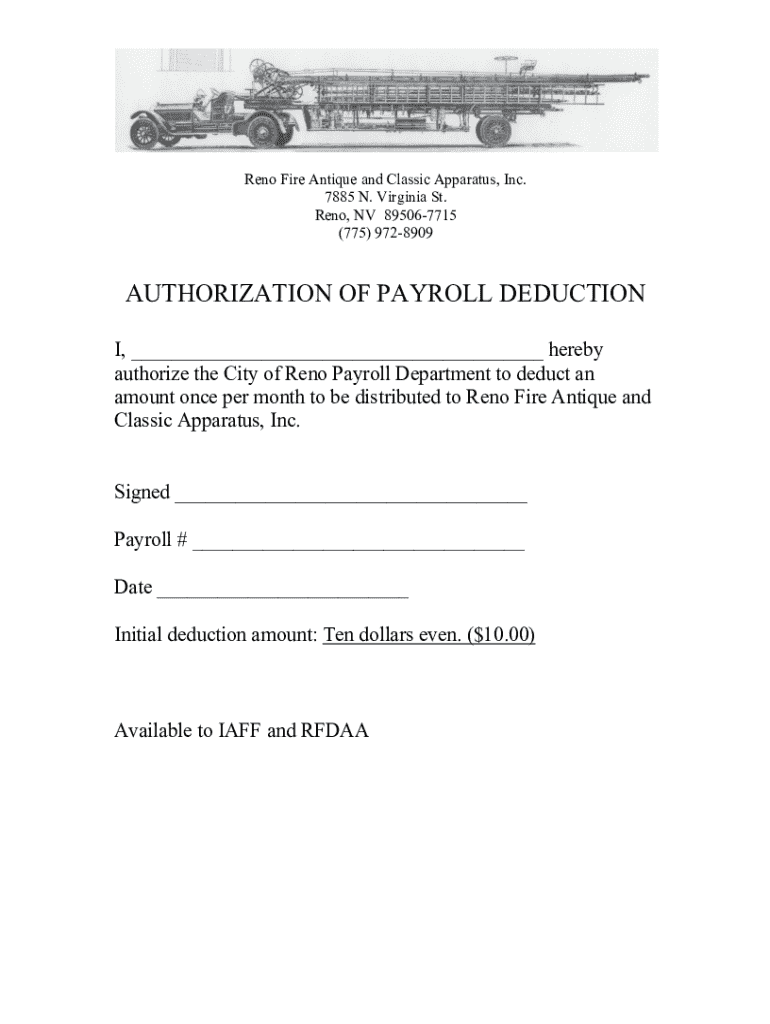

Get the free AUTHORIZATION OF PAYROLL DEDUCTION - Reno

Get, Create, Make and Sign authorization of payroll deduction

Editing authorization of payroll deduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization of payroll deduction

How to fill out authorization of payroll deduction

Who needs authorization of payroll deduction?

Comprehensive Guide to the Authorization of Payroll Deduction Form

Understanding payroll deductions

Payroll deductions are amounts withheld from an employee's paycheck, aimed at fulfilling various obligations such as taxes, benefits, and other voluntary contributions. These deductions serve essential functions in managing employee compensation, impacting take-home pay and budgeting.

Understanding the importance of payroll deduction authorization is paramount. Legally, employers require express consent to withhold funds from employee paychecks. For employees, these deductions influence financial planning and can significantly affect disposable income each pay period.

Overview of the authorization of payroll deduction form

The authorization of payroll deduction form is a formal document that grants employers permission to deduct specific amounts from employees' wages. It is often utilized for various purposes, such as enrolling in benefit programs or facilitating savings contributions.

Step-by-step guide to completing the payroll deduction authorization form

Completing the payroll deduction authorization form can be straightforward if you follow a structured approach. Here’s a step-by-step guide:

Editing and managing the form using pdfFiller’s tools

pdfFiller offers various interactive features that streamline the editing process. A user can easily edit PDF forms, filling in necessary information seamlessly, or make changes to pre-filled forms to ensure accuracy.

Additionally, keeping track of multiple authorization forms is simplified within your pdfFiller account, allowing organized management of documents while ensuring all information is readily accessible.

Common mistakes to avoid

When completing the payroll deduction authorization form, several pitfalls may lead to errors and complications. Here are common mistakes to watch out for:

Submitting the payroll deduction authorization form

After completing the payroll deduction authorization form, it's crucial to submit it correctly. Generally, the authorization should be sent to your HR or payroll department.

Submitting on time is critical; any delays could result in deductions not reflecting in your upcoming pays, affecting your financial planning.

Frequently asked questions about payroll deductions

Employees often have questions regarding payroll deductions. Here’s a look at some frequently asked questions and their answers:

Additional considerations

While navigating payroll deductions, several additional factors come into play that can influence an employee’s financial situation.

Understanding the broader context of payroll deductions, including compliance and tax considerations, enriches your overall knowledge and enhances financial decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get authorization of payroll deduction?

Can I create an electronic signature for signing my authorization of payroll deduction in Gmail?

How do I edit authorization of payroll deduction straight from my smartphone?

What is authorization of payroll deduction?

Who is required to file authorization of payroll deduction?

How to fill out authorization of payroll deduction?

What is the purpose of authorization of payroll deduction?

What information must be reported on authorization of payroll deduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.