Get the free New Home Application: $150

Get, Create, Make and Sign new home application 150

Editing new home application 150 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new home application 150

How to fill out new home application 150

Who needs new home application 150?

A comprehensive guide to the New Home Application 150 Form

Understanding the New Home Application 150 Form

The New Home Application 150 form is a vital document in the process of buying a new home. It serves as the official application for home loans in many states across the United States. Its purpose is to collect detailed information from potential homebuyers to help lenders assess their eligibility for mortgage financing. Without this form, securing a home loan can become exceedingly difficult, as it contains crucial data needed for evaluating the applicant's financial status.

Target audiences for the New Home Application 150 form include home buyers, real estate agents, and loan officers. Home buyers need to complete the form accurately to initiate the loan process efficiently. Real estate agents often assist clients in understanding and completing the application, while loan officers rely on the submitted form to recommend approval or denial of loan requests.

Key components of the New Home Application 150 Form

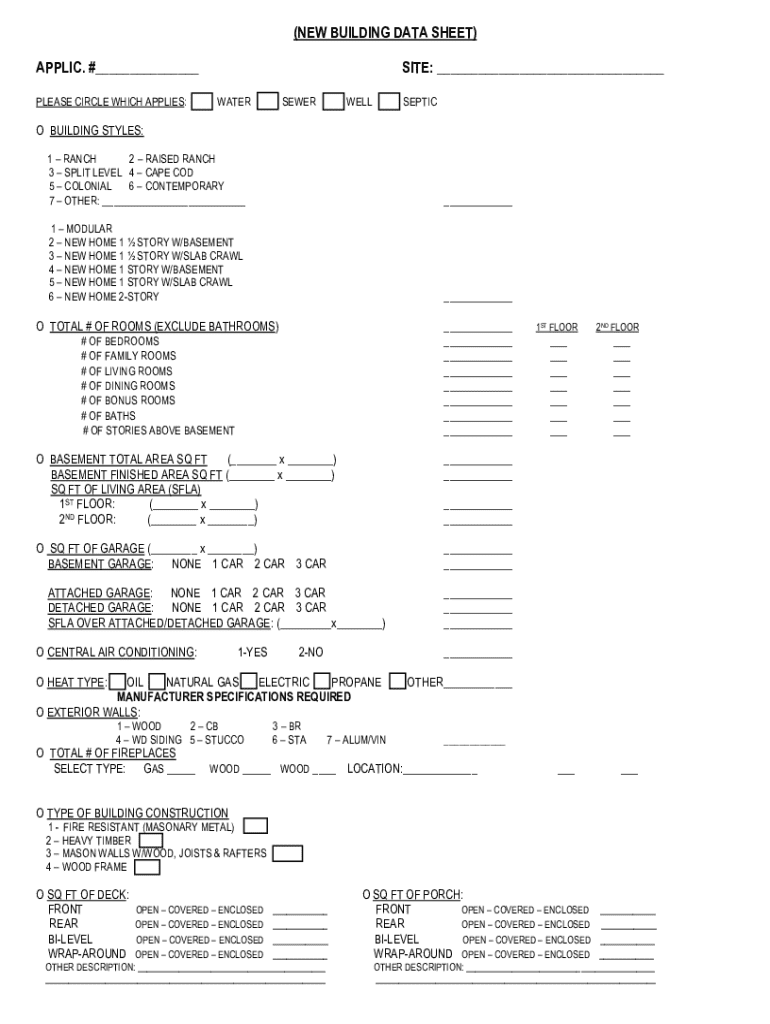

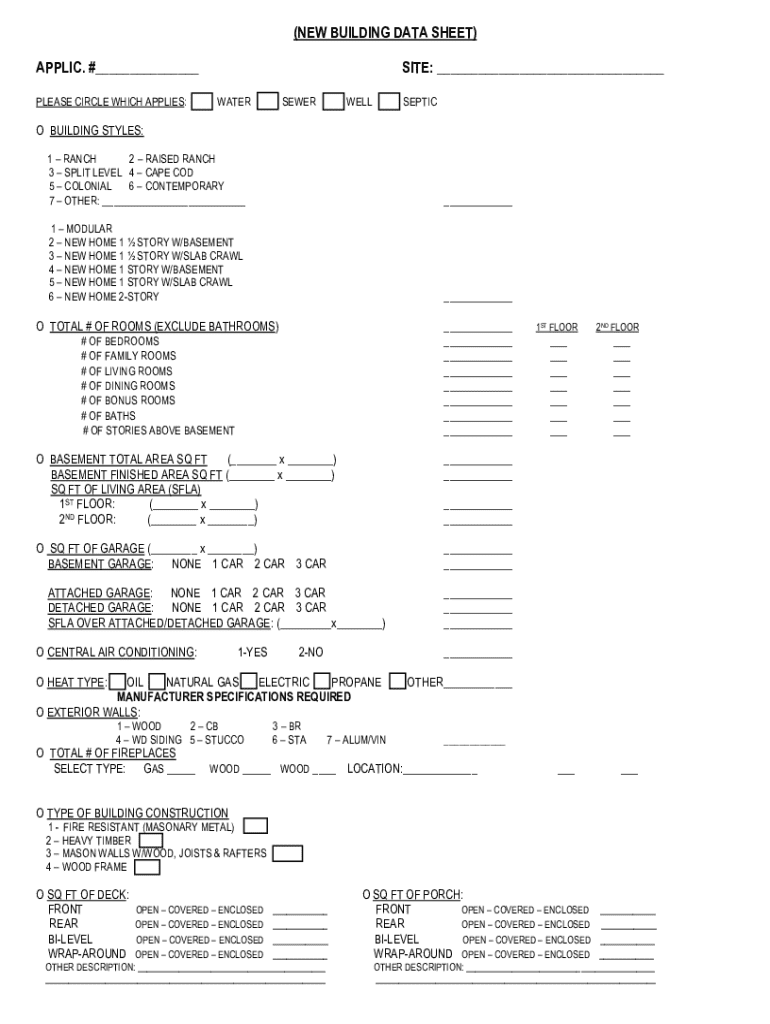

The New Home Application 150 form consists of several critical components that every applicant must understand for a successful submission. Firstly, basic information is required, which includes the applicant's personal details such as name, address, and contact information. Property details are also necessary; these include the address of the new home and the type of home – whether it is a single-family residence, condominium, or another type of property.

