Get the free IRS letter date

Get, Create, Make and Sign irs letter date

How to edit irs letter date online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs letter date

How to fill out irs letter date

Who needs irs letter date?

Comprehensive Guide to IRS Letter Date Form

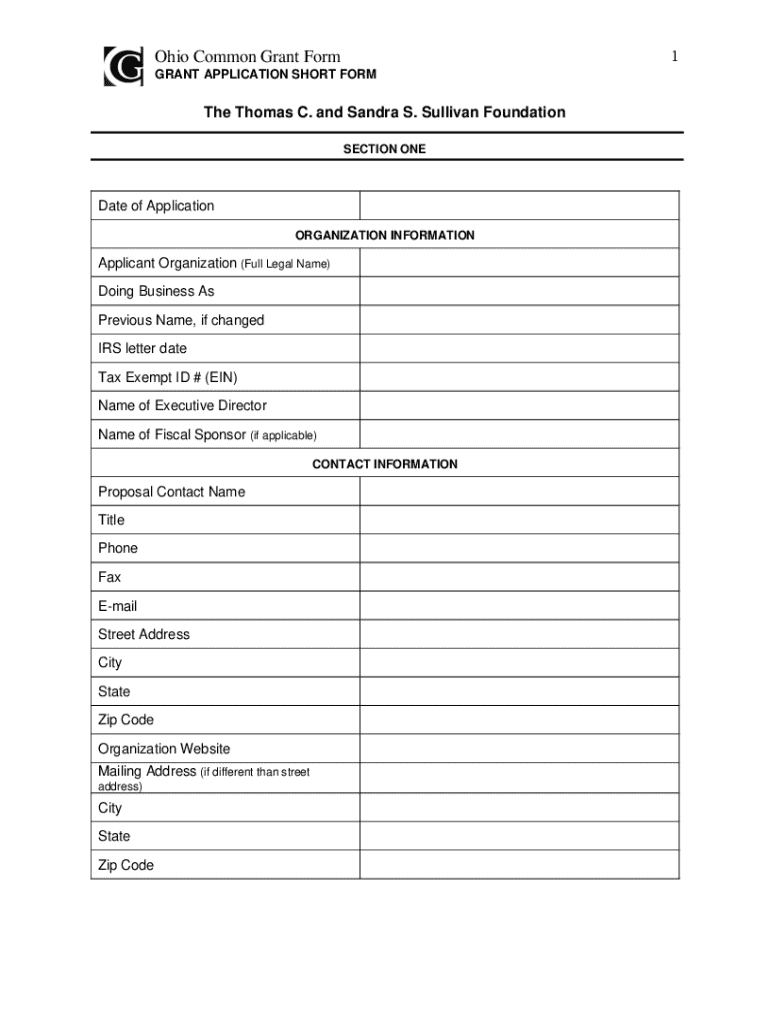

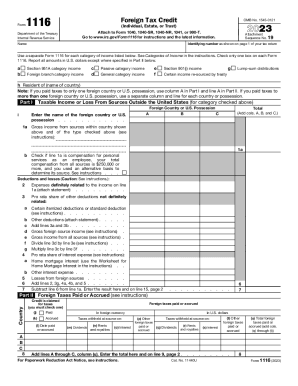

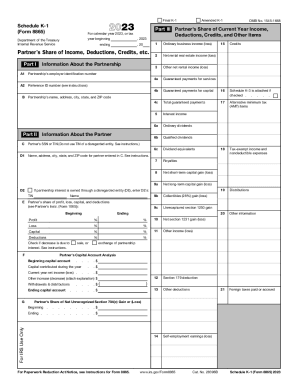

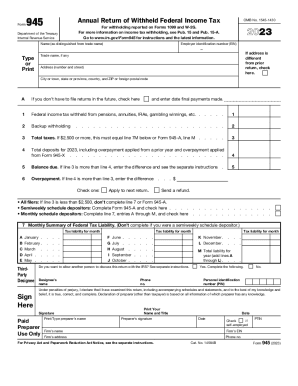

Understanding the IRS letter date form

The IRS letter date form is a crucial document that signifies the official correspondence from the Internal Revenue Service (IRS) regarding tax matters. The significance of this form lies in its role in maintaining compliance with federal tax laws. Each letter is timestamped with a specific date that marks the beginning of any time-sensitive actions or deadlines that the taxpayer must adhere to.

IRS letters can pertain to various issues such as audits, notices of additional tax owed, or general inquiries that may require the taxpayer’s attention. Understanding the context and the date indicated on these documents is essential for effective tax management and ensuring timely responses to avoid further complications.

