Get the free Tobacco Tax and Licensing Rules for Pennsylvania Businesses

Get, Create, Make and Sign tobacco tax and licensing

Editing tobacco tax and licensing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tobacco tax and licensing

How to fill out tobacco tax and licensing

Who needs tobacco tax and licensing?

Understanding the Tobacco Tax and Licensing Form

Understanding tobacco tax regulations

Tobacco taxation is a significant mechanism used by governments worldwide to regulate the consumption of tobacco products, thereby promoting public health and generating revenue. These regulations encompass various types of products, including cigarettes, cigars, and smokeless tobacco, which are all subject to specific taxes. Complying with tobacco tax laws is crucial for both individuals and businesses to avoid legal complications and substantial penalties.

Various entities dealing with tobacco, such as manufacturers, importers, and distributors, must understand these tax structures thoroughly. Beyond federal regulations, states impose their own taxes, resulting in a complex landscape that businesses must navigate successfully.

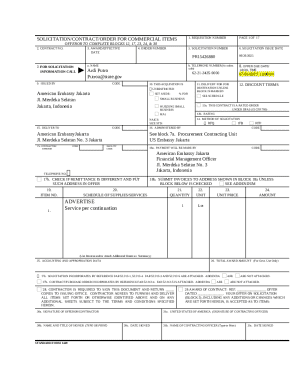

Detailed breakdown of the tobacco tax and licensing form

The tobacco tax and licensing form is designed to facilitate compliance with state and federal tobacco regulations. Its primary purpose is to streamline the registration process for manufacturers, distributors, and retailers. When filling out the form, it's essential to provide accurate and comprehensive information; errors can lead to penalties or delays in processing.

This form is particularly critical for small businesses that may not have the same resources or guidance as larger companies. The importance of understanding who needs to complete this form cannot be overstated, as failure to comply can lead to significant financial repercussions.

Step-by-step instructions for completing the form

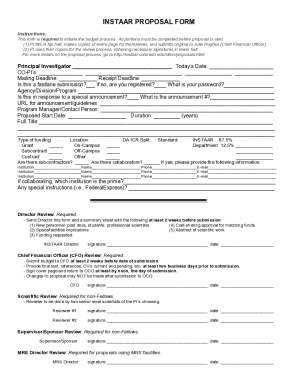

Successfully completing the tobacco tax and licensing form involves several crucial steps. First, gather all necessary documentation, which includes financial paperwork, previous tax returns, and identification numbers. Accurate reporting is vital, as discrepancies can result in audits or penalties.

Next, fill out the form systematically. Each section is designed to collect specific information about your business and products, including the business name, address, and tax identification number, along with the types of tobacco products being manufactured or sold. Common mistakes include omitting information or providing incorrect figures.

Editing and managing your tobacco tax form

Using pdfFiller can greatly simplify the process of managing your tobacco tax and licensing form. This platform allows you to upload and edit your forms seamlessly, ensuring that you maintain accuracy. With features such as real-time collaboration and easy e-signatures, pdfFiller supports your business by making document management straightforward and efficient.

Record-keeping is a fundamental aspect of compliance. Detailed records not only help in filing accurate returns but also serve as critical documentation in the event of an audit. Utilizing digital tools can enhance your record-keeping practices and ensure that you have access to all necessary documents.

