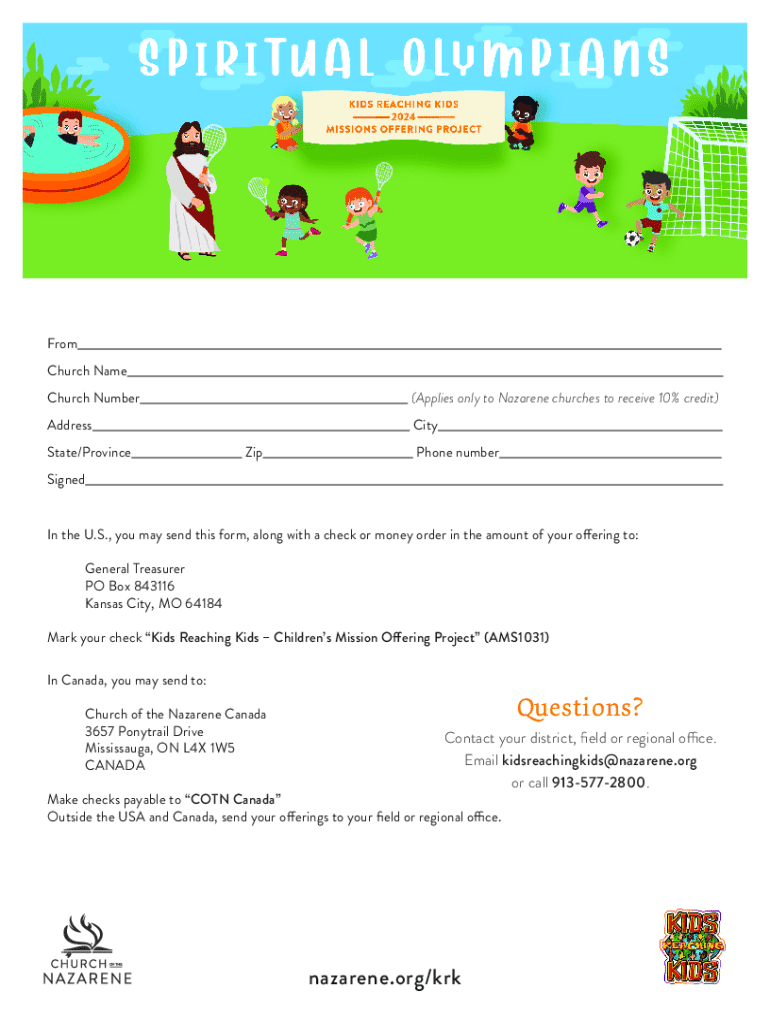

Get the free Where Do We Send Money from our Church

Get, Create, Make and Sign where do we send

Editing where do we send online

Uncompromising security for your PDF editing and eSignature needs

How to fill out where do we send

How to fill out where do we send

Who needs where do we send?

Where do we send form: A comprehensive guide to form submission

Understanding form submission requirements

Submitting forms correctly is crucial to ensuring your application, request, or notification is processed efficiently. Each form you send into the pipeline holds significant importance, from tax returns to legal documents. Incorrect submissions can result in delayed processing, penalties, or even legal repercussions.

Understanding the unique requirements for each submission type will empower you to avoid common pitfalls and navigate the filing process with confidence.

