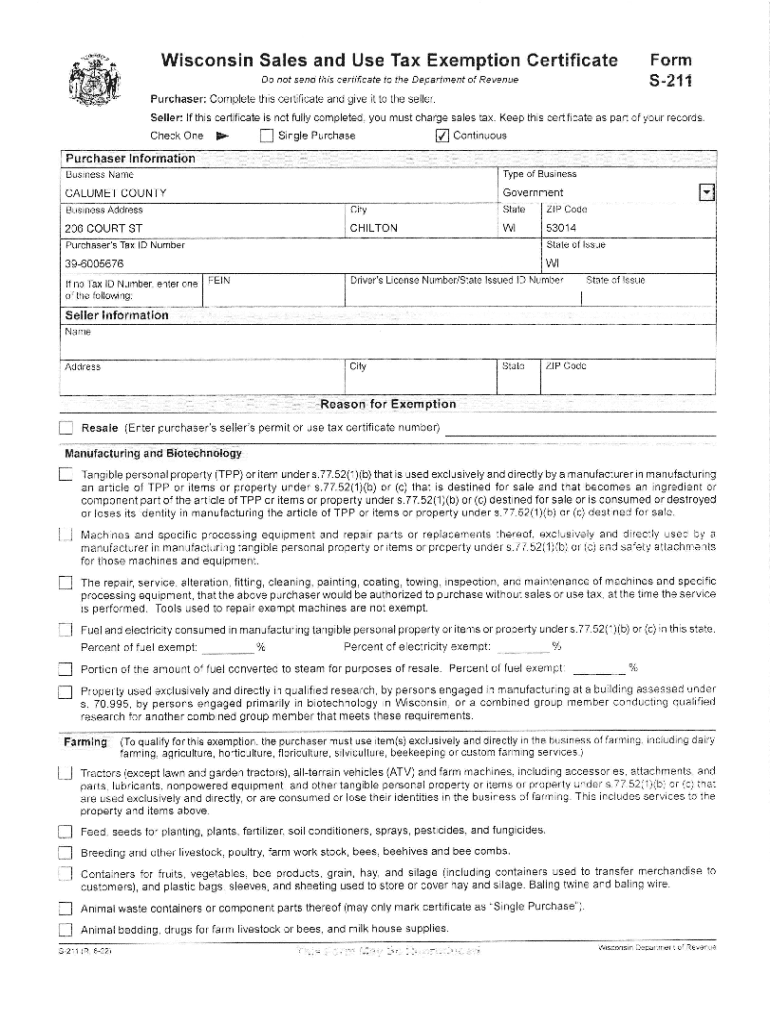

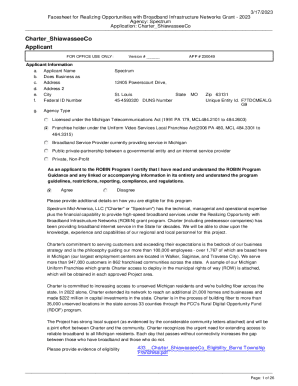

Get the free Wisconsin Sales and Use Tax Exemption Gertificate Form

Get, Create, Make and Sign wisconsin sales and use

How to edit wisconsin sales and use online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wisconsin sales and use

How to fill out wisconsin sales and use

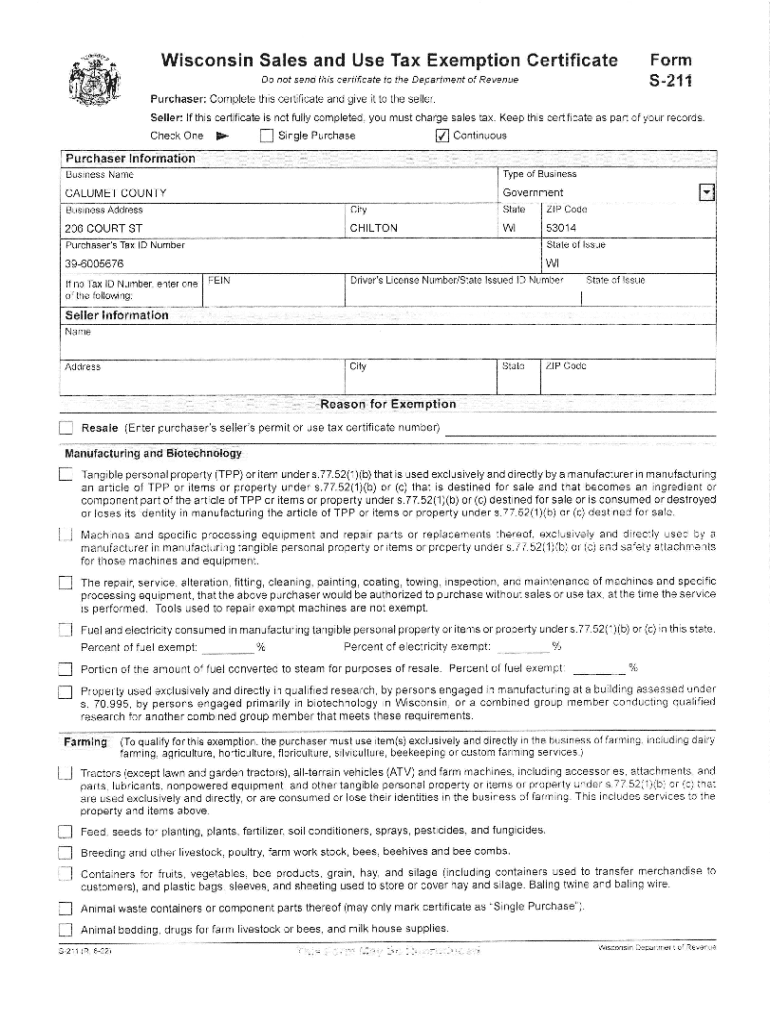

Who needs wisconsin sales and use?

