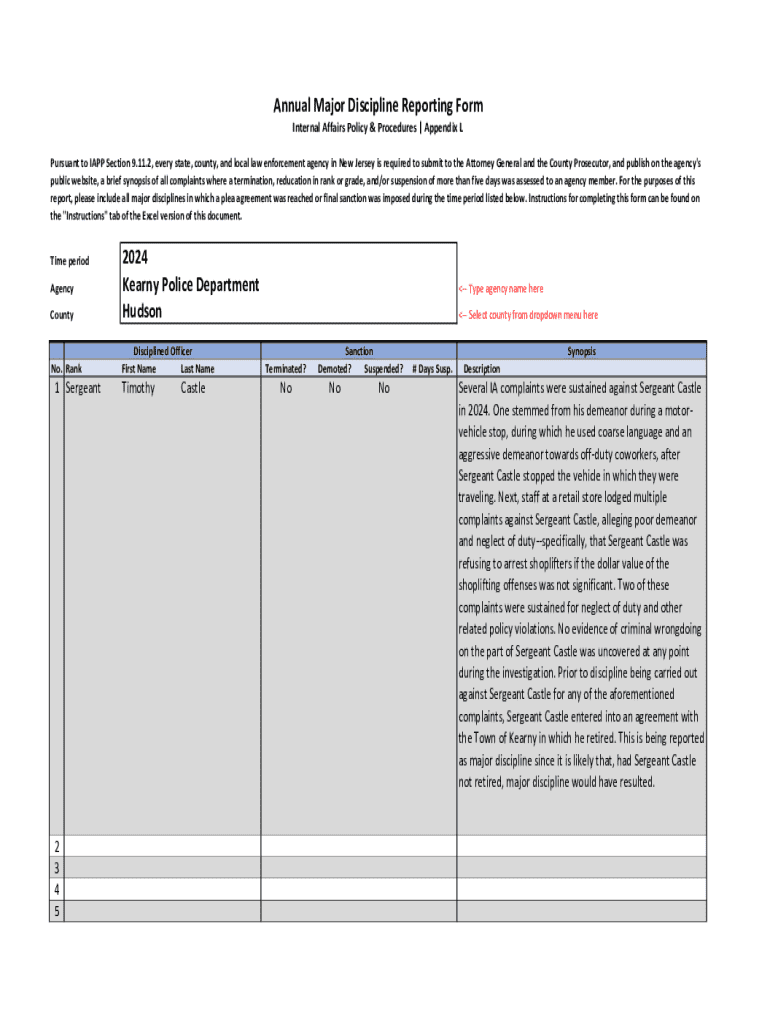

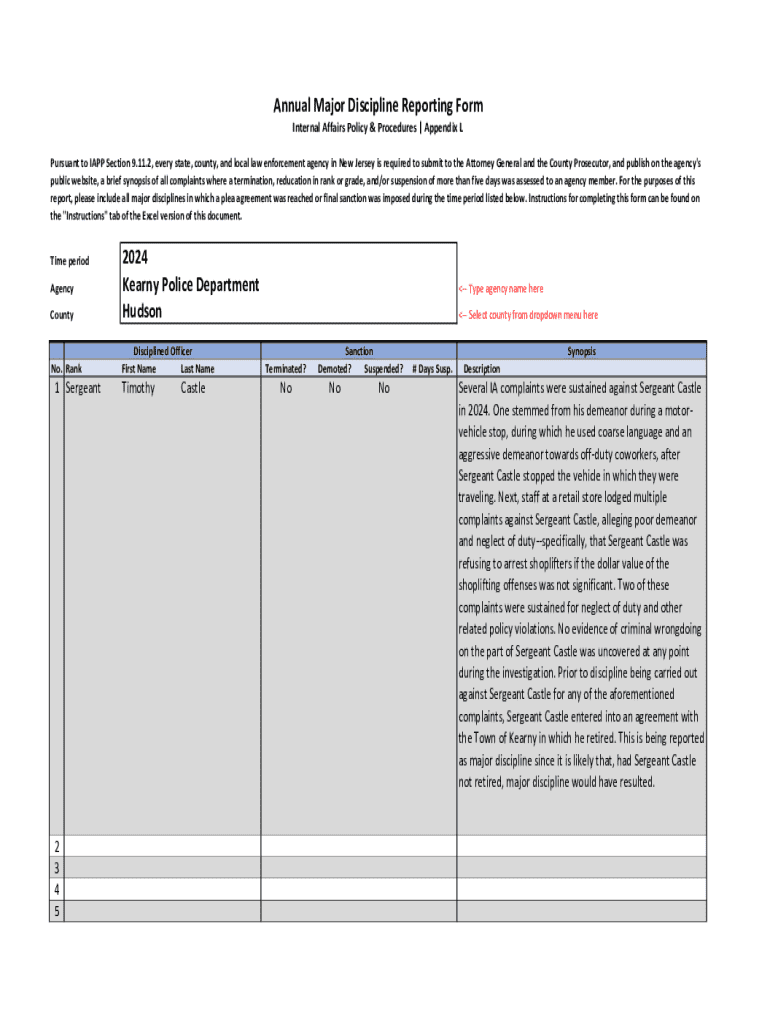

Get the free Appendix L - Annual Major Discipline Reporting Form, 2024.xlsx

Get, Create, Make and Sign appendix l - annual

How to edit appendix l - annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appendix l - annual

How to fill out appendix l - annual

Who needs appendix l - annual?

Appendix - Annual Form: A Comprehensive How-to Guide

Understanding Appendix - Annual Form

Appendix L - Annual Form serves as a critical document in various sectors, particularly for those managing financial and compliance reporting. This specific form ensures that organizations adhere to necessary regulations and maintain accurate financial records. Its primary purpose is to compile annual data that reflects organizational activity, income, expenses, and overall compliance with regulatory guidelines.

Completing the Appendix L - Annual Form is not just about filling out a document; it’s a responsibility that ensures transparency and accountability. The importance of this form cannot be overstated as it directly impacts how stakeholders, auditors, and regulatory bodies view an organization's operational integrity.

Who needs to file the Appendix - Annual Form?

The Appendix L - Annual Form is typically required for organizations and individuals engaged in certain financial activities. This includes businesses of varying sizes, non-profit organizations, and governmental entities that must report their financials annually. Understanding who needs to complete this form allows targeted reporting and ensures that all required parties remain in compliance with laws and regulations.

Moreover, teams responsible for compliance and financial reporting within these entities bear the responsibility of correctly filling out and submitting this form. Clarity in roles can lead to smoother processes and minimize last-minute confusion.

