Get the free Business Tax Administrative Rule 400.23-2 400.9323-2A ...

Get, Create, Make and Sign business tax administrative rule

Editing business tax administrative rule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax administrative rule

How to fill out business tax administrative rule

Who needs business tax administrative rule?

Comprehensive Guide to Business Tax Administrative Rule Forms

Understanding business tax administrative rule forms

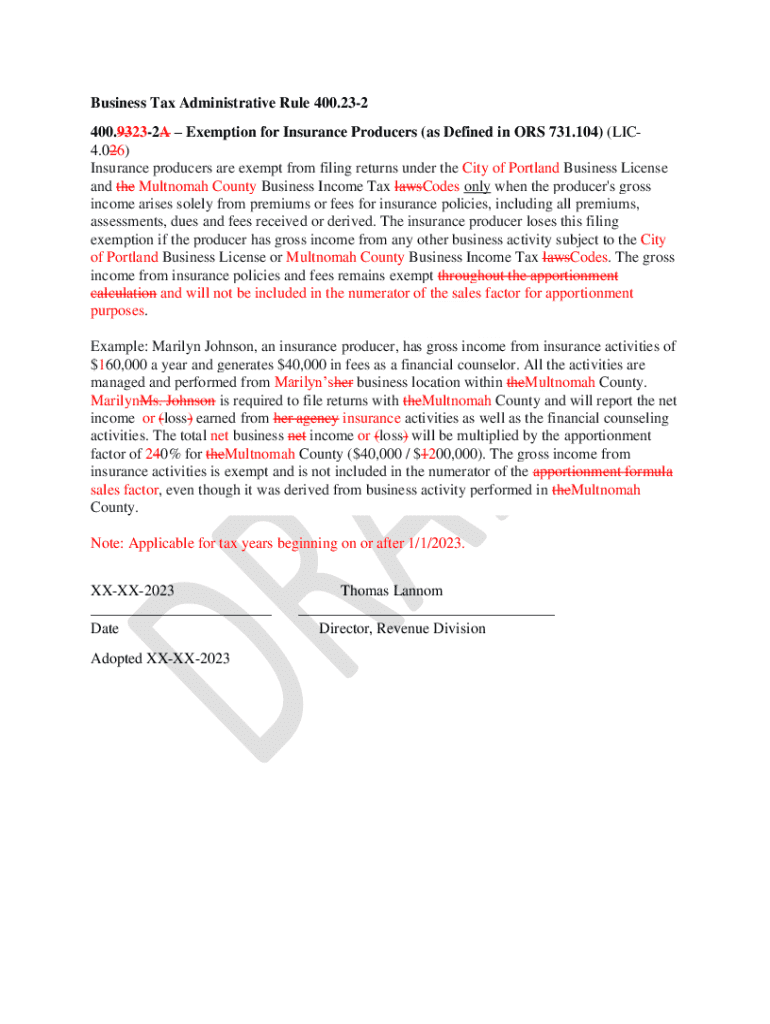

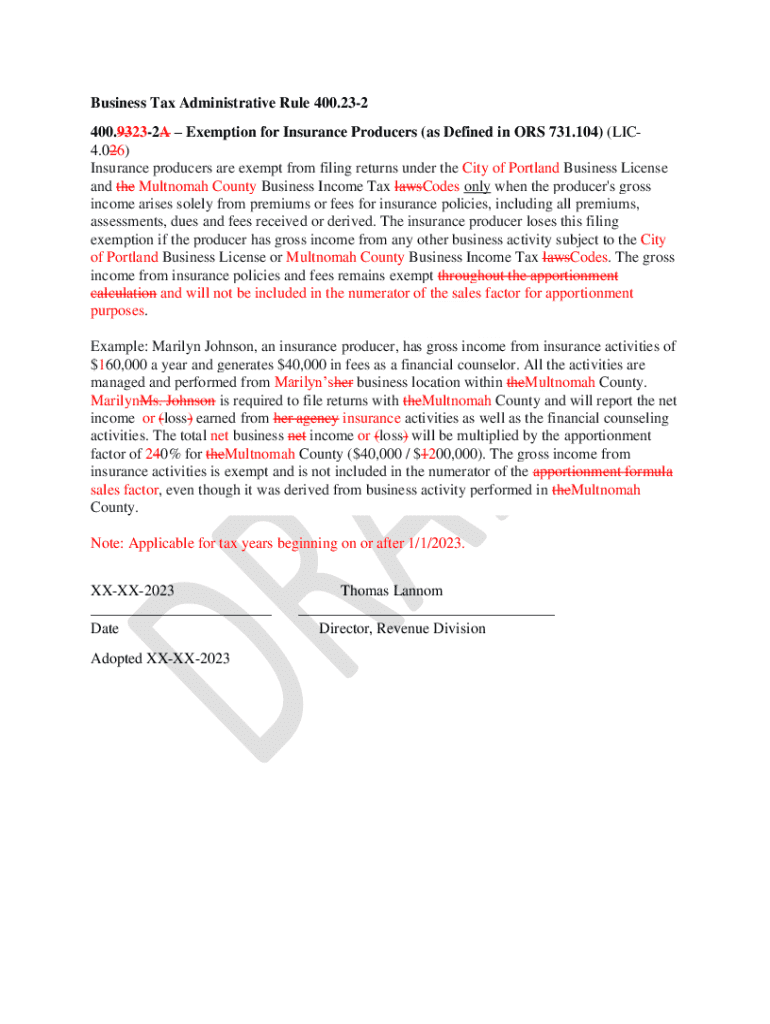

Business tax administrative rule forms are crucial documents that assist businesses in navigating the complexities of tax regulations. These forms are typically required by government agencies and reflect a company's compliance with tax rules. Filling out these forms accurately is not only a legal obligation but also essential for ensuring that a business can claim eligible deductions and credits, contributing to its overall financial health.

