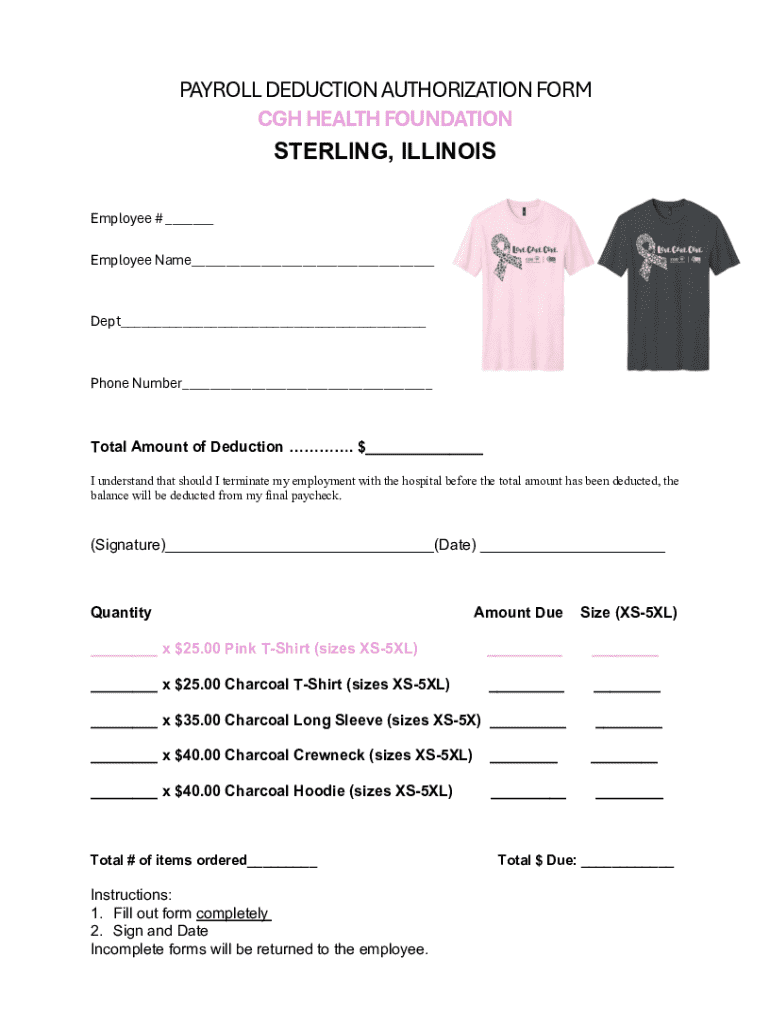

Get the free payroll deduction authorization form - Sterling

Get, Create, Make and Sign payroll deduction authorization form

Editing payroll deduction authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction authorization form

How to fill out payroll deduction authorization form

Who needs payroll deduction authorization form?

Understanding Payroll Deduction Authorization Forms: A Complete Guide

Understanding payroll deduction authorization forms

Payroll deduction authorization forms are essential documents that allow employees to authorize their employers to deduct specified amounts from their wages for various purposes. These deductions can range from health insurance premiums to retirement savings, and understanding this form is crucial for both employees and employers.

For employees, this form serves as a way to manage contributions to benefits, ensuring that necessary amounts are deducted consistently and accurately. From the employer's perspective, having employees fill out these forms helps facilitate the accurate distribution of funds and compliance with both company policies and government regulations.

Common uses for payroll deduction authorization forms include:

Key elements of a payroll deduction authorization form

A payroll deduction authorization form is structured to capture essential information that validates the deduction process. The first section of the form typically includes personal information, ensuring that the correct employee records are associated with the deductions.

The personal information section includes:

Authorization criteria should clearly specify the types and amounts of deductions. This section will include specific percentages or fixed amounts the employee agrees to have deducted from their paychecks. Lastly, signature requirements are mandatory. Employees must provide consent by signing and dating the form, ensuring that they understand and agree to the deductions.

Filling out the payroll deduction authorization form

Completing a payroll deduction authorization form correctly is paramount to avoid issues later on. Here are step-by-step instructions for filling out the form:

To ensure accuracy and completeness, consider these tips: read through each section carefully, ask your HR department if you have questions, and keep a copy of the signed form for your records.

Customizing the payroll deduction authorization form with pdfFiller

pdfFiller is an exceptional tool that allows users to customize, edit, and manage payroll deduction authorization forms seamlessly. Its robust features enable users to create documents that meet specific needs while enhancing accuracy.

To access the template on pdfFiller, simply search for payroll deduction authorization under the templates section. Here, you can utilize interactive tools like editing options, enabling you to fill out the form quickly or change existing information.

Collaboration is made easy with pdfFiller, allowing HR or payroll departments to review and modify forms directly. Once the form is ready, users can also take advantage of the eSign capabilities that ensure legal validity, allowing employees to sign the form electronically.

Managing payroll deduction authorization forms

Proper management of payroll deduction authorization forms is just as crucial as completing them accurately. First, store these forms securely in the cloud, utilizing platforms like pdfFiller for easy access and security.

Next, create a tracking system for deductions, enabling both employees and employers to monitor changes over time. When it comes to modifying existing authorization forms, establish a routine to review and update deduction amounts.

When changes are necessary, it is essential to communicate these updates promptly to employees, ensuring they are aware of any adjustments to their pay deductions.

Best practices for payroll deductions authorization

Ensuring compliance with federal and state regulations is paramount for employers handling payroll deductions. Staying informed about regulatory changes helps maintain compliance and avoid potential penalties.

Clear communication with employees about how deductions work, what they are for, and the implications of their choices can foster a more trusting workplace environment. Providing support and education regarding deductions can empower employees to make informed decisions.

Employers should also schedule regular reviews of deductions to ensure their relevance and accuracy. Factors such as changes in employee status or alterations in benefit offerings may necessitate adjustments.

Common issues and troubleshooting

Like any process, completing a payroll deduction authorization form can come with challenges. Common issues might include missing information, unclear deduction types, or employees forgetting to sign the form. Organizations can mitigate these through careful instruction and clarity in the form's design.

Disputes related to deductions can arise, especially if changes in circumstances aren't communicated effectively. It's essential to establish a transparent process where employees can address discrepancies or misunderstandings.

In the FAQ section, employees may need guidance on what to do if they change their minds about a deduction. Employees should be informed that revising their authorization is possible by completing a new form. Additionally, handling errors in previously submitted forms requires a similar approach— a new form should be submitted with the correct information.

Conclusion: streamlining the payroll deduction process

Understanding and properly managing payroll deduction authorization forms is vital for efficient payroll operations. Employers and employees alike benefit from clear communication, accurate documentation, and reliable tools such as pdfFiller.

By leveraging the capabilities of pdfFiller, users can enhance efficiency and compliance regarding payroll processes. This streamlined approach not only reduces administrative burdens but also fosters a more transparent and positive relationship between employers and employees.

Utilizing the resources available on pdfFiller for effective document management can simplify the payroll deduction journey for both parties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in payroll deduction authorization form?

How do I edit payroll deduction authorization form straight from my smartphone?

How do I complete payroll deduction authorization form on an iOS device?

What is payroll deduction authorization form?

Who is required to file payroll deduction authorization form?

How to fill out payroll deduction authorization form?

What is the purpose of payroll deduction authorization form?

What information must be reported on payroll deduction authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.