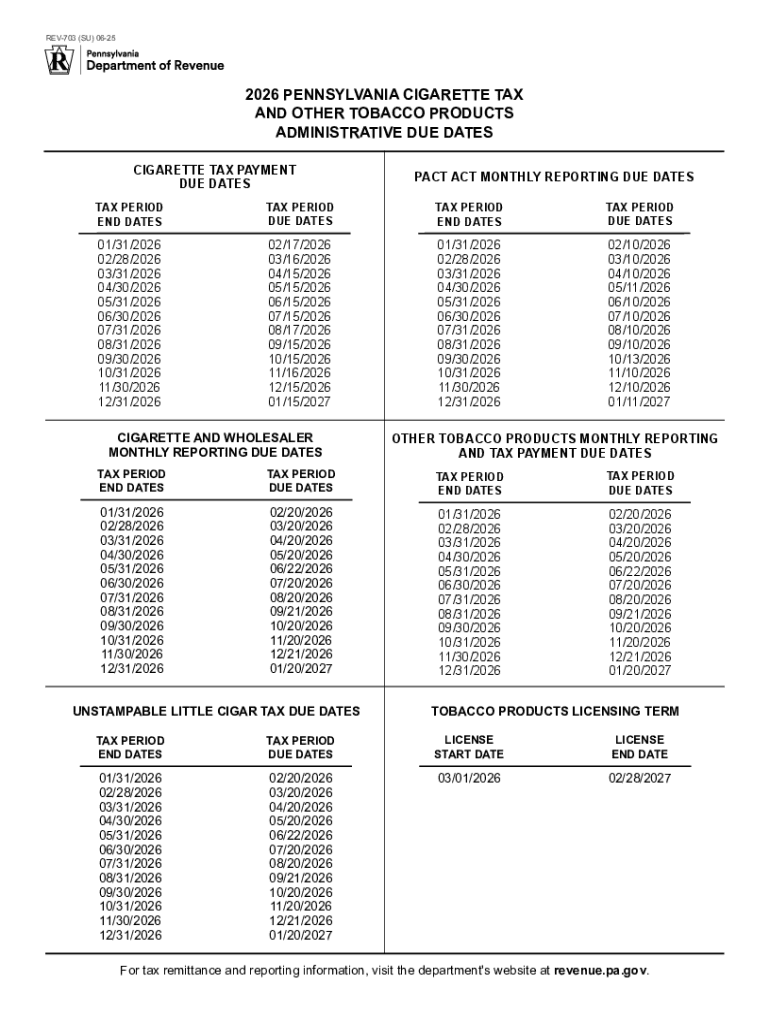

Get the free 2026 Pennsylvania Cigarette Tax and Other Tobacco Products Administrative Due Dates ...

Get, Create, Make and Sign 2026 pennsylvania cigarette tax

How to edit 2026 pennsylvania cigarette tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 pennsylvania cigarette tax

How to fill out 2026 pennsylvania cigarette tax

Who needs 2026 pennsylvania cigarette tax?

2026 Pennsylvania Cigarette Tax Form: A Comprehensive Guide

Understanding the 2026 Pennsylvania cigarette tax form

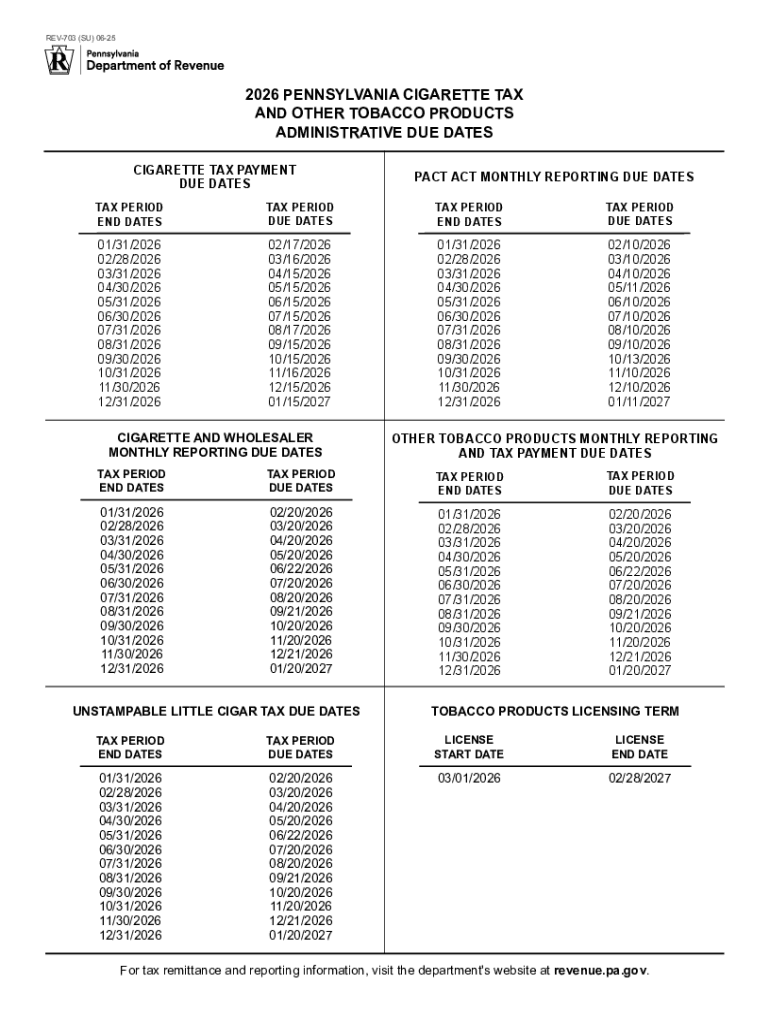

The 2026 Pennsylvania cigarette tax form stands as a crucial document for both consumers and businesses operating within the state. Pennsylvania has a long history of cigarette taxation, which serves to regulate tobacco sales and generate revenue for state programs. In recent years, these regulations have seen notable changes, prompting the introduction of the 2026 form to address new compliance requirements and procedural updates.

