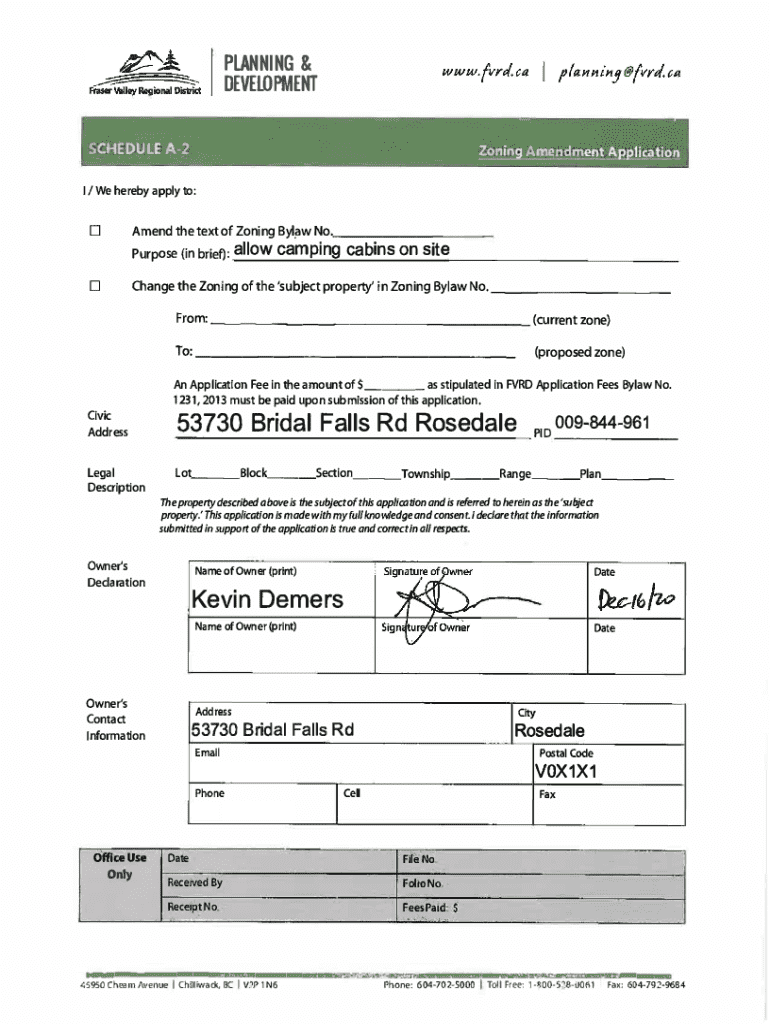

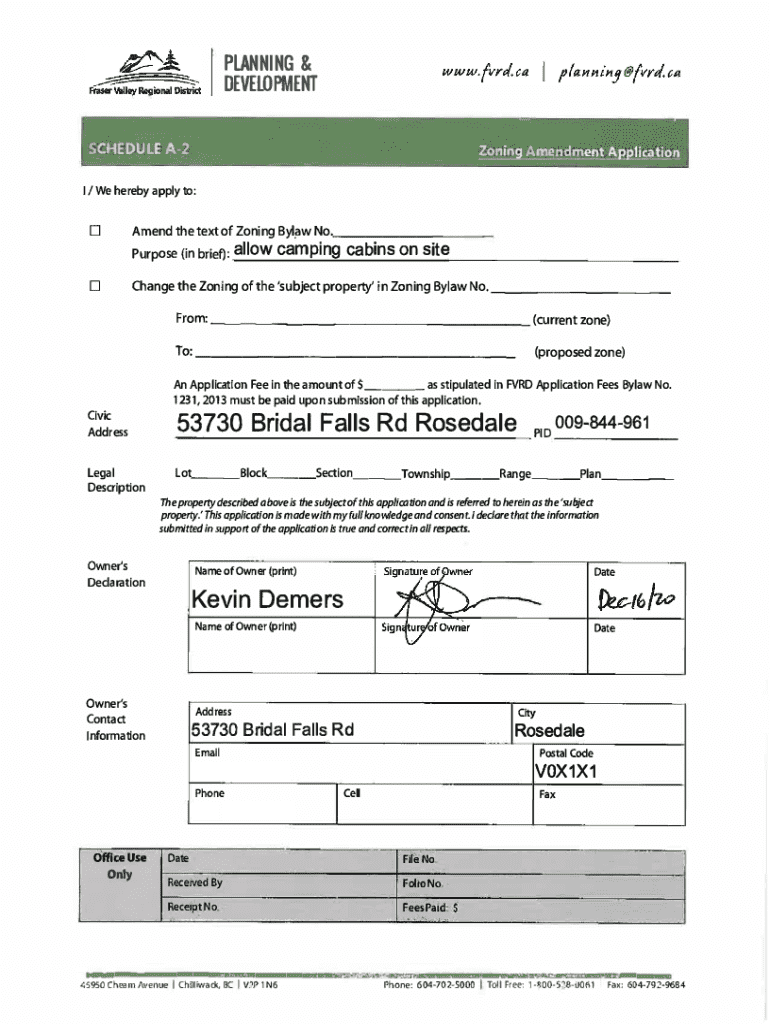

Get the free 11 " .-- .,., . - . 53730 Bridal Falls Rd Rosedale Pio Kevin Demers

Get, Create, Make and Sign 11 -- - 53730

How to edit 11 -- - 53730 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 11 -- - 53730

How to fill out 11 -- - 53730

Who needs 11 -- - 53730?

A comprehensive guide to the 11 -- - 53730 form

Understanding the 11 -- - 53730 form

The 11 -- - 53730 form serves a crucial role for individuals and businesses alike, often linked to specific taxation and regulatory frameworks. This form is essential for documenting various financial transactions, ensuring compliance with local and federal requirements. By understanding its purpose, users can appreciate the importance of accurately completing the form to avoid potential penalties or tax complications.

Pre-fill considerations

Before filling out the 11 -- - 53730 form, it is vital to assess eligibility criteria. Not everyone is required to fill out this form, and knowing who needs it can simplify the preparation process. Typically, individuals or businesses with defined income thresholds or specific accounting situations will need to complete this form.

