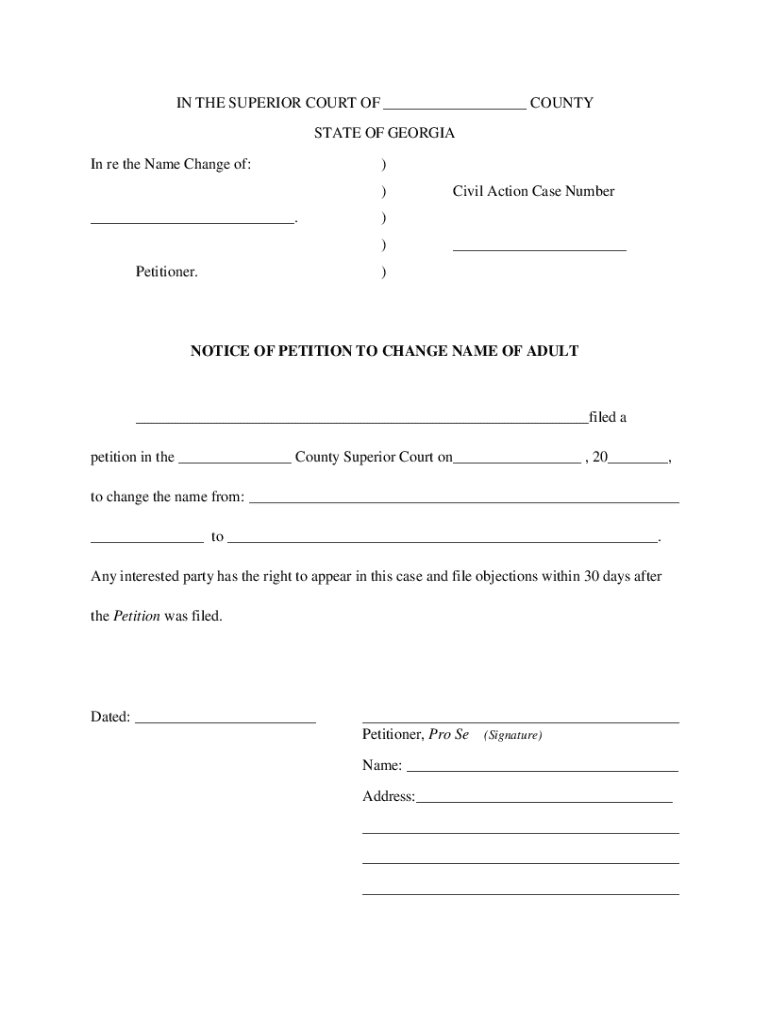

Get the free filed a

Get, Create, Make and Sign filed a

How to edit filed a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out filed a

How to fill out filed a

Who needs filed a?

Filed a form: A comprehensive how-to guide

Understanding the importance of filing a form

Filing a form isn't just a task; it's a crucial component of effective document management in both personal and professional contexts. When you file a form, you're ensuring compliance with regulations, maintaining proper records, and facilitating communication with governmental agencies or organizations.

The necessity of filing forms stretches across various spheres, from applying for government benefits, such as unemployment tax claims, to submitting crucial financial documents like gross receipts tax forms. Ignoring or mismanaging these forms can lead to delays and complications that could have significant repercussions.

