Get the free Charitable Trust Bureau, 115 S

Get, Create, Make and Sign charitable trust bureau 115

How to edit charitable trust bureau 115 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable trust bureau 115

How to fill out charitable trust bureau 115

Who needs charitable trust bureau 115?

Understanding the Charitable Trust Bureau 115 Form

Understanding the Charitable Trust Bureau 115 Form

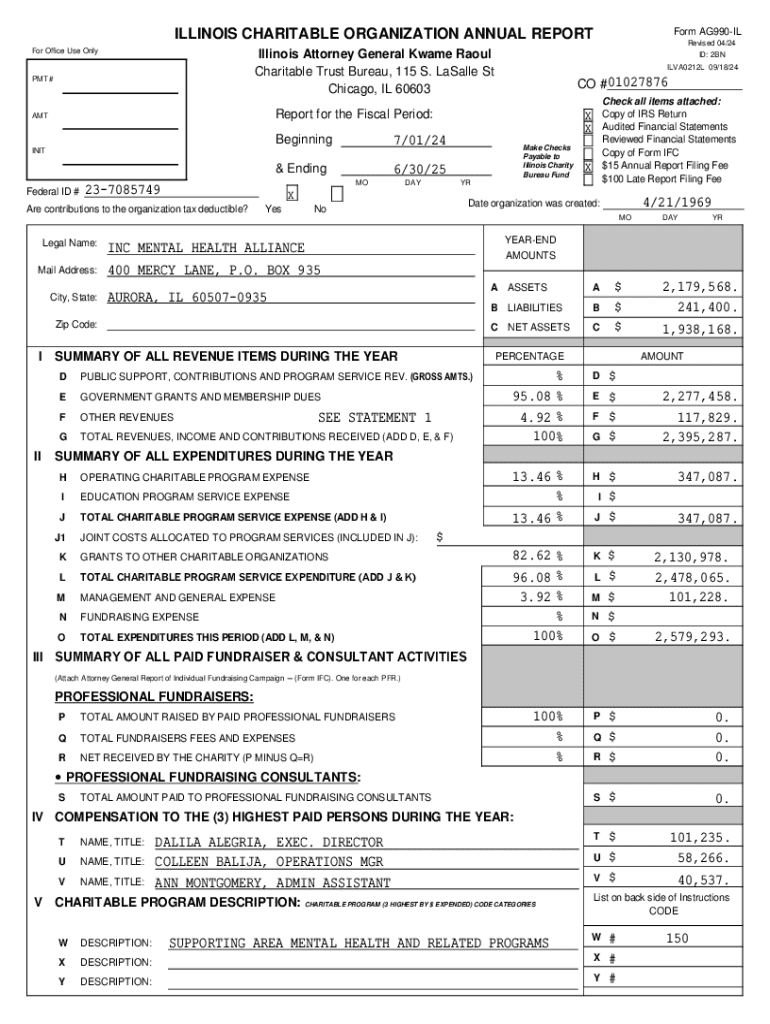

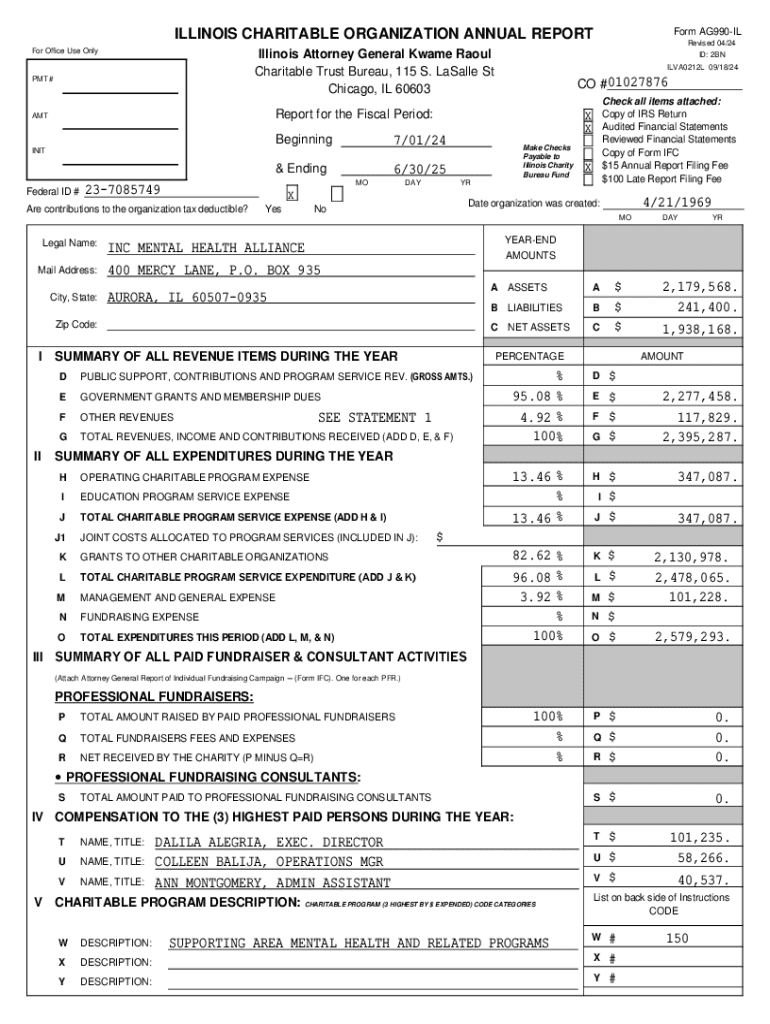

The Charitable Trust Bureau 115 Form is a critical document utilized by charitable organizations to comply with state regulations. This form is essential for ensuring transparency, accountability, and adherence to legal standards governing the establishment and operation of charitable trusts. Such forms are typically required by state regulatory bodies, which oversee the activities of charitable organizations to protect public trust and facilitate charitable contributions.

Filing this form not only ensures compliance with state laws but also enhances the credibility of the organization among its stakeholders, including donors, beneficiaries, and regulatory entities. For organizations looking to operate successfully, a good understanding of the Charitable Trust Bureau 115 Form and its implications is indispensable.

When and why you need to file the 115 form

Filing the Charitable Trust Bureau 115 Form is typically governed by specific timelines which can vary by state. Organizations must be cognizant of these deadlines to maintain their status and uphold compliance standards. Regular deadlines often include annual renewals or updates whenever there are substantial changes in organizational structure or purpose.

Key scenarios that trigger the need for this form include the formation of new charitable trusts, restructuring existing ones, or when the organization reaches certain contribution thresholds set by regulatory bodies. By filing the form on time, organizations not only avoid potential penalties but also prioritize their commitment to compliance and transparency in their operations.

Step-by-step guide to filling out the Charitable Trust Bureau 115 Form

Filling out the Charitable Trust Bureau 115 Form requires careful preparation and attention to detail. The first step is gathering all necessary information, including relevant documents related to the organization’s formation, purpose, financial data, and governance structure. Accurate and complete information is crucial to ensure a smooth filing process.

The form comprises several key sections that require specific details. Each section typically includes:

To ensure accuracy and compliance, avoid common mistakes such as incomplete sections, unclear descriptions, and failure to sign or date the form. Careful review and possibly seeking expert assistance can significantly enhance the quality of your submission.

Interactive tools for completing the 115 form

Leveraging digital tools can streamline the process of filling out the Charitable Trust Bureau 115 Form. Platforms like pdfFiller offer interactive features that make editing, signing, and managing documents intuitive and efficient. Users can access a range of editing tools that simplify the process of filling in required fields and ensuring compliance with all necessary regulations.

