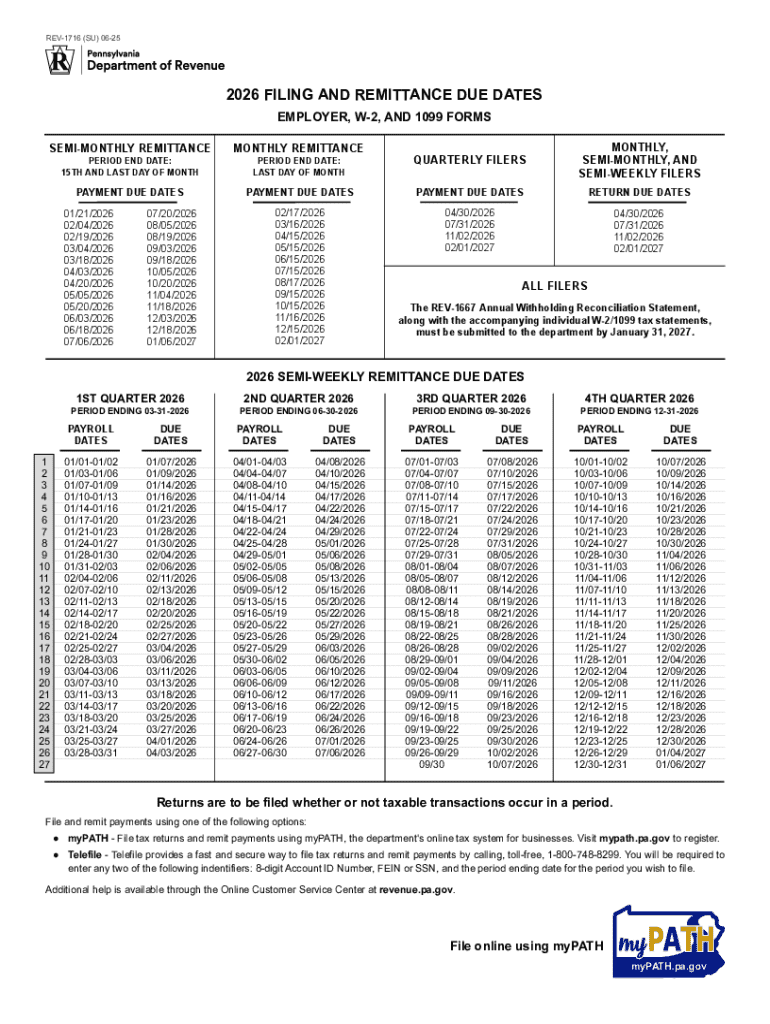

Get the free 2026 Filing and Remittance Due Dates - Employer, W-2, and 1099 Forms (REV-1716). For...

Get, Create, Make and Sign 2026 filing and remittance

How to edit 2026 filing and remittance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 filing and remittance

How to fill out 2026 filing and remittance

Who needs 2026 filing and remittance?

