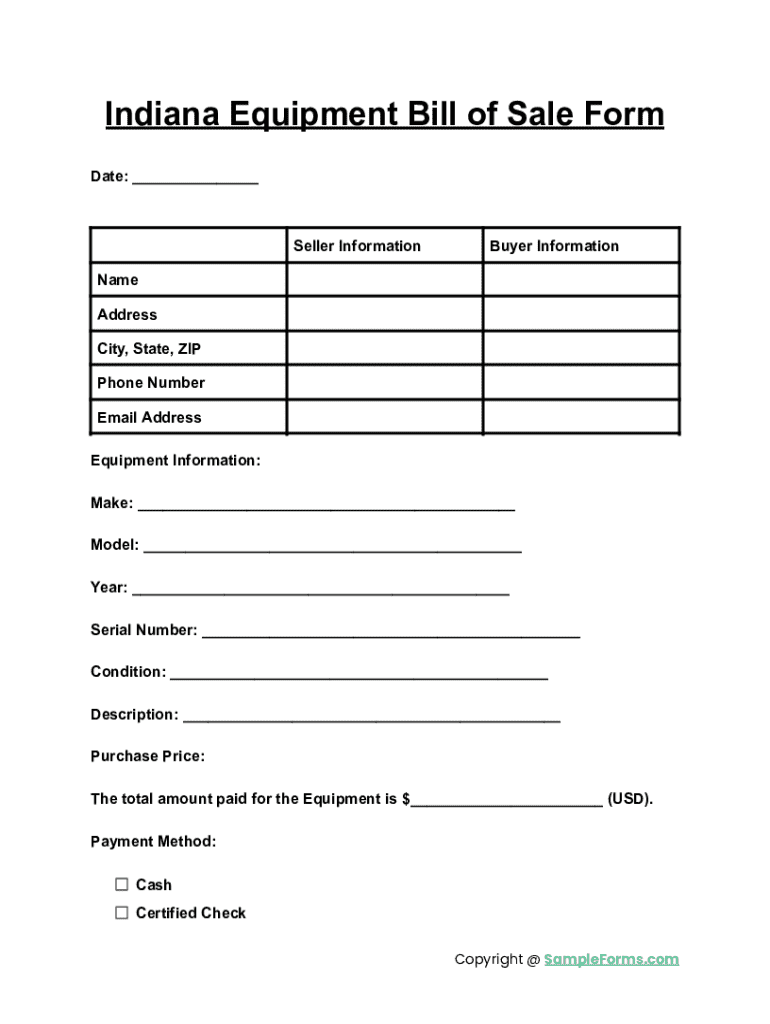

Key components of the Indiana Bill of Sale form

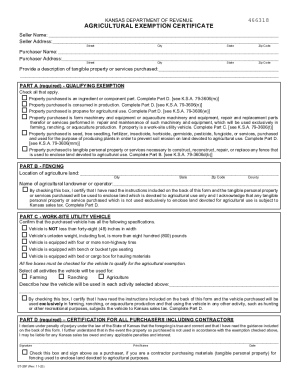

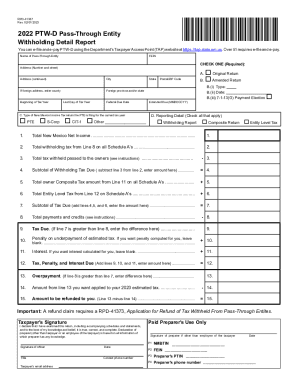

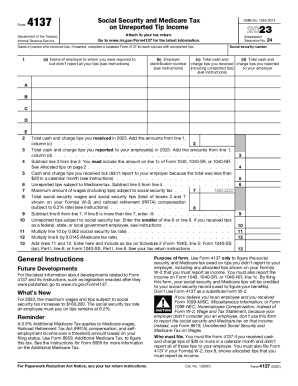

An Indiana Bill of Sale should include essential information that clearly outlines the transaction between the seller and buyer. Key components include the full names and addresses of both parties, a description of the item being sold, the sale price, and the date of the transaction. These details ensure that both parties are on the same page regarding what is being sold and the conditions of the sale.

The description of the item is particularly important for vehicles. For example, including the Vehicle Identification Number (VIN) helps prevent any confusion regarding the item being sold. Similarly, if the Bill of Sale relates to real estate, the property address and legal description should be included. Optional components like payment methods and terms can provide clarity and further protect the interests of both parties.

How to create an Indiana Bill of Sale

Creating an Indiana Bill of Sale is a straightforward process when followed step by step. The first step involves gathering all necessary information concerning the parties involved and the item being sold. This preparation significantly reduces the chance of omissions and errors.

