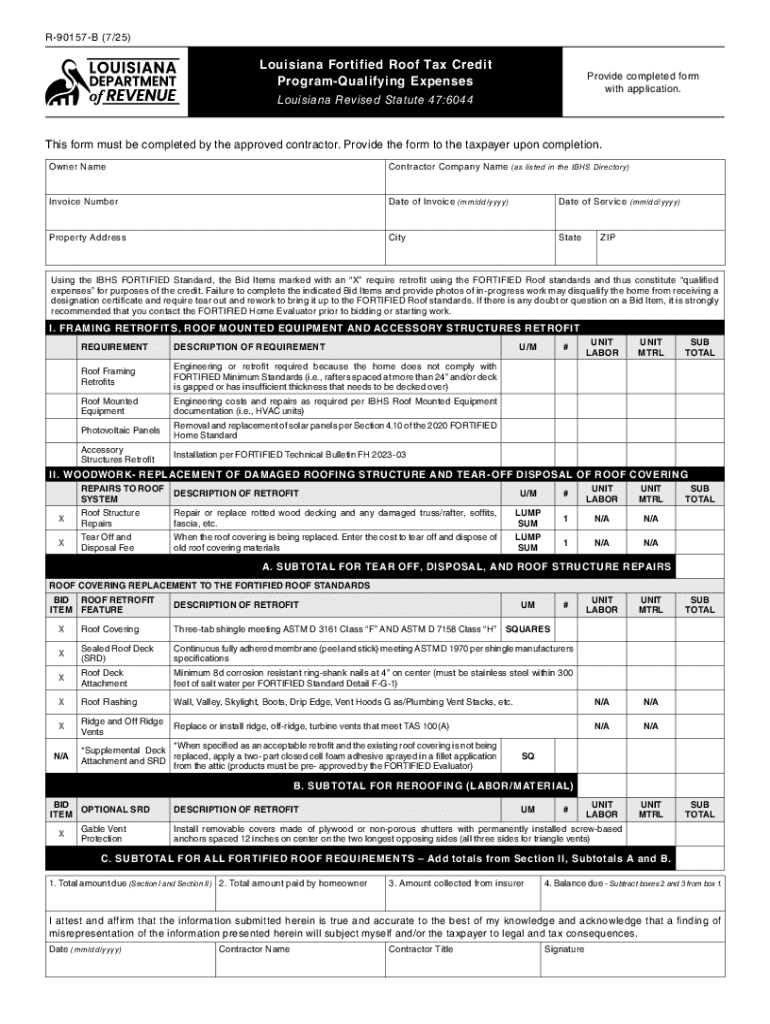

Get the free Louisiana Fortified Roof Tax Credit Program-Qualifying Expenses

Get, Create, Make and Sign louisiana fortified roof tax

How to edit louisiana fortified roof tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out louisiana fortified roof tax

How to fill out louisiana fortified roof tax

Who needs louisiana fortified roof tax?

