Get the free New Account Application for Retail Investors

Get, Create, Make and Sign new account application for

How to edit new account application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application for

How to fill out new account application for

Who needs new account application for?

New Account Application for Form: A Comprehensive Guide

Overview of new account applications

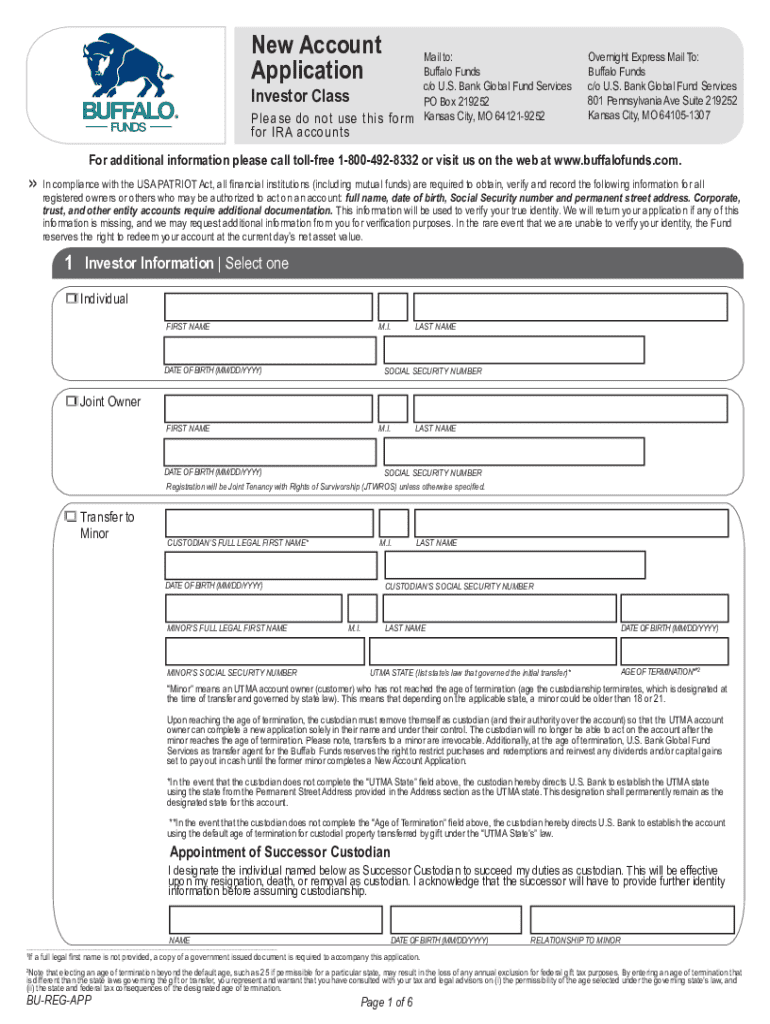

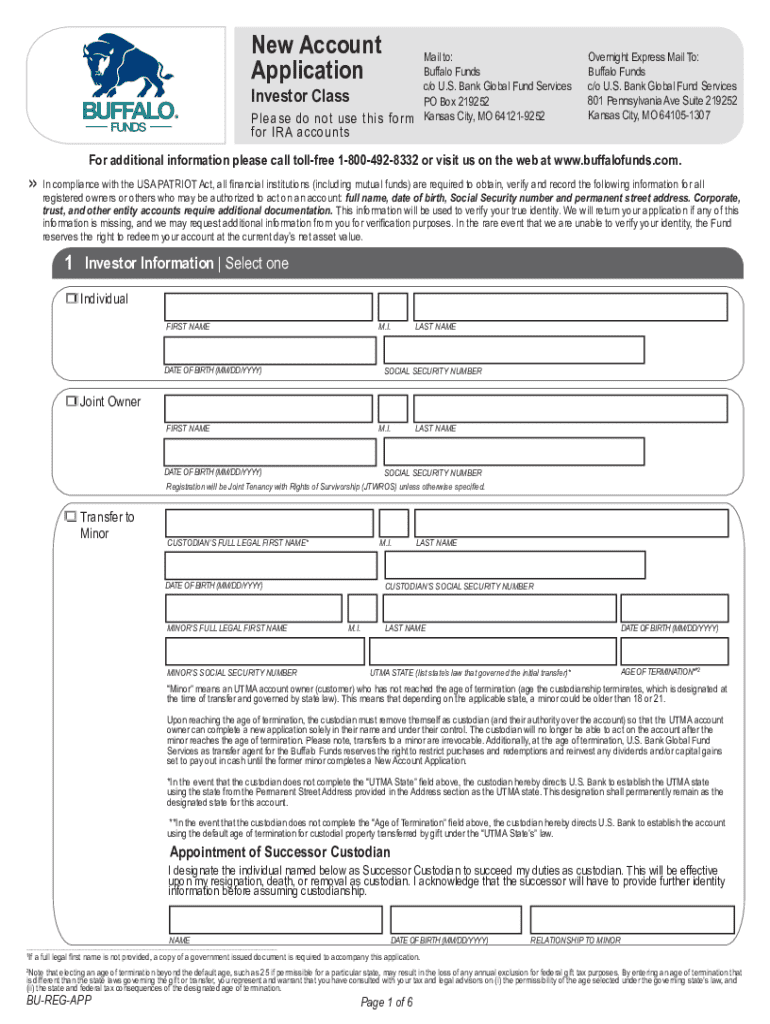

A new account application form is a crucial document used to gather necessary information for establishing a new account, either personal or business. The purpose of these applications is not only to collect data but also to ensure that all regulatory and institutional requirements are met before account approval. Accurate submission of this form is vital because it helps prevent delays and reduces the likelihood of complications during the account opening process, which can vary significantly across different industries such as banking, insurance, and digital services.

The significance of submitting accurate information cannot be overstated. Errors in the application can lead to account rejection or delays in processing. New account applications are commonly used in various contexts, including opening bank accounts, setting up utility services, or creating accounts on digital platforms. Understanding the nuances of these applications can streamline the initiation of services, giving you access to financial tools and resources promptly.

Understanding the types of new account applications

New account applications can be categorized into several types, primarily personal vs. business applications. Personal account applications are usually straightforward, requiring basic identification and financial data. In contrast, business applications may need additional documentation, including business licenses and tax IDs, making them more complex.

