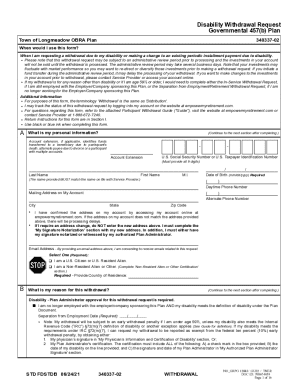

Get the free Form m1 instructions. Minnesota has a state income tax rate ranging from 5.35% to 9....

Get, Create, Make and Sign form m1 instructions minnesota

How to edit form m1 instructions minnesota online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form m1 instructions minnesota

How to fill out form m1 instructions minnesota

Who needs form m1 instructions minnesota?

Form M1 Instructions Minnesota Form - A Comprehensive Guide

Overview of the Minnesota Form M1

The Minnesota Form M1 is essential for residents looking to file their state income tax returns. This form is the key document through which taxpayers report their income, claim deductions, and calculate their state tax liability. Understanding Form M1 is crucial for avoiding errors and ensuring compliance with Minnesota tax regulations.

Key deadlines for submitting the M1 form align with federal tax deadlines, typically falling on April 15 each year. However, it's essential to verify if these dates shift due to weekends or holidays. Minnesota residents, particularly those with specific eligibility criteria based on income and residency status, must be aware of these deadlines to avoid penalties.

Preparing to complete your Form M1

Successfully completing your Form M1 requires gathering several essential documents. Starting with personal information such as your Social Security Number (SSN) and your current address is crucial. This helps ensure that your tax return is accurately linked to your identity, which is foundational for the Department of Revenue to process your return effectively.

Next, you’ll need your income statements, including W-2s, 1099s, and any additional income documentation. Ensure you have these documents organized as they represent the total income you earned during the fiscal year. Also, familiarize yourself with deductions and credits that may apply based on your financial situation. Notably, Minnesota has specific laws that can differ significantly from federal tax laws, which may affect your return.

Step-by-step instructions for filling out Form M1

Filling out the Form M1 can be methodical if approached in steps. Begin with your personal information, ensuring all details in the identification section are accurate. Common errors include typos in names or incorrect SSNs, which can delay processing. After confirming your personal information, proceed to report your income. Line-by-line detailed instructions are provided in the form; carefully follow these to avoid discrepancies.

When reporting your income, use corresponding forms and schedules, as required. If you have multiple income sources, such as investments or freelance work, make certain each is accounted for according to Minnesota requirements. Moreover, when applying deductions and credits, it's essential to distinguish between standard and itemized deductions to maximize tax savings. Minnesota offers several credits that could reduce your overall tax liability significantly.

Editing and correcting your Form M1

Mistakes happen, and knowing how to make corrections to your Form M1 is crucial. If you realize you've made an error after submission, don’t panic. You can submit an amended return using Form M1X to rectify the discrepancies. It’s essential to address any mistakes as soon as possible to prevent potential penalties from the Department of Revenue.

When writing to amend your filing, include a clear explanation of the changes and relevant documentation. Be mindful of deadlines for submitting amended returns, which may be different from the filing deadlines for the initial return. Ensure you carefully compare your original filing against the amended one to illustrate the changes clearly.

Signing and submitting your Form M1

Once your Form M1 is complete, signing it is the next crucial step. Electronic signatures are permissible, and using services like pdfFiller can enhance efficiency. E-signing not only saves time but also provides a secure method of approval, ensuring your information remains confidential throughout the submission process. You can easily eSign your documents directly in the interface, simplifying your experience.

Moreover, you'll need to decide how to submit your form; online e-filing is generally quicker and more efficient, while mailing may take longer due to postal processing times. Weigh the pros and cons of each method. For instance, e-filing allows immediate confirmations of submission, reducing worry and providing immediate tracking capabilities.

Managing after submission

After submitting your Form M1, it's essential to know what to expect. The Minnesota Department of Revenue sends a confirmation once your return is processed, which typically takes a few weeks. Staying informed about your filing status can relieve stress, especially if you're waiting on a tax refund. Tracking your refund can be done through the Department of Revenue's online tools for added convenience.

If you receive any notices from the Department of Revenue, review them carefully. They may require further action or provide information on any adjustments to your return. Understanding notices in different languages, including English, Spanish, and Somali, can be essential for communication. The translation disclaimer aids in ensuring clarity for all residents.

Interactive tools and resources

Utilizing interactive tools such as those offered by pdfFiller can streamline your Form M1 experience. pdfFiller has robust form editing features that allow for easy modifications and ensure that your documents retain their integrity and accuracy. Whether you’re assembling financial documents or handling multiple forms, the platform serves as an all-in-one solution.

Additionally, engage with frequently asked questions pertaining to the Form M1. Knowing common queries can equip you with vital information about tax regulations, filing processes, and the supports available through the Minnesota Department of Revenue and its website.

Special considerations

Individuals with unique situations, such as self-employment or specific family situations, should take special care while filling out their Form M1. Minnesota offers particular provisions for freelancers, business owners, or those with substantial investment income that may affect their tax situation. Utilizing expert resources can bolster the quality of your submission.

Be aware that if you're a non-resident or a part-year resident, your filing requirements may vary. Resources are available, including guidance from the Minnesota Department of Revenue and community organizations, like the Hmong American Partnership, which often provides tailored support to help individuals and families navigate tax filing processes.

Additional features of pdfFiller

Choosing pdfFiller for managing your documents offers numerous benefits. With its cloud-based platform, you can edit, eSign, and collaborate on your Forms M1 securely from any location. This flexibility is crucial for individuals and teams that operate in diverse environments or operate remotely.

Finally, pdfFiller provides access to a wide range of related forms and templates that can simplify your tax preparation process. Whether you're looking for federal forms, state-specific documents, or templates for personal use, pdfFiller ensures that everything you need is at your fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form m1 instructions minnesota?

How do I make changes in form m1 instructions minnesota?

Can I sign the form m1 instructions minnesota electronically in Chrome?

What is form m1 instructions minnesota?

Who is required to file form m1 instructions minnesota?

How to fill out form m1 instructions minnesota?

What is the purpose of form m1 instructions minnesota?

What information must be reported on form m1 instructions minnesota?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.