Preparing to complete the Appendix - Annual Form

Before diving into the Appendix L - Annual Form, preparation is key. Gather all necessary documents and information to ensure a seamless filling experience. Required documents often include financial statements from the year, tax returns, audit reports, and any supporting documentation that enhances the validity of the reported data.

Common misconceptions can lead to errors and delays. One prevalent myth is the belief that the form is optional for small businesses. In reality, if your business meets the criteria defined by regulatory bodies, the form is essential for compliance. Moreover, many assume that the form must be submitted in a specific paper format, whereas digital submissions through platforms like pdfFiller can simplify the process significantly.

Step-by-step guide to filling out the Appendix - Annual Form

Filling out the Appendix L - Annual Form involves multiple sections, each crucial for providing a comprehensive overview of the organization's financial health. The first section generally requires personal information about the individual responsible for the filing, including their name, title, and contact details.

The subsequent section focuses on financial data, where you will report income, expenses, and any significant changes since the last submission. It's vital to ensure that all numbers are accurate and backed by thorough documentation to avoid discrepancies during audits.

Finally, the reporting requirements section often outlines what additional documents or disclosures may be needed. A thorough understanding of what’s required in each section of the form can save time and prevent potential errors.

Using pdfFiller's interactive tools can tremendously simplify this process. Features like auto-fill, collaboration tools, and template options help streamline form completion and ensure that users do not overlook critical data.

