Get the free MISSOURI FORM CDTC-770 MISSOURI DEPARTMENT ...

Get, Create, Make and Sign missouri form cdtc-770 missouri

How to edit missouri form cdtc-770 missouri online

Uncompromising security for your PDF editing and eSignature needs

How to fill out missouri form cdtc-770 missouri

How to fill out missouri form cdtc-770 missouri

Who needs missouri form cdtc-770 missouri?

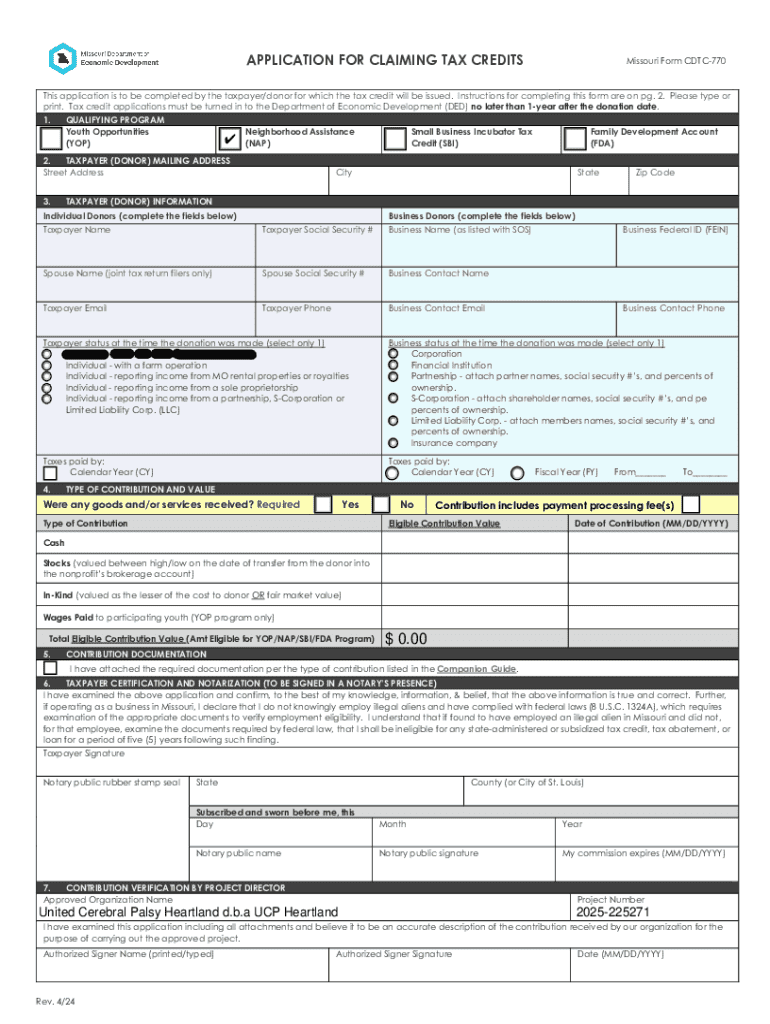

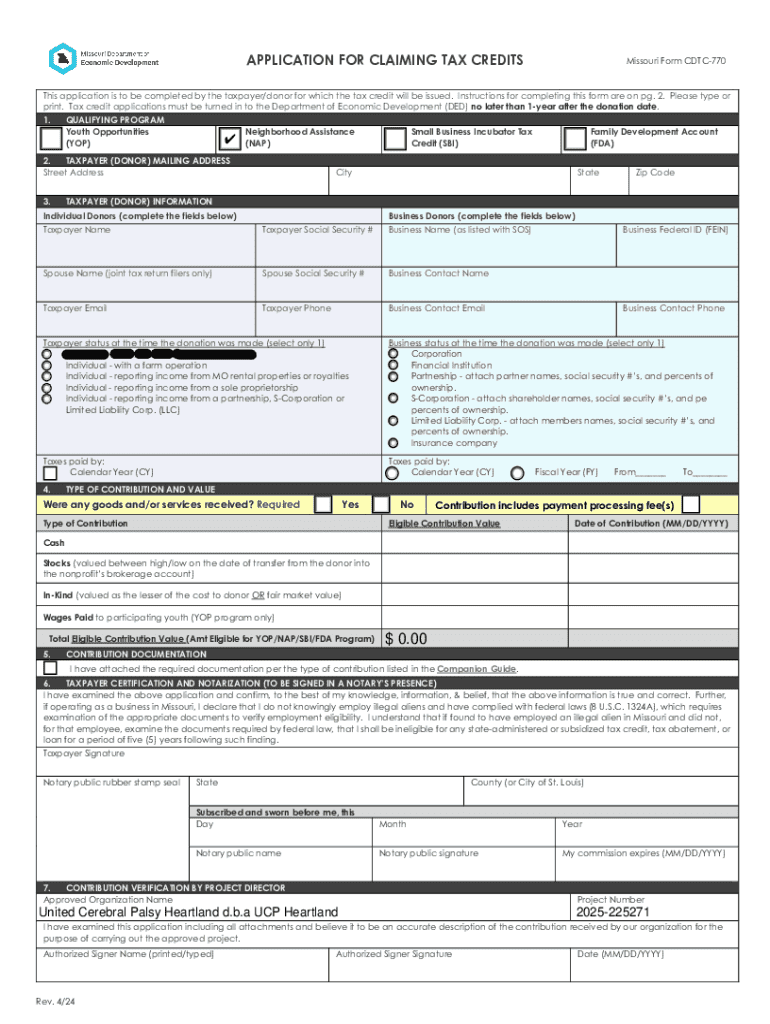

Comprehensive Guide to Missouri Form CDTC-770

Understanding the Missouri Form CDTC-770

The Missouri Form CDTC-770 is a crucial document utilized for claiming specific tax credits offered by the state of Missouri. This form is imperative for individuals and organizations looking to take advantage of tax benefits intended to support various economic activities such as job creation, healthcare initiatives, and more.

More than just a form, the CDTC-770 connects taxpayers with financial relief programs that are designed to stimulate economic growth within the state. Its importance lies in ensuring that eligible claimants can maximize potential savings through tax credits.

Who needs to use the Missouri Form CDTC-770?

Eligibility for the Missouri Form CDTC-770 is primarily determined by the specific tax credits applied for. Individuals, businesses, and certain organizations that meet the stipulated requirements must complete the form to receive the benefits. The eligibility criteria may include income thresholds, funding criteria, or specific project qualifications.