Gathering essential information is a critical step. Key documents include prior tax returns, income statements, and any other relevant financial records. It's recommended to compile these details beforehand to avoid last-minute errors. Common pitfalls include missing documentation, incorrect calculations, and misunderstanding specific requirements set forth in the form.

Step-by-step instructions for filling out the form

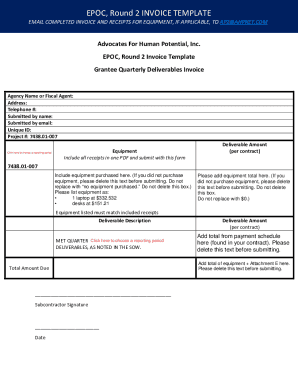

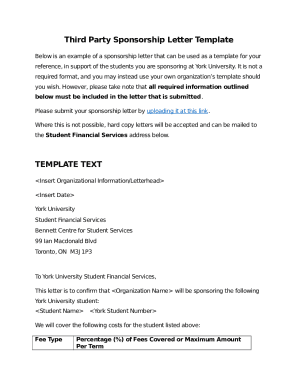

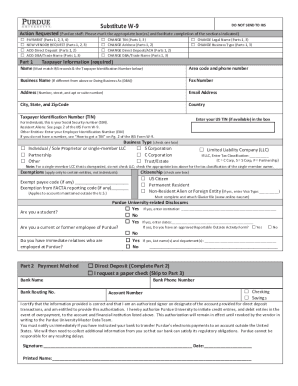

Filling out the 11 -- - 53730 form can seem daunting, but a methodical approach makes it manageable. Start with personal information, ensuring that your name, address, and contact details are correct. After personal data, move on to the financial details where you will report income, expenses, and other relevant information. Take your time to cross-check each entry against your documentation.

Every section of the form is designed to capture specific details efficiently. For instance, the Personal Information section typically requires your full legal name, residential address, and social security number, while the Financial Details section focuses on your income streams and expenditures. Leaving special notes or annotations can clarify complex entries, but make sure they are concise and straight to the point.

