Get the free IRS Form 8937 Reporting - An Often-Overlooked U.S. Tax ...

Get, Create, Make and Sign irs form 8937 reporting

Editing irs form 8937 reporting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8937 reporting

How to fill out irs form 8937 reporting

Who needs irs form 8937 reporting?

IRS Form 8937 Reporting Form - How-to Guide

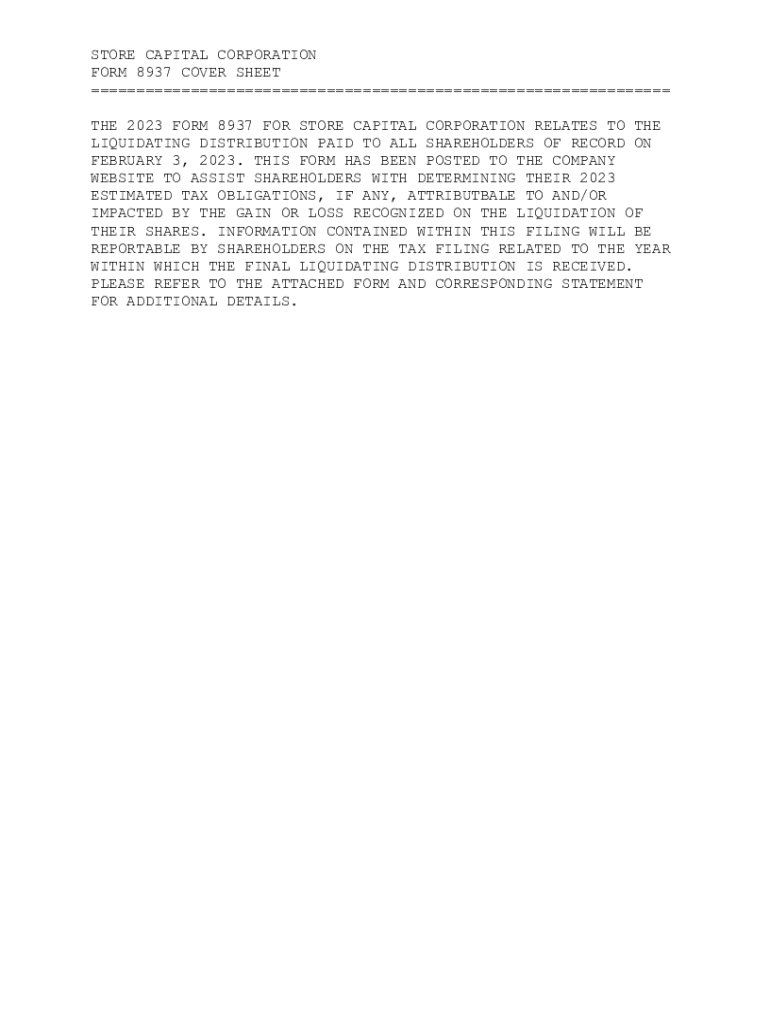

Understanding IRS Form 8937: An overview

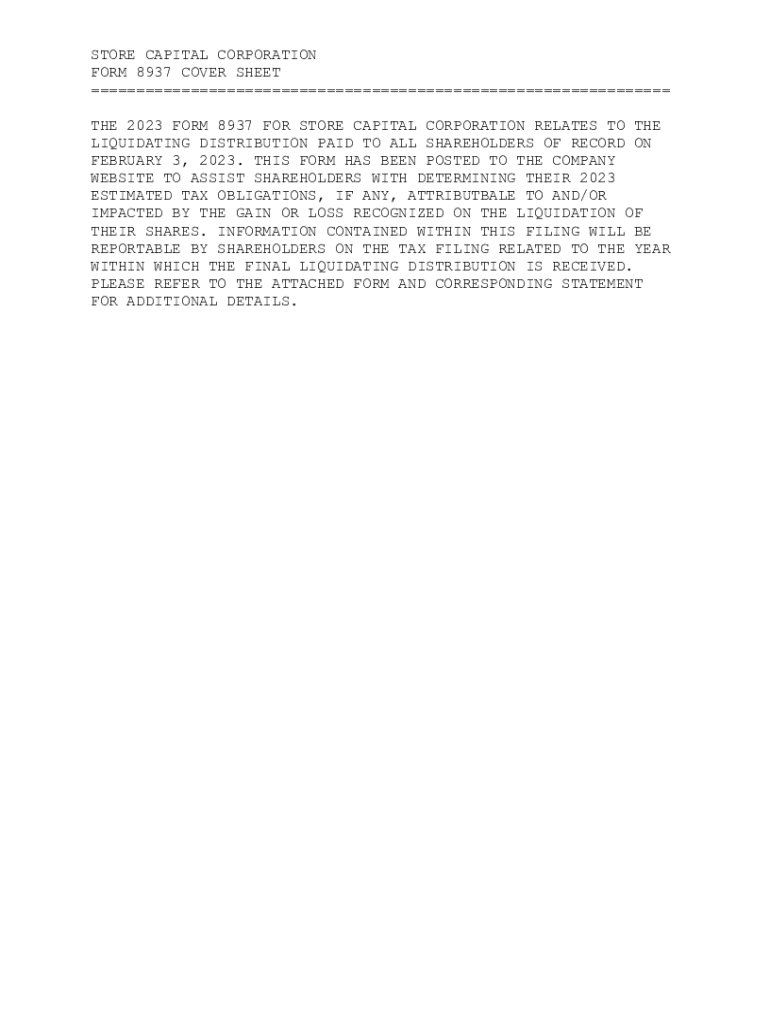

IRS Form 8937 is used to report organizational actions that affect the securities of a corporation, partnership, or investment trust. This form is especially significant for the proper communication of corporate actions to shareholders and the IRS.

