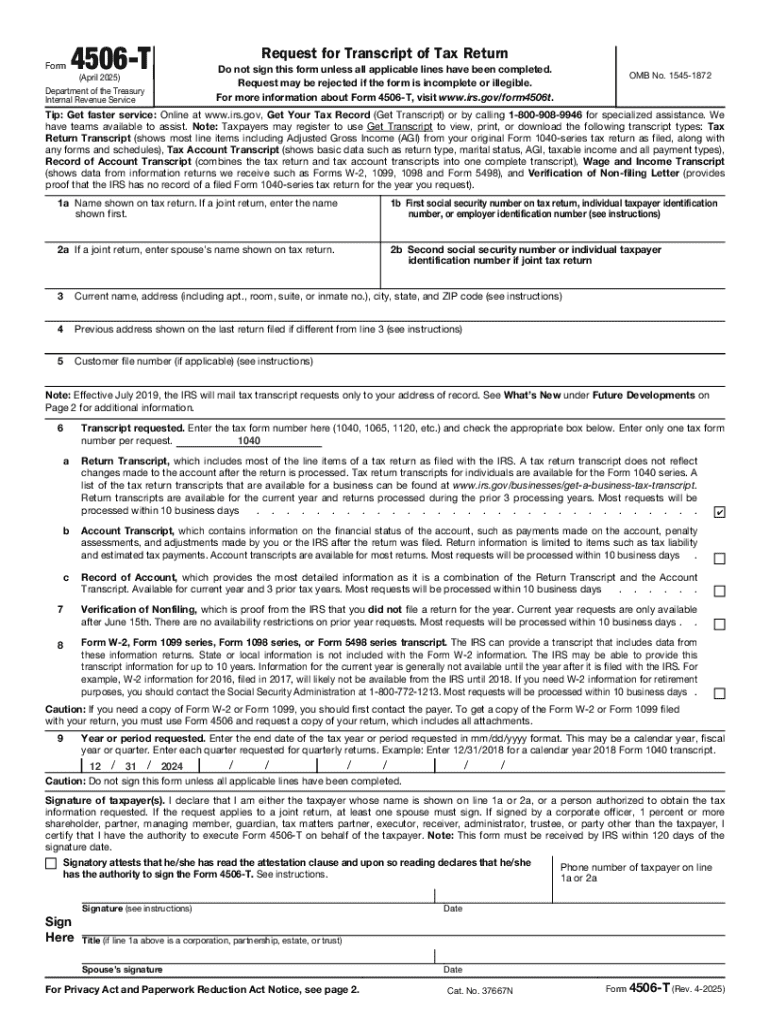

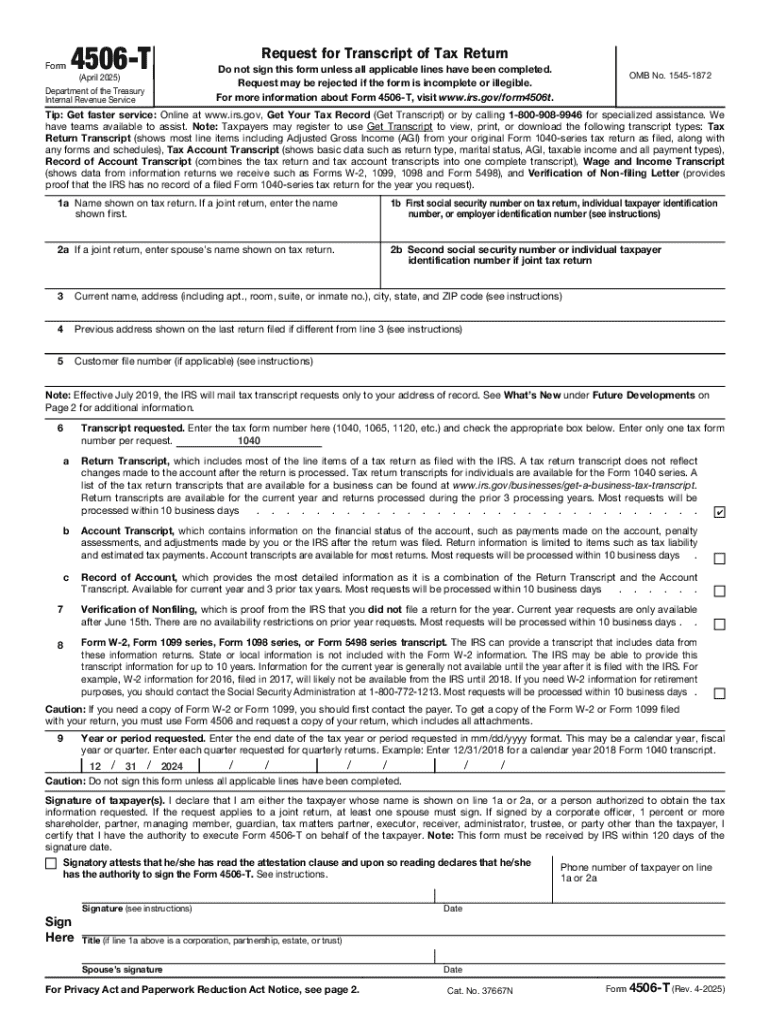

Get the free Form 4506-T (Rev. 4-2025). Request for Transcript of Tax Return

Get, Create, Make and Sign form 4506-t rev 4-2025

How to edit form 4506-t rev 4-2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4506-t rev 4-2025

How to fill out form 4506-t rev 4-2025

Who needs form 4506-t rev 4-2025?

