Get the free Treasury : Cash Management Forms

Get, Create, Make and Sign treasury cash management forms

Editing treasury cash management forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasury cash management forms

How to fill out treasury cash management forms

Who needs treasury cash management forms?

Treasury Cash Management Forms: Essential Tools for Financial Efficiency

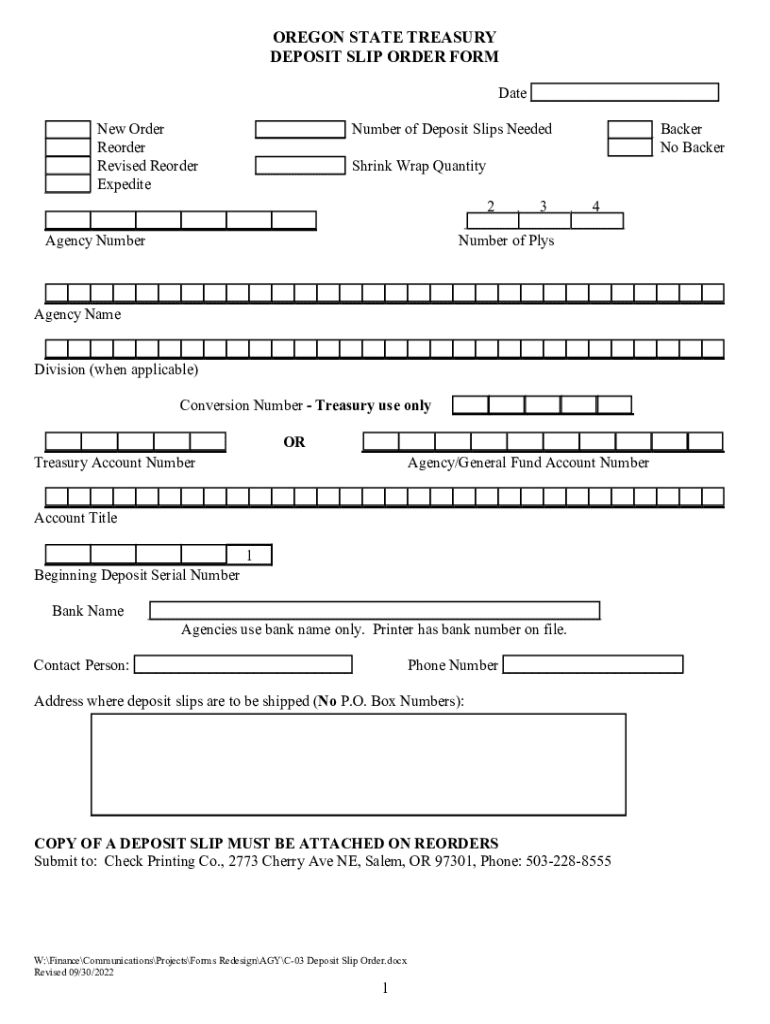

Understanding treasury cash management forms

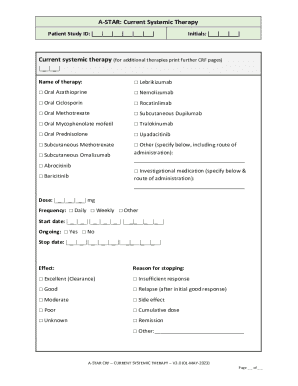

Treasury cash management forms are critical documents that facilitate the effective handling of cash within an organization. These forms serve multiple purposes, ranging from assisting in financial reporting to managing cash flow efficiently. By standardizing processes associated with cash handling, treasury cash management forms help organizations maintain a clear overview of their liquidity and funding status.

The importance of these forms cannot be overstated; they play a significant role in ensuring that cash is utilized efficiently, thus maximizing profitability and minimizing financial risk. In a dynamic economic environment, where businesses need to respond swiftly to market changes, having a solid grasp on cash management through these forms is vital.

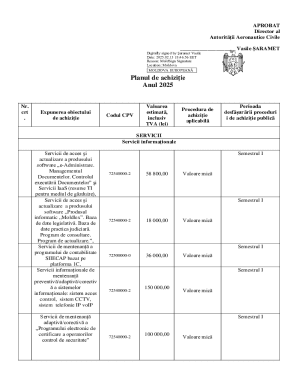

Types of treasury cash management forms

There are various types of treasury cash management forms that organizations can use, each catering to specific cash management activities. Here’s a brief overview of some of the most common forms:

The role of treasury cash management in organizations

Effective cash management is critical to an organization’s operational and financial stability. It directly influences liquidity and funding strategies, which, if neglected, could lead to cash shortages or inefficiencies that hinder growth. An organization that manages its cash flows with precision enhances its operational efficiency, allowing it to allocate resources effectively and invest in opportunities.

