Get the free Liberty County Farm Revenue Taxation Market Value of ...

Get, Create, Make and Sign liberty county farm revenue

Editing liberty county farm revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out liberty county farm revenue

How to fill out liberty county farm revenue

Who needs liberty county farm revenue?

Understanding the Liberty County Farm Revenue Form: A Comprehensive Guide

Overview of the Liberty County Farm Revenue Form

The Liberty County Farm Revenue Form is a crucial document for agricultural operations within Liberty County, serving as a key tool for financial transparency and regulatory compliance. This form is designed to capture essential financial data from individual farms and agricultural businesses, allowing local authorities to monitor and support the farming sector's economic health. It specifically outlines income and expenses associated with farm operations, ensuring that reporting is standardized and that farmers adhere to local fiscal regulations.

By accurately completing the Liberty County Farm Revenue Form, farmers can not only fulfill their legal obligations but also gain insights into their financial performance, aiding in strategic planning and operational improvements. Furthermore, the data collected via this form contributes to local agricultural policies and initiatives.

Eligibility criteria

Determining whether you need to fill out the Liberty County Farm Revenue Form hinges on specific eligibility criteria. Primarily, any individual or business engaged in agricultural production within Liberty County is required to submit this form. This includes various types of farms, such as crop farms, livestock operations, and specialty produce growers, encompassing both large commercial enterprises and smaller homestead applications.

For instance, if you're a farmer growing corn or raising cattle on your property, you fall under the requirement to file this form irrespective of your operation's size. Agritourism operations also need to report their agricultural income via this form, thus contributing to the economic analysis of farming in the county. If any of the farm-related activities yield income, completing the Liberty County Farm Revenue Form is essential.