The significance of these forms lies in their role in maintaining transparent communication between businesses and tax authorities. They help mitigate risks associated with non-compliance, such as audits, fines, and reputational damage. Businesses must be well-versed in the key regulations and guidelines governing the use of these forms to ensure they remain compliant with state and federal tax laws.

Preparing to complete your business tax administrative rule form

Before diving into the completion of your business tax administrative rule form, it's essential to gather all necessary information. Start by collecting your tax identification numbers, which are critical for business tax identification. Additionally, financial records and previous tax returns will provide the context required for accurate completion.

Selecting an accessible platform is also vital for a smooth completion process. Many find that using pdfFiller enhances their experience, thanks to its user-friendly interface that streamlines the process of filling out forms. The cloud-based features allow you to manage documents efficiently, making it easy to access your forms from anywhere.

Step-by-step guide to filling out the business tax administrative rule form

Accessing the correct form is the first step in the process. Using pdfFiller, users can navigate to the desired business tax administrative rule form with ease. The website features interactive tools that assist in locating the precise form needed for your business, ensuring you start off on the right foot.

After accessing the form, inputting required information accurately is paramount. Typically, forms will ask for details such as business name, tax identification number, revenue figures, and other relevant data. To ensure accuracy, consider double-checking entered data against your financial records and utilizing the on-screen validation tools that pdfFiller provides.

Editing and modifying your business tax administrative rule form

Once you've completed the form, there may be instances where adjustments are needed. pdfFiller’s editing features allow you to make changes directly on the document. This capability enables you to revise text or numerical entries, ensuring the final form is both accurate and compliant with tax regulations.

Additionally, the platform facilitates collaboration by allowing you to share the document with team members. This feature can be particularly beneficial for businesses that want to review the form collectively. Collaborative tools help streamline the review process and enhance communication, making it easier to address any discrepancies.

Signing and securing your form

After ensuring that your business tax administrative rule form is correctly filled out and reviewed, it’s essential to sign it properly. pdfFiller provides robust eSignature options that allow for quick and secure signing. Utilizing electronic signatures not only streamlines the approval process but also ensures that the document holds legal validity.

Securing sensitive information is also a critical aspect of form management. With pdfFiller, businesses can take proactive steps to ensure data protection, including password-protecting documents and enabling secure sharing options. This level of security helps maintain confidentiality while complying with necessary privacy regulations.

Submitting your business tax administrative rule form

Submission methods for your completed business tax administrative rule form vary and can include online submission or physical mailing. PdfFiller simplifies this process by enabling online submissions directly through the platform, which can expedite processing times. Additionally, users can track their submission status via pdfFiller, reducing anxiety regarding the forms’ acceptance and processing.

However, it’s essential to avoid common pitfalls during submission. Incomplete forms can lead to delays, while sending documents to the wrong address or department can result in lost time and resources. By following the submission guidelines and utilizing pdfFiller’s tracking feature, businesses can streamline this crucial step.

Managing your forms post-submission

Once your business tax administrative rule form is submitted, maintaining a systematic approach to document organization is key. PdfFiller offers excellent tools for filing and archiving completed forms, allowing businesses to store records securely for future reference. By having organized documentation, businesses can quickly access prior submissions and stay compliant with audit requirements.

It's also crucial to stay informed about updates to business tax regulations since tax laws can evolve. PdfFiller assists users in managing ongoing changes, ensuring that all forms are up-to-date with the most recent tax requirements. Leveraging pdfFiller's constant updates helps prevent potential issues in future submissions.

Additional tools and resources

PdfFiller offers a range of interactive tools that can enhance the experience of preparing business tax administrative rule forms. For instance, customizable form templates ensure compliance with specific industry standards and regulations, while built-in tax calculators can help estimate taxes owed or refundable amounts. Such tools take the guesswork out of tax preparation.

Additionally, connections to related business resources provide users with a broader perspective on tax obligations. Networking opportunities and community discussions can foster insights that benefit businesses as they navigate the complexities of administration and compliance.

FAQs about business tax administrative rule forms

When filling out business tax administrative rule forms, common questions often arise regarding specific entries and required documentation. Users frequently seek clarification on how to correctly input revenue figures or how to report deductions. Understanding what information is necessary and the process for entry can alleviate a lot of stress associated with compliance.

PdfFiller’s support team can be a valuable resource for troubleshooting issues and providing guidance. Businesses can also access tutorials and FAQs specifically designed to address the most common issues encountered during form completion, helping to ensure a smooth process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out business tax administrative rule using my mobile device?

How do I edit business tax administrative rule on an iOS device?

How do I fill out business tax administrative rule on an Android device?

What is business tax administrative rule?

Who is required to file business tax administrative rule?

How to fill out business tax administrative rule?

What is the purpose of business tax administrative rule?

What information must be reported on business tax administrative rule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.