Get the free Authorization for Voluntary Payroll Deduction Form - Fill ...

Get, Create, Make and Sign authorization for voluntary payroll

How to edit authorization for voluntary payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization for voluntary payroll

How to fill out authorization for voluntary payroll

Who needs authorization for voluntary payroll?

Authorization for Voluntary Payroll Form: A Comprehensive Guide

Understanding the authorization for voluntary payroll form

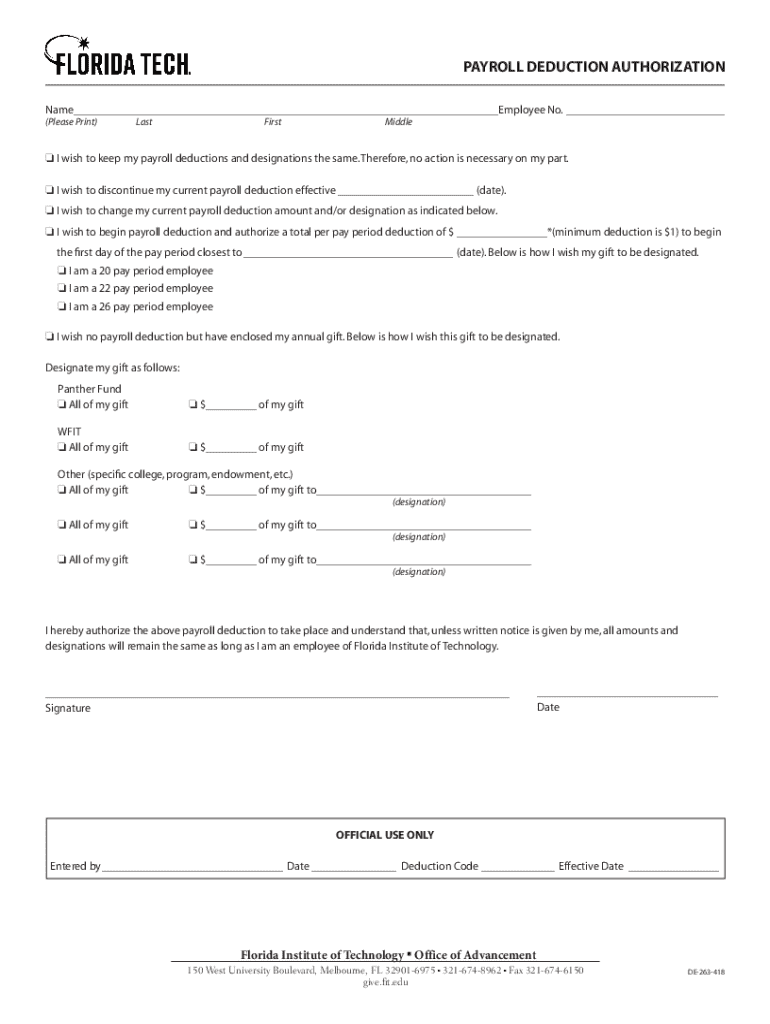

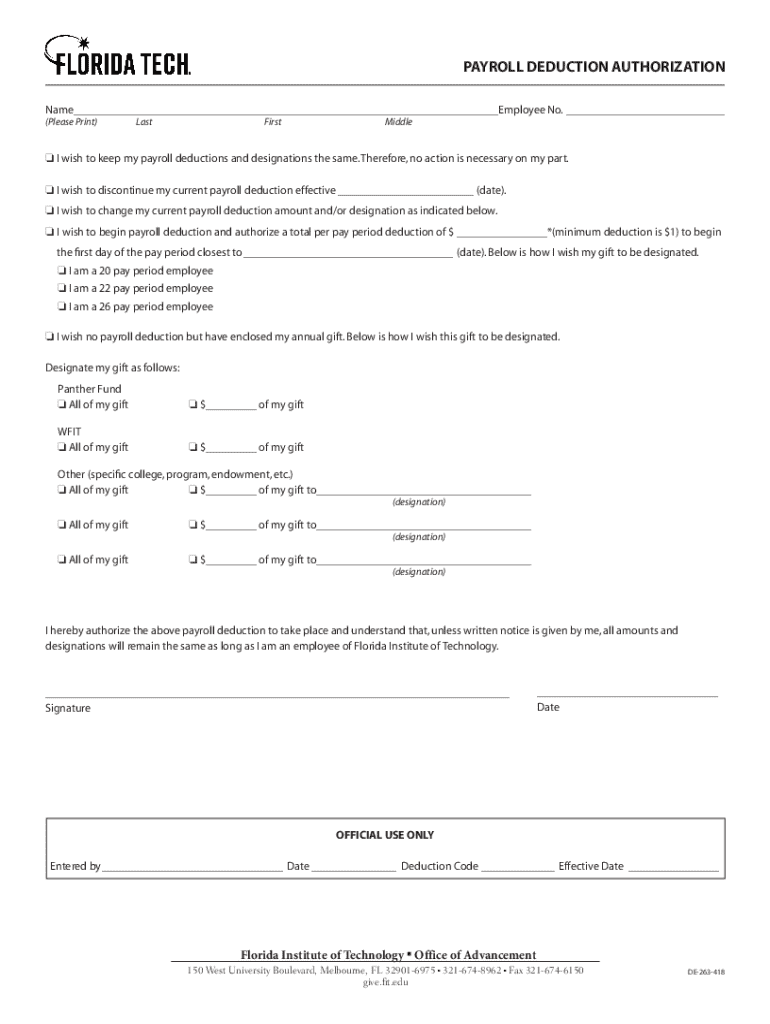

The authorization for voluntary payroll form is a key document that allows employees to specify which deductions should be taken from their paychecks. This form covers various voluntary contributions, such as health premiums, retirement savings, and charitable donations. It's imperative for both the employee and employer to have clarity about these deductions, ensuring that the paycheck reflects both the expected gross and net pay.

Implementing a voluntary payroll option is more than just a convenience—it's a crucial tool for fostering a supportive workplace environment. By providing employees with the ability to contribute to benefits and savings seamlessly, organizations can improve employee satisfaction and retention. Key components of the authorization form typically include personal identification information, the deductions selected, and the employee's signature, signaling their consent.

Types of voluntary payroll deductions

Voluntary payroll deductions can encompass a variety of benefits that employees choose to participate in. Here are some common types included under this umbrella:

Understanding these deductions is crucial as they directly impact take-home pay, which is why employees need to consider carefully how much they want to allocate to these options.

Step-by-step guide to completing the authorization for voluntary payroll form

Filling out the authorization for voluntary payroll form can be straightforward if approached systematically. Here’s a comprehensive step-by-step guide:

Editing and customizing your authorization form

Using pdfFiller’s editing tools, you can personalize your authorization for voluntary payroll form easily. You may want to add notes or comments to clarify certain deductions, or perhaps you have specific instructions you want to include for your payroll department. A key benefit of using pdfFiller is the ability to save multiple versions of your form, allowing for adjustments as your financial situation changes.