Next, financial information is essential. This section asks applicants to disclose their income and employment status, any existing debts, and liabilities. Accurate reporting ensures that the lender can evaluate the applicant's financial health correctly. Moreover, applicants must specify their desired home loan details. This includes the type of loan they wish to apply for and the total loan amount they are requesting.

Step-by-step guide to completing the New Home Application 150 Form

Filling out the New Home Application 150 form properly can be the difference between a smooth loan approval process and significant roadblocks. To start, applicants should gather all necessary documents, including identification papers, proof of income, bank statements, and credit history. This pre-emptive step simplifies the application experience and ensures no critical information is missing.

Step 1 involves gathering these essential documents. Step 2 entails accurately filling out the basic information section, ensuring that names, addresses, and other personal details are correctly entered. Applicants should double-check for accuracy to prevent any delays caused by clerical errors. In Step 3, divulging financial information is crucial; applicants should ensure transparency about their income and expenses, as lenders depend on this data to assess affordability.

Lastly, in Step 4, applicants must choose the right type of home loan and the amount they wish to request. It's advisable to conduct preliminary research on the various types of loans available to select the best fit for their financial situation.

Common mistakes to avoid with the New Home Application 150 Form

When completing the New Home Application 150 form, applicants should be vigilant to avoid common pitfalls that could jeopardize their application. One prevalent mistake is overlooking required information. It is crucial to double-check that all sections of the form are completed fully and accurately. Missing information can lead to delays, as lenders may require clarification or resubmission.

Another common error involves providing inaccurate financial information. Misrepresentation, whether intentional or accidental, can lead to serious consequences, including rejection of the application or legal repercussions. Additionally, neglecting to submit supporting documentation is a frequent misstep. All necessary documents should accompany the application for it to be complete and credible in the eyes of potential lenders.

Tools for filling out and managing your application

Filling out the New Home Application 150 form can be simplified greatly by utilizing platforms like pdfFiller's interactive tools. This online platform allows users to easily edit and fill out PDF forms, saving time and effort. Users can input their details directly without worrying about formatting issues or messy handwriting.

Moreover, pdfFiller offers eSignature capabilities, enabling applicants to sign documents electronically. This feature expedites the application process, allowing for quicker submission and response times. The platform also includes collaboration tools that allow teams to work on applications together in real time, ensuring that everyone involved is on the same page and that nothing is overlooked.

Submitting the New Home Application 150 Form

Once the New Home Application 150 form is completed and all supporting documents are in order, the next critical step is submission. Applicants typically have several options for submitting their application, including electronic submission through the lender’s portal or by mail. Each method has its pros and cons. Electronic submission allows for faster processing, whereas mail may be necessary for those who prefer a physical copy or have issues with internet access.

After submission, applicants should anticipate a review process. This process can vary depending on the lender but often includes an evaluation of the completed application and supporting materials. Knowing what to expect can alleviate anxiety; usually, lenders will provide a timeline for when applicants can expect a response.

Tracking your application

Staying informed about the status of the New Home Application 150 form is essential for applicants. Many lenders offer ways to track application status through their websites or customer service departments. Users can check their application’s progress by providing personal identification information or reference numbers. Keeping in touch with the lender can help address any questions or concerns that arise during the process.

After submission, it's wise to prepare for potential follow-up requests, as lenders might ask for additional documentation or clarification. Being proactive in communication can facilitate smoother processing and ultimately lead to quicker decisions on approval or denial.

Frequently asked questions (FAQs)

The New Home Application 150 form may generate various questions among applicants. Some common queries include what to do if a mistake is made after submitting the form. In such cases, reaching out to the lender as soon as possible is advisable to rectify any errors. Applicants may also wonder about approval timelines; typically, this can range from a few days to several weeks, depending on the complexity of the case and the lender’s workload.

Additionally, understanding the process for withdrawing an application is important. If a situation arises where an applicant wishes to withdraw their submission, it can usually be done by contacting the lender directly for specific instructions.

Final tips for a successful New Home Application

Successfully navigating the New Home Application 150 form requires diligence, accuracy, and an understanding of the process. Applicants should implement best practices such as thoroughly reviewing their submission, maintaining organized documentation, and being prepared for follow-up requests. It may also benefit applicants to consult with professionals for guidance on any questions about specific information or requirements.

Furthermore, resources are available online, often provided by government organizations or real estate associations, to assist potential homeowners in preparing their applications. Taking advantage of these resources can significantly affect one's success in obtaining a home loan and, ultimately, achieving the dream of homeownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new home application 150 in Gmail?

How can I modify new home application 150 without leaving Google Drive?

How can I send new home application 150 to be eSigned by others?

What is new home application 150?

Who is required to file new home application 150?

How to fill out new home application 150?

What is the purpose of new home application 150?

What information must be reported on new home application 150?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.