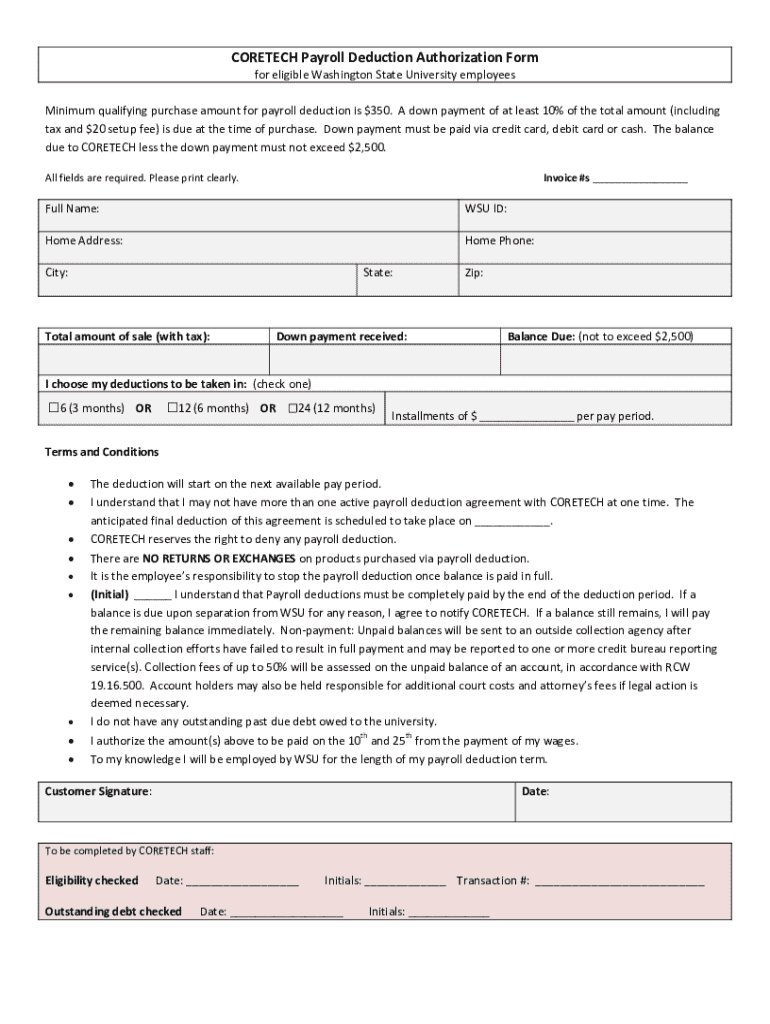

Get the free CORETECH Payroll Deduction Authorization Form

Get, Create, Make and Sign coretech payroll deduction authorization

Editing coretech payroll deduction authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coretech payroll deduction authorization

How to fill out coretech payroll deduction authorization

Who needs coretech payroll deduction authorization?

