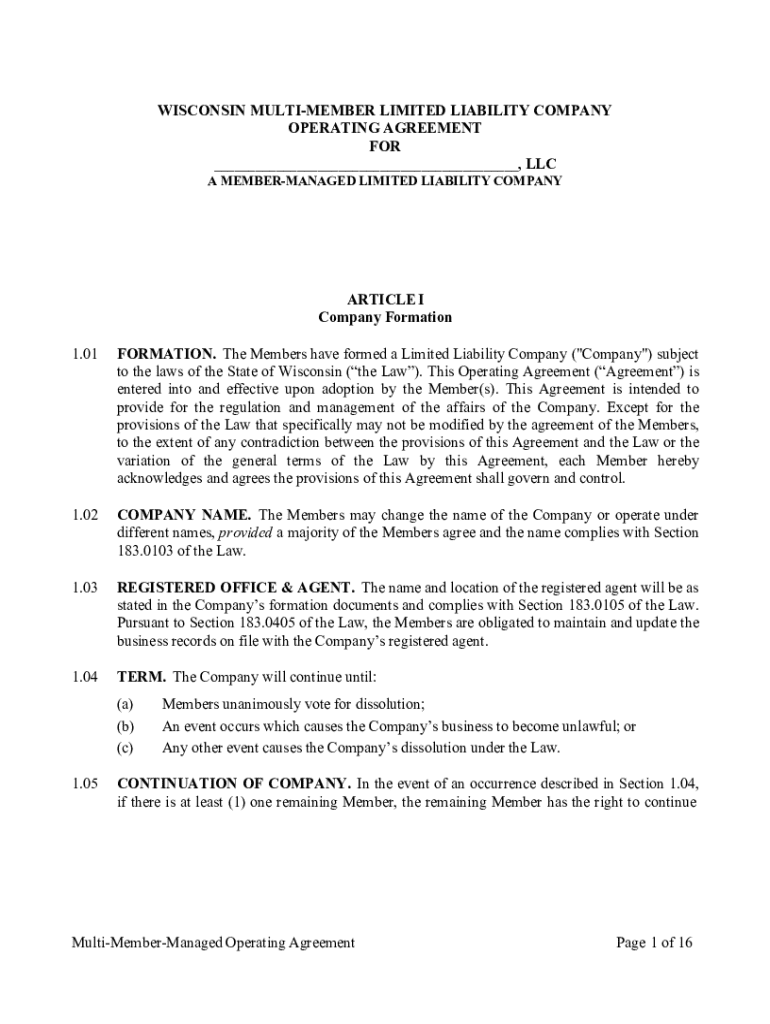

Get the Free Wisconsin Multi-Member LLC Operating Agreement ...

Get, Create, Make and Sign wisconsin multi-member llc operating

How to edit wisconsin multi-member llc operating online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wisconsin multi-member llc operating

How to fill out wisconsin multi-member llc operating

Who needs wisconsin multi-member llc operating?

