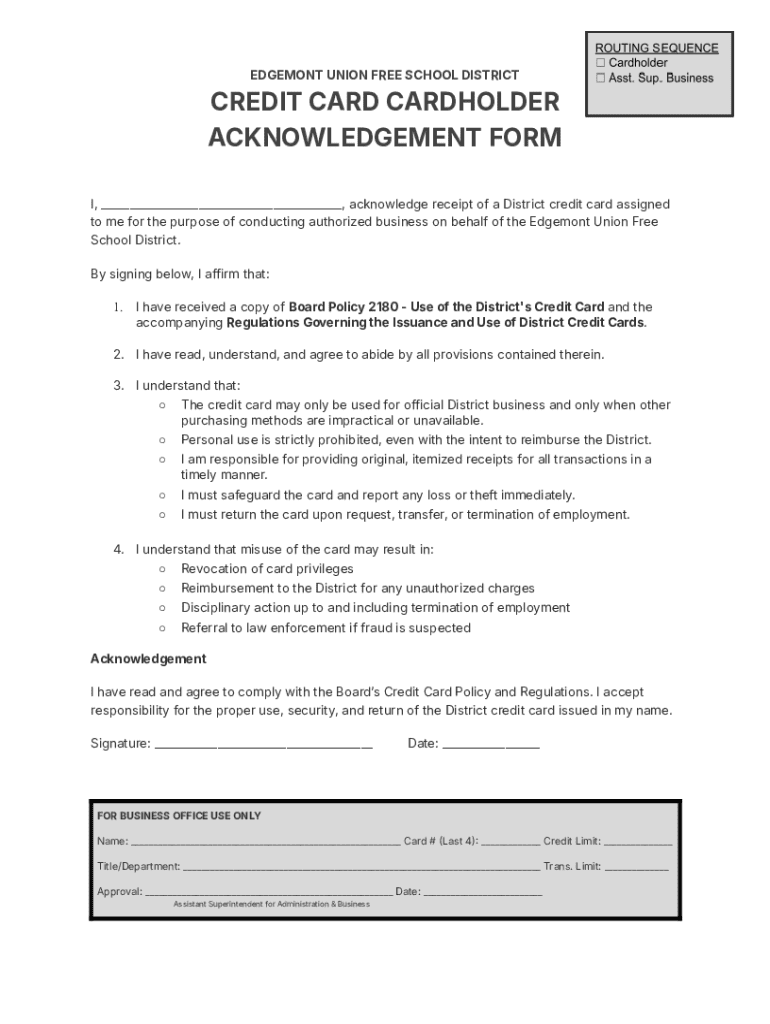

Get the free Credit Card Cardholder Acknowledgment Form

Get, Create, Make and Sign credit card cardholder acknowledgment

How to edit credit card cardholder acknowledgment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card cardholder acknowledgment

How to fill out credit card cardholder acknowledgment

Who needs credit card cardholder acknowledgment?

