Get the free FINANCIAL INVESTORS TRUST Form DEFA14A Filed 2025-08-07. Accession Number

Get, Create, Make and Sign financial investors trust form

Editing financial investors trust form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial investors trust form

How to fill out financial investors trust form

Who needs financial investors trust form?

Financial Investors Trust Form Guide: A Step-by-Step Approach

Understanding the financial investors trust form

A Financial Investors Trust Form is a foundational document used in estate planning and wealth management. It establishes a trust that can hold and manage assets on behalf of designated beneficiaries. The importance of this form cannot be overstated, as it plays a critical role in ensuring assets are managed according to the investor's wishes. By utilizing trusts, investors can control the distribution of their wealth, protect assets from taxation, and provide for their loved ones efficiently. This trust arrangement also offers a framework for investment products that align with your financial goals.

The significance of trusts extends beyond mere asset distribution. They allow for advanced financial planning, offering diverse benefits such as reducing potential estate taxes and providing a clear structure for investment management. In essence, a well-structured trust can safeguard assets in a jurisdiction of choice, keeping in mind local regulations and investor preferences.

Preparing to fill out the form

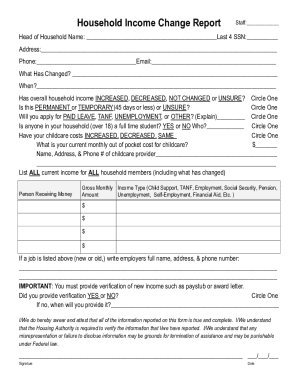

Before diving into the completion of the Financial Investors Trust Form, gathering the necessary information is crucial. Start by compiling personal details such as your full name, home address, and Social Security number (SSN). It's vital that these details are accurate as they will directly relate to your assets and financial identity.

Financial details are equally important. You should list all relevant assets, including bank accounts, real estate, investments, and other properties. Additionally, note any liabilities such as loans or mortgage balances. This comprehensive documentation serves as the foundation for effective trust management and ensures clarity in your financial planning.

Understanding your objectives is key when preparing to fill out this form. This means identifying whether your goal is estate planning, asset protection, or another purpose. Engaging with a financial advisor can provide invaluable insights tailored to your specific situation. Advisors can assist you in aligning your financial products and planning strategies with the overall function of the trust.

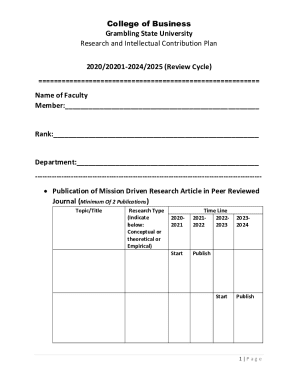

Step-by-step instructions for completing the form

Once you've gathered all necessary information, the next step is filling out the form. Here’s a section-by-section breakdown to simplify the process.

Section 1: Personal Information

This section requires your basic personal details. Ensure that your name is spelled correctly and that you provide your current address. Pay close attention to the accuracy of your Social Security number, as any errors can lead to complications.

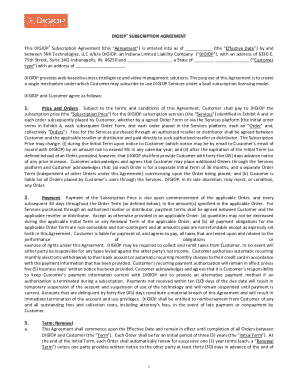

Section 2: Trust Details

In this segment, you will define the type of trust you wish to establish—whether it’s revocable or irrevocable. Clarifying the purpose of the trust is essential, as it helps to align the document with your financial goals and investment strategies.

Section 3: Asset Declaration

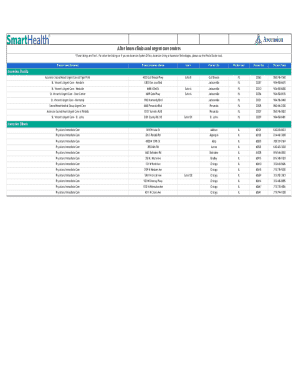

This crucial section involves listing your assets. When listing assets such as real estate or investment products, it's important to include a current valuation. To create clarity, adopt best practices like grouping assets by type and avoiding ambiguous descriptions.

