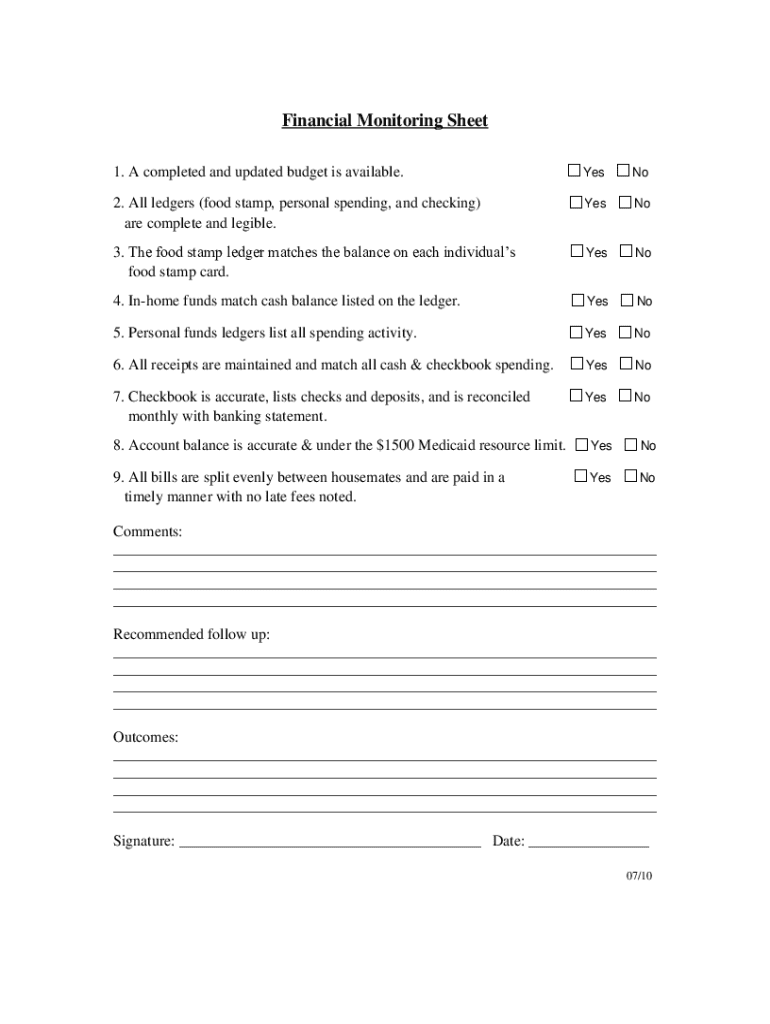

Get the free Financial Monitoring Sheet

Get, Create, Make and Sign financial monitoring sheet

Editing financial monitoring sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial monitoring sheet

How to fill out financial monitoring sheet

Who needs financial monitoring sheet?