Moreover, applications can be categorized into online and offline formats. With the rise of technology, many institutions now offer online new account applications, enabling users to fill out forms from anywhere. This convenience contrasts with offline applications that require physical forms mailed or submitted in person. Regardless of the format, there are common features in new account applications which typically include sections such as personal details, financial information, and sometimes a declaration statement.

These variations ensure that the application process meets the needs unique to each industry. For instance, banks may require extensive credit history checks, whereas digital platforms might focus more on identity verification.

Essential information required in a new account application

To complete a new account application effectively, certain essential information is needed. Personal details usually form the foundational section, including your full name, contact information, and sometimes your Social Security Number (SSN) or Tax ID, especially for tax-resident individuals. It's essential to provide accurate personal details as mismatched information could lead to delays or denials.

Next comes financial information. This typically includes income verification, bank statements, or credit information to assess the applicant's financial status. Some applications also require you to disclose any existing accounts to avoid conflicts of interest or identity fraud. Additionally, further documentation may be requested, including proof of identification, such as a driver's license or passport, and proof of address, like recent utility bills or lease agreements.

Step-by-step guide on how to fill out a new account application

Filling out a new account application form can seem daunting, but breaking it down into manageable steps makes the process more straightforward. Start with Step 1: Gathering Required Documents. Create a checklist of necessary documents such as your ID proof, income statements, and any other pertinent information to ensure you have everything handy before starting the application.