Wisconsin Multi-Member Operating Form: A Comprehensive Guide

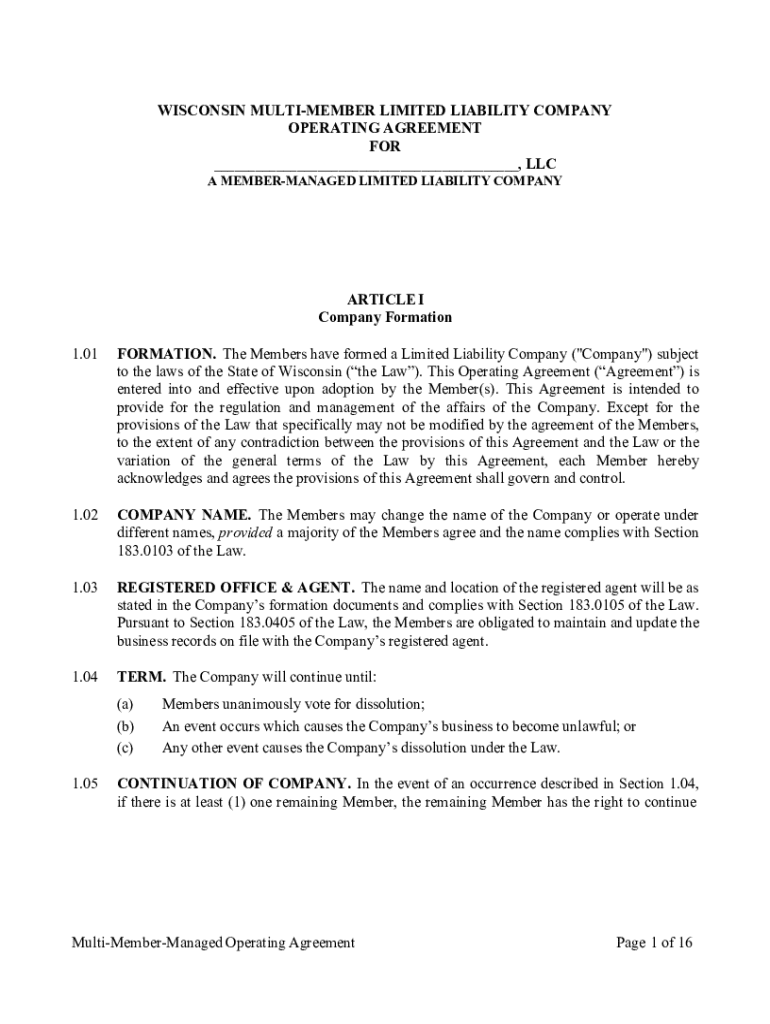

Understanding the Wisconsin multi-member operating agreement

A multi-member LLC is a business structure that allows two or more individuals or entities to operate a limited liability company together. This form has several characteristics and advantages that make it appealing to entrepreneurs. Unlike a single-member LLC, where only one individual owns the business, in a multi-member LLC, members share ownership and responsibilities. This structure fosters collaboration and can lead to more diverse skill sets and resources, which can be particularly beneficial when it comes to decision-making and tackling business challenges.

In Wisconsin, the LLC landscape is supportive of multi-member arrangements. Legal requirements include registering the LLC, filing necessary documents, and adhering to state laws. An operating agreement is particularly important in this setting, as it lays out the internal rules and guidelines for the LLC's operations. This document not only helps in avoiding misunderstandings among members but also provides clarity on management and profit sharing.

Key components of the Wisconsin multi-member operating agreement

Creating a robust operating agreement for your multi-member LLC in Wisconsin involves several essential elements. First, the membership structure should outline the ownership percentages of each member, which indicates who has what stake in the company. This is crucial, as financial interests and control often correlate closely. Next, the management structure must be clearly defined; it can either be member-managed, where all members take part in decision-making, or manager-managed, where designated individuals handle management duties.

Voting rights are another critical component, establishing how decisions are made at significant junctures, from business strategies to financial operations. Members should also delineate capital contributions, detailing what each member invests into the business and how profits will be distributed. Beyond these essentials, optional provisions like buy-sell agreements and indemnification clauses can be included to protect members' interests and outline exit strategies.

Step-by-step guide to creating your operating agreement

Creating a Wisconsin multi-member LLC operating agreement can be broken down into four key steps. Step 1 begins with gathering important information. Identify the members of your LLC and clarify their roles, contributions, and responsibilities. Clarifying financial contributions upfront helps prevent disputes later on. Step 2 is drafting the initial document. Utilizing an operating agreement template can simplify this process and allow for customization based on your specific needs.

As you draft, it’s important to include key phrases that ensure clarity and compliance with Wisconsin laws. Step 3 involves reviewing and finalizing the agreement—this is where consulting with legal professionals can add significant value. Their expertise can help you refine your document, ensuring it meets all legal requirements. Finally, Step 4 is signing and storing the document securely. Best practices for securing your agreement include using eSigning platforms and cloud storage solutions to ensure convenient access and preservation.

Common mistakes to avoid in the operating agreement

Understanding common pitfalls can save multi-member LLC owners significant hassle down the road. One major mistake is overlooking key provisions that protect all members. Robust operating agreements address various scenarios to safeguard the interests of all shareholders, and neglecting this can lead to conflicts. Another common error is failing to update the agreement following any change in membership; as members join or leave, the terms should reflect the current structure and ownership stakes.