Comprehensive Guide to the Wisconsin Sales and Use Form

Understanding sales and use tax in Wisconsin

Sales and use tax is a critical component of state revenue in Wisconsin, applying to sales of tangible personal property and certain services. This tax structure ensures that the state can fund essential services such as education, infrastructure, and healthcare. Understanding sales and use tax forms is pivotal for compliance, making the Wisconsin Sales and Use Form a necessary document for residents and businesses alike.

Filing the Wisconsin Sales and Use Form allows entities to report sales tax they have collected on taxable sales and calculate any use tax owed on purchases where sales tax was not collected. Adhering to these requirements not only keeps you compliant but also avoids penalties and maintains clear communication with the Wisconsin Department of Revenue.

Overview of the Wisconsin Sales and Use Form

The Wisconsin Sales and Use Form serves as the medium through which sales tax collected from customers is reported, and any applicable use tax is calculated. This form is essential for businesses and individuals who engage in taxable transactions within the state.

Key features of the form include sections dedicated to both sales and use tax reporting, which must be appropriately filled out depending on whether the individual or entity collected sales tax. This dual functionality highlights the form’s importance in ensuring comprehensive tax compliance.

Completing the Wisconsin Sales and Use Form

Filling out the Wisconsin Sales and Use Form correctly is crucial to avoid complications. It can be daunting, but following a step-by-step approach simplifies the process considerably. Start with the personal information section, ensuring all required details such as name, address, and tax identification number are included.

Next, you’ll need to address the sales details section. This involves reporting total sales made during the period, including any sales tax collected. Finally, for the use tax calculation, if you have made purchases without payment of sales tax, calculate the amount owed and ensure it's accurately reflected on the form.

Using pdfFiller for the Wisconsin Sales and Use Form

pdfFiller streamlines the process of filling out the Wisconsin Sales and Use Form by offering powerful editing capabilities and eSigning options. Users can upload the form from their device, making it easy to start the process from anywhere.

After uploading, users can take advantage of various editing tools—like adding text or checkmarks—and modifying any field on the form to ensure all information is complete and accurate before submission.

Submitting the Wisconsin Sales and Use Form

Once completed, submitting the form correctly is as important as filling it out. Ensure you understand where to send your completed form, which, for the Wisconsin Sales and Use Form, can often be submitted electronically or via mail.

Pay attention to deadlines; late submissions can result in penalties. Keeping a copy of your submission and any confirmation received is key to ensuring smooth communication with state tax authorities.

Managing sales and use tax records

Maintaining accurate tax records is not just advisable; it's essential for compliance and auditing purposes. The Wisconsin Sales and Use Form records must be stored securely, with clear documentation of sales activities and any tax collected.

pdfFiller offers robust document management features that simplify this process. Users can create saved templates for future use, ensuring that repetitive tasks are quick and error-free. Furthermore, the platform provides organization capabilities that allow for easy retrieval of tax records when necessary.

Additional considerations for vendors

Vendors operating in Wisconsin must be aware of special requirements when it comes to sales and use tax. This includes understanding specific exemptions applicable to certain types of transactions, services, or goods. Knowing these nuances can support strategic pricing and compliance.

The accuracy of the Wisconsin Sales and Use Form directly affects your business transactions. Failure to comply with state tax regulations can lead to penalties, interest, and potential audits which can disrupt business operations.

Frequently asked questions (FAQs)

The Wisconsin Sales and Use Form can generate inquiries from users. By addressing common questions, individuals can better navigate the complexities of sales tax compliance. One major query is the location from which the form can be obtained—a straightforward task as it's available on the Wisconsin Department of Revenue website.

Another essential question is about amending submissions. Should there be any errors in your filed form, it's possible to submit an amended return, which requires specifics that vary based on the nature of the amendment.

Navigating changes in tax regulations

Tax regulations are not static; they are subject to change, which can complicate the filing process. Staying updated on Wisconsin tax law changes is crucial for compliance. This ensures that your filings are accurate and in line with any new rules or requirements set forth by the Department of Revenue.

pdfFiller can assist users in keeping informed through relevant updates and resources, allowing you to adapt your processes and maintain adherence to the state’s regulations while minimizing risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the wisconsin sales and use electronically in Chrome?

How do I edit wisconsin sales and use straight from my smartphone?

How do I fill out wisconsin sales and use using my mobile device?

What is Wisconsin sales and use?

Who is required to file Wisconsin sales and use?

How to fill out Wisconsin sales and use?

What is the purpose of Wisconsin sales and use?

What information must be reported on Wisconsin sales and use?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.