Get the free Direct Deposit Payroll Authorization Form - Formalu

Get, Create, Make and Sign direct deposit payroll authorization

Editing direct deposit payroll authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit payroll authorization

How to fill out direct deposit payroll authorization

Who needs direct deposit payroll authorization?

Direct deposit payroll authorization form: A comprehensive guide

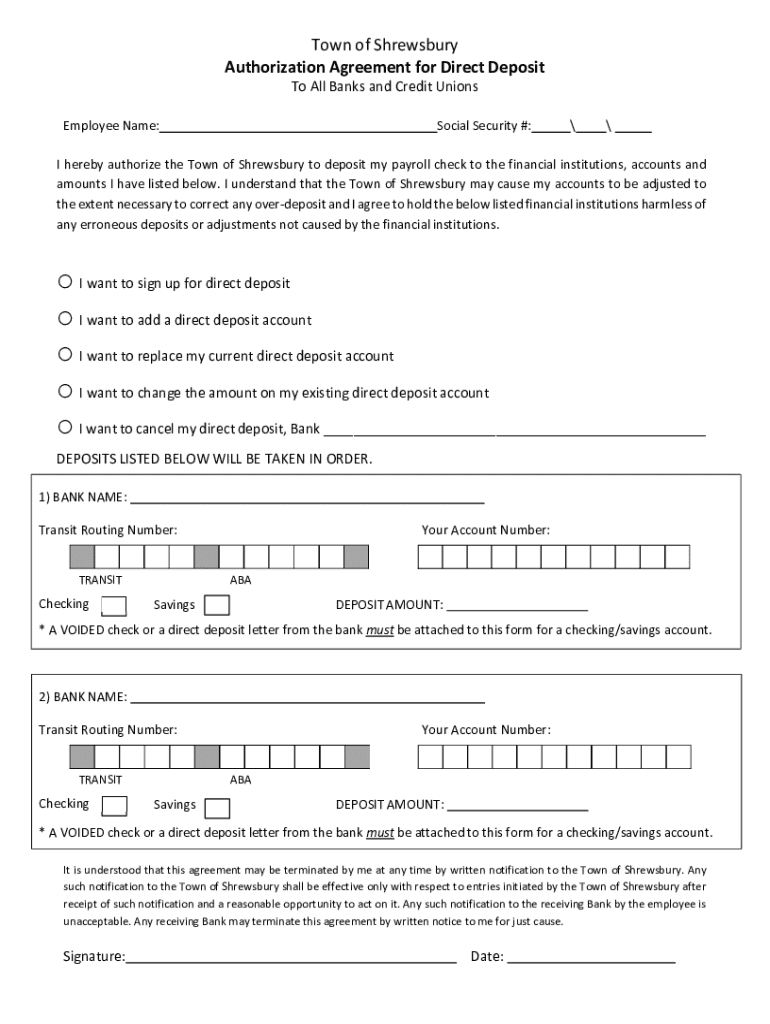

Understanding the direct deposit payroll authorization form

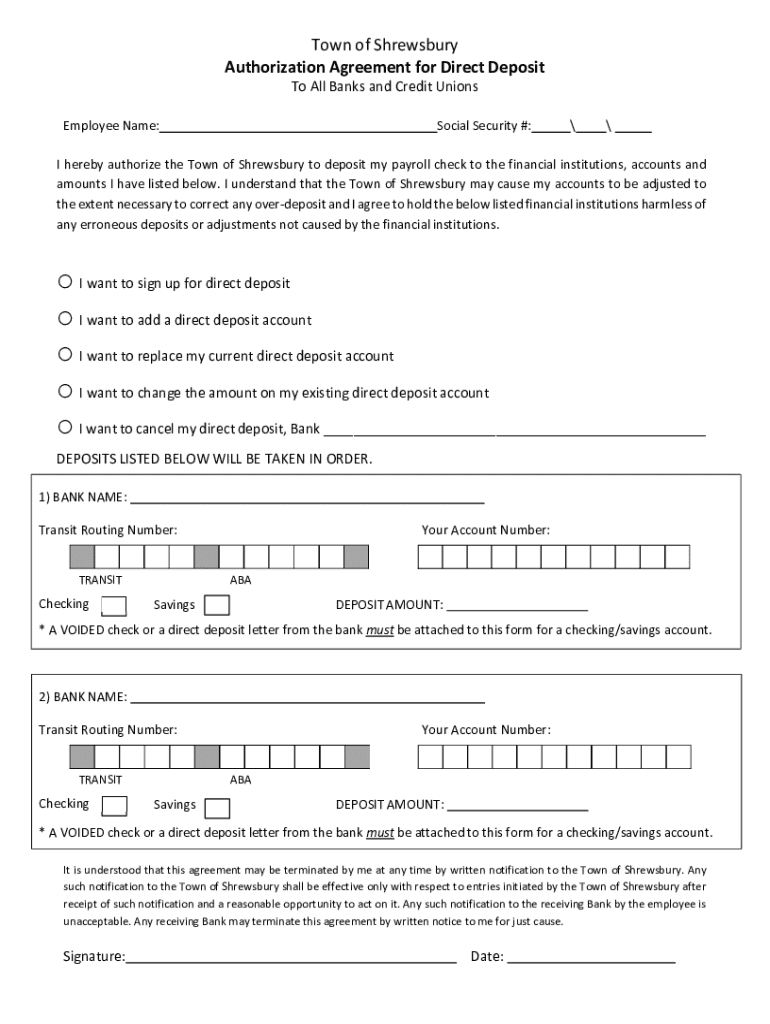

The direct deposit payroll authorization form is a crucial document that enables employees to receive their salary directly into their bank accounts instead of receiving a physical paycheck. This form facilitates a convenient, timely, and straightforward payment method, ensuring that employees have immediate access to their funds on payday. By authorizing the deposit directly into their banks, employees can manage their finances better and avoid the hassle associated with physical check deposits.

For employers, implementing a direct deposit payroll system can streamline payroll processing, reduce operational costs related to printing checks, and improve overall employee satisfaction by providing a reliable payment method. Moreover, this system minimizes the risk of lost or stolen checks, enhancing financial security for both parties.

Eligibility requirements

Not every employee is automatically eligible to use the direct deposit payroll authorization form. Generally, anyone who is on payroll and has a bank account capable of receiving electronic transfers can utilize this form. However, companies may have specific eligibility criteria that potential users must meet, which typically include employment status and length of service.

When completing the form, employees are required to provide pertinent information, such as their personal details, including name and address, as well as banking information, which typically involves the account number and routing number. This information checks the feasibility of setting up a direct deposit account. Employers, on the other hand, have the responsibility to ensure the secure handling of this sensitive information and maintain compliance with data protection regulations.

How to fill out the direct deposit payroll authorization form

Filling out the direct deposit payroll authorization form is a straightforward process, especially when using digital platforms like pdfFiller. Below is a step-by-step guide to ensure accuracy and efficiency.

While filling out the form, employees should avoid common mistakes such as entering incorrect bank details, omitting important fields, or not signing the form. To enhance submission accuracy, it's advisable to use clear handwriting or enter information digitally, and always double-check every entry before submitting the form.

Workflow for submitting the form

