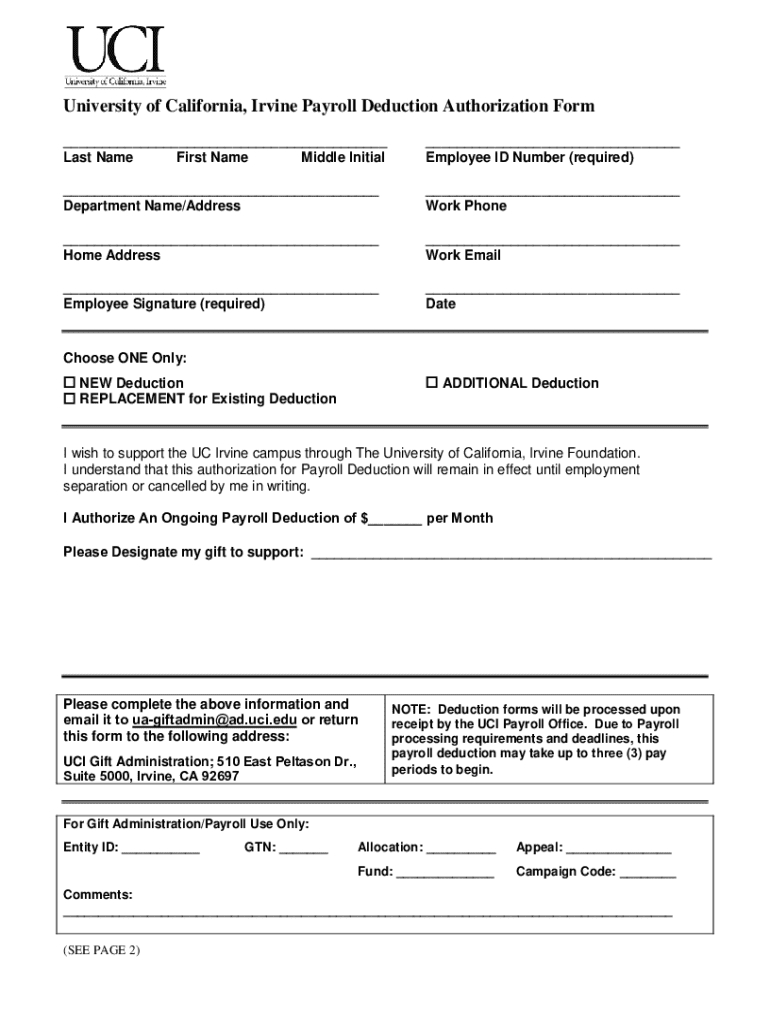

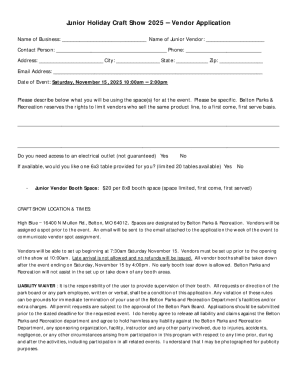

Get the free Irvine California Payroll Deduction Authorization Form - give uci

Get, Create, Make and Sign irvine california payroll deduction

How to edit irvine california payroll deduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irvine california payroll deduction

How to fill out irvine california payroll deduction

Who needs irvine california payroll deduction?

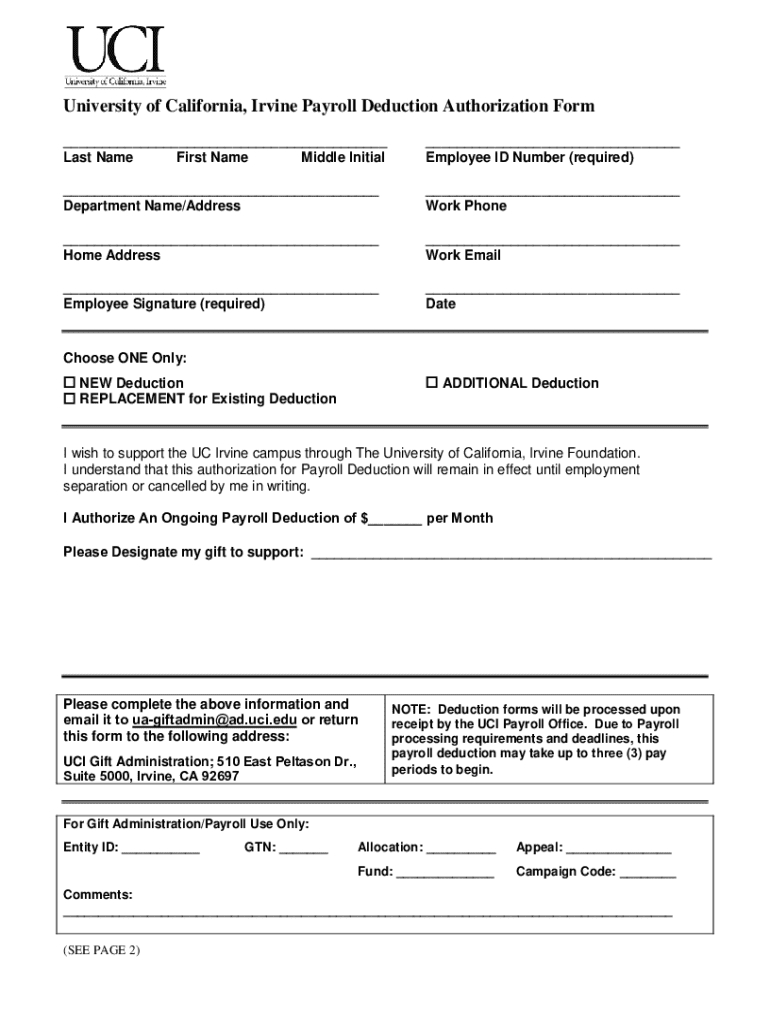

Understanding the Irvine California Payroll Deduction Form

Overview of payroll deduction in Irvine, California

Payroll deductions play a critical role in managing employee compensation in Irvine, California. These deductions represent amounts withheld from an employee's paycheck for various purposes, ranging from tax withholdings to health insurance premiums. Understanding payroll deductions is vital for both employees and employers, as it impacts net income, tax liabilities, and compliance with state and federal regulations.

