Get the free NOTICE REGARDING FEDERAL AND STATE INCOME ...

Get, Create, Make and Sign notice regarding federal and

How to edit notice regarding federal and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice regarding federal and

How to fill out notice regarding federal and

Who needs notice regarding federal and?

Understanding Notices Regarding Federal Forms: Your Comprehensive Guide

Understanding federal notices and their importance

A federal notice is an official communication from a government agency, commonly outlining actions required from individuals or businesses in compliance with federal regulations. These notices are crucial in ensuring that recipients take suitable action, whether it's responding to a tax inquiry, submitting paperwork for immigration processes, or addressing employment-related requirements. Ignoring federal notices can lead to negative ramifications, such as fines, legal issues, or other sanctions, emphasizing the importance of timely responses.

There are several types of federal notices, including tax notices, immigration notifications, and employment-related communications, each tailored to specific regulatory frameworks. For instance, a notice from the IRS might request additional documents to support personal income tax returns, while an immigration notice may require applicants to submit specific forms such as the I-797 or Notice to Appear (NTA).

Key components of a federal notice

Every federal notice typically includes several key components that recipients should carefully review. Header information clearly identifies the issuing federal agency, which helps establish the notice's authenticity. The date is also crucial, as it marks when the notice was sent, while reference numbers assist in tracking the communication within agency systems.

Moreover, federal notices specify eligibility criteria or actions required, providing recipients with a clear understanding of what is expected. Accompanying this information is usually a deadline for responses, which is critical for compliance.

Common types of federal notices

Federal notices vary significantly depending on their purpose. Tax notices, often from the IRS, are typically issued for various reasons, such as discrepancies in tax returns or requests for additional information to calculate a tax assessment. These notices are pivotal for taxpayers to ensure they remain compliant with their income tax obligations.

Within the realm of immigration, notices like the Form I-797 inform individuals of approval or action needed regarding their immigration status. Individuals may also encounter Notices to Appear (NTA) if facing immigration-related issues, requiring critical responses to avoid serious repercussions.

Employment-related notices are typically sent by the Department of Labor and may involve compliance with labor laws or wage-related documentation. Understanding the specific requirements laid out in these notices is essential for maintaining good standing in the employment sector.

How to properly respond to a federal notice

Properly responding to a federal notice requires a systematic approach. Begin by reviewing the notice details to understand the required actions clearly. Pay attention to the eligibility criteria and deadlines to ensure you gather all necessary information and documentation accordingly.

Next, draft your response, ensuring you address each point raised in the notice. Be specific, concise, and include reference numbers or other identifiers that link your response to the original communication. Once your response is ready, submit it according to the methods prescribed in the notice, which could range from electronic upload to mailing hard copies.

It's also important to keep copies of your submissions and any correspondence for future reference. This organizational strategy can safeguard against potential disputes or further inquiries.