Section 4: Trustee and Beneficiary Designations

Clarifying the roles of the trustee and beneficiaries is vital for the trust to function properly. The trustee is responsible for managing the assets of the trust, while beneficiaries are the individuals or entities that will benefit from it. Specify their names and roles clearly, ensuring there is no ambiguity about responsibilities.

It's common for individuals to overlook signature requirements or make mistakes with notarization. Common errors include incomplete asset listings or failing to disclose all liabilities. Being vigilant during this process can save you from complications down the line.

Editing and reviewing the financial investors trust form

After completing the form, it's imperative to review it for accuracy. One of the most efficient ways to edit and finalize your trust form is by utilizing pdfFiller. This platform provides a user-friendly interface for revising your documents easily and includes features that streamline the process of sharing with professionals for review.

Consider creating a final checklist before submission, ensuring completeness and accuracy. This checklist may include confirming all required signatures, verifying the proper notarization, and ensuring that necessary attachments, such as evidence of asset ownership or financial details, are included.

Signing and submitting the form

Understanding the legalities around signatures is essential. pdfFiller offers a straightforward eSignature option designed explicitly for documents like the Financial Investors Trust Form. Utilizing eSignatures can greatly simplify the signing process, making it faster and more efficient without compromising legal validity.

Once signed, the form must be submitted to the appropriate local governing body. Each jurisdiction may have its own submission protocols, so familiarizing yourself with these local regulations is crucial. Keeping copies of all submitted documents and correspondence is equally important, as maintaining thorough records will aid in future reviews or clarifications that may arise.

Managing your financial investors trust post-submission

Even after submission, managing your trust is an ongoing process. There are several situations that necessitate updating the Financial Investors Trust Form, including changes in beneficiaries or the acquisition of additional assets. pdfFiller can be an invaluable resource here, assisting you in maintaining up-to-date records easily through its cloud-based services.

Monitoring the status of your trust is also vital. Utilizing tools and notifications available through various trust management platforms can help you track the approval process and prompt you to address any potential issues promptly. Being proactive can mitigate misunderstandings and facilitate smoother interactions with financial institutions.

Additional considerations for financial investors

When creating or revising your Financial Investors Trust Form, it's critical to consider the tax implications associated with trusts. Trusts can significantly affect beneficiaries' tax situations, potentially leading to taxable events depending on distributions made from the trust. It's advisable to consult with a tax professional, who can provide tailored advice based on the specific structure of your trust and local tax laws.

Moreover, understanding the various types of trusts—such as revocable or irrevocable trusts—is essential for effective financial planning. Revocable trusts offer flexibility, allowing changes to be made during the grantor's lifetime, while irrevocable trusts typically provide stronger asset protection but are challenging to alter once established. Evaluating your situational needs can guide you to the right choice.

Leveraging pdfFiller for a seamless experience

pdfFiller provides a host of features specifically designed to facilitate the creation, editing, and management of trust forms. Its robust document management capabilities allow for swift adjustments to your forms, securing not only accuracy but also accessibility. With pdfFiller, you can engage in collaborative work, seeking input from colleagues and advisors directly within the document.

The benefits of using a cloud-based platform like pdfFiller extend beyond document creation; they include accessibility from any device and robust security frameworks that protect sensitive information. This ensures that you can manage your Financial Investors Trust Form and associated documents anytime, anywhere, without compromising on data privacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial investors trust form in Gmail?

How do I make edits in financial investors trust form without leaving Chrome?

How do I fill out financial investors trust form using my mobile device?

What is financial investors trust form?

Who is required to file financial investors trust form?

How to fill out financial investors trust form?

What is the purpose of financial investors trust form?

What information must be reported on financial investors trust form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.