Moreover, the management of treasury cash is pivotal for preparing for unexpected expenditures or market fluctuations. A well-devised cash management strategy helps organizations maintain adequate liquidity levels and fend off potential financial crises.

Key components of treasury cash management

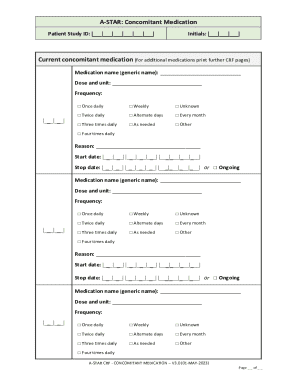

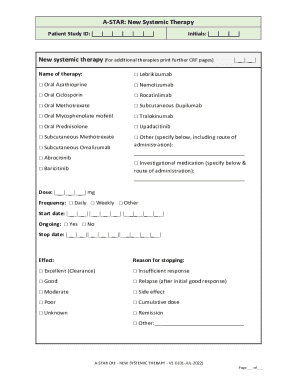

The effectiveness of treasury cash management hinges on several key components. These include:

How to create and utilize treasury cash management forms

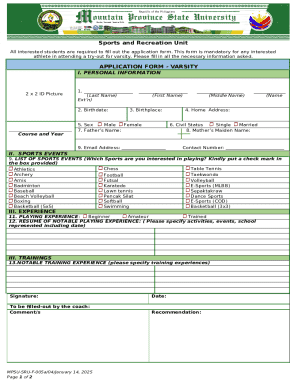

Creating and utilizing treasury cash management forms effectively can simplify the financial processes of any organization. Start by gathering the necessary financial data, as accurate information is vital for successful cash management. Here is a step-by-step guide:

