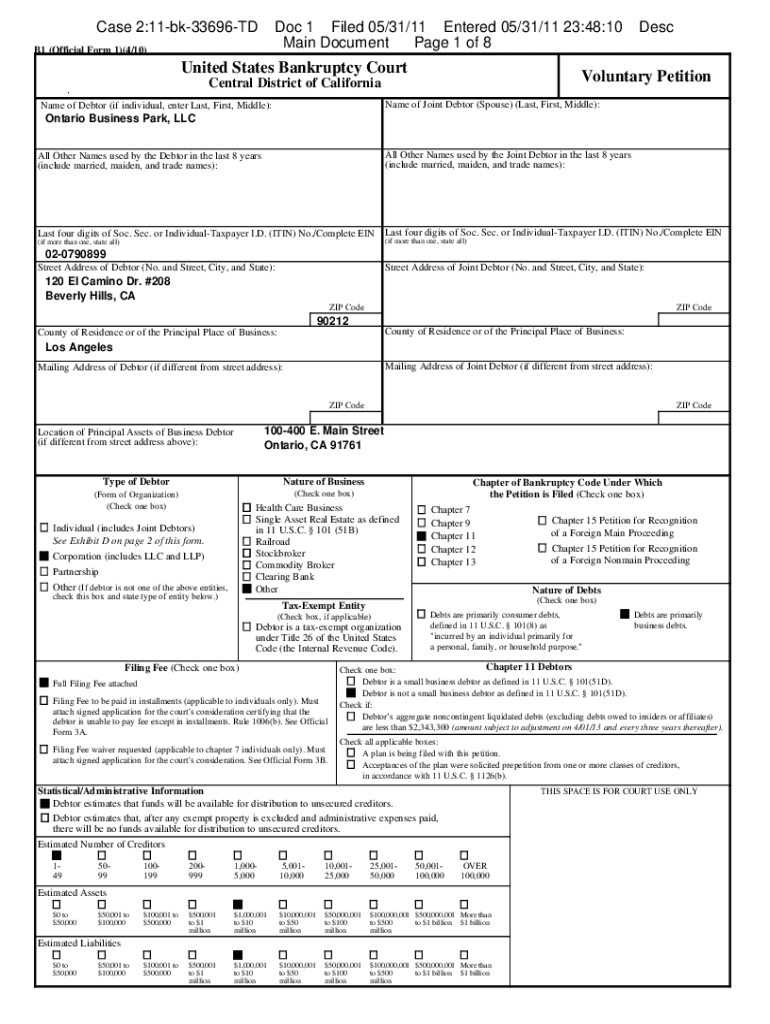

Get the free Bankruptcy Forms. Ontario Business Park, LLC - Blake Lindemann 255747

Get, Create, Make and Sign bankruptcy forms ontario business

How to edit bankruptcy forms ontario business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bankruptcy forms ontario business

How to fill out bankruptcy forms ontario business

Who needs bankruptcy forms ontario business?

Navigating Bankruptcy Forms for Ontario Businesses

Overview of bankruptcy forms in Ontario

Bankruptcy forms are crucial for businesses in Ontario navigating financial distress. The process of filing for bankruptcy involves a variety of legal documents, governed by the Bankruptcy and Insolvency Act, designed to protect both the debtor and creditors. Correctly completing these forms is essential to ensure a smooth process, alleviate potential liabilities, and facilitate recovery prospects.

The Bankruptcy and Insolvency Act in Ontario lays the framework for how bankruptcies are handled, providing essential rights and protections for both businesses and individuals. The forms required can differ based on circumstances, addressing various needs, such as voluntary or involuntary bankruptcy filings. Understanding the nuances of these forms can streamline the bankruptcy process and preserve valuable time and resources.

Key bankruptcy forms for Ontario businesses

When managing a bankruptcy in Ontario, there are several key forms that businesses must fill out. Each of these forms serves a distinct purpose and requires specific information to be completed effectively. Below are descriptions and insights into the four primary bankruptcy forms used in Ontario.

Form 1: Statement of Affairs

The Statement of Affairs is vital for outlining the financial situation of the debtor. It provides a comprehensive snapshot of assets, liabilities, and financial affairs, helping trustees understand the estate's overall health.

Key information required includes assets and their values, liabilities owed to creditors, and any contingent liabilities. To complete this form, follow these steps: gather necessary financial documentation, assess your asset and liability values accurately, and detail any other relevant information as required on the form.

Form 2: Notice of Bankruptcy

The Notice of Bankruptcy formally announces the bankruptcy declaration. It must be filed promptly and made available to concerned parties, including creditors. The requirements include the name of the debtor, the bankruptcy date, and the trustee information.

To effectively fill out this form, ensure that all details are accurate and current to avoid legal complications during the bankruptcy process.

Form 3: Proof of Claim

The Proof of Claim is a document filed by creditors indicating the amount owed by the debtor and the basis for the claim. It is essential in ensuring creditors get a fair distribution of the estate's assets.

When completing this form, ensure to provide clear detail regarding the debt incurred and supporting evidence, such as contracts or invoices, to substantiate your claim.