2026 Filing and Remittance Form: A Comprehensive How-to Guide

Understanding the 2026 Filing and Remittance Form

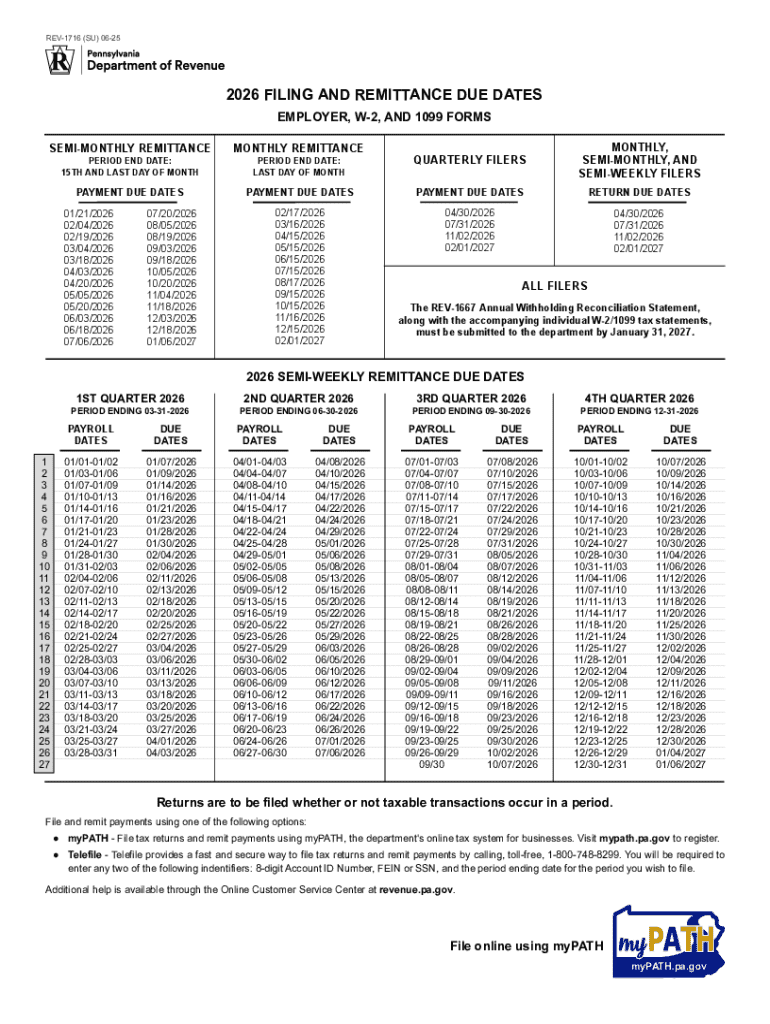

The 2026 filing and remittance form is essential for individuals and businesses to report their income, taxes owed, and remittances to the appropriate authorities. Understanding its key features is crucial for ensuring compliant and accurate filings. Key features include dedicated sections for income declaration, tax calculations, and remittance instructions.

Accurate filings are vital, as errors can lead to penalties or delays in processing. Additionally, timely submission ensures that you avoid late fees and potential legal repercussions. This form is required for various stakeholders, including self-employed individuals, small business owners, and corporations.

A step-by-step guide to completing the 2026 filing and remittance form

Completing the 2026 filing and remittance form involves several crucial steps. Below is a comprehensive guide to assist you in filling out this essential document correctly.

Step 1: Gathering required information is the first step. Make sure to collect all necessary personal identification details, including your Social Security number and tax identification number, as well as financial data and any supporting documents necessary to substantiate your claims.

Step 2: Accessing the form on pdfFiller allows for enhanced ease of use. Navigate to the pdfFiller platform, and you can find the 2026 filing and remittance form quickly. Download it in your preferred format to begin.

Filling out the form

When filling out the form, ensure accuracy in the interactive fields provided. Each section has specified areas for data entry, so enter your information carefully. Common mistakes to avoid include misspelling names, incorrectly entering amounts, or omitting required information.

Step 4: Reviewing your entries is critical. Always double-check for any errors before moving on. Utilize pdfFiller's editing tools to make corrections swiftly, ensuring that all information is current and accurate.

Saving and exporting your form

After you have completed the form, it is essential to save your work. You can export the document in different formats, such as PDF or Word, based on your needs. Consider how you might need to secure your document—pdfFiller offers password protection and other security options to ensure your data remains confidential.

How to eSign and submit your completed form

eSigning is an integral part of the submission process. Electronic signatures provide numerous benefits, including speed and convenience. To eSign your document on pdfFiller, simply follow the step-by-step eSigning process that includes initialing and signing using a stylus or by typing your name.

Step 5: Submission options vary by preference. You can choose direct online submission through pdfFiller, where your form is sent directly to the necessary department, or you can print and mail a physical copy to ensure it reaches the correct hands.

Managing your 2026 filing and remittance forms

Organization is key when dealing with the 2026 filing and remittance forms. Create a folder structure on your computer or use pdfFiller’s cloud storage to keep all your documents easily accessible. This method lets you reference necessary materials quickly.

Tracking your submission status also holds importance. Utilize available resources to monitor progress, such as confirmation emails from pdfFiller or online tracking tools provided by the relevant tax authority.

Common issues & troubleshooting for the 2026 filing and remittance form

While filling out the 2026 filing and remittance form, it is not uncommon to encounter issues. Frequent problems include missing information and technical difficulties during the submission process. Recognizing these issues early can help mitigate complications.

For troubleshooting, pdfFiller offers customer support options along with community forums that can provide quick answers to common problems. Understanding how to navigate these resources efficiently will empower you to resolve any filing issues.

Best practices for filing and remittance in 2026

Planning ahead is crucial for smoothing your filing and remittance experience in 2026. By proactively gathering your documents and understanding the requirements, you can streamline your process and minimize stress.

Being aware of deadlines is equally important. Mark specific dates on your calendar to avoid missing crucial time frames. Finally, maintaining meticulous financial records is vital; consider using dedicated apps or software to facilitate thorough record-keeping.

Additional resources on filing taxes in 2026

As you prepare for the 2026 filing and remittance form, consider exploring additional resources available on pdfFiller. These resources can guide you in understanding related forms and templates specific to your needs. Government resources often provide updated information about tax regulations, forms, and guidelines as well.

Lastly, frequently asked questions related to the 2026 filing form can clarify uncertainties, helping to enhance your overall understanding of the filing process and requirements.

User testimonials and experience insights

Numerous users of pdfFiller have shared their experiences with the 2026 filing and remittance form, praising the platform’s ease of use and efficiency. Testimonials often highlight how the interactive fields and cloud storage streamline the filing process, reducing the time spent on paperwork.

By empowering users to manage their documents efficiently, pdfFiller transforms how individuals interact with tax forms, enabling smoother experiences. These success stories demonstrate the impact of using pdfFiller as a tool for efficient filing and remittance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2026 filing and remittance online?

How do I edit 2026 filing and remittance straight from my smartphone?

Can I edit 2026 filing and remittance on an Android device?

What is 2026 filing and remittance?

Who is required to file 2026 filing and remittance?

How to fill out 2026 filing and remittance?

What is the purpose of 2026 filing and remittance?

What information must be reported on 2026 filing and remittance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.