Common scenarios for using this form include small businesses applying for job creation credits, healthcare providers looking for assistance with operational costs, or community organizations aiming to improve local services. Each situation not only affects individual finances but also plays a pivotal role in revitalizing local economies.

Preparing to complete the Missouri Form CDTC-770

Before diving into the completion of the Missouri Form CDTC-770, gather all necessary documents to ensure a smooth process. Key identification information includes your Social Security Number, tax identification number for businesses, and any relevant state-issued ID numbers.

In addition to personal identification, be ready with detailed financial documentation. This might encompass your income statements, business profit and loss statements, and any documentation that confirms your eligibility for the credits being applied for. Having these documents prepared will make filling out your form much more manageable.

The Missouri Form CDTC-770 can be completed either online or offline. Many taxpayers prefer the convenience of online submission through platforms like pdfFiller, offering intuitive editing features. Preparing to use these features efficiently can greatly enhance your submission experience.

With pdfFiller, you can benefit from user-friendly tools that streamline the entire filing process, ensuring accuracy and efficiency in your submission.

Step-by-step guide to filling out Missouri Form CDTC-770

Filling out the Missouri Form CDTC-770 requires attention to detail and a systematic approach. Begin by filling in the Personal Information Section, which includes your name, address, Social Security Number or tax ID, and contact information. Ensure that all details are current and accurates to avoid discrepancies later on.

