Get the free Changes to PEBB benefits for 2026Washington State Health ...

Get, Create, Make and Sign changes to pebb benefits

How to edit changes to pebb benefits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out changes to pebb benefits

How to fill out changes to pebb benefits

Who needs changes to pebb benefits?

Changes to PEBB Benefits Form for 2026: What You Need to Know

Overview of PEBB benefits changes

This year marks significant changes to the Public Employees Benefits Board (PEBB) benefits structure, with updates that will impact employees and retirees across multiple areas. Understanding these changes is vital not only for ensuring compliance but also for optimizing your health and wellness benefits. Awareness of new eligibility requirements and enrollment timelines can help you avoid potential disruptions in coverage.

The alterations made to the PEBB benefits form are designed to streamline the enrollment process and enhance user experience. Employees and retirees must take the time to familiarize themselves with the updated features to ensure they make the most informed decisions about their benefits. The importance of being aware of these changes cannot be overstated, as they can have a lasting effect on your health care options and overall costs.

Key changes in PEBB benefits for 2026

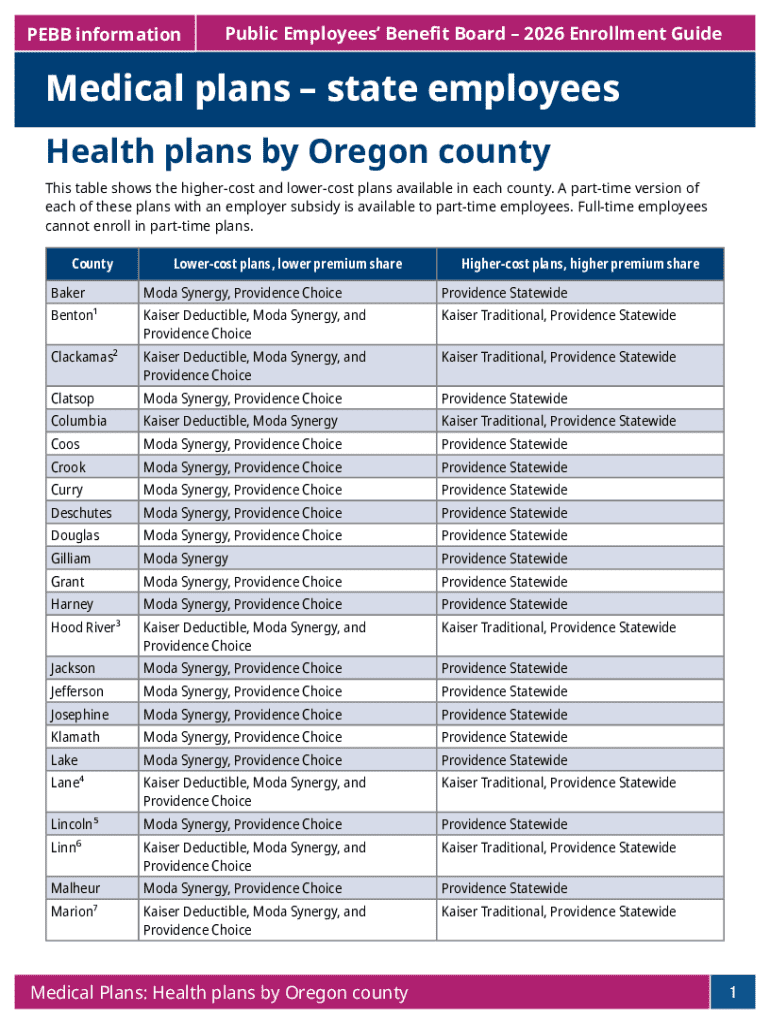

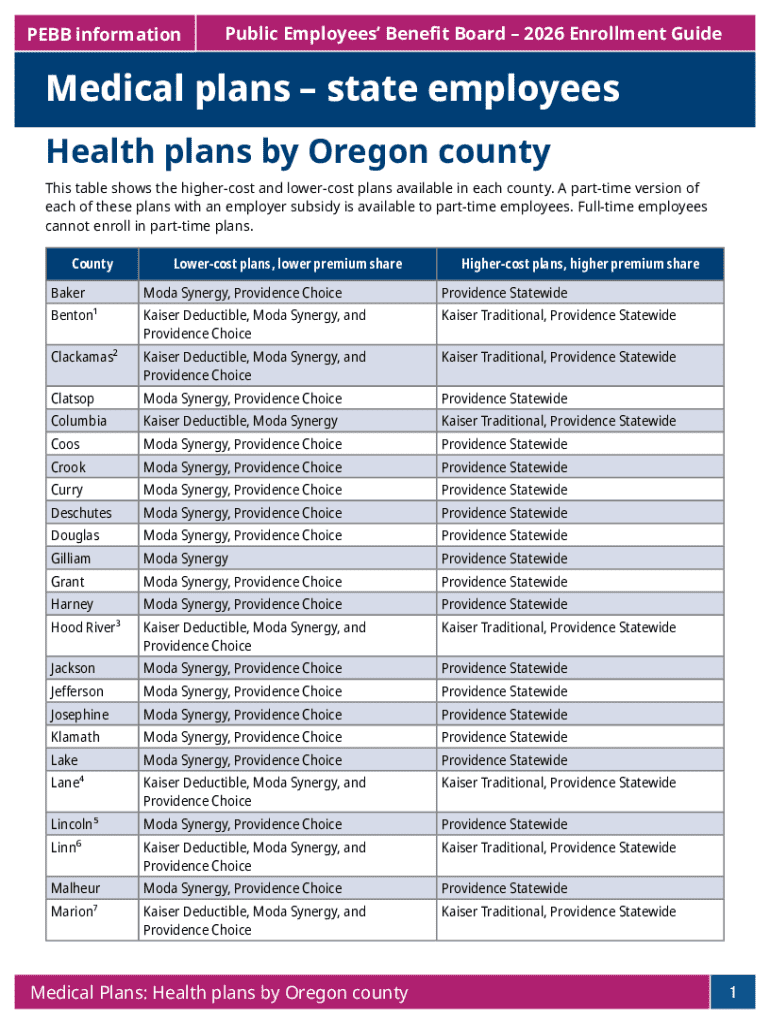

Among the most notable updates for the year are the introduction of new medical plan options designed to cater to diverse health needs. These changes aim to provide a broader range of choices for employees and retirees while keeping costs manageable.

The updates also include significant alterations to existing medical plans, which may affect coverage and associated costs. Such changes warrant careful attention to ensure continued alignment with individual health care needs.

New medical plan options

The PEBB program is excited to announce the addition of several new medical plans in 2026 to better serve the diverse needs of employers and their employees. Each new plan comes with distinct coverage benefits and eligibility criteria, ensuring individuals can choose options that best fit their healthcare requirements. During the open enrollment period, employees should review each new option, comparing their offerings against the existing plans.

