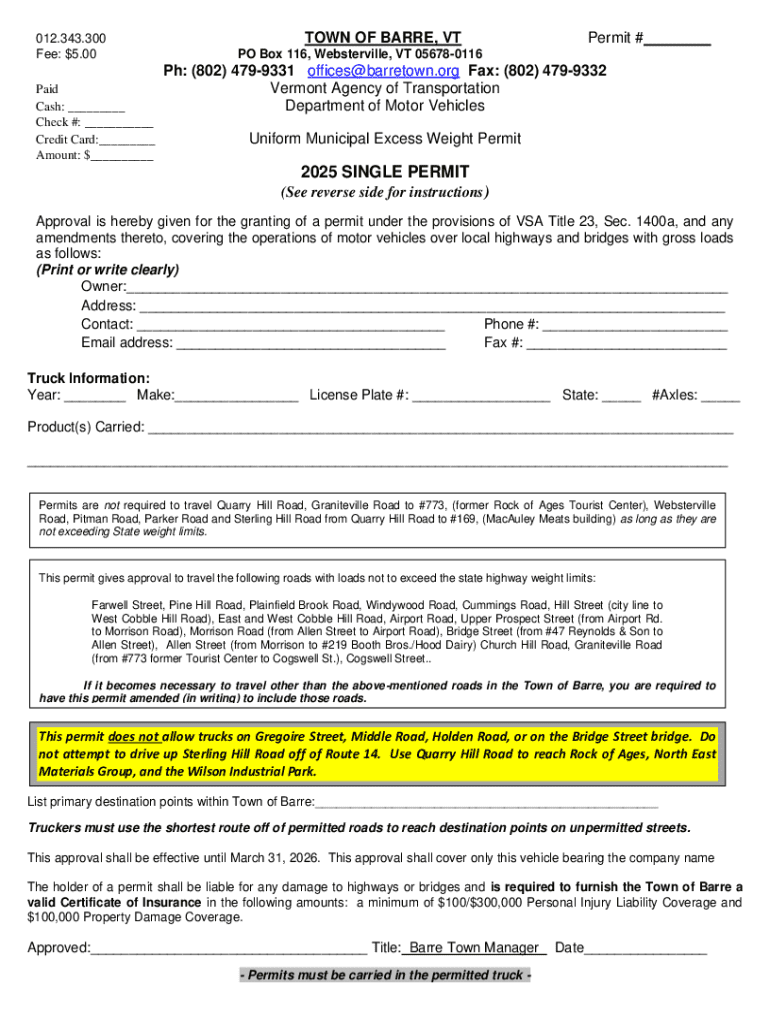

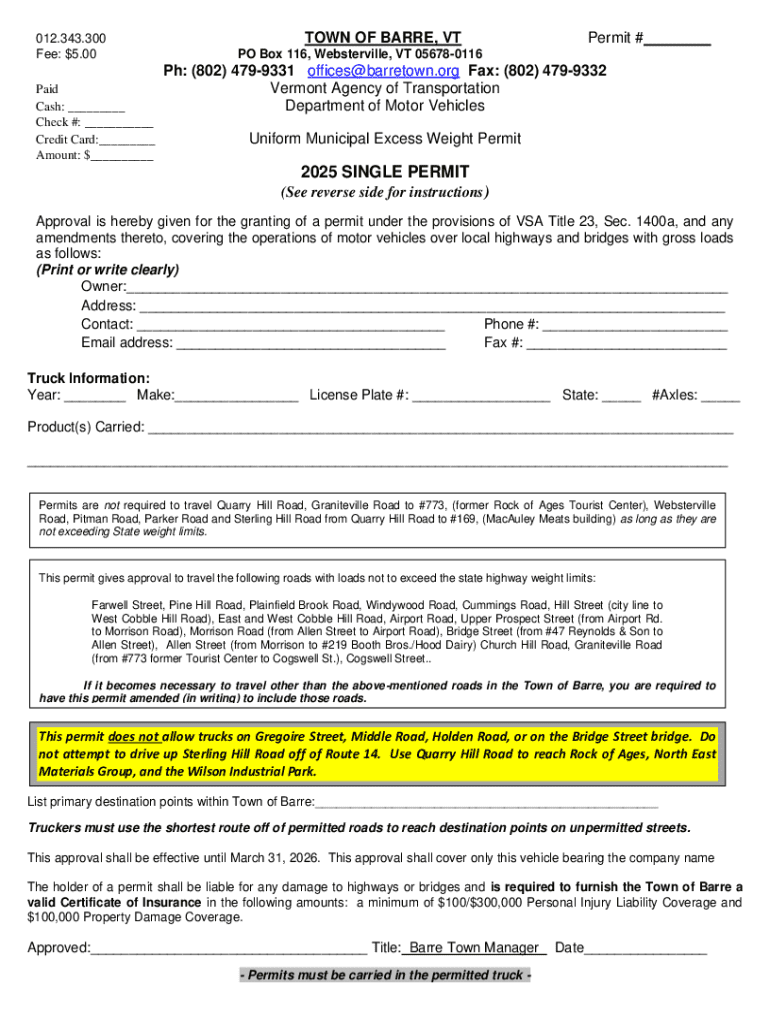

Get the free Make Payments with Credit Card or E-check

Get, Create, Make and Sign make payments with credit

Editing make payments with credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out make payments with credit

How to fill out make payments with credit

Who needs make payments with credit?

Make Payments with Credit Form: A Comprehensive How-to Guide

Understanding credit forms and their importance

A credit form is an essential document that enables individuals and businesses to authorize payments using their credit cards. Typically used in both online and offline transactions, these forms collect necessary information from cardholders, ensuring a smooth payment process. The importance of credit forms lies in their ability to facilitate secure transactions, minimizing risks of fraud.

They are equipped with various security features, such as encryption technologies and compliance with legal standards like PCI DSS (Payment Card Industry Data Security Standards), which protect sensitive cardholder information. This secure structure not only builds trust between customers and businesses but also serves as a deterrent for potential fraud, enhancing the overall reliability of financial transactions.

Types of credit forms and their applications

There are several types of credit forms tailored to different payment scenarios. Understanding these can help you choose the right form for your needs.

Step-by-step guide: Making payments with credit forms

Making payments with credit forms can be straightforward if you follow a few essential steps. Here’s a practical guide to ensure successful transactions.

Common pitfalls when using credit forms

While credit forms make transactions easy, there are several pitfalls to be aware of. Misleading information and errors can occur during the filling process.

Enhancing your payment experience

To enhance the payment process, leveraging technology is crucial. Online payment platforms offer numerous features that improve the security and convenience of financial transactions.

Frequently asked questions (FAQs)

Here are some common queries regarding credit forms and secure payments that might help clarify your concerns.

Explore more with pdfFiller

PdfFiller offers various tools that simplify document management, especially for payment forms. With a cloud-based solution, you can access interactive features that eliminate paper-based processes.

Stay updated with our resources

Keeping abreast of new developments in document management can be beneficial for your business or personal finances. With resources and webinars offered by pdfFiller, you can learn how to maximize your credit form usage effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in make payments with credit without leaving Chrome?

How do I complete make payments with credit on an iOS device?

How do I edit make payments with credit on an Android device?

What is make payments with credit?

Who is required to file make payments with credit?

How to fill out make payments with credit?

What is the purpose of make payments with credit?

What information must be reported on make payments with credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.