Understanding the nuances of the 2026 form is essential for ensuring adherence to state laws and maximizing tax efficiency. This form is significant not only for its role in uncovering reporting obligations but also for reflecting the evolving landscape of nicotine regulation, which includes updates aimed at discouraging smoking and ensuring public health.

Who needs to file the 2026 cigarette tax form?

Filing the 2026 Pennsylvania cigarette tax form is mandatory for certain individuals and businesses involved in the sale and distribution of cigarettes in the state. Key categories of eligible filers include:

Circumstances necessitating the filing may include exceeding a specific quantity of cigarettes purchased or sold and failure to pay the requisite taxes. Certain exemptions apply, such as federal or state agencies purchasing cigarettes under specific programs, which may not necessitate filing the form.

Key components of the 2026 Pennsylvania cigarette tax form

The 2026 Pennsylvania cigarette tax form comprises several sections, each addressing critical aspects of tobacco sales. These include:

Understanding terminology on the form is vital. Taxable items typically include most commercial cigarettes, while non-taxable items may encompass specific exemptions or government-related purchases.

Step-by-step guide to completing the form

Before filling out the 2026 Pennsylvania cigarette tax form, preparation is key. Begin by collecting necessary documents such as previous tax records, invoices from providers, and any relevant transaction documentation relevant to your sales and purchases.

Here's a streamlined outline on how to complete the form:

Avoid common mistakes such as misreporting sales figures or incorrectly calculating the tax owed to prevent penalties or the need for revisions.

Submitting the 2026 Pennsylvania cigarette tax form

After completing the form, the next step involves submission, which can be done through various channels. Online submissions are encouraged for their efficiency; the Pennsylvania Department of Revenue provides portals like myPATH for filing. Alternatively, physical forms can be mailed, but this requires adherence to specific postal guidelines.

Important deadlines exist for submission, which vary depending on whether you're filing as an individual or a business. Missing these deadlines could result in penalties, thus timely submissions are critical.

Frequently asked questions (FAQs)

Addressing common queries about the filing process can be immensely helpful for those engaged with the 2026 Pennsylvania cigarette tax form. For instance, if a mistake is made on the submitted form, prompt action should be taken to correct it, including possible resubmission or amendments.

Another common inquiry concerns the calculation of the cigarette tax on out-of-state purchases. This often falls under specific regulations, which may require particular documentation to validate the exemption or tax calculation, emphasizing the need for thorough record-keeping.

Tools for managing your 2026 Pennsylvania cigarette tax form

To streamline the process of managing your 2026 Pennsylvania cigarette tax form, tools from pdfFiller can be invaluable. Features that enhance your experience include the ability to edit tax documents with ease, collaborate directly with team members, and utilize eSign for quick submission.

Interactive resources, such as calculators tailored to estimating your tax obligations, can significantly reduce the time spent on the form. Additionally, sample filled forms can serve as practical references to help guide you through the filing process.

Updates and changes to tax policies for 2026

Legislation can revolutionize aspects of the cigarette tax framework. Updates from 2025 to 2026 have brought specific changes, including adjusted tax rates and stricter compliance requirements aimed at reducing overall tobacco sales.

Staying informed about these changes is crucial. Regularly visit the Pennsylvania Department of Revenue website for updates or consult with tax professionals to maintain compliance with the latest tax laws.

Related tax forms and documents

Besides the 2026 Pennsylvania cigarette tax form, taxpayers may encounter various other forms relevant to their overall tax responsibilities, such as income tax forms or forms relating to sales tax. Familiarity with these documents can ensure comprehensive tax compliance.

Accessing additional resources, including guides and templates through pdfFiller, can enhance understanding of required documentation and simplify the filing process.

Community insights and shared experiences

Shared experiences from other individuals and businesses can offer valuable insights into the filing process for the 2026 Pennsylvania cigarette tax form. Community discussions often highlight best practices and tips from those who have successfully navigated the form.

Expert tax advisors also provide recommendations tailored to unique circumstances faced by filers. Their perspectives can illuminate complex areas of tax law, providing clarity to those unfamiliar with regulatory nuances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2026 pennsylvania cigarette tax online?

Can I create an eSignature for the 2026 pennsylvania cigarette tax in Gmail?

How do I edit 2026 pennsylvania cigarette tax straight from my smartphone?

What is 2026 Pennsylvania cigarette tax?

Who is required to file 2026 Pennsylvania cigarette tax?

How to fill out 2026 Pennsylvania cigarette tax?

What is the purpose of 2026 Pennsylvania cigarette tax?

What information must be reported on 2026 Pennsylvania cigarette tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.