Understanding Form 4506-T Rev 4-2025 Form: A Comprehensive Guide

Understanding Form 4506-T

Form 4506-T, also known as the Request for Transcript of Tax Return, is a crucial form issued by the IRS. Its primary purpose is to allow taxpayers to request a variety of tax transcripts, which can be instrumental for various reasons, such as securing loans, applying for financial aid, or verifying income. This form is indispensable for those who need an official record of their tax return to validate their financial history.

Obtaining a tax transcript is significant as it serves as evidence of past tax filings. Whether you’re an individual looking to verify your income or a corporation needing to substantiate financial claims, Form 4506-T can facilitate the retrieval of essential tax information without the delays typically associated with full tax return requests.

Key differences between Form 4506 and Form 4506-T

While both Form 4506 and Form 4506-T serve to retrieve tax information, there are key differences between them. Form 4506 is a request for a complete copy of a tax return, including all attachments, whereas Form 4506-T allows for the request of tax transcripts, which summarize your tax information for specific tax years without the full details.

Understanding these distinctions is crucial in determining which form to use based on your specific needs. For instance, if you're involved in a situation requiring detailed financial documentation, Form 4506 is most appropriate. However, for simpler needs where a summary will suffice, Form 4506-T is the better option.

Preparing to complete Form 4506-T

Before filling out Form 4506-T, it’s vital to gather all essential information. Personal details, including your name, address, and Social Security Number (SSN), are crucial for accurately processing your request. Each of these elements must be spelled correctly to avoid delays or issues with the IRS.

Furthermore, understanding your eligibility for requesting a tax transcript is essential. Individuals, corporations, and other types of organizations can make requests, but the requirements may differ slightly. Individuals must provide their personal information, while entities might need to include an Employer Identification Number (EIN) on the form.

It is also important to consider the different types of transcripts available, which include tax return transcripts and account transcripts. Tax return transcripts show most line items from your return, while account transcripts give a detailed account of your tax information. Familiarizing yourself with these options can accelerate the request process, ensuring you receive the right documentation in a timely manner.

Step-by-step guide to completing Form 4506-T

Filling out Form 4506-T requires careful attention to detail. In Section I, you’ll provide your personal information, which must include your full name, address, and Social Security Number or EIN. This section is critical for verifying your identity and matching your request to the correct tax records.

In Section II, you will specify the type of transcript you’re requesting. You need to choose the appropriate options based on your needs, detailing which tax years are relevant for your request. This is a crucial step, as selecting the wrong type can lead to time-consuming errors.

After determining the request type, Section III requires you to choose your delivery method. You can select either mail or fax, each having its pros and cons. Mail is typically more reliable, but it takes longer, while fax is quicker but can sometimes lead to transmission errors.

Submitting your Form 4506-T

Once you've completed Form 4506-T, the next step is submitting it to the IRS. There are two main methods for filing: mailing or faxing the form directly to the IRS. Each approach has its unique protocols that you’ll need to follow to ensure that your request is processed.

Pro tip: To confirm that your submission is received, you can follow up with the IRS. If you do not receive confirmation within a reasonable timeframe, consider re-checking your submission or contacting the IRS for further assistance.

Addressing any issues promptly after submitting your form is essential for ensuring that your request does not experience unnecessary delays, especially if you’re on a timeline for your particular situation.

FAQs and solutions

When dealing with tax forms like Form 4506-T, it’s common to encounter issues or have questions. For example, if you submit the form with incorrect information, the IRS may reject your request. This could result in longer wait times or even the need to resubmit the form.

If your request is denied, identify the reason for denial, which could stem from missing information or eligibility issues. Revising your form and ensuring you meet all requirements can help remedy the situation.

In case of persistent issues, reach out to IRS support or explore administrative support resources available through platforms like pdfFiller. This support can be instrumental in addressing tax relief problems and navigating the complexities surrounding such requests.

Benefits of using pdfFiller for Form 4506-T

Using pdfFiller to create and manage Form 4506-T offers several advantages. The platform provides interactive tools that allow you to fill out the form digitally, which significantly reduces the likelihood of errors that can occur in handwritten entries. Editing capabilities further simplify corrections if initial information needs modification.

Additionally, the cloud-based nature of pdfFiller means that you can access your documents from anywhere, simplifying not only the completion of Form 4506-T but also its management. The platform’s collaboration features enable team members to work together more effectively, streamlining the overall process.

Related tax forms and information

In addition to Form 4506-T, there are several other forms that individuals frequently encounter during tax season. Understanding how they interconnect with your financial situation can assist you in navigating your tax responsibilities. Some common forms include 1040 for individual income tax returns and W-2 for reporting wages.

It's also beneficial to research tax relief options available to taxpayers suffering from financial hardship. Understanding these programs and which forms apply can provide additional support during tax season. Furthermore, Form 4506-T plays a significant role in the tax audit process by offering documentation to substantiate claims made on tax returns. Preparing effectively for an audit involves being organized with your tax documents and knowing where to find them.

Expert insights on managing tax documents

Effective management of tax documents is essential for both compliance and stress reduction during tax season. Use techniques such as clearly labeling files, maintaining a digital backup of documents, and regularly reviewing your tax records to minimize future filing conflicts.

The role of technology in tax preparation is transforming how individuals and businesses manage their finances. Solutions like pdfFiller enable streamlined document processing and enhance overall efficiency in tax filing.

As tax laws evolve, staying informed about changes ensures that your document management strategies remain relevant. Embracing digital tools sends a signal of readiness for whatever the tax landscape might bring.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 4506-t rev 4-2025?

How do I make edits in form 4506-t rev 4-2025 without leaving Chrome?

How can I edit form 4506-t rev 4-2025 on a smartphone?

What is form 4506-t rev 4?

Who is required to file form 4506-t rev 4?

How to fill out form 4506-t rev 4?

What is the purpose of form 4506-t rev 4?

What information must be reported on form 4506-t rev 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.