Get the free CPA Letter and Sample CPA Letter Template for Reference

Get, Create, Make and Sign cpa letter and sample

Editing cpa letter and sample online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cpa letter and sample

How to fill out cpa letter and sample

Who needs cpa letter and sample?

Understanding CPA Letters and Sample Form

Understanding CPA letters

A CPA comfort letter serves as a vital document in various financial transactions, offering assurance about certain financial data. It is primarily issued by Certified Public Accountants (CPAs) and plays a significant role in scenarios such as mergers, acquisitions, financing, and regulatory compliance. When businesses seek external financing, lenders often require these letters to substantiate a borrower’s financial credibility. Thus, the CPA comfort letter not only supports the legitimacy of financial statements but also strengthens the position of individuals or enterprises engaging in significant financial dealings.

The essence of a CPA comfort letter lies in its ability to provide reassurance regarding the integrity and accuracy of the financial information presented. CPAs are trained professionals whose licenses and ethics require them to uphold stringent standards. Therefore, the issuance of a comfort letter implies that the CPA has fully reviewed the entity’s financial documents and is prepared to validate the claims made in financial statements. This overview highlights the importance of grasping what constitutes a comfort letter and its relevance in the world of finance.

Components of a CPA comfort letter

A well-structured CPA comfort letter includes several key components to ensure clarity and reliability. The standard elements found in such a letter typically encompass:

The wording within a CPA comfort letter is of paramount importance, given that the credibility of financial data hinges on precise language. The CPA must ensure that their statements are unequivocal, thereby eliminating any ambiguity regarding their findings. Such clarity is essential to fulfilling the expectations of stakeholders relying on the financial data presented.

Importance of CPA letters

CPA comfort letters are necessary in various scenarios, notably during mergers and acquisitions, financing and lending transactions, and for regulatory compliance. In mergers and acquisitions, both parties involved require solid proof that the financial positions of the entities are accurately represented to avoid post-transaction conflicts. In financing scenarios, lenders utilize these letters to assess the viability and creditworthiness of a borrower, confirming that the reported income and tax filing history are accurate.

In terms of benefits, CPA comfort letters enhance credibility by serving as an external validation of financial statements. These letters act as a risk mitigation tool since they provide a layer of assurance regarding the financial health of an organization. When financial institutions and other stakeholders are equipped with reliable information, they can make informed decisions with confidence, leading to smoother transactions and improved business relationships.

Crafting a CPA comfort letter

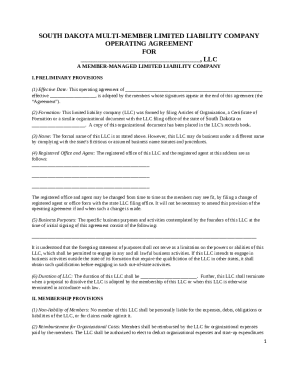

Constructing a CPA comfort letter template requires careful attention to detail, ensuring all necessary sections are included for completeness and clarity. Essential sections to craft should consist of:

Additionally, structuring the content effectively aids in readability. Use commonly understood financial terminology and avoid overly technical language, ensuring that all stakeholders, regardless of their financial background, can grasp the information clearly. A well-crafted letter not only upholds professional standards but also serves as a testament to the CPA’s thoroughness and credibility.

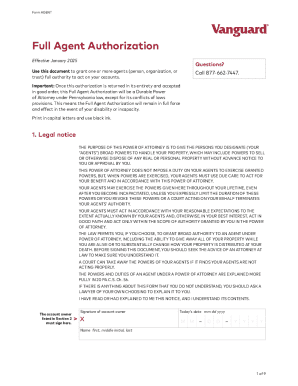

Sample CPA comfort letter

A filled-out sample CPA comfort letter might resemble the following excerpt: [Date] [Your Name] [Your Firm] [Firm Address] [City, State, Zip] [Recipient Name] [Recipient Title] [Company Name] [Company Address] [City, State, Zip] Dear [Recipient Name], We have examined the financial statements of [Company Name] as of [Date]. In accordance with our examination, we are pleased to confirm the accuracy of the financial data presented by [Company Name] in regard to [specific financial aspects]. It is noteworthy that our assessments were conducted in compliance with the standards set forth by the American Institute of Certified Public Accountants. This letter serves to provide assurance regarding the financial stability and reporting integrity of [Company Name]. We have no reasons to believe that the financial data has been misrepresented or misstated. Best regards, [Your Name] [Your Title] [Your Firm] This simple template highlights the key phrases such as 'accuracy of financial data' and acts as a context for how to structure an actual CPA comfort letter. By dissecting its components, the parts of a good CPA letter can be appreciated even further.