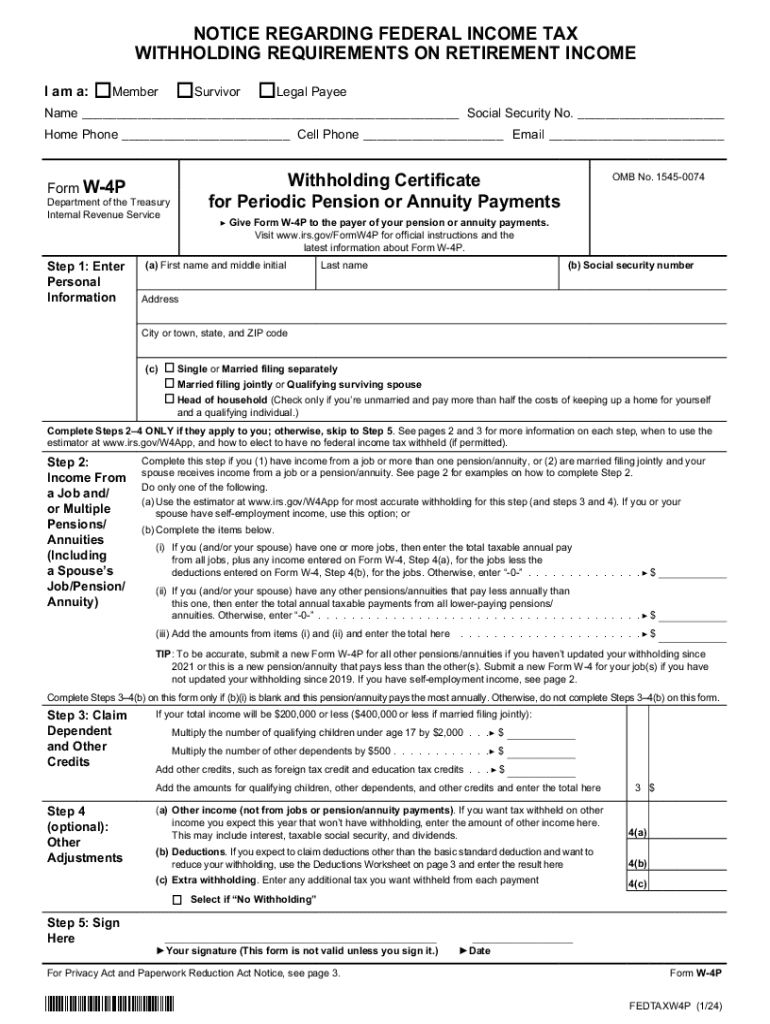

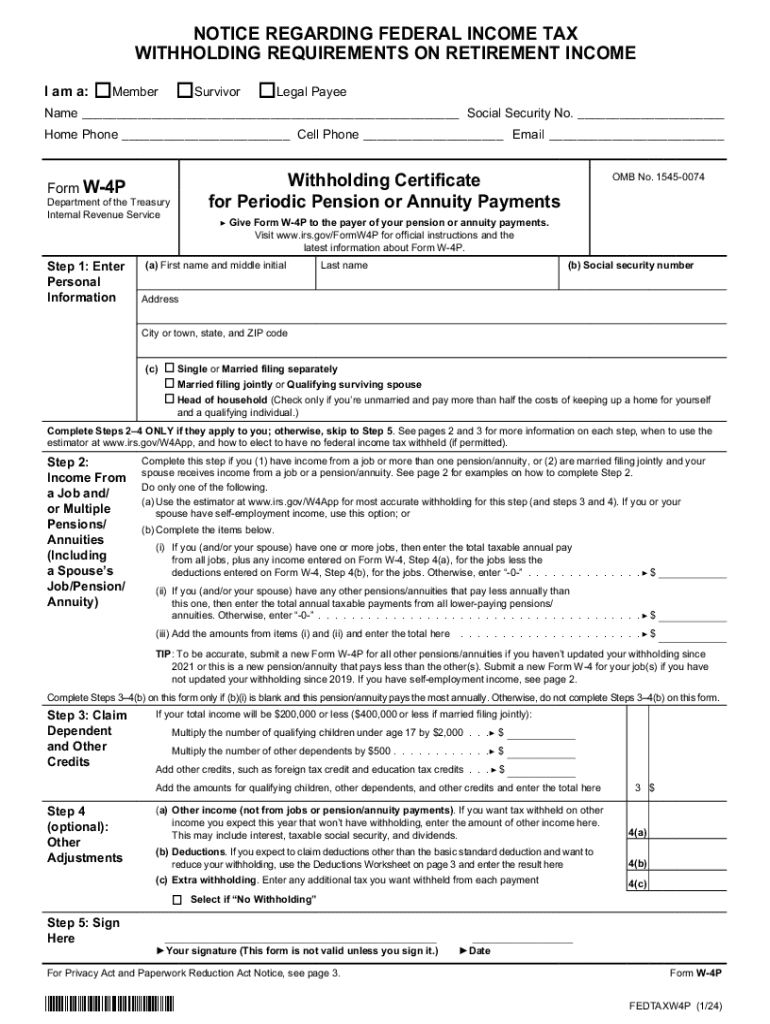

Utilizing forms with federal notices

Accompanying many federal notices are specific forms that must be completed and submitted. Familiarity with these forms is essential, as they often dictate the nature of the response required. Common forms include IRS 1040 for income tax returns or I-130 for family-sponsored immigration petitions.

Completing these forms accurately is pivotal to ensure that your response to the federal notice is valid. Many resources, including pdfFiller, provide detailed instructions on how to fill out common federal forms correctly, streamlining the process of compliance and reducing the chance of errors that could lead to further complications.

FAQs related to federal notices and forms

Navigating the realm of federal notices and their corresponding forms can often lead to questions. If you disagree with the notice you received, it's crucial to follow the appeal process outlined in the document. This often involves submitting supporting documentation to substantiate your claim.

Tracking your response to federal agencies is equally important. Most agencies, including the IRS and Department of Labor, offer online systems where you can check the status of your submissions and any open inquiries.

Real-life scenarios and testimonials

Real-life case studies can illustrate the importance of responding effectively to federal notices. For example, one individual received a tax notice from the IRS regarding an inconsistency in their reported personal income tax return. By promptly drafting a thorough response using the appropriate form, they were able to resolve the issue without further complications. This highlights the necessity of acting quickly.

Testimonials from users of pdfFiller further emphasize the platform's utilities. Many have shared how pdfFiller’s tools simplified filling out complex forms and facilitated timely responses, saving them time and reducing stress associated with federal compliance.

Interactive tools for managing federal notices

pdfFiller offers a range of features designed to streamline document creation and management. Users benefit from various templates tailored to specific federal forms, eliminating the hassle of searching for official templates. Additionally, the platform allows for collaborative editing, enabling teams to work together on responses to notices or forms efficiently.

To effectively draft responses, pdfFiller guides users through each step, ensuring all necessary information is included. This collaborative aspect is particularly valuable for teams dealing with multiple notices, enabling seamless communication and collaboration.

Navigating federal resources

To stay informed about federal notices and related forms, it’s essential to access accurate resources. Government websites like IRS.gov and USCIS.gov offer comprehensive information and links to necessary forms. Utilizing these resources ensures you are using the most current forms and guidelines.

pdfFiller also ensures access to updated document templates. This feature saves users from wasting time searching for forms or information elsewhere, streamlining the document management process.

Advanced tips for managing multiple notices

Managing multiple federal notices requires organization and a proactive approach. It is advisable to create a centralized tracking system that logs each notice received, the response deadlines, and any correspondence sent. Utilizing tools within pdfFiller to set reminders can also ensure you never miss critical deadlines.

Best practices include regularly reviewing your checklist and ensuring that all team members are informed about their responsibilities regarding specific notices. Consistently following up on submissions and maintaining open lines of communication can help uphold compliance and good standing with federal agencies.

Involving legal assistance

In some cases, engaging legal assistance is advisable when dealing with federal notices, especially if you believe that your rights are at stake, or you face complex situations. Legal professionals with expertise in federal compliance can help navigate the requirements and provide clarity on potential repercussions of the notices.

If legal support is necessary, research and contact professionals who specialize in federal regulatory compliance, as securing the right help can make a significant difference in outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete notice regarding federal and online?

How do I edit notice regarding federal and in Chrome?

Can I sign the notice regarding federal and electronically in Chrome?

What is notice regarding federal and?

Who is required to file notice regarding federal and?

How to fill out notice regarding federal and?

What is the purpose of notice regarding federal and?

What information must be reported on notice regarding federal and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.