Understanding the Credit Card Cardholder Acknowledgment Form

Understanding the credit card cardholder acknowledgment form

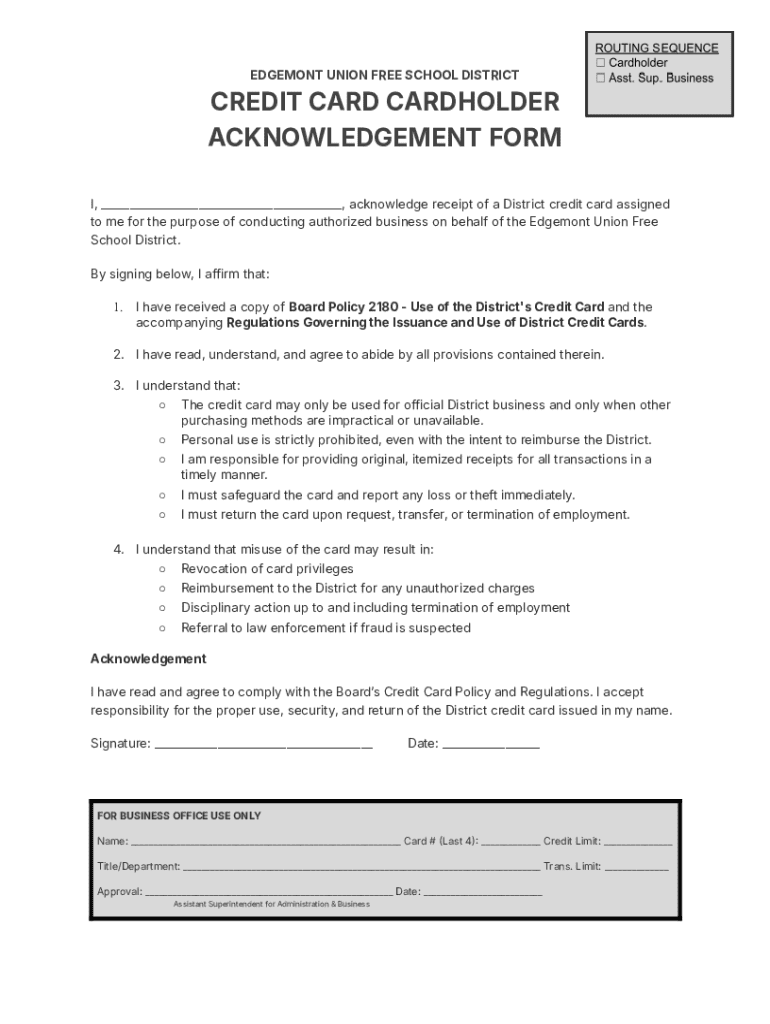

The credit card cardholder acknowledgment form serves as a formal agreement between the credit card issuer and the cardholder. It outlines essential details that verify the cardholder's understanding and acceptance of the terms associated with the credit card, including responsibilities and liabilities. This form is crucial as it holds cardholders accountable for their financial behavior regarding the usage of the credit card, ensuring they are aware of the potential risks involved.

The acknowledgment form is not merely a piece of paperwork; it is a practical tool that reinforces financial accountability among cardholders. By clearly delineating the responsibilities that come with credit card usage, the form helps prevent misunderstandings that may arise regarding fees, penalties, and credit limits. A solid grasp of what is being agreed upon is essential for both parties, hence the necessity of this acknowledgment.

Key components of the credit card cardholder acknowledgment form

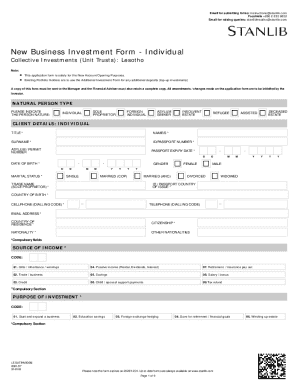

The credit card cardholder acknowledgment form is structured to capture critical information that lays the groundwork for a successful credit relationship. Essential details include the cardholder’s full name, which identifies the individual responsible for the credit account, and the account number, which uniquely identifies the specific credit card issued. Another crucial piece of information is the authorization date, marking when the cardholder officially agrees to the terms.

Specific clauses and disclosures are also vital components of the form. They typically outline the terms and conditions under which the credit card can be used, including any applicable interest rates and fees. It's also important to include billing guidelines that elucidate payment due dates and processes, helping to clarify how charges will appear and when payments must be made to avoid late fees. To conclude the acknowledgment, the form must include fields for the cardholder's signature and date, which confirm their understanding and acceptance of all terms stated.

Benefits of using the credit card cardholder acknowledgment form

Using the credit card cardholder acknowledgment form provides several key benefits that enhance financial management. First, it protects the financial interests of both the credit issuer and the cardholder. With a clear record of the terms of use, both parties can refer back to the agreement should any issues arise, minimizing risks related to misunderstandings. This documentation can be pivotal in resolving disputes or clarifying the responsibilities of each party.

Enhancing accountability is another significant advantage of the acknowledgment form. It ensures that all parties, especially team members in a corporate setting, understand their shared responsibilities regarding credit usage. This clarity leads to better compliance with company policies and reduced financial risks associated with reckless spending or fraud. Lastly, the form streamlines documentation by providing an easily accessible reference for anyone who handles company credit cards, promoting efficiency in financial operations.

Step-by-step guide to completing the credit card cardholder acknowledgment form

Completing the credit card cardholder acknowledgment form may appear challenging at first, but following a clear set of steps can streamline the process. **Step 1:** Gather necessary information. Collect all personal and card details; accuracy is essential. **Step 2:** Review the terms and conditions. It is critical to ensure you fully understand any fees, limits, and obligations outlined in the agreement, as this knowledge will guide your usage of the card.

**Step 3:** Fill out the form accurately. Enter the required information such as name, account number, and authorization date carefully. **Step 4:** Review and edit the form. Double-check all details for accuracy to prevent any mistakes that could lead to disputes later on. **Step 5:** Sign and date the form. This final step confirms your understanding and agreement to the terms specified, legally binding you to the responsibilities included in the acknowledgment.

Best practices for managing the credit card cardholder acknowledgment form

Effective management of the credit card cardholder acknowledgment form can greatly improve oversight of credit card usage. One best practice is to keep copies of completed forms. Whether in digital format or hard copies, having these documents accessible ensures they can be referred to quickly in case of any discrepancies or questions about usage.