Louisiana Fortified Roof Tax Form: A Comprehensive How-To Guide

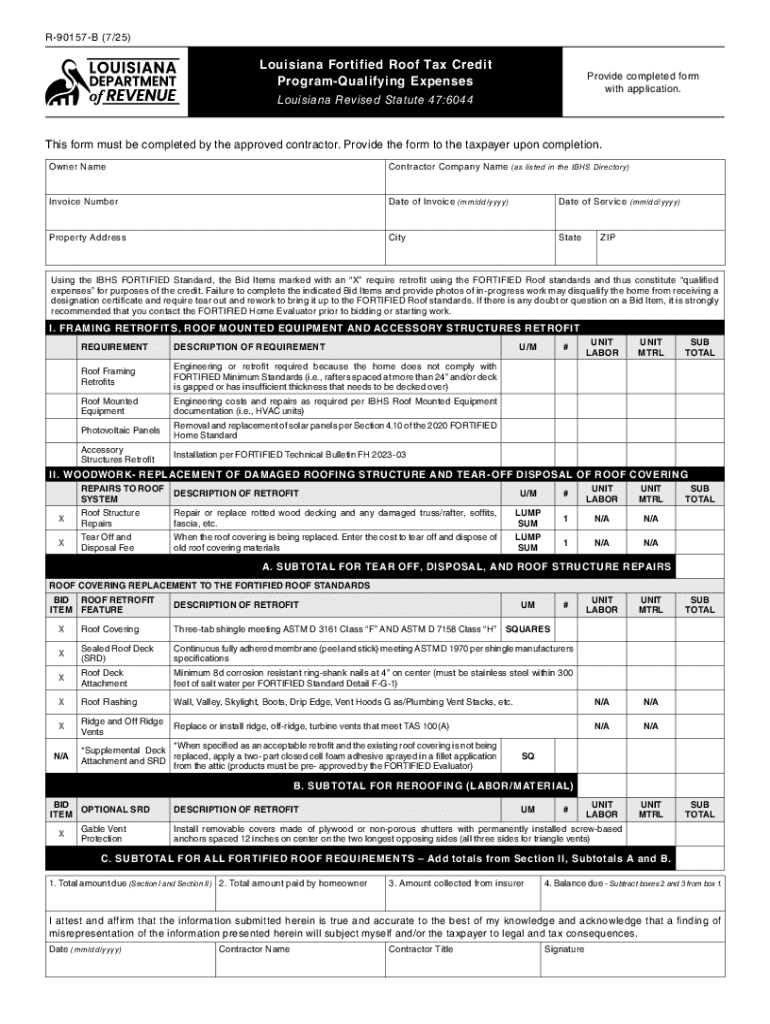

Understanding the Louisiana fortified roof tax incentives

Fortified roofs play a crucial role in protecting homes in Louisiana from extreme weather events, such as hurricanes and hailstorms. These roofs are designed and constructed to withstand high winds and other environmental challenges, significantly reducing the risk of damage. For homeowners, investing in a fortified roof not only enhances safety but also leads to potential savings on insurance premiums and property taxes.

The Louisiana Fortified Roof Program aims to encourage homeowners to fortify their roofs through tax incentives. The program acknowledges various roof types that adhere to specific designations established for weather resistance. By enrolling in this program, homeowners can significantly benefit from tax reductions, contributing to community resilience.

The Louisiana fortified roof tax form: A step-by-step guide

To claim your tax incentives, it’s essential to use the correct Louisiana fortified roof tax form. This specific form is available through the Louisiana Department of Revenue’s website and can be downloaded as a PDF. The correct form will include sections tailored to highlight the significant investments made in your roof.

Filling out the form requires careful attention. Each section needs accurate information, including your personal details, property specifics, a description of the fortified roof installation, and confirmation of your eligibility based on the program's standards.

Essential documentation for submission

Submitting the Louisiana fortified roof tax form demands specific documentation to validate your claim. It’s essential to include proof of your roof's installation, which can comprise detailed contractor invoices or a contractor’s affidavit confirming the fortified specifications.

Including this information will enhance your application, helping to ensure prompt approval and accurate processing by the local taxing authority.

Submission process for the fortified roof tax form

Once your Louisiana fortified roof tax form is filled out and all necessary documents are attached, it's time to submit your application. You have several options: you can submit the form electronically through platforms like pdfFiller, or you may choose to mail it to your local tax office.

After submission, maintaining a record and following up to track your application status is advisable. You can contact the local tax office for updates or confirmations regarding your submission.

Key deadlines and important dates

Being aware of deadlines for the Louisiana fortified roof tax form is essential for homeowners. Tax form submissions generally occur annually, with specific due dates established by the state. Missing these deadlines could result in lost opportunities for tax credits.

Timely renewal is necessary for homeowners to maintain ongoing eligibility for tax benefits associated with their fortified roofs.

Potential benefits: Tax credits and deductions

One of the significant advantages of securing a Louisiana fortified roof is the possibility of receiving tax credits. Homeowners can expect substantial savings on their annual tax bills due to reduced rates offered to those who have invested in fortified roof features.

Understanding how these credits impact your overall tax situation can provide financial benefits during tax season.

Common questions and troubleshooting

The submission of the Louisiana fortified roof tax form may raise several questions. Homeowners often seek clarity regarding eligibility, potential errors, and the status of their application. Familiarizing yourself with the most common inquiries can streamline the submission process.

Addressing concerns proactively can enhance your application process and expedite approvals.

Utilizing pdfFiller for enhanced document management

pdfFiller offers a comprehensive solution for managing documents related to the Louisiana fortified roof tax form. Users can easily create, edit, and sign PDF documents through the platform’s intuitive design. This cloud-based system is ideal for homeowners and contractors involved in fortification projects.

The collaborative tools provided by pdfFiller enhance communication and ensure accurate project completion, thereby increasing the likelihood of successful tax submissions.

Stay updated: Changes to Louisiana's fortified roof program

Homeowners should remain informed about any recent changes affecting the Louisiana fortified roof tax incentives. Legislative amendments may introduce new qualification criteria or adjustments to tax benefits aimed at further supporting community resiliency following extreme weather.

Staying updated allows you to maximize your benefits and ensure compliance with current standards.

Interactive tools

pdfFiller provides useful interactive tools to assist homeowners in navigating the complexities of the Louisiana fortified roof tax form. These tools can guide users through the completion of their tax documents, ensuring accuracy and compliance with program guidelines.

These tools enhance user experience, making it easier for homeowners to maximize their benefits while navigating the submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send louisiana fortified roof tax to be eSigned by others?

Can I sign the louisiana fortified roof tax electronically in Chrome?

How can I edit louisiana fortified roof tax on a smartphone?

What is Louisiana Fortified Roof Tax?

Who is required to file Louisiana Fortified Roof Tax?

How to fill out Louisiana Fortified Roof Tax?

What is the purpose of Louisiana Fortified Roof Tax?

What information must be reported on Louisiana Fortified Roof Tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.