Comprehensive Guide to Financial Monitoring Sheet Forms

Understanding financial monitoring sheets

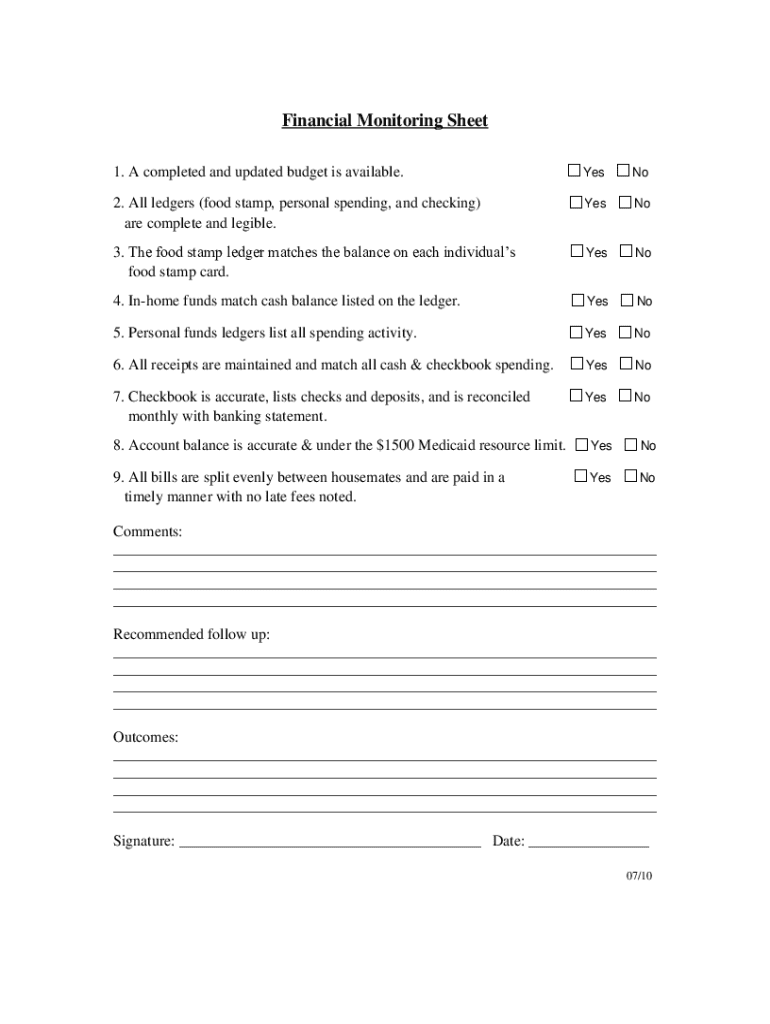

A financial monitoring sheet is a structured document designed to help individuals and businesses track their financial activities. It serves as a vital tool for budgeting, managing expenses, saving for future goals, and ensuring financial accountability. By providing a clear overview of income, expenses, and savings, these sheets aid users in making informed financial decisions.

The importance of financial monitoring sheets cannot be overstated. For individuals, they offer a tangible way to manage household budgets, monitor savings goals, and prepare for emergencies. For businesses, effective financial monitoring sheets help in analyzing cash flow, optimizing expenditures, and facilitating growth strategies. Consequently, the right financial monitoring sheet form can pave the way for better financial health.

Types of financial monitoring sheets

There are two primary types of financial monitoring sheets: personal and business. Personal financial monitoring sheets are tailored to individual users, capturing essential categories like income, expenses, and savings. They may include monthly budget templates where users can visualize and track their income and expenditures, ensuring they maintain healthy spending habits.

Conversely, business financial monitoring sheets cater to enterprises and include metrics critical to business growth. These sheets typically track cash flow, assess profit margins, and detail investments. They also help business owners make informed decisions on allocating resources effectively and identifying areas where costs can be reduced. Understanding these distinctions is crucial for selecting the appropriate financial monitoring sheet for your needs.

Components of a financial monitoring sheet

A comprehensive financial monitoring sheet typically consists of several basic components. Income sources must be clearly defined, including salaries, side businesses, and dividends. It's also vital to categorize expenses into fixed, variable, and discretionary expenditures, which allows for a thorough examination of spending patterns. By breaking down these categories, users can identify areas for potential savings.

Beyond the basics, advanced features enhance the functionality of financial monitoring sheets. Users can incorporate charts and graphs to create visual data representations, making it easier to interpret financial information at a glance. Automated calculations can also be set up for quicker insights, such as total spending, remaining budgets, and projections for future income. This combination of basic and advanced components ensures that your financial monitoring sheet is both informative and actionable.

Creating your financial monitoring sheet

Choosing the right template is essential for an effective financial monitoring sheet. Options abound, including those available in Excel, Google Sheets, or even PDF formats. When selecting a template, consider factors such as ease of use, ability to customize, and compatibility with your device. Choosing a flexible format allows you to modify your sheet as your financial situation evolves.

