Get the free transfer-of-securities-form

Get, Create, Make and Sign transfer-of-securities-form

Editing transfer-of-securities-form online

Uncompromising security for your PDF editing and eSignature needs

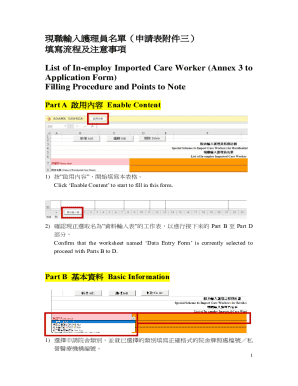

How to fill out transfer-of-securities-form

How to fill out transfer-of-securities-form

Who needs transfer-of-securities-form?

Transfer of Securities Form - How-to Guide

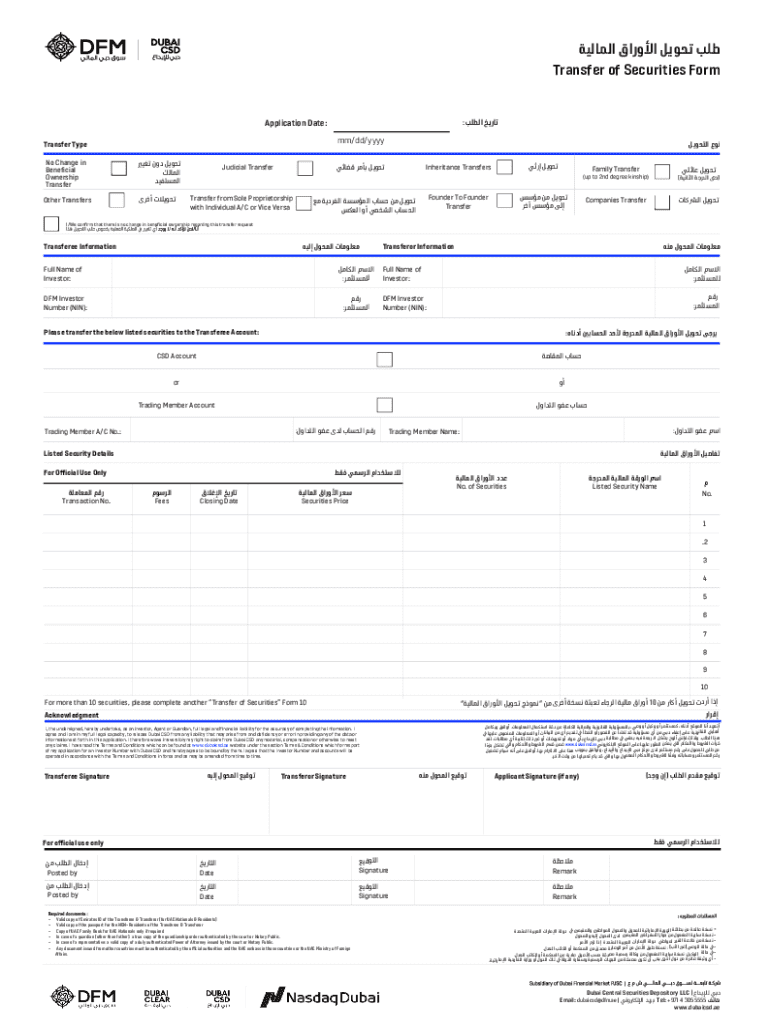

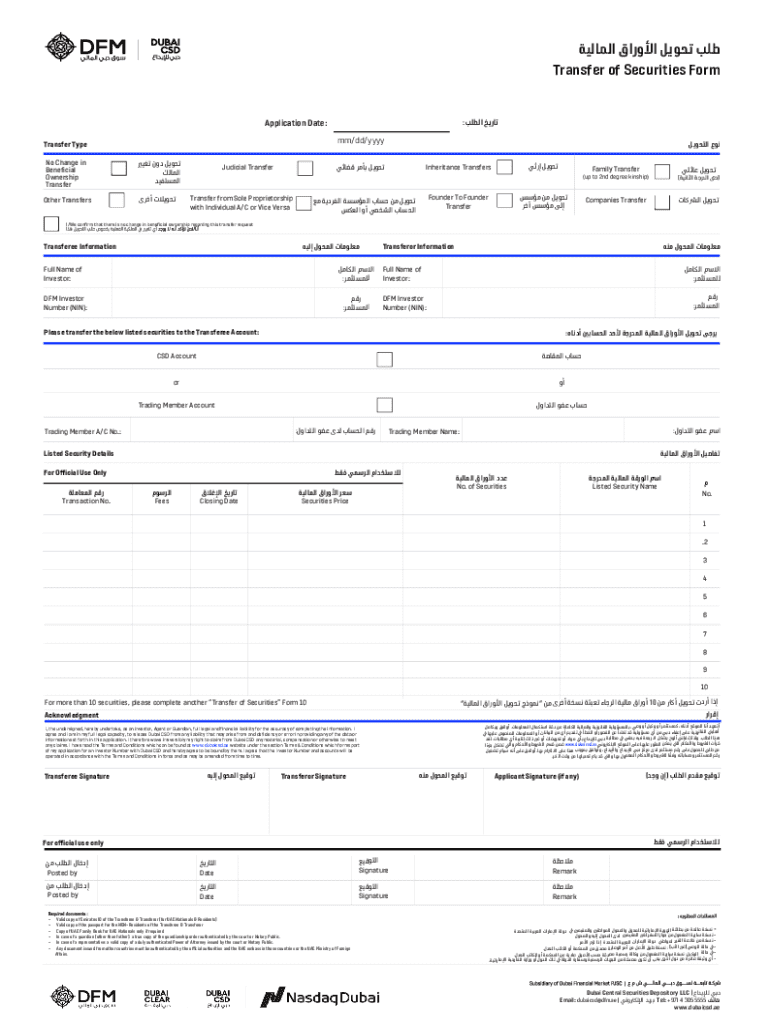

Understanding the transfer of securities

A transfer of securities refers to the process by which ownership of financial instruments, such as stocks or bonds, is transferred from one party (the transferor) to another (the transferee). Each security represents a claim on an asset or a portion of the issuer's earnings. Properly managing securities transfers is crucial not just for compliance reasons but also to ensure that ownership records are accurate and up to date.