Form 4: Trustee’s Report on the Administration of Estate

This form summarizes the trustee's administration of the bankrupt's estate, detailing asset realization and distribution to creditors. Understanding this report is crucial for transparency during the bankruptcy process.

To fill it out, include details about the administration actions taken, the distribution of assets and expenses, and an evaluation of the estate’s financial situation.

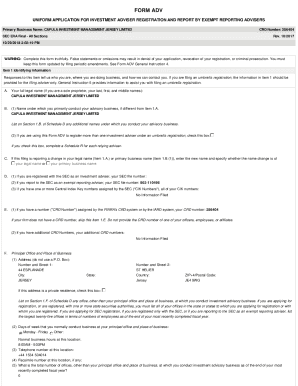

How to access bankruptcy forms in Ontario

Accessing bankruptcy forms in Ontario is straightforward, with multiple online resources available for businesses. The official website of the Office of the Superintendent of Bankruptcy Canada offers downloadable versions of all necessary forms.

To download and print the forms, follow this step-by-step guide: First, visit the office's website. Next, navigate to the section specifically for bankruptcy forms. Choose the form you need, and click the download link. Ensure you download the latest version to meet the current legal requirements.

Additionally, pdfFiller provides interactive tools that enhance your form-filling experience, from editing PDFs to collaborative features, making the process more efficient.

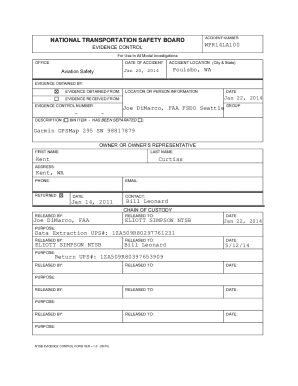

Completing bankruptcy forms: A step-by-step process

Understanding each section of your bankruptcy forms is imperative for accuracy and compliance. Focus on gathering all necessary information before starting, and double-check the details before submission to avoid common mistakes.

Common mistakes include incorrect financial figures, missing information, or failing to sign the forms. It’s beneficial to review FAQs related to form completion available on pdfFiller, as these resources can provide clarity on specific sections.

Utilizing interactive editing tools on pdfFiller can greatly enhance your experience. Features such as digital signatures and collaborative editing allow you to streamline the entire filling process.

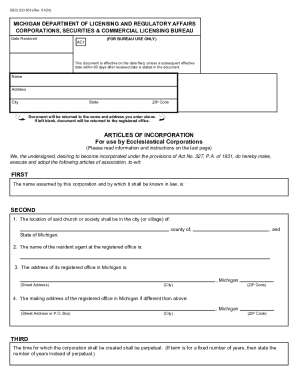

Submitting your bankruptcy forms

Once you've completed your bankruptcy forms, submitting them accurately is the next crucial step. Procedures for submission vary; however, typically, you would submit your completed forms to the Office of the Superintendent of Bankruptcy Canada or any designated local office.

Be aware of key deadlines to ensure timely submission to avoid complications. After submission, tracking down confirmation of receipt is essential. You can confirm that your forms were received by requesting acknowledgment from the office.

Managing your bankruptcy documentation

Managing all documentation related to your bankruptcy can simplify the process and ensure you remain organized. Best practices for document management include keeping a dedicated folder for bankruptcy-related documents and ensuring all paperwork is stored securely.

Utilizing cloud storage solutions has become increasingly popular, as they offer easy access from anywhere while keeping backups of essential documents. Tools like pdfFiller come equipped with features for ongoing document management, allowing you to track changes and edits efficiently.

Getting help with bankruptcy forms

Navigating the complexities of bankruptcy forms can come with challenges. Common issues often include misinterpreting form requirements or incorrectly submitting supporting documents. To resolve these challenges, seeking professional assistance is advisable.

Options for professional help include consulting with a licensed insolvency trustee or financial advisor. Additionally, pdfFiller offers user support options and a comprehensive FAQ and resource section to aid in addressing common concerns.

FAQs about bankruptcy forms in Ontario

Understanding common questions related to bankruptcy forms not only provides clarity but also alleviates anxiety during the process. Queries often include topics such as the consequences of filing improperly or the timeline for processing submissions.

Clarifications on misunderstandings related to bankruptcy forms are also available, with many resources from both governmental websites and pdfFiller enabling users to get the necessary guidance.

Testimonials and user experiences

Gathering insights from individuals and businesses who have navigated bankruptcy forms provides invaluable context. Many have shared real experiences about how using dedicated tools such as pdfFiller has minimized the challenges they faced during the process.

Success stories highlight the ease of document management and collaboration options, illustrating how businesses can effectively handle their bankruptcy documentation while staying compliant and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bankruptcy forms ontario business in Gmail?

How can I modify bankruptcy forms ontario business without leaving Google Drive?

Can I edit bankruptcy forms ontario business on an iOS device?

What is bankruptcy forms ontario business?

Who is required to file bankruptcy forms ontario business?

How to fill out bankruptcy forms ontario business?

What is the purpose of bankruptcy forms ontario business?

What information must be reported on bankruptcy forms ontario business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.