Once you have selected a template, follow these step-by-step instructions to create your financial monitoring sheet: Start by setting up your document in pdfFiller, where you can easily manipulate sections and headers. Customize these headers to reflect your specific financial goals and categories. Finally, list your income and expenses accurately, taking care to adhere to best practices for data entry to ensure that your records remain consistent.

Filling out your financial monitoring sheet

To maximize the effectiveness of your financial monitoring sheet, adopting best practices for data entry is crucial. Establishing a routine for regular updates, whether weekly or monthly, can help maintain accuracy. Compiling information in real-time will provide a clearer picture of your financial situation and allow for timely adjustments.

Consider special circumstances, such as irregular income or seasonal expenses, when filling out your sheet. Incorporating these elements into your budget planning means setting aside funds in preparation for potential fluctuations. By predicting expenses or income trends, you can create a robust financial plan that withstands variations throughout the year.

Editing and refining your financial monitoring sheet

pdfFiller offers a suite of editing tools specifically designed to enhance your financial monitoring sheet. The platform provides interactive functionalities, enabling you to resize and rearrange sections to suit your needs. Adding comments or collaborative features allows for team input, making it easier to align on financial goals and responsibilities.

To ensure your sheet works effectively for you, consider personalizing calculations that align with your budgeting goals or savings ambitions. Captivating visual aspects can also motivate you to stay on track; ensuring that your financial sheet is visually appealing may just be the boost you need to maintain diligence in your spending habits.

Signing and sharing your financial monitoring sheet

Formalizing agreements through eSigning is a powerful feature of pdfFiller, ensuring your financial arrangements are recognized and secure. To eSign your financial monitoring sheet, follow the platform’s simple guide, making sure that your document reflects all necessary signatures accurately.

When it comes to sharing your financial monitoring sheet, be mindful of security. Utilize pdfFiller’s secure sharing options to protect sensitive financial information, particularly when collaborating with teams or financial advisors. This not only ensures confidentiality but also provides a collaborative space for strategic discussions.

Managing and maintaining your financial monitoring sheet

Establishing a routine for checks and updates is essential to managing your financial monitoring sheet effectively. By scheduling regular reviews—monthly, quarterly, or yearly—you can gain insights into your financial status and adjust your targets as circumstances change. This proactive approach allows you to stay on top of your financial reality.

For advanced management techniques, consider integrating additional financial tools to assist with comprehensive analysis. Utilizing historical data not only guides your budgeting but also aids in anticipating future challenges. This foresight can be pivotal in achieving long-term financial goals and creating strategies well in advance.

Troubleshooting common issues

Despite the predominance of digital solutions, technical glitches can arise while using pdfFiller for your financial monitoring sheet. Familiarize yourself with common issues and solutions to minimize downtime. Additionally, being prepared for potential data entry mistakes is crucial; maintaining a meticulous approach can greatly reduce such occurrences.

In the event of a mistaken entry, having a clear path for corrections is essential. Establish guidelines for error prevention in the future, such as double-checking entries before saving or utilizing the in-built error-check features of pdfFiller. This ensures higher accuracy rates in your financial tracking.

Ensuring financial data security

Data security is paramount when dealing with financial information. pdfFiller employs advanced security features, including encryption and access controls, to safeguard your financial monitoring sheets. Understanding these protections will give you peace of mind as you manage sensitive financial data.

In addition to using secure platforms, practicing best practices for data security is vital. Regularly backup your financial monitoring sheets and implement secure sharing methods to prevent unauthorized access. Such proactive measures will fortify your financial information against potential threats.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial monitoring sheet directly from Gmail?

How do I make edits in financial monitoring sheet without leaving Chrome?

How do I edit financial monitoring sheet on an iOS device?

What is financial monitoring sheet?

Who is required to file financial monitoring sheet?

How to fill out financial monitoring sheet?

What is the purpose of financial monitoring sheet?

What information must be reported on financial monitoring sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.