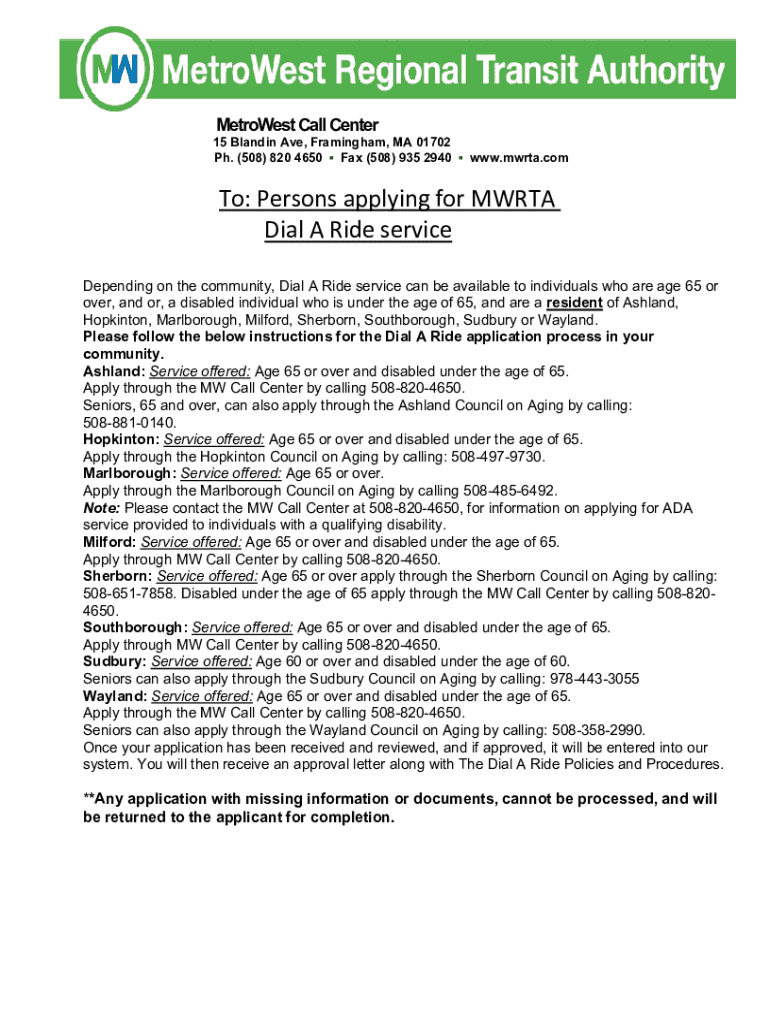

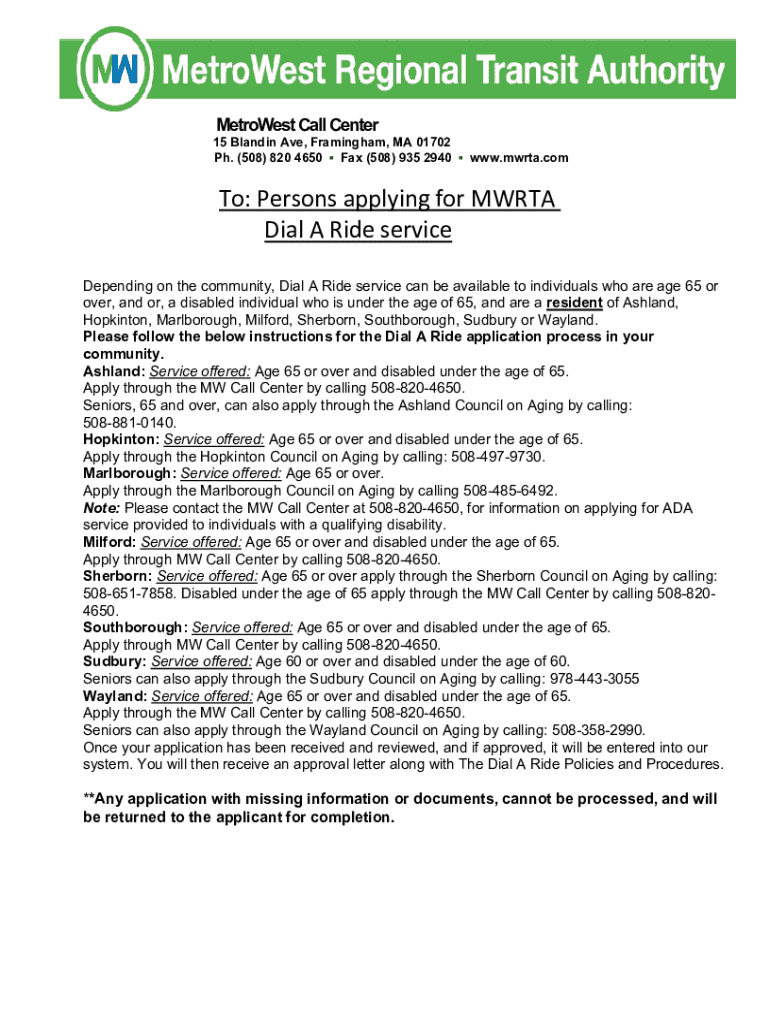

Get the free Persons applying for MWRTA Dial A Ride service

Get, Create, Make and Sign persons applying for mwrta

Editing persons applying for mwrta online

Uncompromising security for your PDF editing and eSignature needs

How to fill out persons applying for mwrta

How to fill out persons applying for mwrta

Who needs persons applying for mwrta?

A Comprehensive Guide for Individuals Applying for MWRTA Form

Understanding the MWRTA Form

The MWRTA Form, or the Massachusetts Wage and Removal Tax Application, plays a crucial role for individuals navigating various local and state-level tax procedures. Specifically designed for those seeking clarity and support in managing their tax obligations, this form ensures compliance with the necessary regulations. It's essential for residents who wish to take advantage of potential tax benefits and relief programs.

The purpose of the MWRTA Form extends beyond mere compliance. It assists individuals in outlining their tax responsibilities while also providing a roadmap for potential deductions and credits they may qualify for. In essence, completing this form is a proactive step towards sound financial management.

Preparing to apply for the MWRTA Form

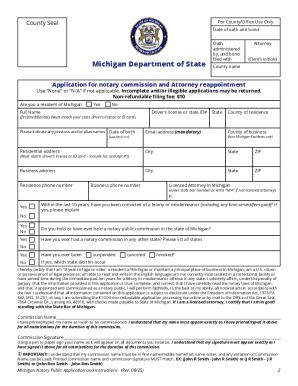

To successfully apply for the MWRTA Form, individuals must gather specific documentation. This preparation mitigates potential delays and errors during the application process. Firstly, identification documents such as a driver's license or passport are essential. These are crucial as they verify your identity and residency.

Additionally, proof of residency is required. This could include utility bills, rental agreements, or any official documents that confirm your residence in Massachusetts. Finally, it’s prudent to check for other necessary documents that may apply based on your unique situation, such as tax returns or employment records.

There are common misconceptions about the MWRTA Form that can lead to unnecessary confusion. One myth is that only high-income earners need to file this form, which is inaccurate. Individuals from various income brackets can benefit from it, making it essential for everyone to understand their tax obligations. Clarifying these requirements is key to demystifying the form-filling process.

Step-by-step guide to filling out the MWRTA Form

Accessing the MWRTA Form is straightforward, particularly through pdfFiller. Navigating to the website will direct you to the relevant section where you can access the form in a user-friendly PDF format. The platform ensures you have the most current version of the MWRTA Form, which is essential for compliance.

Filling out the form effectively involves inputting personal information accurately. Start with your basic details such as name, address, and social security number. Pay attention to the additional details required, including income sources and deductions you're claiming. pdfFiller’s intuitive interface helps guide you through these sections easily.