The importance of IRS Form 8937 lies in its role in transparency and compliance. It ensures that both shareholders and the IRS are informed about the tax implications of actions like stock splits, mergers, or cash dividends, which impact a shareholder's cost basis.

Key terminology explained

Who needs to file Form 8937?

Form 8937 is primarily filed by corporations, partnerships, and investment trusts that conduct actions affecting securities. To be eligible, these entities must have undergone a qualifying corporate action that impacts their shareholders' cost basis or tax liability.

Scenarios that necessitate the filing of Form 8937 include:

Detailed breakdown of Form 8937 sections

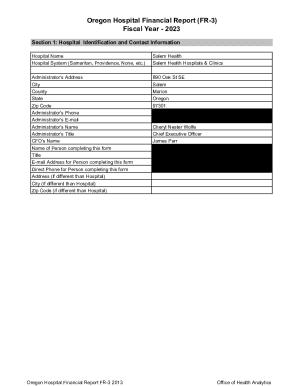

Section 1: Issuer information

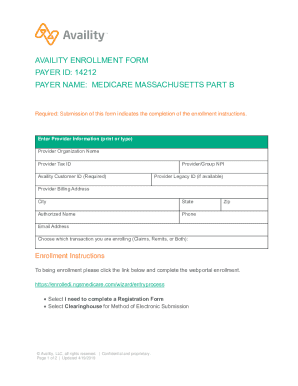

This section requires basic information about the issuer, including their name, address, and Employer Identification Number (EIN). To gather this data, ensure that you have your corporate records handy and consult your financial department if necessary.

Section 2: Corporate action details

In this section, you will need to provide a description of the corporate action being reported. It's essential to clearly state the nature of the action, its purpose, and its impact on stockholders to prevent any confusion later.

Section 3: Ownership and tax information

Here, understanding the concepts of ‘Record Date’ and ‘Payment Date’ is critical. The Record Date determines who among shareholders is entitled to receive the benefits from the corporate action, while the Payment Date is when the action is executed.

Section 4: Signature and certification

The final section is where the entity certifies the information is true, and the signer is authorized. Ensuring that the person signing the form has the appropriate authority is crucial for the integrity of the filing.

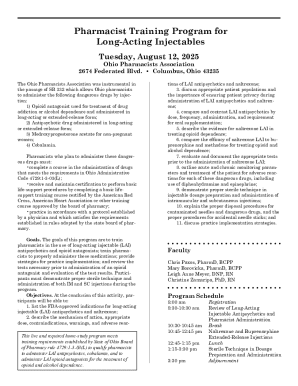

Step-by-step guide to completing the form

Before you start, prepare by gathering all necessary documentation related to the corporate action. This includes financial statements, past corporate records, and any relevant tax information.

When filling out each section of the IRS Form 8937, consider using templates or digital fillable forms to streamline the process. pdfFiller provides interactive tools that can help you gather all required data effortlessly.

Submitting IRS Form 8937

Once the form is completed, it can be submitted electronically or via paper filing. Electronic filing is generally faster and allows for easier tracking, while paper filing may take longer to process.

Make sure to be aware of the submission timeline to avoid penalties. The IRS typically requires Form 8937 to be filed within a specific timeframe after the corporate action has taken place.

Understanding post-submission: what comes next?

After submission, monitor any IRS communications for clarifications or follow-ups. It is not uncommon for the IRS to request additional information if necessary.

Record-keeping is essential for both corporate compliance and individual tax purposes. Ensure that all documents related to Form 8937 are securely stored for future reference.

Integrating IRS Form 8937 with broader tax strategies

Understanding how IRS Form 8937 fits into your overall tax strategy is vital. Proper filing can impact your entity’s IRS records and your tax liability.

Collaborating with tax professionals ensures that you remain compliant with the latest tax regulations while optimizing your tax planning strategies for your organization. Updating shareholders on the implications of corporate actions is also crucial.

Using pdfFiller for IRS Form 8937 management

pdfFiller streamlines the process of completing IRS Form 8937 by providing seamless editing capabilities. Users can easily input data directly into the form using their cloud-based platform, making collaboration efficient and straightforward.

The platform also enables eSigning capabilities, allowing authorized personnel to sign the form digitally, which expedites submission and recordkeeping.

Frequently asked questions about IRS Form 8937

Many individuals have misconceptions regarding Form 8937, often perplexed about who needs to file it or the exact timing for submission.

The most common clarifications needed involve complex scenarios. For instance, what to do if there are multiple corporate actions occurring simultaneously or how to adjust the cost basis after a significant corporate restructuring.

Additional support and tools for IRS Form 8937 filers

Understanding IRS Form 8937 fully may require additional support, especially for first-time filers. Engaging in interactive consultations with experts can clarify complex issues.

Moreover, accessing historical data and case studies on previous corporate actions can provide invaluable context and guidance. Community forums also exist where individuals can share experiences and tips for better navigation of this tax form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs form 8937 reporting?

How do I edit irs form 8937 reporting in Chrome?

Can I edit irs form 8937 reporting on an Android device?

What is IRS Form 8937 reporting?

Who is required to file IRS Form 8937 reporting?

How to fill out IRS Form 8937 reporting?

What is the purpose of IRS Form 8937 reporting?

What information must be reported on IRS Form 8937 reporting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.