For employees, payroll deductions can lead to significant tax advantages, allowing for the diversion of before-tax dollars into retirement savings accounts, such as a 401(k). Employers also benefit through simplified tax reporting and a clearer understanding of payroll costs, creating a smoother operation within human resources and accounting departments.

Types of payroll deductions available

Understanding the types of payroll deductions available is essential for employees in Irvine. Payroll deductions generally fall into two categories: mandatory and voluntary. Mandatory deductions include those required by law, like federal and state taxes and Social Security contributions, while voluntary deductions include various employee-chosen withholdings.

Mandatory deductions are non-negotiable and are based on an employee's income. On the other hand, voluntary deductions give employees more control over their finances, allowing them to prioritize important aspects like health care and retirement savings.

Understanding the payroll deduction form

The payroll deduction form serves a pivotal role in managing employee remuneration. For employees, this form outlines the various deductions that will be taken from their paychecks. Filling it out correctly is critical as it directly impacts take-home pay, financial planning, and compliance with employer policies.

Each section of the payroll deduction form is designed to ensure that employees clearly understand the deductions they are opting into. This transparency helps employees avoid surprises on their paychecks and supports compliance with IRS guidelines and state regulations.

Detailed steps to fill out the Irvine payroll deduction form

Filling out the Irvine California payroll deduction form may seem daunting initially, but breaking it down into manageable steps can simplify the process. The form must be filled out accurately to ensure appropriate deductions are made, reflecting the employee's choices and needs.

To ensure accuracy, employees should gather all necessary information beforehand, consider their financial goals, and understand how different deductions will impact their take-home pay. Here’s a step-by-step guide to help you through the process.

Common mistakes when filling out payroll deduction forms can lead to serious consequences. To circumvent errors, ensure understanding of Mandatory vs. Voluntary deductions, check amounts or percentages entered, and verify the required signature and date.

Tips for editing and managing your payroll deduction form

Maintaining an up-to-date payroll deduction form is crucial for effective financial planning. In instances where personal or financial circumstances change—like marriage or the birth of a child—reviewing and possibly restructuring your deductions is ideal. pdfFiller provides a straightforward online solution to access and edit your forms seamlessly.

To start, accessing the Irvine payroll deduction form online is simple. A brief search will lead to multiple trusted sources, including your employer's human resources page, which may directly link to the form. pdfFiller also enables easy editing of PDFs without the hassle of printing and scanning.

Signing and submitting the payroll deduction form

After completing the payroll deduction form, the next step is signing and submitting it. Ensuring that this portion is completed accurately is as important as filling out the body of the form. Signature verification is essential for both compliance and authenticity of the document.

To streamline this process, utilize digital signing tools available through pdfFiller. These tools not only simplify the act of signing but also enhance document security, keeping your information safe while enabling you to sign from any location.

Managing changes to your payroll deductions

Change is constant in life, and so is the need to adjust payroll deductions accordingly. Whether you experience a shift in employment status, encounter new financial goals, or undergo personal life changes, it’s essential to continuously reassess your payroll deductions. This proactive approach ensures that you are optimizing your paycheck according to your needs.

When it’s time to update your payroll deductions, be sure to consult your employer about the specific changes needed. To re-submit the updated payroll deduction form, follow your HR department's guidelines to ensure a smooth transition in your payroll management.

Frequently asked questions (FAQs) about payroll deductions

Payroll deductions can introduce confusion, especially for newcomers or those unfamiliar with various forms and processes. Here are some common questions employees in Irvine might have about their payroll deductions.

Additional resources for payroll deductions

In an effort to support employees in Irvine, various resources are available that help clarify and enhance their understanding of payroll deductions. This includes direct connections with payroll representatives, who can provide tailored advice, and online tools that help predict take-home pay after deductions.

Why choose pdfFiller for your payroll needs?

Opt for pdfFiller for a practical and efficient solution to your document management needs, particularly for forms like the Irvine California payroll deduction form. Its cloud-based platform enables users to create, edit, sign, and collaborate on documents seamlessly from virtually anywhere, enhancing both convenience and security.

Moreover, pdfFiller empowers your overall document creation experience with robust tools, helping you manage the intricacies of payroll deductions without hassle. With user-friendly features and real-time collaboration, it's the ideal choice for individuals and teams navigating document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the irvine california payroll deduction in Gmail?

Can I edit irvine california payroll deduction on an iOS device?

How do I complete irvine california payroll deduction on an iOS device?

What is irvine california payroll deduction?

Who is required to file irvine california payroll deduction?

How to fill out irvine california payroll deduction?

What is the purpose of irvine california payroll deduction?

What information must be reported on irvine california payroll deduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.