Understanding the differences between these new plans and existing ones is critical. While some may offer broader networks or additional services, others might have higher premiums or different cost-sharing structures. This year's open enrollment timeline will be crucial, beginning in the fall and officially ending shortly before the start of the new plan year.

Updates to existing medical plans

With these enhancements in mind, employees should carefully examine modifications to existing medical plans. Notable changes include adjustments in coverage, cost-sharing, and potentially the availability of certain services. Employers should communicate these adjustments clearly to ensure all employees understand their options and how these may impact their premiums and out-of-pocket costs.

In addition to basic coverage, there have been notable enhancements in areas like preventative care and chronic disease management, which are crucial for promoting long-term health. Employees should weigh these changes against their personal health situations and financial circumstances to make informed choices.

Changes to dental plans

As part of the benefits update for 2026, significant changes have also been introduced to the dental coverage options available under PEBB. These modifications include the introduction of new plans structured to better align with overall health and wellness strategies. Employers should ensure employees have access to thorough documentation explaining these changes.

It's crucial for employees to compare these updated dental plans with previous offerings. Differences in coverage can include adjustments in copayments, maximums, and allowed services. To help employees make informed decisions, a side-by-side comparison chart is available, highlighting the benefits across each plan.

Flexible spending arrangements (FSAs) adjustments

The 2026 updates to Flexible Spending Arrangements (FSAs) introduce changes to contribution limits for both health care and dependent care accounts. For individuals looking to maximize their benefits, being aware of these limits is essential. The new contribution amounts can significantly affect budget planning for medical expenses and child care support.

Notably, these accounts are limited to a designated contribution cap, which has been adjusted accordingly. Employees must be proactive in understanding their enrollment options and deadlines to avoid losing the tax benefits these accounts offer. Timely submission of claims and understanding the grace periods will also be vital under the revised guidelines.