Another essential practice is to regularly update the information contained within the forms, especially when changes occur in terms of personnel or new agreements are made. Furthermore, consider using secure cloud-based platforms for storage, which can facilitate easy access while ensuring the protection of sensitive information. This is where a tool like pdfFiller can be invaluable, offering features for editing and signing documents, along with collaboration options that allow teams to work together effectively without losing track of important financial documents.

Implementing the credit card cardholder acknowledgment form in your workflow

Integrating the credit card cardholder acknowledgment form into your organizational workflow can enhance financial oversight significantly. One strategy is assigning responsibilities for maintaining and updating these forms to specific team members. This fosters a sense of ownership and accountability regarding credit management within the organization.

Additionally, linking acknowledgment forms to your company's spending policies creates a unified approach to financial management. Employees will understand that acknowledging the terms is not merely procedural but rather part of the broader financial procedural framework that ensures compliance and mitigates risks associated with credit use.

Customizing the credit card cardholder acknowledgment form

Customizing the credit card cardholder acknowledgment form to fit your company's specific needs is a practical approach to managing credit card usage. Personalization can include adding company branding to the form, making it clear that it is an official document. This not only establishes professionalism but also fosters a sense of trust from employees who will see the seriousness with which the company approaches financial stewardship.

Tailoring the terms based on usage scenarios is another essential aspect of customization. Different departments may have varied spending requirements and associated risks, and the acknowledgment form can reflect these differences. Utilizing pdfFiller's interactive features, such as drag-and-drop editing tools, can facilitate this process, allowing for quick adjustments to terms and conditions that suit particular team requirements.

FAQ section on credit card cardholder acknowledgment forms

When dealing with the credit card cardholder acknowledgment form, several common questions arise. For instance, what should be done if a form is found to be incorrect? The best approach is to review the mistake, make corrections, and ensure all parties involved acknowledge the amendments. This consistent communication is crucial to maintaining accurate records. How do you handle lost or misplaced forms? In this case, it is advisable to re-issue the acknowledgment form to the cardholder, who should then complete and sign the new document to ensure that all information remains up to date.

Another significant concern pertains to the legal implications of the acknowledgment form. This document serves as a binding agreement; thus, failure to adhere to the outlined terms could result in legal repercussions. Understanding these risks and maintaining transparency throughout the process safeguards all parties involved and promotes responsible credit management.

Case studies and real-world applications

Numerous organizations have successfully implemented the credit card cardholder acknowledgment form to enhance accountability and mitigate financial risks. For example, a mid-sized retail company deployed the form across its sales departments, resulting in a marked decrease in spending discrepancies. By ensuring that every employee understood their financial obligations through the acknowledgment form, the company witnessed improved budget adherence and a greater sense of responsibility among team members.

Testimonials from users highlight the utility of the acknowledgment form in enhancing financial clarity. Many individuals and teams have expressed satisfaction in seeing reduced conflicts regarding expenditure, attributing these positive outcomes to the clear documentation provided by the acknowledgment process. As organizations continue to prioritize accountability and compliance, such case studies emphasize the value of the acknowledgment form as a fundamental component of responsible credit management.

Engaging with pdfFiller features for financial documentation

Engagement with pdfFiller's suite of interactive tools significantly enhances the management of credit card cardholder acknowledgment forms. The platform facilitates easy editing, signing, and real-time collaboration, which are crucial for maintaining accurate documentation. Users are equipped with the tools to modify forms as needed, ensuring that any updates to terms or user information are captured quickly and efficiently.

One notable advantage is the accessibility of pdfFiller's platform, allowing users to access forms anytime, anywhere, which is vital for teams that may operate in multiple locations or remotely. Furthermore, the ability to collaboratively edit and comment on documents makes it easier to achieve consensus on terms or policies, ensuring that everyone involved is on the same page regarding financial procedures.

Stay updated with best practices

Keeping abreast of best practices for managing credit card cardholder acknowledgment forms is essential for maximizing their effectiveness. Subscribing to newsletters or blogs focused on financial documentation can provide users with the latest insights and strategies for optimization. Regularly revisiting and adapting your procedures ensures that your organization remains compliant and mitigates risks associated with credit management.

Engaging with current trends in document management empowers individuals and teams to stay ahead of potential challenges related to credit usage. In the dynamic business landscape, continuous learning about effective practices in financial documentation will benefit not just compliance but also contribute to overall organizational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card cardholder acknowledgment?

How do I edit credit card cardholder acknowledgment straight from my smartphone?

How do I fill out credit card cardholder acknowledgment on an Android device?

What is credit card cardholder acknowledgment?

Who is required to file credit card cardholder acknowledgment?

How to fill out credit card cardholder acknowledgment?

What is the purpose of credit card cardholder acknowledgment?

What information must be reported on credit card cardholder acknowledgment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.