Additionally, many LLC owners ignore state-specific legal requirements when drafting their operating agreements. Each state's regulations may hold different legal ramifications, making it vital to ensure your document complies with Wisconsin laws. Failure to do so can result in costly legal challenges that could have been easily avoided with proper oversight.

FAQs on Wisconsin multi-member operating agreements

The purpose of an operating agreement is to detail how the LLC will operate, which becomes essential for managing relationships among members and providing a mechanism for resolving disputes. This document can also be modified over time, allowing members to adapt the agreement based on business growth or changes in ownership. If a member decides to exit the company, the operating agreement typically outlines the process for their departure, ensuring that remaining members are protected and know the steps to take.

Furthermore, it's crucial to note that an effective operating agreement enhances liability protection for members. By clearly defining roles, responsibilities, and financial boundaries, an LLC can better shield its members from personal liability related to the company's debts and obligations. Therefore, having an operating agreement isn't just about organizational structure; it plays a direct role in the legal protections offered to members.

Tools and resources for managing your operating agreement

Effective management of your Wisconsin multi-member LLC operating agreement can be greatly enhanced by utilizing interactive forms and templates available on pdfFiller. This platform facilitates document creation with ease, enabling you to customize standard operating agreement templates according to your business needs. When comparing digital solutions, look for features such as cloud storage options, the ability to collaborate in real-time, and comprehensive eSigning capabilities.

For teams, collaborative editing tools can streamline input from all LLC members, ensuring everyone has a stake in the final product. Version control is also essential—maintaining a history of document changes allows for transparency and protects against miscommunications that could arise from disagreements on what the operating agreement stipulates.

Legal considerations in Wisconsin for LLCs

Compliance with Wisconsin LLC laws is paramount for all LLCs operating in the state. An important aspect of legal compliance is having a well-crafted operating agreement. Without it, members risk misunderstandings and legal complications over financial disputes or operational decisions. An operating agreement serves as a vital legal document, outlining each member's rights and responsibilities and greatly aiding in maintaining compliance with state regulations.

The implications of not having an operating agreement can be severe; not only does it expose members to personal liability, but it can also lead to complications in the event of disputes or member changes. Therefore, having an operating agreement is not just a good practice—it’s essential for legal protection and operational integrity.

Real-life examples and case studies

Illustrative scenarios can demonstrate the power of an effective operating agreement. For example, consider a multi-member LLC that had clearly defined roles within its operating agreement. When one member attempted to take on additional responsibilities without consensus, the established terms helped resolve the disagreement amicably. This not only reinforced the importance of the operating agreement but also highlighted how clear expectations can prevent conflicts.

In contrast, another case involved an LLC that neglected to address buy-sell agreements within their operating agreement. When a founding member left, their share ownership led to disputes and complications, ultimately requiring legal intervention to resolve. This situation serves as a cautionary tale about the importance of well-structured agreements; when crafted correctly, they can avoid costly conflicts and ensure smooth business operations.

Conclusion

Crafting a comprehensive and well-structured operating agreement is essential for any Wisconsin multi-member LLC. This document not only serves as an internal guideline but also protects members from potential legal and financial pitfalls. Utilizing tools available on platforms like pdfFiller can streamline the creation and management process, ensuring you have a compliant and functional agreement at your fingertips. By prioritizing this foundational element of your LLC, you set your business up for success in an increasingly complex business landscape.

Get started with pdfFiller

pdfFiller simplifies the process of creating and managing your Wisconsin multi-member LLC operating agreement. With easy-to-use templates, eSigning capabilities, and collaborative editing features, pdfFiller empowers users to streamline their document management. Access the tools needed to ensure compliance with Wisconsin laws and effectively manage your operating agreement, putting your multi-member LLC on the path to success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wisconsin multi-member llc operating from Google Drive?

How can I send wisconsin multi-member llc operating for eSignature?

How do I edit wisconsin multi-member llc operating straight from my smartphone?

What is Wisconsin multi-member LLC operating?

Who is required to file Wisconsin multi-member LLC operating?

How to fill out Wisconsin multi-member LLC operating?

What is the purpose of Wisconsin multi-member LLC operating?

What information must be reported on Wisconsin multi-member LLC operating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.