Once you've entered all necessary information, you can utilize pdfFiller’s editing tools to enhance accuracy before finalizing your application. It's wise to save your progress regularly to avoid losing your details due to interruptions. With pdfFiller, you can seamlessly edit your entries to ensure everything is correct.

Utilizing interactive tools

pdfFiller offers a range of interactive tools that significantly enhance the MWRTA Form application process. One standout feature is the live preview of your completed form, allowing you to see how your entries will appear and make adjustments accordingly. This feature can prevent many common mistakes that could arise from filled fields being overlooked.

Furthermore, the platform includes interactive checklists that guide you through the completion of the MWRTA Form. Collaboration becomes efficient as team members can share the form, offering input and feedback directly on the document. Managing changes and comments in real-time can streamline the overall workflow.

Signing the MWRTA Form

Signing the MWRTA Form is a critical step in ensuring its legality. eSigning through pdfFiller is a secure and recognized method, which can save time compared to traditional signing methods. Users can sign the form from any location, ensuring convenience and flexibility, which aligns perfectly with today’s fast-paced lifestyle.

To eSign, simply follow the concise step-by-step instructions provided within the pdfFiller platform. Ensure your digital signature is valid and recognized by staying updated with state regulations on eSignatures. Once your signature is affixed, you can feel confident that your form now carries the necessary authorizations.

Submitting your MWRTA Form

Once your MWRTA Form is complete, understanding the submission guidelines is crucial. You can typically submit your completed form through online channels, depending on your local tax authority's regulations. Be aware of key deadlines to avoid penalties or delays in processing, as this will ensure you stay compliant with local laws.

Avoid common submission errors by cross-checking your form before sending it off. Consider creating a checklist of critical items to verify, including ensuring there are no missing signatures or incomplete fields, which could hinder the processing of your application.

What happens after submission?

After submitting the MWRTA Form, you may wonder about the processing times. While these can vary based on the volume of applications and the efficiency of local tax operators, it's typically advisable to expect some waiting period. Knowing this timeline helps manage expectations and reduces anxiety about the process.

Checking the status of your application can usually be done through the local tax authority's online platform. Should follow-up requests arise, be prepared to provide any additional information requested swiftly. This proactive approach can smoothen the continuation of your application processing.

Troubleshooting common issues

Navigating any potential issues while filling out the MWRTA Form is essential for a smooth application process. One common problem individuals face is difficulty understanding specific fields or requirements on the form. To address these concerns, refer to FAQs typically provided on the platform used for application.

If challenges with submissions arise, do not hesitate to contact support for assistance. pdfFiller offers a responsive team that can guide you through the process, ensuring no question remains unanswered, reinforcing its commitment to user satisfaction.

Additional tips for successful form application

To ensure a successful MWRTA Form application, adopting best practices for completing forms online is paramount. Start by using the correct version of the form and reading instructions carefully before filling anything out. This attention to detail can save time and miscommunications during the process.

Leveraging pdfFiller for comprehensive document management also enhances the organization of your forms and records. By efficiently categorizing completed forms, you minimize confusion in future tax-related endeavors. These small but significant steps can streamline your overall experience.

Enhancing your document skills

As you become adept at managing the MWRTA Form, consider how pdfFiller can facilitate your handling of other forms as well. The platform is equipped with tools designed for a multitude of forms ranging from tax applications to contracts, empowering you to become more efficient in your document-related tasks.

Keep an eye on future updates and enhancements. pdfFiller continues to refine its services, ensuring you stay ahead in the document handling game. Embracing these improvements can enhance your abilities and ease in dealing with various forms in today's digital world.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my persons applying for mwrta directly from Gmail?

How do I execute persons applying for mwrta online?

How can I fill out persons applying for mwrta on an iOS device?

What is persons applying for mwrta?

Who is required to file persons applying for mwrta?

How to fill out persons applying for mwrta?

What is the purpose of persons applying for mwrta?

What information must be reported on persons applying for mwrta?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.