Types of forms

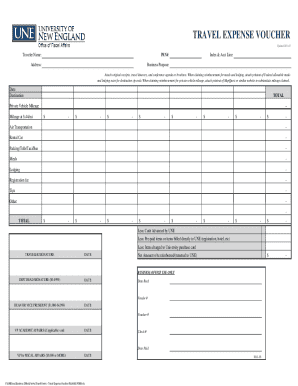

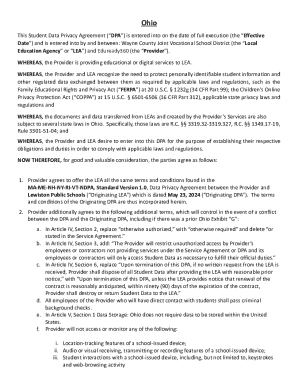

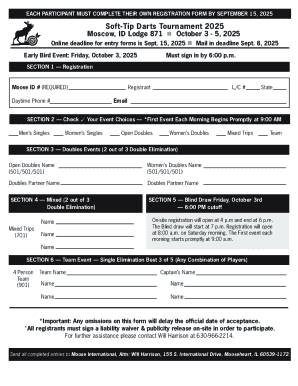

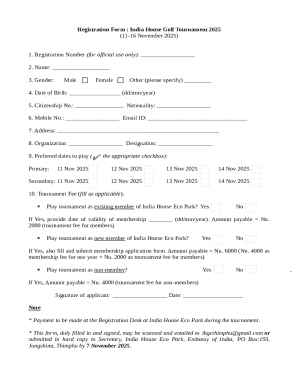

Forms can be categorized into various types depending on their purpose. Common categories include tax forms, legal forms, and medical forms.

Identifying the correct destination for your form

Choosing the right destination for your form submission is pivotal to ensure it reaches the appropriate entity for processing. Factors such as the type and purpose of the form, geographic location, and submission deadlines play a central role in determining where to send forms.

For example, when sending tax-related documents, knowing whether to submit to federal or state agencies is critical for compliance, while other documents may need to reach local authorities or specific departments within an organization.

Step-by-step guide: locating the right filing address

To send your form to the correct location, accessing official websites is the most reliable method. Government and agency websites usually have dedicated sections for form submissions, which include updated addresses and procedural guidelines.

Using official resources is paramount in ensuring accuracy; unofficial sites may provide outdated or incorrect information, leading to submission mishaps.

Tips for submitting your form effectively

Submitting forms doesn't just end with getting the address right. The method of mailing can significantly impact the submission assurance. For crucial documents, consider using certified mail, which provides a tracking number, allowing you to confirm that your form was received.

If electronic submission options are available, these can often streamline the process. E-filing not only saves time but can also reduce the likelihood of delays, as submissions are processed quicker compared to traditional mailing methods.

Specific instructions for popular forms

When it comes to where to send tax forms, for instance, directing your documents to the correct IRS address is essential. The address varies depending on the type of form and the state you reside in, making it imperative to check the IRS website for the latest information.

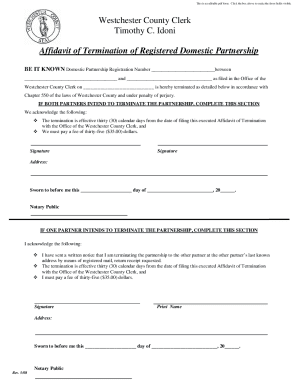

Legal forms often have specific court requirements and submitting to the wrong court can result in delays. Familiarize yourself with local court rules for the correct submission process.

Medical forms also have their own set of rules, particularly regarding HIPAA compliance; hence, ensure that submissions are sent to the appropriate health insurance provider.

FAQs on form submission

Understanding what happens if you miss submission deadlines is crucial. Failing to submit can lead to penalties, fines, or even ineligibility for services or refunds you might be entitled to. Depending on the form, extensions may be available, although the process can differ.

Moreover, if you find that you need to change your submission destination after sending, contacting the receiving agency or department promptly can sometimes initiate a redirection, provided the form hasn't been processed yet.

Utilizing pdfFiller for document management

pdfFiller empowers users to simplify their document management needs. With features that facilitate editing, eSigning, and collaboration, pdfFiller operates from a single cloud-based platform, making it easy to prepare documents for submission.

By leveraging pdfFiller, individuals and teams can streamline the process of preparing forms, adding comments, and sharing documents with stakeholders efficiently.

Next steps after submission

After submitting your form, confirming receipt is a vital step. Depending on the agency or department, tracking options vary, so explore if your submission can be tracked online.

Understanding what comes next based on the type of form submitted is equally important; for example, after submitting tax forms, taxpayers can expect to await a refund or the processing of their business tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in where do we send without leaving Chrome?

Can I create an electronic signature for signing my where do we send in Gmail?

How do I fill out where do we send using my mobile device?

What is where do we send?

Who is required to file where do we send?

How to fill out where do we send?

What is the purpose of where do we send?

What information must be reported on where do we send?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.