How to use pdfFiller for CPA comfort letters

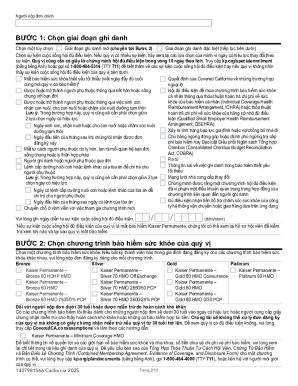

pdfFiller offers a seamless solution for filling out CPA comfort letters, ensuring a smooth document creation process. To access and edit your CPA comfort letter template within the platform, follow these steps:

Furthermore, pdfFiller promotes collaboration with team members, allowing for shared access and feedback on the document. Teams can manage the letter efficiently, ensuring that high standards of accuracy and accountability are maintained throughout the document creation process.

Navigating limitations and best practices

While CPA comfort letters are instrumental in various financial transactions, it is important to recognize their limitations. Often, these letters come with an understanding that the scope is limited to the information provided. CPAs can only assure the accuracy of the data they have reviewed, so users must be cautious about the reliance placed on the letter’s assertions. Being transparent about what is being confirmed can avoid potential misunderstandings.

Implementing best practices when crafting and using CPA comfort letters is equally vital. Maintaining transparency throughout the process ensures that all parties involved have a clear grasp of the information shared. Regular updates enhance the reliability of the letter, particularly in dynamic situations where financial conditions may fluctuate. Establishing consistent communication with the CPA can also help reinforce the credibility and effectiveness of the document in supporting business transactions.

Interactive tools

pdfFiller provides a suite of interactive tools designed for efficient management of CPA comfort letters. These tools include functionalities for document editing, eSigning capabilities, and collaborative features that allow for real-time feedback from other team members. The cloud-based nature of pdfFiller allows users to access and modify documents from anywhere, ensuring flexibility when dealing with important financial assertions.

Utilizing these interactive tools not only streamlines the process of managing CPA letters but also provides tangible advantages in enhancing productivity and collaboration. Having the ability to create, edit, and share documents instantly aids teams in adhering to tight deadlines and responding promptly to lender’s needs, ultimately fostering a more efficient workflow.

FAQs about CPA comfort letters

Several common questions arise regarding CPA comfort letters, reflecting the interest in their application and nuances. For example:

Understanding these frequently asked questions helps to demystify the process, providing greater confidence to organizations considering the utility of CPA comfort letters in their financial operations.

Real-life applicability

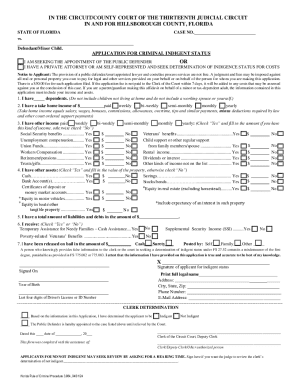

Case studies illuminate the important role that CPA comfort letters play in real-world scenarios. In one instance, a small business seeking an SBA loan required a comfort letter to validate their annual income and tax filing history. The CPA ensured that the bank was aware of the business’s self-employment status, instilling confidence in the lender regarding the accuracy of reported figures. This resulted in the business obtaining the necessary funding.

Another case involved a startup negotiating a significant lease agreement, which required verification of the company's revenue streams. The CPA’s letter highlighted critical financial details, clarifying the startup’s fiscal stability and assisting in securing favorable lease terms. These examples underscore the transformative impact that CPA comfort letters can have on various business dealings, emphasizing their necessity in successfully navigating complex financial landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cpa letter and sample for eSignature?

How do I edit cpa letter and sample in Chrome?

Can I edit cpa letter and sample on an iOS device?

What is cpa letter and sample?

Who is required to file cpa letter and sample?

How to fill out cpa letter and sample?

What is the purpose of cpa letter and sample?

What information must be reported on cpa letter and sample?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.