Interactive tools for document enhancement

Using a platform like pdfFiller can significantly enhance your experience with the 11 -- - 53730 form. pdfFiller's editing capabilities allow you to make real-time adjustments, ensuring all your information is accurate before submission. Additionally, collaborative features are useful for teams needing to work together, allowing multiple users to comment, edit, and finalize the document simultaneously.

Features such as customizable templates and cloud storage further streamline the filing process. Users can save previous versions of the form, making it easy to compare and review changes over time. This capability not only saves time but also guarantees that all necessary amendments are captured seamlessly.

Signing and submitting the form

Once the 11 -- - 53730 form is filled out accurately, the next step involves signing and submitting the document. Using pdfFiller’s eSignature tools simplifies the signing process. Users can add their signature electronically, thus eliminating the need for physical copies. Follow the guided steps within pdfFiller to input your signature quickly.

Regarding submission, there are options to submit the form electronically or via physical mail. For electronic submissions, ensure you have accurate email addresses and use confirmation features to verify receipt. For physical submissions, use certified mail for tracking purposes and maintain a copy of the submitted documents for your records.

Managing and tracking your 11 -- - 53730 form

Managing your 11 -- - 53730 form does not end with submission. Maintaining organized records is essential. pdfFiller offers comprehensive solutions for storing and organizing your forms. With cloud storage, users can access their documents from anywhere, ensuring they retain the most current version without the risk of losing physical copies.

Tracking the submission status of your form is equally important. Many tax agencies provide online portals to check the receipt and status of submitted forms. Using pdfFiller’s notification features, users can also set up alerts to receive updates once the form has been processed, allowing for timely follow-ups if necessary.

Common issues and troubleshooting

When dealing with the 11 -- - 53730 form, several common issues may arise. Users often face challenges when filling out the form, such as unclear instructions or sections that seem ambiguous. Additionally, submission errors can lead to delays or rejections, which can complicate your tax situation.

To troubleshoot these problems, consider consulting the frequently asked questions on the official form website or using community forums for insights from other users. Having a checklist for the required sections and common mistakes can prevent oversights, saving you from potential headaches later on.

Practical examples and case studies

Real-life applications of the 11 -- - 53730 form provide invaluable insights into its effective use. Consider a freelance graphic designer who needs to report income earned over the year. By accurately completing the form, they effectively communicate their earnings and business expenses, illustrating financial integrity to tax authorities.

Another example involves a small business navigating annual tax filings. After filling out the 11 -- - 53730 form, the business not only complies with legal regulations but also uncovers potential deductions. Such insights from diligently completing the form can offer financial benefits, demonstrating the significance of accuracy throughout the process.

FAQs about the 11 -- - 53730 form

To aid users in accurately filling out the 11 -- - 53730 form, several common questions frequently arise. For instance, 'What should I do if I realize I've made a mistake after submission?' highlights the importance of understanding correction procedures. It's vital to know that amendments are often permitted, provided you follow the correct steps.

Another frequent query involves understanding specific sections of the form. Users often ask, 'What financial details are mandatory?' Knowing the documentation needed can prevent unnecessary stress and ensure seamless completion of the form.

Advancing your document management skills

Beyond understanding the 11 -- - 53730 form, improving your document management skills can yield significant benefits for personal and business affairs. Familiarizing yourself with additional forms and documents, such as 1040 tax returns or W-2s, can provide a more holistic view of your financial landscape.

Leveraging pdfFiller's capabilities allows users to manage multiple document types effectively from one platform. This not only enhances organizational efficiency but also empowers users to stay on top of various filing deadlines, ensuring that all necessary paperwork is submitted promptly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 11 -- - 53730 in Gmail?

How do I edit 11 -- - 53730 online?

How do I edit 11 -- - 53730 straight from my smartphone?

What is 11 -- - 53730?

Who is required to file 11 -- - 53730?

How to fill out 11 -- - 53730?

What is the purpose of 11 -- - 53730?

What information must be reported on 11 -- - 53730?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.