Get the free State of California et al. v. Department of Health and Human ...

Get, Create, Make and Sign state of california et

Editing state of california et online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of california et

How to fill out state of california et

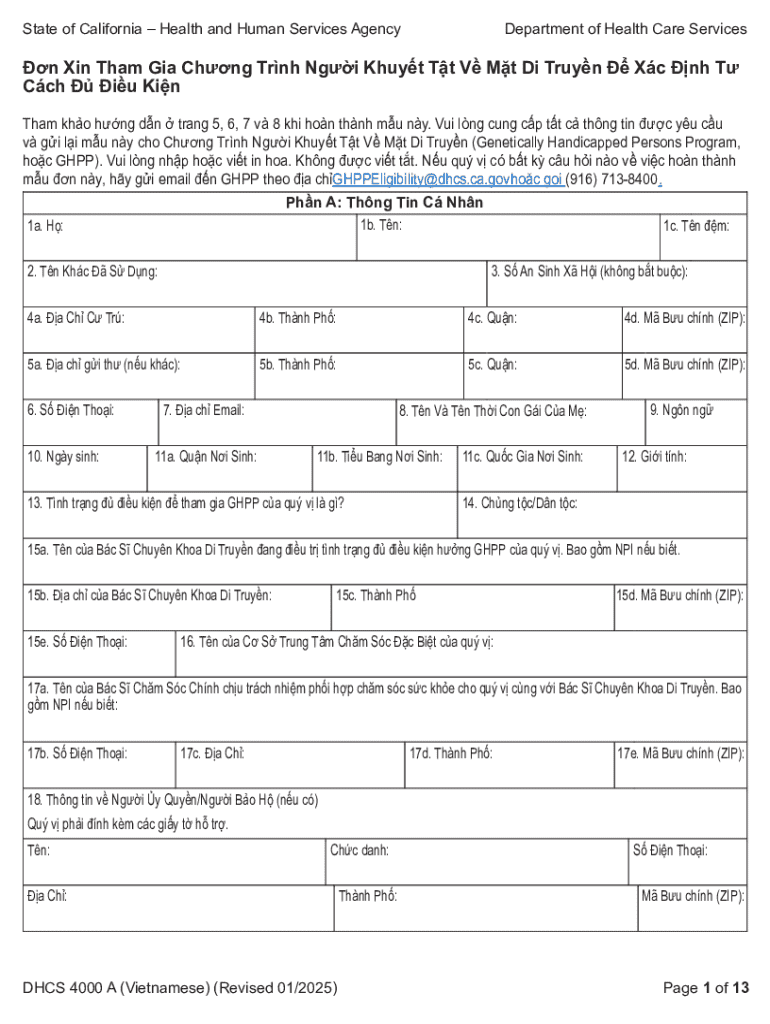

Who needs state of california et?