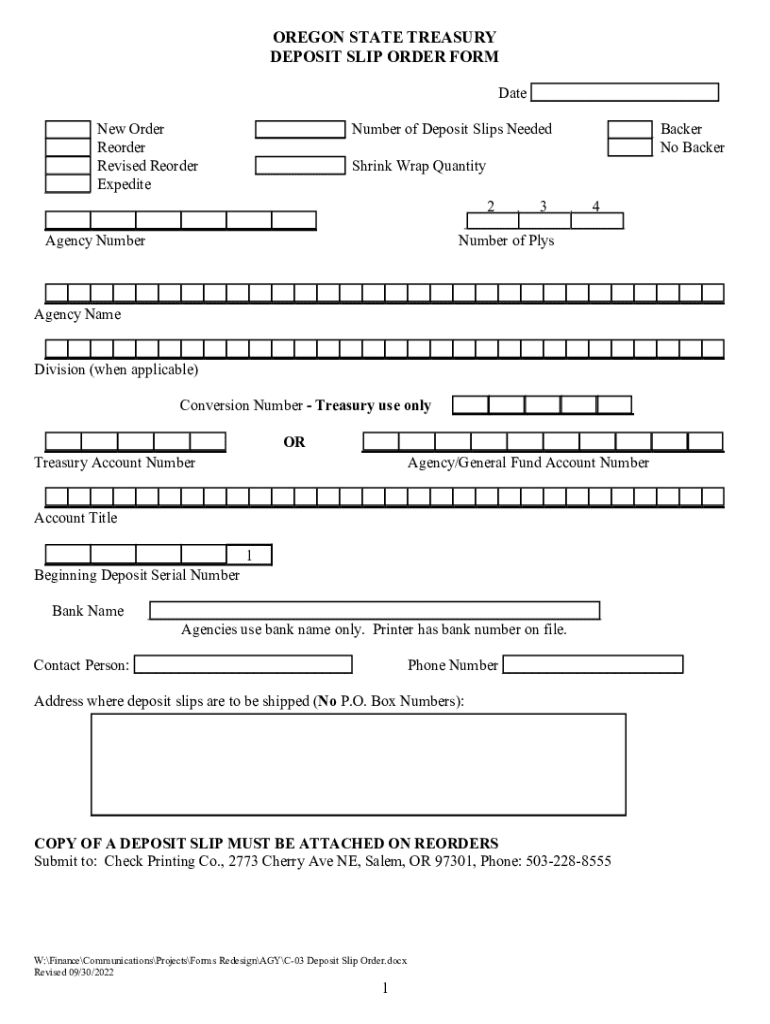

Accurate data entry is critical. Double-check numerical data and confirm compliance with accounting standards to prevent inaccuracies that could lead to incorrect analyses. Leveraging technological tools, such as pdfFiller, can streamline the form completion process. Features like auto-fill, eSign, and collaboration tools simplify the management of treasury cash management forms, making it easy for users anywhere, including professionals operating in the state of Oregon or beyond.

Best practices for managing treasury cash management forms

To maximize efficiency, organizations should adopt best practices for managing treasury cash management forms. Utilizing technology effectively is one of the foremost strategies. Digital tools offer numerous advantages over traditional paper forms; digital management allows for easy updates and quick access across teams.

Organizations should maintain regular updates and monitoring of their forms. Keeping these documents current is vital for effective treasury management. Establishing a schedule for reviewing and updating cash management strategies helps ensure that responses to changing market conditions are swift and effective.

Moreover, collaboration across teams—such as finance, accounting, and treasury departments—enhances the completion and accuracy of these forms. Utilizing shared platforms for document review and approval processes helps avoid potential errors and fosters a culture of teamwork.

Common challenges in treasury cash management and solutions

Despite its importance, treasury cash management often faces various challenges. Common issues include poor cash flow visibility and inaccurate forecasting, which can derail even well-intentioned financial strategies. Organizations may find it difficult to understand their actual cash position or to predict future needs accurately.

To overcome these challenges, implementing robust monitoring tools is essential. Organizations should utilize both conventional and cutting-edge technologies for cash monitoring and forecasting. Additionally, training staff on effective cash management practices empowers teams to maintain high standards in financial operations.

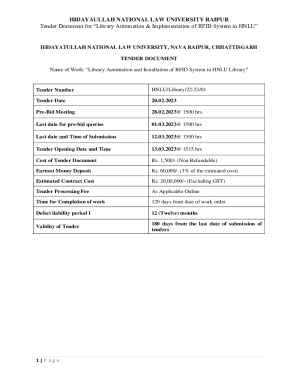

Enhancing security and compliance with treasury forms

Adherence to regulatory requirements is a fundamental aspect of managing treasury cash management forms. Organizations must remain cognizant of compliance standards related to treasury management, as laws and regulations are regularly updated. Failure to maintain compliance can result in penalties and damage to an organization’s reputation.

Furthermore, securing sensitive financial information is a priority. Best practices for data protection should be adopted, including encryption and the use of secure access protocols. Implementing eSignatures adds an extra layer of security, ensuring that approvals are legitimate and properly documented.

Case studies: Successful implementation of treasury cash management forms

Examining real-world examples can provide valuable insights into effective treasury cash management. For instance, Organization A utilized streamlined cash management forms to enhance visibility and efficiency in their treasury operations. As a result, they improved their cash flow forecasting accuracy by 20% and reduced approval times for payments.

In another instance, Organization B focused on compliance by adopting standardized treasury cash management forms. Their proactive approach led to meeting regulatory requirements successfully, reducing audit findings by 30%. These case studies underscore the potential lessons for other organizations seeking to enhance their treasury management processes.

From these examples, organizations can draw key takeaways including the necessity for clear procedures, regular reviews, and the role of technology in enhancing cash management activities.

Conclusion on the importance of efficient treasury cash management

In conclusion, treasury cash management forms are not merely administrative documents; they are foundational tools that support the financial health of organizations. By implementing the best practices outlined in this guide, teams can enhance their cash management processes significantly.

In a fast-paced financial landscape, the ability to utilize treasury cash management forms effectively can foster agility and resilience. Teams looking to optimize their operations will benefit from adopting innovative forms and tools like those offered by pdfFiller, ensuring they are equipped to promote financial well-being and stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my treasury cash management forms directly from Gmail?

How can I send treasury cash management forms for eSignature?

How do I edit treasury cash management forms straight from my smartphone?

What is treasury cash management forms?

Who is required to file treasury cash management forms?

How to fill out treasury cash management forms?

What is the purpose of treasury cash management forms?

What information must be reported on treasury cash management forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.