Once the direct deposit payroll authorization form is filled out, employees must follow a structured submission process. Typically, the first step involves saving the completed form using pdfFiller, which allows for easy documentation management. Employees can also eSign the document digitally, increasing its security and efficiency.

After submission, it becomes the employer's responsibility to review and process the authorization. They need to ensure the information is accurate and set up direct deposits effectively. Additionally, employees should be aware of how to modify or update their information should their bank details change.

Managing your direct deposit preferences

After submitting the direct deposit payroll authorization form, there are several aspects to consider regarding the management of your direct deposit. Initially, it's essential to monitor your direct deposit transactions. Employees should regularly check their bank statements to ensure that deposits are occurring accurately and on schedule.

If however, issues arise, such as incorrect payments or errors from the bank, immediate action is necessary. Employees should contact both the employer's payroll department and their bankers to clarify the issue. Additionally, if there are updates to banking information, such as changing banks or account types, employees must fill out a new direct deposit payroll authorization form promptly to avoid payment disruptions.

Benefits of using pdfFiller for payroll forms

pdfFiller stands out as an optimal platform for managing payroll forms like the direct deposit payroll authorization form. This cloud-based solution simplifies the document creation and management process, allowing individuals and teams to handle sensitive information securely and efficiently. Whether you are working solo or as part of a team, pdfFiller provides tools for real-time collaboration during the form-filling process.

Another significant benefit of utilizing pdfFiller is the secure cloud-based storage for sensitive information. Employees can rest assured that their banking and personal information is kept confidential and accessible only by authorized individuals. Furthermore, pdfFiller allows seamless sharing options, making it easy to collaborate with HR teams or financial advisors when necessary, ensuring all involved parties have the information they need.

Frequently asked questions (FAQs)

The direct deposit payroll authorization form can often raise questions from users. Here are some of the most frequently asked inquiries that address common concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find direct deposit payroll authorization?

How do I fill out direct deposit payroll authorization using my mobile device?

How do I complete direct deposit payroll authorization on an iOS device?

What is direct deposit payroll authorization?

Who is required to file direct deposit payroll authorization?

How to fill out direct deposit payroll authorization?

What is the purpose of direct deposit payroll authorization?

What information must be reported on direct deposit payroll authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.