Submitting the tobacco tax and licensing form

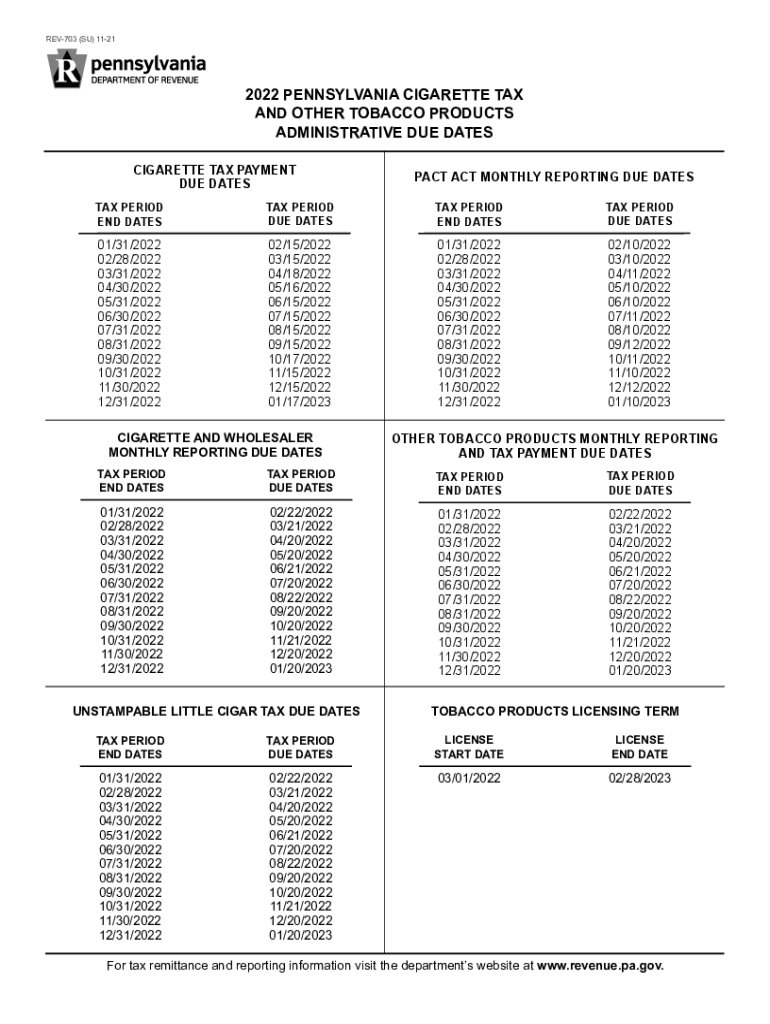

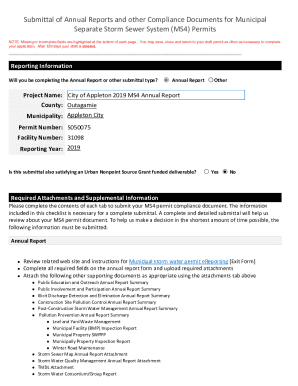

Submission requirements for the tobacco tax and licensing form can vary significantly from state to state. Understanding your state's specific requirements and deadlines is crucial to maintaining compliance. For instance, some states may have electronic submission options, while others may require paper forms.

To track the status of your submission, ensure you save confirmation receipts if submitting electronically, or follow up with the relevant tax agency if submitting by paper. Each state will have its own procedure for confirming receipt of the form, so familiarize yourself with these differences.

Common questions and answers

Frequently asked questions about tobacco tax compliance often revolve around the implications of submitting incorrect information. It is essential to rectify any mistakes quickly, as failing to do so can result in penalties and audits by tax authorities. Always ensure clarity and correctness to avoid an audit situation.

For those needing assistance, several resources are available. State and federal tax agencies provide help through their hotlines and websites. Furthermore, pdfFiller offers tailored support for document-related inquiries, guiding users through any challenges they may encounter while filing.