Editing the Appendix - Annual Form

Even with meticulous preparation, mistakes can occur. It's crucial to know how to correct any errors before submission. pdfFiller provides straightforward editing options that allow users to amend any section of the Appendix L - Annual Form effortlessly.

Ensuring compliance with regulations is just as vital as accurate reporting. Make use of built-in compliance checklists provided by the platform that can alert users to common errors or omissions. Pay close attention to accuracy in financial reporting, as inaccuracies could lead to penalties or compliance issues.

Signing and submitting the Appendix - Annual Form

Once the form is completed and errors are corrected, the next step is signing and submitting the Appendix L - Annual Form. Electronic signatures, or eSigning, have gained popularity due to their legality and convenience. They are accepted in various jurisdictions, making it easier to complete the submission process swiftly.

There are multiple submission methods available, including online submissions through pdfFiller, mailing physical copies, or delivering in-person, depending on regulatory requirements. Each method has its considerations, such as tracking submissions and receiving confirmations of receipt.

Managing your Appendix - Annual Form documents

Document management plays a crucial role in the lifecycle of the Appendix L - Annual Form. Storing completed forms securely is vital, and leveraging cloud-based solutions offered by pdfFiller can significantly enhance your document management processes. Cloud storage not only secures your data but also allows for easier access and collaboration among team members.

Another essential aspect is tracking changes and updates. By utilizing version control features, pdfFiller enables users to monitor modifications made to the Appendix L forms throughout the year. This ensures that any alterations are logged and can be traced back if needed, providing an additional layer of security and accountability.

Frequently asked questions (FAQs) about Appendix - Annual Form

Many individuals and teams have common queries when it comes to the Appendix L - Annual Form. Understanding typical questions can prepare users for a smoother filing experience. Some of the frequently asked questions include the filing deadlines, amendments for previous submissions, and clarification on financial entries.

Addressing these questions early in the process can alleviate anxiety and result in more accurate filings. For instance, knowing the exact deadlines helps prevent last-minute rushes, while being clear on what constitutes acceptable financial data can lead to more confident and accurate reporting.

Case studies and success stories

Real-life examples of successful Appendix L - Annual Form completions can serve as excellent case studies. For instance, a local nonprofit organization utilized pdfFiller to efficiently complete their form after a complete overhaul of their financial reporting process. This organizational change not only improved compliance but also fostered a sense of confidence among its stakeholders.

Another example could be a small business that faced challenges with data accuracy in their financial reports. After employing pdfFiller's interactive features, the business was able to streamline its reporting process, leading to significant time savings and improved accuracy. Success stories like these highlight the positive outcomes of engaging effectively with the Appendix L process.

Troubleshooting common issues

Navigating potential issues during the Appendix L - Annual Form process is crucial for a stress-free experience. Common problems may include data discrepancies, miscalculated entries, or missing documentation. Knowing how to address these sensitivities can save valuable time and effort.

If you encounter problems, refer back to your gathered documents to verify that you have included all necessary information. Additionally, pdfFiller’s support features can guide you through technical challenges, ensuring that filing remains straightforward.

Additional support and resources

Accessing help when needed is vital for effective form completion. pdfFiller offers a myriad of support features, including live chat assistance and comprehensive tutorials that can guide users through any uncertainties they may encounter while filling out the Appendix L - Annual Form.

Additionally, advanced features like OCR (Optical Character Recognition) enhance user experience by allowing users to transform scanned documents into editable formats, further expanding document management options.

Learning and adaptation

Continuous improvement for future filings requires reflection on your experiences. After submitting the Appendix L - Annual Form, take the time to evaluate the process. Identifying what worked well and what did not can significantly inform better practices for upcoming years.

Incorporating feedback into your approach to the Appendix L process can lead to progressively smoother filing experiences. Engaging team members in discussions about their insights can enhance organizational efficiency as everyone works toward the common goal of compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find appendix l - annual?

Can I edit appendix l - annual on an Android device?

How do I complete appendix l - annual on an Android device?

What is appendix l - annual?

Who is required to file appendix l - annual?

How to fill out appendix l - annual?

What is the purpose of appendix l - annual?

What information must be reported on appendix l - annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.