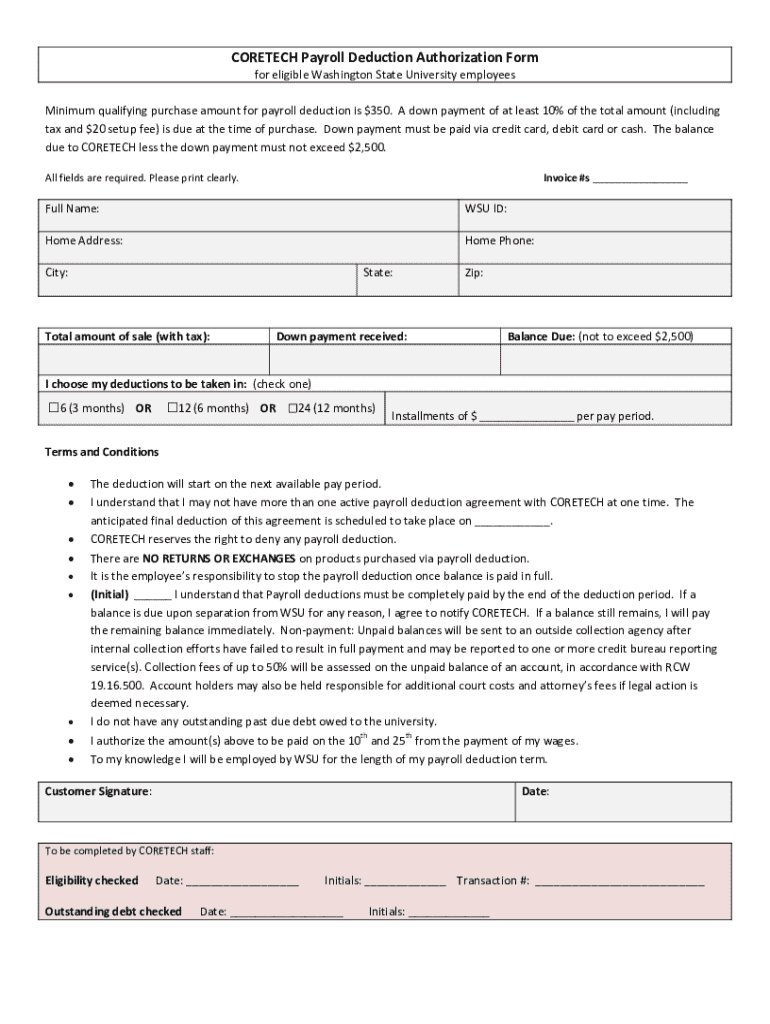

Comprehensive Guide to the Coretech Payroll Deduction Authorization Form

Understanding payroll deductions

Payroll deductions refer to amounts withheld from an employee's earnings by their employer for various purposes. These deductions can cover taxes, benefits, and other financial obligations. Understanding payroll deductions is crucial for employees as it affects their overall financial health and take-home pay.

The significance of payroll deductions lies in their contribution to employee benefits such as health insurance, retirement plans, and tax obligations. A well-managed payroll deduction system ensures that employees can access essential benefits seamlessly, reflecting a practical approach to budgeting and financial management.

What is the Coretech payroll deduction authorization form?

The Coretech payroll deduction authorization form is a document that enables employees to authorize the deduction of specific amounts from their paychecks for various purposes, such as contributions to health insurance or retirement accounts. This form plays a vital role in streamlining payroll processes, ensuring transparency and compliance with employee requests for deductions.

Individuals looking to structure their benefits or contributions should fill out this form. By authorizing payroll deductions, employees can manage their financial responsibilities more efficiently, allowing for systematic payments toward items like health care premiums or retirement savings.

Authorizing payroll deductions can yield several benefits, including simplified budgeting, automatic payments that reduce missed deadlines, and potential tax savings through pre-tax deductions.

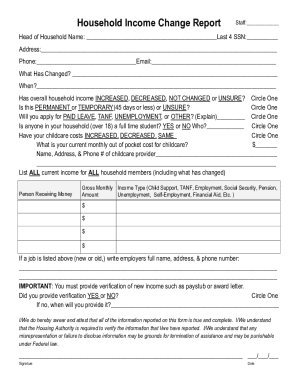

Key components of the Coretech payroll deduction authorization form

Understanding the key components of the Coretech payroll deduction authorization form will help you fill it out accurately and efficiently. The form generally comprises several sections, each vital for processing deductions correctly.

The personal information section is where you'll input your basic details, including your name, address, and employee ID. This ensures that your employer can easily identify your record and process deductions with precision.

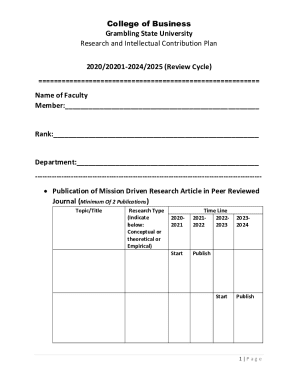

Step-by-step guide: How to complete the Coretech payroll deduction authorization form

Completing the Coretech payroll deduction authorization form doesn't have to be overwhelming. Follow these steps for a smooth process:

Common scenarios requiring the Coretech payroll deduction authorization form

The Coretech payroll deduction authorization form can be essential in various scenarios that affect employees. Here are some typical situations that may necessitate its completion:

Frequently asked questions (FAQs) about payroll deduction authorization

Understanding the policies surrounding payroll deductions can raise questions among employees. Here are some FAQs regarding the Coretech payroll deduction authorization form:

Managing your payroll deductions

Effectively managing payroll deductions is crucial for ensuring your financial commitments are met without any hiccups. Here are some strategies to keep in mind:

Leveraging pdfFiller for simplifying the payroll deduction authorization process

pdfFiller is designed to streamline the administrative burdens associated with the Coretech payroll deduction authorization process. By providing easy-to-use electronic forms, employees can navigate the authorization process efficiently.

Best practices for payroll deduction authorization

Implementing best practices for managing and authorizing payroll deductions can protect against errors and enhance financial management. Here are recommended practices:

Importance of understanding your payroll deductions

Understanding payroll deductions is paramount for employees wanting to maintain control over their finances. Deductions impact your take-home pay significantly, influencing budgeting decisions and long-term financial planning.

Employees should evaluate the benefits they receive through payroll deductions, ensuring that these contributions align with their overall financial goals. Staying informed about changes in employment policies or benefits is also crucial to maximizing the utility of payroll deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete coretech payroll deduction authorization online?

Can I sign the coretech payroll deduction authorization electronically in Chrome?

Can I edit coretech payroll deduction authorization on an Android device?

What is coretech payroll deduction authorization?

Who is required to file coretech payroll deduction authorization?

How to fill out coretech payroll deduction authorization?

What is the purpose of coretech payroll deduction authorization?

What information must be reported on coretech payroll deduction authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.