This flexibility is particularly valuable for employees who may have variable income or are periodically reviewing their benefit selections. The platform allows quick edits for seamless updates to your payroll deduction choices.

Frequently asked questions (FAQs) about the authorization for voluntary payroll form

Employees often have several queries when it comes to the authorization for voluntary payroll form. Here are some frequently asked questions that can provide clarity:

Best practices for managing your payroll deductions

Effectively managing payroll deductions requires a proactive approach. Here are some best practices to keep your contributions aligned with your financial goals:

Additional tools and resources in pdfFiller

pdfFiller offers a suite of interactive tools for managing payroll effectively. Users can access templates for the authorization for voluntary payroll form and examples of completed forms to ensure all necessary information is included.

Collaboration features in pdfFiller also simplify communication between team members and HR personnel. This can prove invaluable in settings where multiple employees are adjusting their payroll deductions simultaneously.

Integrating your authorization form with other payroll processes

Efficient payroll management necessitates coordination between HR and employees. Keeping open lines of communication regarding any changes in deductions is essential. Utilizing pdfFiller can streamline the submission and tracking processes for these forms.

As payroll changes occur, having a centralized location for all documentation in pdfFiller ensures that both management and employees remain on the same page, with easy access to required records for audits or adjustments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify authorization for voluntary payroll without leaving Google Drive?

Where do I find authorization for voluntary payroll?

How do I edit authorization for voluntary payroll online?

What is authorization for voluntary payroll?

Who is required to file authorization for voluntary payroll?

How to fill out authorization for voluntary payroll?

What is the purpose of authorization for voluntary payroll?

What information must be reported on authorization for voluntary payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.