When to expect an IRS letter

Taxpayers can anticipate receiving an IRS letter based on specific events, often tied to their tax filing activities or compliance status. Late or missed tax payments commonly prompt the IRS to send notifications, urging taxpayers to settle their dues. Similarly, changes in a taxpayer's tax status, such as the sale of properties or changes in income, can trigger letters requiring clarification or additional documentation.

The timeframe for receiving a letter following a tax event can vary considerably. Typically, you may receive correspondence anywhere from a few weeks to several months after significant actions occur, such as filing your return or responding to an IRS inquiry. For instance, if you filed an amended return, you might wait up to six weeks to hear back. It's crucial to remain proactive during these periods to ensure you do not miss critical IRS deadlines.

Decoding the IRS letter date form

Decoding an IRS letter involves understanding key components found in the letter that align with the date and its implications for taxpayers. Each letter typically includes critical fields such as the date issued, a reference number correlating to the taxpayer’s case, and specific actions required from the taxpayer. Recognizing these components enables taxpayers to respond appropriately and within the stipulated timeframe.

Common IRS letters include the Notice of Deficiency, expressing that the IRS believes a taxpayer owes additional tax, and Notices of Examination, outlining audit details. In these documents, dates play a vital role as they often dictate the time the taxpayer has to respond, whether to provide further information or to dispute the findings.

How to respond to an IRS letter

Responding to an IRS letter requires careful attention to detail and adherence to the guidance provided in the correspondence. The first step is determining the required action based on the specified issues - be it providing documentation, disputing a claim, or simply acknowledging receipt of the letter. Each letter contains guidelines, often stipulating a deadline by which a response must be submitted.

After identifying your response requirements, drafting a well-crafted reply is essential. When communicating with the IRS, maintain clarity and professionalism in your correspondence. It’s also a good practice to keep meticulous records of all communications, including dates of letters received and responses sent, as this provides a helpful reference in case further queries arise.

Managing documentation related to IRS letters

Effective tax management extends beyond responding to IRS letters; it heavily involves organizing relevant documentation. Keeping a systematic arrangement of your tax documents, including letters and responses, is crucial for compliance and analysis. Use folders - both digital and physical - to categorize IRS correspondence by years or tax issues for easy retrieval when needed.

Tools like pdfFiller can significantly enhance your organization strategy concerning IRS correspondence. By facilitating easy document creation, editing, signing, and collaborative features, pdfFiller empowers users to manage their tax-related documentation seamlessly from anywhere. This cloud-based platform ensures that all your records remain accessible, allowing efficient management and stress-free compliance.

Need additional help?

When navigating the complexities of IRS letters, some situations may warrant external advice. If you find the correspondence confusing or feel unsure of how to proceed, seeking the assistance of a qualified tax professional can provide clarity and guidance. A knowledgeable advisor can help interpret IRS guidelines and suggest the best course of action based on your specific circumstances.

For solutions tailored to your document management needs, pdfFiller offers excellent customer support. Users can access live chat assistance and explore a comprehensive FAQ section to address common inquiries regarding IRS letters and forms. Utilizing pdfFiller’s knowledge base streamlines the queries process, making it a valuable resource for taxpayers dealing with IRS correspondence.

FAQs about IRS letter date forms

Frequently, taxpayers express concerns regarding the IRS letter date form and its implications. Addressing common questions is vital for clarifying misunderstandings and ensuring all parties are informed. For instance, many individuals are unsure about the meaning of specific dates indicated on the letters or the necessary actions to take following receipt of a notice. Understanding the significance of these details can alleviate stress and promote effective communication with the IRS.

Additionally, it is essential to share tax tips that empower taxpayers to engage confidently with the IRS. Simple strategies, such as noting down deadlines and double-checking information provided in letters, can significantly enhance the process and avoid last-minute complications. Ensuring accuracy is also key; errors can lead to prolonged issues and inconveniences for taxpayers.

User experiences and case studies

Real-life experiences can offer invaluable insights when dealing with IRS letters. Many individuals and teams have successfully navigated the complexities of IRS correspondence using strategies rooted in proactive communication and the effective organization of documents. Case studies reveal trends in how users interacted with their IRS letters, highlighting common challenges faced, such as misinterpretation of instructions or delays in response times.

Testimonies from users who employed pdfFiller show the platform’s efficiency in managing tax-related documents, especially for those who deal with multiple forms. The capability to edit, e-sign, and collaboratively manage documents ensures that users can address IRS inquiries promptly and efficiently. Sharing both success stories and lessons learned provides a roadmap for others who may find themselves in similar situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find irs letter date?

How do I edit irs letter date in Chrome?

Can I edit irs letter date on an iOS device?

What is irs letter date?

Who is required to file irs letter date?

How to fill out irs letter date?

What is the purpose of irs letter date?

What information must be reported on irs letter date?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.