Once you have the required information, you may choose to either start from a template or draft the document from scratch. Templates can provide a framework that makes the process easier. After inputting the details into the appropriate sections, it is crucial to review the document for accuracy. Finally, both the seller and buyer must sign and date the form to make it legally valid.

Utilizing pdfFiller for your Indiana Bill of Sale

pdfFiller has positioned itself as a top cloud-based document solution, making it easier for users to create, edit, and manage their documents from anywhere. With pdfFiller, creating your Indiana Bill of Sale form becomes effortless. One of the standout features is the availability of interactive templates which users can quickly fill out.

In addition to templates, pdfFiller's editing and customization tools allow users to modify existing documents to fit their specific needs. eSignature options enhance the transaction experience, facilitating seamless agreements without the need for in-person meetings. Accessing and filling out the Bill of Sale form on pdfFiller is straightforward and user-friendly.

Frequently asked questions about Indiana Bills of Sale

Several common inquiries arise regarding the Indiana Bill of Sale, particularly around its use and implications. One frequently asked question is what happens if the Bill of Sale is lost. In such cases, it is always advisable to create a new Bill of Sale to maintain a clear record of the transaction. This is especially true for vehicle ownership, where proof is vital for registration.

Another common question pertains to using a Bill of Sale for gifting a vehicle. In Indiana, a Bill of Sale can indeed be used to document the transfer of ownership for gifts, ensuring that both parties have a record of the transaction without monetary exchange considerations. Additionally, sales between family members can also benefit from a Bill of Sale, which formalizes the transfer and can reduce misunderstandings.

Common mistakes to avoid when completing an Indiana Bill of Sale

Mistakes when filling out an Indiana Bill of Sale can potentially lead to unwanted legal consequences. One common error is not capturing all required information. It’s crucial to ensure that all relevant details, like the item description and sale price, are included to avoid disputes later on.

Another frequent oversight is failing to sign and date the document, which renders it invalid. Additionally, misunderstandings about the tax implications of the sale can create complications, as sales may impact tax responsibilities. Lastly, it's vital to understand state-specific requirements for certain types of sales, as these can vary significantly.

Tips for storing and managing your Bill of Sale

Proper storage and management of your Bill of Sale after its completion are equally important as the creation process. A best practice is to maintain both physical and digital copies of the document. While a physical copy can be kept in a safe place, such as a file cabinet, a digital version offers the advantage of easy access and backup.

Backing up your documents in a cloud service or external hard drive ensures that they remain secure and retrievable. Lastly, legal considerations regarding document access and security are paramount; always keep sensitive information under lock and key to prevent unauthorized access.

State information & compliance

It's essential to be aware of Indiana state laws surrounding vehicle ownership and transfer, as these laws dictate the requirements for a Bill of Sale. The state enforces strict guidelines on how ownership is documented to prevent fraud, protect consumers, and ensure proper tax collection.

Notable changes affecting the Bill of Sale requirements occasionally arise, particularly regarding technology and digital signatures. Keeping updated on these legal requirements can ensure compliance while protecting both sellers and buyers. Understanding the law's nuances enables a smoother sales process and better navigation of potential pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indiana bill of sale in Gmail?

How do I edit indiana bill of sale in Chrome?

Can I edit indiana bill of sale on an iOS device?

What is indiana bill of sale?

Who is required to file indiana bill of sale?

How to fill out indiana bill of sale?

What is the purpose of indiana bill of sale?

What information must be reported on indiana bill of sale?

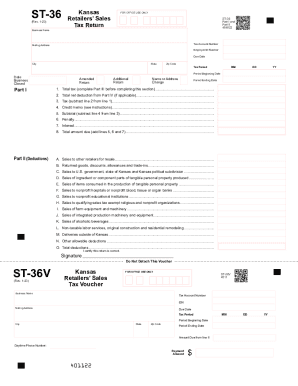

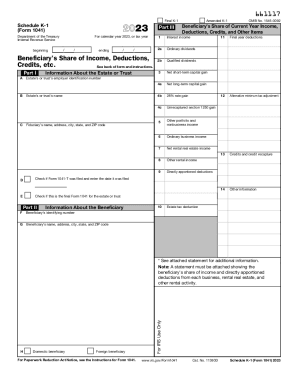

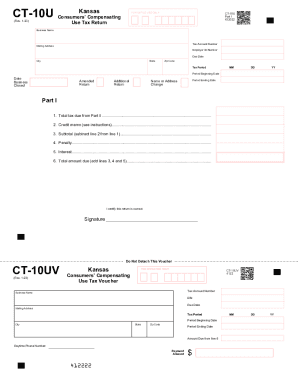

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.