State of California ET Form - How-to Guide

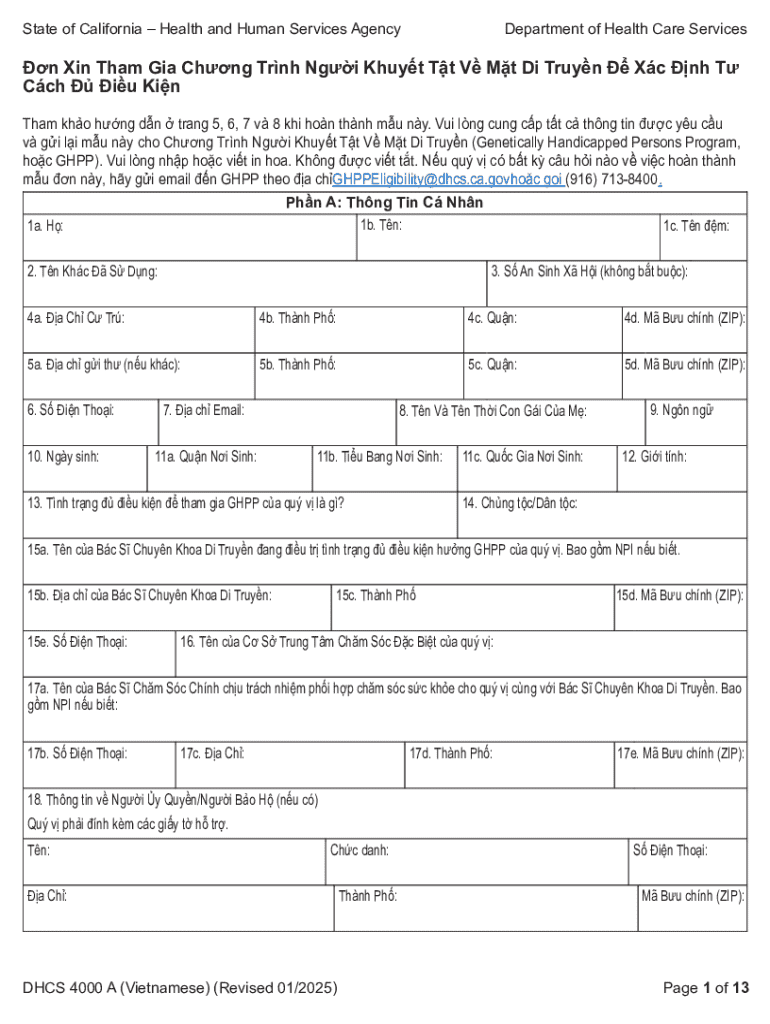

Understanding California estate tax (ET) forms

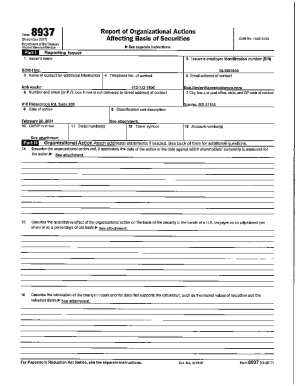

California estate tax forms, often referred to as ET forms, are crucial for managing the tax obligations associated with the transfer of assets following a person's death. These forms ensure the proper reporting of the decedent's estate, including the valuation of property, liabilities, and ultimately the estate tax owed. Understanding the purpose and necessity of filing California ET forms can streamline the often complex process of estate management.

Filing for estate taxes is not just a bureaucratic formality; it is a legal requirement that ensures compliance with state tax laws. The importance of accurately completing these forms cannot be overstated, as improper filings can lead to significant penalties or unintended financial burdens for the heirs. It's also essential to stay updated on key changes to the California estate tax laws, especially following the 2023 updates that may affect filing requirements and tax calculations.

Types of California ET forms

California has several specific ET forms that cater to various scenarios in estate tax filings. Understanding the differences is key to ensuring compliance and minimizing tax liabilities.

California estate tax information

The California estate tax information form gathers essential details about the estate's assets and liabilities. This includes property valuations, outstanding debts, and a list of heirs. Key deadlines must be observed to prevent penalties.

California estate tax return

The California estate tax return is the primary document used for reporting the estate's total value. It incorporates vital components such as personal information about the decedent, details about the estate's assets and liabilities, and initial tax calculations. Common mistakes include misvaluing assets or overlooking debts, which can drastically affect tax calculations.

California additional estate tax return

If there are changes in the estate's valuation post-filing, an additional return may be required. Understanding when and why to file this additional return is essential for ensuring compliance with California tax laws.

California generation-skipping transfer tax return

For those who leave property to grandchildren or beyond, the generation-skipping transfer tax return comes into play. This form has specific requirements and calculations that must be carefully followed.

Declaration concerning residence

Residency plays a crucial role in estate tax calculations in California. The declaration concerning residence confirms the decedent's legal residence, impacting tax calculations and filing requirements.

Filling out your California ET form

Filling out the California estate tax return can seem daunting, but breaking it down into manageable steps simplifies the process.

Tips for accurate reporting include keeping supporting documentation organized and, if necessary, enlisting the help of professionals with expertise in estate taxes. This can prevent costly errors and ensure compliance.

Common issues and how to resolve them

Mistakes can happen in the estate tax filing process, leading to either underpaid or overpaid taxes. Recognizing these miscalculations early can save time and money.

Frequently asked questions about California estate tax returns arise, especially concerning deadlines. If you miss the filing deadline, penalties may apply. Amending a return is possible but requires following specific protocols to ensure compliance.

Utilizing tools for managing your California ET form

Modern technology has made managing estate tax filings considerably easier through various interactive tools.

Interactive tools for filling and submitting forms

pdfFiller offers features that allow users to edit, eSign, and collaborate on California ET forms effortlessly. This ensures that all necessary parties can participate in the finalization of estate documents from any location.

Managing your online documents securely

A cloud-based document management system, like pdfFiller, ensures your documents are securely stored while still accessible. This provides peace of mind when handling sensitive estate tax information.

State of California resources for estate tax filers

When navigating the complexities of estate taxes, utilizing official state resources can be invaluable.

Making the most of pdfFiller for your estate tax needs

pdfFiller stands out for its seamless document editing and signature capabilities, making the management of California ET forms efficient.

The advantages of a centralized document management platform include ease of access and collaboration. Case studies shared by users highlight the effectiveness of pdfFiller in streamlining the estate tax filing process, relieving stress, and ensuring precise compliance with California’s estate tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state of california et in Gmail?

How can I send state of california et for eSignature?

How do I edit state of california et in Chrome?

What is state of california et?

Who is required to file state of california et?

How to fill out state of california et?

What is the purpose of state of california et?

What information must be reported on state of california et?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.