Dependent care assistance program (DCAP) modifications

The Dependent Care Assistance Program (DCAP) has undergone vital modifications in 2026, simplifying enrollment and increasing flexibility for employees. Clarifying eligibility criteria and limits on contributions can help families budget their dependent care expenses effectively. Employers should assist employees in recognizing these changes and ensuring participation.

The new structure allows for greater accessibility to families. Employees can maximize benefits by understanding changes like eligibility updates and flexible claim submission plans that ease the financial burden of dependent care. Detailed guidance can assist employees in navigating this revised program efficiently.

Long-term disability (LTD) insurance updates

Long-term Disability (LTD) insurance has also seen updates that could provide additional security to employees. New provisions now ensure that employees are covered with enhanced options tailored to different levels of income replacement. The restructuring aims to offer a more comprehensive support system during challenging times.

Employees should familiarize themselves with the new provisions, differences from previous policy terms, and the claims filing process. Understanding what is needed for claims submission can prevent future delays and ensure timely financial support during periods of disability, enhancing overall peace of mind.

Rule changes impacting PEBB benefits

Recent regulatory shifts have had a significant impact on PEBB benefits, necessitating keen awareness among employees and employers alike. Understanding these changes is fundamental, as they can influence coverage options, premiums, and overall access to benefits. The coverage changes accompanying these rule changes reflect an evolving landscape meant to address current health care needs.

Employers should ensure that team members are informed about these shifts to avoid any confusion during enrollment. Employees can stay updated through official communications and regular informational sessions, making it easier to navigate the evolving structure of PEBB benefits.

2026 monthly premiums: employees

Budgeting for the changes in premiums for 2026 is essential for all employees enrolled in PEBB benefits. Variations in premiums between individual and family coverage, as well as differences among the various plans offered, merit careful consideration. Employees should prepare by reviewing expected costs and how these may impact their overall financial plans.

Employers must clearly communicate these changes and the rationale behind them. Providing unit cost breakdowns along with the annual total may help employees manage their budgets effectively, enabling forward planning for associated healthcare costs.

Tools for navigating changes to PEBB benefits form

The recent changes to the PEBB benefits form emphasize the importance of having the right tools for navigating the updated structure. For individuals and teams managing their documentation, understanding how to fill out the updated forms accurately is paramount for avoiding delays in processing and ensuring timely access to benefits.

Using resources such as pdfFiller greatly enhances this experience. This platform empowers users to fill out, edit, and submit the PEBB benefits form effortlessly, ensuring no detail is overlooked. Access to electronic submission significantly streamlines the overall process, allowing users to manage their documents from any device rapidly.

Interactive tools to manage your PEBB benefits

Incorporating interactive tools can greatly enhance your interaction with the new PEBB benefits form. pdfFiller offers a suite of features that can facilitate document management effectively. The platform allows users to not only fill out forms but also share them with team members for collaborative editing and input.

Utilizing eSignature capabilities enables a smooth submission process, making it easier for employees to provide consent and finalize their applications without delay. The comprehensive toolset provided supports users in their efforts to navigate the transition effortlessly.

Frequently asked questions (FAQs)

Understanding the recent changes to PEBB benefits often raises questions among employees. Common inquiries center around the specifics of coverage, the impact of the changes on individual situations, and clarifications related to the updated benefits form. Addressing these FAQs can help mitigate confusion and ensure that employees are well-informed.

PEBB has resources available to help guide employees through their questions, including online portals and customer support services. Being proactive in seeking information can vastly improve personal understanding of one's benefits and how to utilize them.

Connect with PEBB benefits resources

Staying connected with PEBB benefits resources is essential for receiving timely updates and support regarding your benefits. Employees are encouraged to reach out to the PEBB customer service for personalized assistance, ensuring they fully understand the changes and how they impact their plans.

Utilizing available online portals and tools for enrollment will also keep users informed. Staying proactive in seeking out information will empower employees and retirees to navigate benefits with clarity, ultimately enhancing their overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get changes to pebb benefits?

How do I fill out changes to pebb benefits using my mobile device?

Can I edit changes to pebb benefits on an iOS device?

What is changes to pebb benefits?

Who is required to file changes to pebb benefits?

How to fill out changes to pebb benefits?

What is the purpose of changes to pebb benefits?

What information must be reported on changes to pebb benefits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.