Step 2 involves accessing the application form, which can typically be found on the institution's website. For online applications, ensure you have a reliable internet connection. For offline versions, downloading applications from platforms like pdfFiller allows for easy access to forms in various formats.

In Step 3, begin filling out the application. Take your time to ensure that all sections are completed accurately. Utilize tools available in pdfFiller to edit and fill forms quickly. Step 4 is crucial — review your application thoroughly to guarantee all information is correct. Tools for collaboration in pdfFiller allow you to confirm details or gather input from team members. Finally, Step 5 is submitting your application, where you’ll choose between online submission or printing and mailing the application.

Editing and signing the new account application with pdfFiller

One of the standout features of pdfFiller is its robust editing capabilities. Users can easily make changes to text, add images, or annotate documents without any hassle. These editing features cater to diverse needs, making it convenient to customize applications before final submission. Whether correcting a typo or adding a signature, the process is simple and user-friendly.

Adding an eSignature is equally crucial, especially in a digital landscape where time is of the essence. PdfFiller simplifies the process by guiding users through the eSignature addition step-by-step. Legal considerations surrounding eSignatures can be confusing, but pdfFiller ensures that signed documents are valid and comply with necessary regulations, giving you peace of mind.

Managing your new account application post-submission

After submitting your new account application, tracking its status is essential. Most institutions provide a method to check the progress of your application, whether online or through customer service. Being proactive can alleviate any concerns regarding delays or issues. If you encounter problems, such as being requested to resubmit or amend information, understanding the process of resubmitting or correcting your application is beneficial.

Maintaining clear communication with the institution can also help resolve issues promptly. Organizing your application documents within pdfFiller's cloud-based platform makes it easier to refer back to your submission or produce additional paperwork if needed.

Advantages of using pdfFiller for your new account application

Leveraging pdfFiller for your new account application comes with various benefits. As a cloud-based document management system, it allows users to access their documents from any device, enhancing flexibility in today’s fast-paced environment. This is particularly useful for individuals or teams that may require multi-device access or collaboration, such as members working in different locations.

Additionally, the collaboration features available in pdfFiller foster efficient teamwork, enabling users to work together seamlessly on applications. Security is another pressing concern, and pdfFiller employs top-notch security measures to protect sensitive information, ensuring that your data remains confidential throughout the process.

Troubleshooting common issues with new account applications

Navigating new account applications can sometimes present challenges. Common pitfalls include incomplete fields or incorrect information, which can lead to submission errors. If you encounter issues, referring to the institution’s application guidelines can reveal specific requirements you may have missed.

When submission errors occur, promptly reaching out to customer support resources is advisable. Many institutions have dedicated support for application issues, helping users find resolutions quickly and efficiently. Utilizing pdfFiller’s customer support can also offer insights and assistance with specific editing or submission queries.

Best practices for future applications

To simplify future applications, maintain an updated repository of personal information. Digital copies of essential documents can save time when filling out new forms, while using pdfFiller makes it easier to access this information. Periodically review your application forms to ensure that your personal information is current, and consider utilizing pdfFiller’s features for a variety of document needs beyond just new account applications.

By keeping your information organized and readily available, managing future applications will be a much more streamlined process, reducing stress and confusion as you apply for new accounts across different platforms.

Interactive tools and resources on pdfFiller

pdfFiller enhances the user experience not only with its document management abilities but also through interactive tools and resources. Available templates tailored to various industries simplify the process of filling out applications depending on specific needs. The platform also provides tutorials on utilizing pdfFiller's full range of capabilities, ensuring you remain informed about all available features.

Attending webinars and live demos can further enrich your understanding, offering real-time support and insights into maximizing the platform’s capabilities for your new account applications and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new account application for to be eSigned by others?

How can I get new account application for?

Can I create an electronic signature for the new account application for in Chrome?

What is new account application for?

Who is required to file new account application for?

How to fill out new account application for?

What is the purpose of new account application for?

What information must be reported on new account application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.