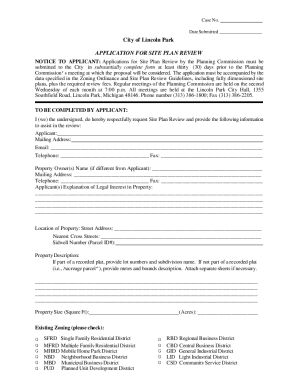

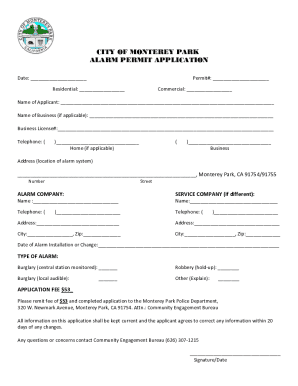

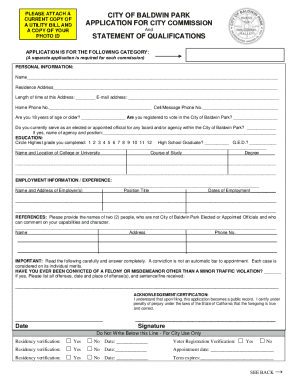

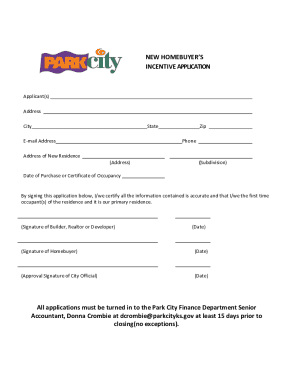

Types of forms you can file

Understanding the various types of forms that exist is imperative for anyone looking to streamline their filing process. Forms vary widely depending on their purpose and the entities they are associated with, including government, legal, and business environments.

Common types of forms you'll encounter include:

Preparing to file a form

Preparation is key when filing a form. Properly gathering the information and documents needed will save you time and prevent errors later on. Start by compiling necessary identification and data according to the requirements of the specific form.

Awareness of deadlines is vital, especially with tax-related forms that are time-sensitive. Choose a platform like pdfFiller, which allows easy access and submission of forms, making the process smoother.

Step-by-step guide to filing your form

Having gathered all necessary documents, it's time to go through the steps for filing your form effectively using pdfFiller.

Step 1: Accessing the form

Your first step is to find the right form. On pdfFiller, you can locate forms by searching the extensive database. The convenience of digital templates allows users to find specific forms and customize them as needed.

Step 2: Filling out the form

When you begin to fill out the form, utilize pdfFiller’s user-friendly editing tools. Ensure each data point is accurate to avoid delays or misunderstandings. Here are a few tips:

Step 3: Reviewing your form

Before submitting, review your form. Utilize collaborative features of pdfFiller to invite others to verify or edit sections as needed. A comprehensive review includes checking all entries against your documentation.

Step 4: Signing the form

Signing the document electronically enhances efficiency. pdfFiller offers secure eSigning options that assure your signature's authenticity and legality. Using the available security features protects your sensitive data.

Step 5: Submitting the form

Now, you can submit your completed form. Depending on the document type, pdfFiller provides varied submission options, ranging from direct submission to email or downloads. It's essential to keep confirmation receipts or any related correspondence to confirm your submission.

Step 6: Keeping track of your submitted form

Utilizing pdfFiller’s document management tools allows you to effectively organize and track your submissions. Setup reminders for follow-ups on the status of submitted forms, particularly those that are vital for compliance like ad valorem tax returns.

Troubleshooting common issues when filing a form

While the process of filing a form is designed to be smooth, challenges can occasionally arise. Efficient troubleshooting ensures that you can navigate any issues quickly.

Understanding your rights and responsibilities when filing forms

When you file a form, you take on both rights and responsibilities. Knowledge of these elements is crucial to ensure compliance and protect your interests. For example, understanding privacy considerations is key, especially when your personal data is being used in documents like tax filings or registrations.

Leveraging pdfFiller for efficient form management

In today’s fast-paced world, utilizing a reliable platform like pdfFiller can make the form management process efficient and hassle-free. The cloud-based solution facilitates document creation and management from virtually anywhere.

Frequently asked questions (FAQs)

Many users have questions regarding form filing processes, particularly concerning the features offered by pdfFiller.

Additional tools and resources

To further assist you in the form filing process, consider utilizing additional tools that complement pdfFiller's capabilities. Several apps exist to help you navigate form complexities and streamline your document management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify filed a without leaving Google Drive?

Where do I find filed a?

How do I complete filed a on an Android device?

What is filed a?

Who is required to file filed a?

How to fill out filed a?

What is the purpose of filed a?

What information must be reported on filed a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.