For instance, the pdfFiller platform includes templates specifically designed for the 115 Form, allowing users to save time and reduce errors. The platform's translation application tool also facilitates accessibility for organizations that serve diverse populations, ensuring greater accuracy and ease of use.

Managing your form after submission

Once the Charitable Trust Bureau 115 Form has been submitted, it’s crucial to track the status of your submission to ensure that there are no outstanding issues. Regulatory bodies may provide updates or request additional information during their review process, which mandates prompt attention.

In case corrections are required, having a systematic approach to store and manage documents related to your submission can ease the modification process. Utilizing tools like pdfFiller allows for easy document management, where historical records can be stored and retrieved effortlessly, providing the organization with a robust archival strategy.

Frequently asked questions (FAQs) about the 115 form

Organizations often have several questions as they navigate the process associated with the Charitable Trust Bureau 115 Form. Addressing common concerns can provide clarity and help organizations stay compliant.

For example, if you miss the filing deadline, it could result in penalties or a loss of good standing with the state. Typically, organizations are encouraged to submit their requests for extensions promptly. Additionally, many states now accept electronic submissions of the 115 Form, which significantly eases the process. Organizations can seek assistance from experienced professionals or regulatory body representatives if they have questions about the filing process.

Case studies: Successful filings using the Charitable Trust Bureau 115 Form

Numerous organizations have successfully navigated the complexities of filing the Charitable Trust Bureau 115 Form. By examining specific case studies, we can see how timely submissions led to positive outcomes for various groups. For instance, a local nonprofit focused on disabilities was able to enhance their funding opportunities significantly after properly filing the 115 Form, which established their credibility in the community.

Testimonials from organizations also highlight how tools like pdfFiller simplified their filing experience. Users have noted that the interactive features allowed for real-time collaboration among team members and dramatically reduced the time required to complete necessary filings.

Special considerations for different types of charitable organizations

Different types of charitable organizations may face varying requirements and considerations when filing the Charitable Trust Bureau 115 Form. Nonprofit organizations typically have to consider regulatory compliance and transparency with donors, while for-profit charitable ventures may also have to navigate unique regulations concerning profit allocation.

Furthermore, smaller organizations often have resilience and flexibility but may lack resources to dedicate to compliance processes. Conversely, larger organizations might have more complex governance structures and thus face distinct challenges in ensuring all information is accurately represented in their filings. Understanding these variations can aid organizations in aligning their operational strategies with compliance.

Additional compliance requirements beyond the 115 form

Beyond the Charitable Trust Bureau 115 Form, organizations may have additional compliance requirements that vary based on their operational scope and funding sources. Many states require annual reporting of financial data, while certain federal regulations may call for specific disclosures regarding funding and governance.

Failure to comply with these ongoing obligations could lead to dire consequences, including potential legal actions and diminished credibility within the fundraising community. Therefore, ongoing education and resource management are crucial for organizations to uphold their compliance standing and effectively navigate interactions with both state and federal entities.

Conclusion: Streamlining your Charitable Trust Bureau 115 Form experience with pdfFiller

pdfFiller offers a comprehensive solution for organizations looking to streamline their experience with the Charitable Trust Bureau 115 Form. With tools that simplify editing, signing, and document management, pdfFiller empowers its users to enhance their productivity and maintain compliance effortlessly.

Additionally, the platform’s commitment to user empowerment ensures that individuals and teams can navigate the complexities of charitable trust filings with ease. By utilizing pdfFiller, organizations gain access to advanced features that help them manage their documentation effectively and focus more on their mission-driven work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in charitable trust bureau 115?

How do I complete charitable trust bureau 115 on an iOS device?

How do I edit charitable trust bureau 115 on an Android device?

What is charitable trust bureau 115?

Who is required to file charitable trust bureau 115?

How to fill out charitable trust bureau 115?

What is the purpose of charitable trust bureau 115?

What information must be reported on charitable trust bureau 115?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.