Next, move to the Tax Credit Eligibility Section. Here, you will indicate which tax credits you are applying for and confirm your eligibility. It’s crucial to refer to state guidelines to ensure you are selecting the correct credits for your situation.

Lastly, the Financial Information Section requires you to provide detailed financial data to support your claims. Include all necessary numbers from your financial documentation and ensure accuracy.

Consider using pdfFiller's editing tools to avoid common mistakes, such as incorrect calculations or typos in the form. Best practices include double-checking all entries and ensuring document clarity throughout.

Additionally, pdfFiller offers interactive tools such as templates and fields to assist in your completion, along with collaboration features that allow for shared editing when working in teams.

Signing and submitting the Missouri Form CDTC-770

Once your Missouri Form CDTC-770 is completed, you will need to sign it. E-signing has become a popular method due to its convenience, and it is accepted by the state of Missouri. The legal validity of electronic signatures is well established, allowing you to proceed without the need for physical signatures.

To eSign with pdfFiller, simply follow the outlined instructions for adding your electronic signature. Once signed, you have multiple submission methods available. You can submit online directly through pdfFiller, which is efficient and trackable, or choose to mail in a printed copy of your form.

Managing your Missouri Form CDTC-770 submission

Once submitted, it’s essential to track the status of your Missouri Form CDTC-770 application. Many taxpayers experience anxiety after submission, wondering if their forms were processed correctly. pdfFiller aids in tracking your submission and allows you to monitor any responses from the state.

In case of rejections or requests for more information, be prepared to address these swiftly. Understand the reasons for any issues and gather the necessary documentation to resolve any discrepancies efficiently.

If you need to amend your application at any point, pdfFiller assists in editing your submitted documents to reflect accurate information and resubmit them directly.

Frequently asked questions (FAQs) about the Missouri Form CDTC-770

It’s common to have questions surrounding the Missouri Form CDTC-770 at different points in the process. One of the most frequently asked questions is about troubleshooting: What to do if you encounter issues during submission?

In handling processing times, most applications typically take several weeks to process, but it's advisable to check the latest updates from the Missouri Department of Revenue. If you need to amend the form after submission, pdfFiller allows for easy editing of previously submitted forms.

Additional support and resources

If you need further assistance with the Missouri Form CDTC-770, there are many resources available to you. The Department of Revenue in the State of Missouri offers contact information for tax assistance. Additionally, utilizing online government portals can provide necessary guidance for completing your forms correctly.

Communities and forums can also be valuable resources for taxpayers seeking advice from peers. Engaging in these discussions may help uncover unique insights about common issues faced during the tax credit application process.

Finally, using document management tools like pdfFiller can greatly enhance your experience. With features that support editing, eSigning, collaboration, and efficient tracking, users can confidently complete their tax documentation.

Conclusion and final thoughts on Missouri Form CDTC-770

The Missouri Form CDTC-770 serves as more than just a tax form; it acts as a bridge between eligible individuals or businesses and the financial benefits provided by the state. By understanding its components, preparing adequately, and utilizing effective submission methods, users can ease the process of claiming these valuable tax credits.

According to Governor Mike Kehoe, streamlining these forms is essential for enhancing community support and resilience. Hence, adopting comprehensive document solutions like pdfFiller for managing tax forms can significantly simplify and improve the filing process.

Emphasizing the importance of efficient document management cannot be overstated, as using platforms like pdfFiller equips users with the tools needed to handle their tax forms with confidence, precision, and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the missouri form cdtc-770 missouri in Chrome?

How can I edit missouri form cdtc-770 missouri on a smartphone?

How do I complete missouri form cdtc-770 missouri on an Android device?

What is missouri form cdtc-770 missouri?

Who is required to file missouri form cdtc-770 missouri?

How to fill out missouri form cdtc-770 missouri?

What is the purpose of missouri form cdtc-770 missouri?

What information must be reported on missouri form cdtc-770 missouri?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.