Important deadlines and compliance tips

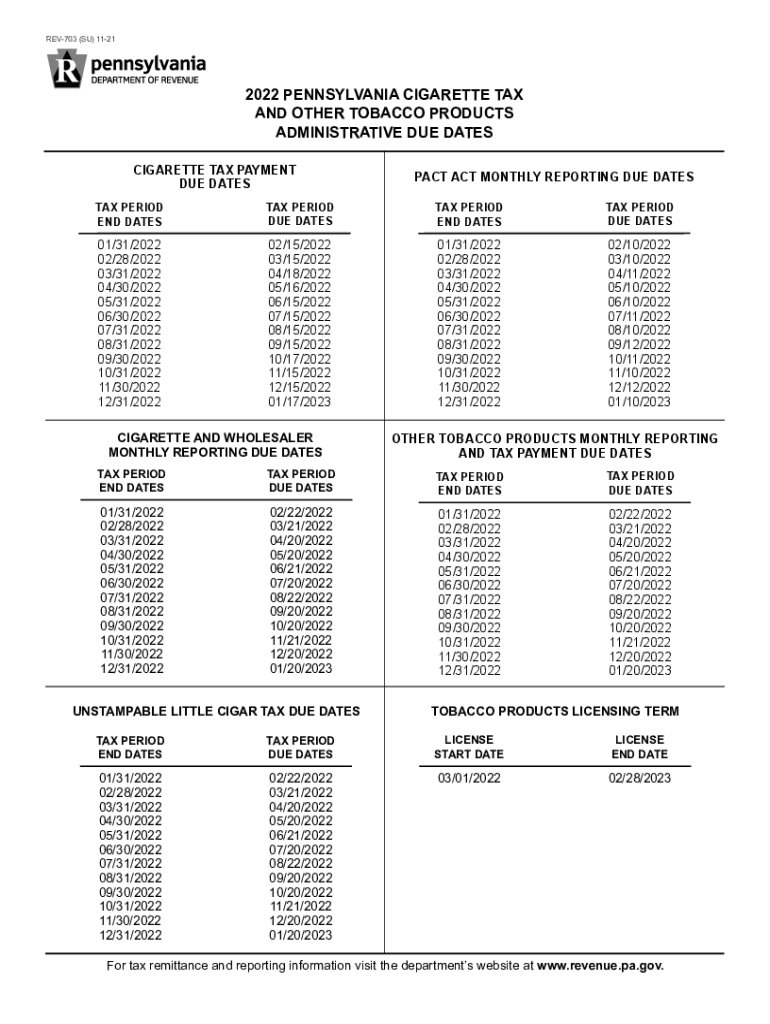

Navigating deadlines for tobacco tax submissions requires thorough attention. Many states impose annual and quarterly compliance timelines, which vary by state and product type. Late filing can result in financial penalties, making it vital to be proactive about these deadlines.

To maintain compliance, consider employing best practices such as regularly checking state tax websites for updates. Digital tools like pdfFiller not only help in managing your documents but can also reduce the risk of missing important deadlines through reminders and alerts.

Additional insights and tools

Interactive tools for tax calculations can help streamline your understanding of financial obligations when dealing with tobacco products. Platforms like pdfFiller provide features to simplify these calculations, allowing for accuracy while preparing your taxes.

Staying informed about tax legislation changes is crucial for compliance. Subscribing to tax newsletters or alerts can keep you updated, positioning you to respond promptly when regulations change. This proactive approach also improves your capacity to manage tax-related tasks effectively.

Platform features for enhanced document management

pdfFiller enhances document management with unique offerings that can make completing your tobacco tax and licensing form much more manageable. Secure e-signature capabilities ensure that your documents remain legally binding and professional, while collaboration features allow teams to work together seamlessly, enhancing overall productivity.

User testimonials indicate that businesses adopting pdfFiller experience significant improvements in their documentation processes, thereby enhancing compliance and efficiency. These positive experiences highlight the platform's value in navigating the complexities of tobacco tax compliance and form management.

Connection with tax professionals

Consulting with a tax advisor can prove beneficial, particularly in complex situations involving tobacco products. Situations such as navigating audits or understanding tax implications require expert assistance to avoid costly mistakes. pdfFiller supports this process by facilitating easy communication with professionals, ensuring that you have the support you need.

When choosing the right tax professional, consider factors like experience with tobacco legislation and user recommendations. Engaging knowledgeable professionals will help ensure you remain compliant while adeptly handling any financial obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my tobacco tax and licensing in Gmail?

Can I edit tobacco tax and licensing on an Android device?

How do I complete tobacco tax and licensing on an Android device?

What is tobacco tax and licensing?

Who is required to file tobacco tax and licensing?

How to fill out tobacco tax and licensing?

What is the purpose of tobacco tax and licensing?

What information must be reported on tobacco tax and licensing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.