Various scenarios can necessitate a transfer of securities, including selling shares to capitalize on market conditions, giving securities as a gift, or transferring ownership due to an inheritance. These situations require careful handling, as errors or omissions can lead to legal disputes or tax complications.

Key elements included in the transfer of securities form

A well-structured transfer of securities form includes several critical elements. First and foremost, personal and contact information from both the transferor and transferee must be clearly stated. This typically includes names, addresses, and identification numbers.

Next, the form must provide a detailed description of the securities being transferred. This can include the type of security (e.g., common stock, preferred stock, bonds), the number of shares or units being transferred, and any relevant identification numbers or certificates.

Additional key elements include the signatures from both parties and the date of the transfer. Signatures validate the form and confirm that both parties agree to the terms outlined within.

When is a transfer of securities form required?

Several scenarios make it necessary to fill out a transfer of securities form. Selling securities, for instance, requires formal documentation to reflect the change in ownership and protect both parties in case of disputes.

Additionally, when securities are gifted or inherited, a transfer form ensures the new owner can claim full rights to the assets. Changes in ownership due to corporate actions, such as mergers, acquisitions, or stock splits, also often demand updated documentation to prevent complications.

Legal regulations surrounding securities transfers vary by region and security type and should be carefully reviewed before proceeding. Compliance with local securities regulations is essential to avoid legal repercussions.

How to fill out the transfer of securities form

Filling out the transfer of securities form correctly is vital to prevent issues later. Here's a straightforward, step-by-step guide to help you through the process.

To ensure accuracy, double-check all fields for completeness before submitting the form. A minor mistake can delay the transfer or require redoing the documentation.

Editing and customizing your transfer of securities form

Utilizing tools like pdfFiller can significantly simplify the process of editing and customizing your transfer of securities form. With their platform, users can effortlessly edit existing templates, add annotations, and comments for clarification, or even convert other file formats to the transfer of securities form.

The ease of editing documents on a cloud-based platform allows individuals and teams to collaborate in real-time, ensuring everyone has access to the most updated version of the document, which is particularly useful during critical transactions or when timelines are tight.

Signing the transfer of securities form

Both physical and electronic signatures are acceptable for the transfer of securities form. Using digital signatures comes with distinct benefits, such as faster processing times and reduced paperwork.

Legality is a concern for many individuals. However, eSignatures are recognized under various laws, including the Electronic Signatures in Global and National Commerce Act (ESIGN) in the United States and the Electronic Identification and Trust Services (eIDAS) in Europe. pdfFiller offers tools for capturing signatures online, ensuring that the signing process is seamless and secure.

Submitting the transfer of securities form

After completing and signing the transfer of securities form, the next step involves submission. There are several methods to submit the transfer form, including direct submission to the securities issuer or utilizing electronic submission options available through online services.

It is essential to follow up on the submission status to ensure smooth processing. Keeping track of your submission can prevent any unexpected delays. Utilize pdfFiller's cloud-based tracking features to monitor your document's status.

Common mistakes to avoid when completing the transfer of securities form

Completing the transfer of securities form requires attention to detail. Common mistakes include providing incomplete information, such as missing transferor or transferee details. Such oversights can increase processing time and may even necessitate resubmission.

Other frequent errors involve mistakes in ownership transfer, such as incorrect signatures or not notarizing the document when necessary. Additionally, failing to keep copies of the submitted form can lead to complications later. It’s advisable to always retain a copy for personal records.

FAQs about transfer of securities

FAQ sections help address common concerns and clarify the process.

Further assistance for transfer of securities form

Whenever guidance is needed, resources are available. pdfFiller offers support through their dedicated customer service, along with tutorials and webinars that aid document management. Engaging in community forums can also provide additional support and share best practices among peers.

Legal considerations in securities transfers

It's vital to be aware of the legal landscape surrounding securities transfers. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the U.S. or the Autorité des marchés financiers (AMF) in Canada, govern these transactions to protect investors and maintain market integrity.

Additionally, potential tax implications must be considered. Transfers can affect capital gains tax obligations, especially in cases like selling stock. It's advisable to consult with a tax professional to understand these implications fully.

Furthermore, regulations may vary by state or region, reinforcing the necessity of understanding specific requirements in areas such as Québec to ensure compliance with local laws.

Leveraging cloud-based solutions for document management

The advantages of using cloud-based solutions for managing the transfer of securities form cannot be overstated. Platforms like pdfFiller provide comprehensive features that facilitate seamless editing, eSigning, and collaboration, ensuring that documents are always accessible from anywhere.

Integrating document management into team collaboration processes further enhances efficiency. Teams can work effortlessly across distances, accessing the necessary documents on the go. This level of accessibility is critical for timely transactions, particularly when dealing with securities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my transfer-of-securities-form directly from Gmail?

Can I create an electronic signature for the transfer-of-securities-form in Chrome?

Can I create an eSignature for the transfer-of-securities-form in Gmail?

What is transfer-of-securities-form?

Who is required to file transfer-of-securities-form?

How to fill out transfer-of-securities-form?

What is the purpose of transfer-of-securities-form?

What information must be reported on transfer-of-securities-form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.