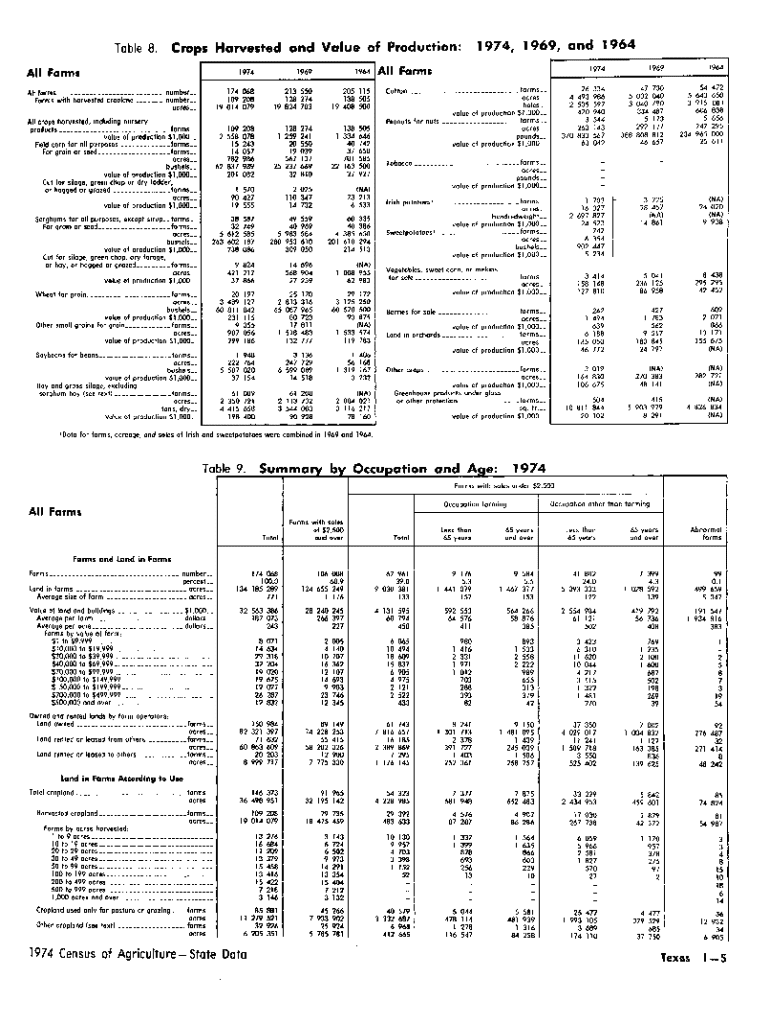

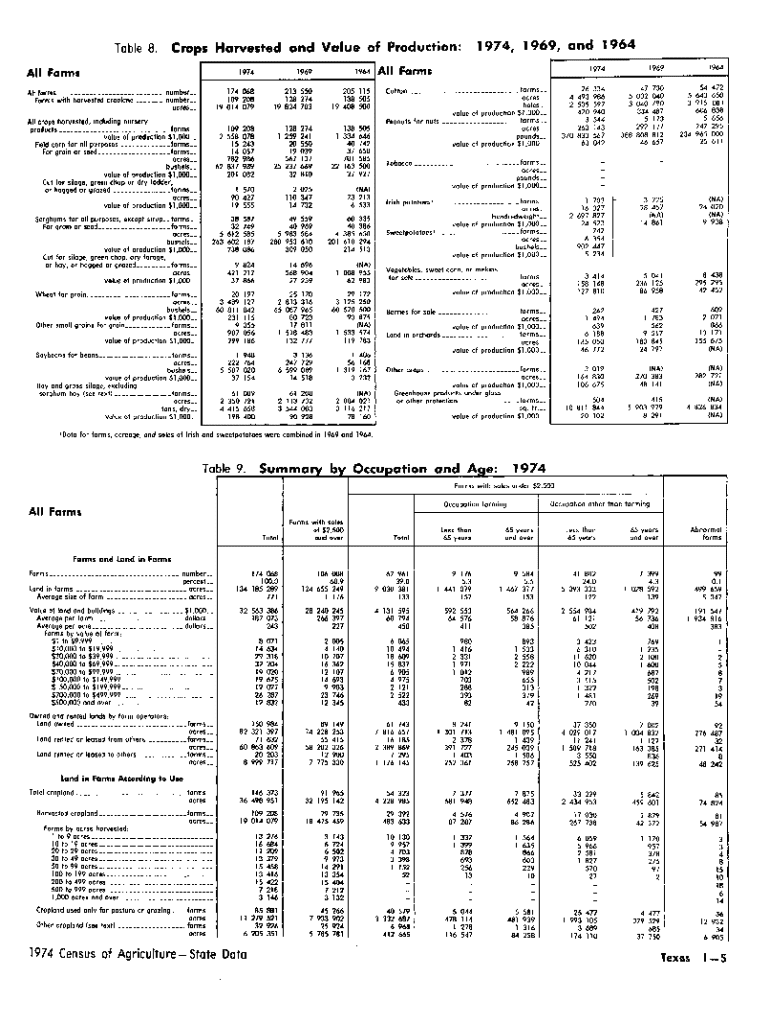

Key components of the Liberty County Farm Revenue Form

The Liberty County Farm Revenue Form consists of several distinct sections that ensure comprehensive financial reporting. Understanding these components is vital for accurate completion. The first section is Income Reporting, where farmers must detail all types of income generated from their operations. This includes direct sales from crops and livestock, government subsidies, and any grants received for farm development.

Next is the Expense Reporting section, where you can itemize deductible expenses that directly impact your farm's profitability. Categories for expenses often include operational costs such as fuel, feed, seeds, and maintenance, as well as capital expenditures for machinery and equipment purchases. Additionally, there may be a section for Additional Information where any necessary disclosures, such as upcoming changes in operation or discrepancies in prior submissions, can be logged.

Step-by-step instructions for completing the form

Before diving into filling out the Liberty County Farm Revenue Form, it's crucial to prepare adequately. Start by gathering all necessary documentation, including your current financial records, previous year’s tax returns, and any other relevant information. This preparation will help streamline the process and ensure you have all details at your fingertips.

Once you're ready to fill out the form, adhere to the following steps: 1. Begin with entering your basic farm information such as the name, address, and identification numbers. 2. Move on to the Income Reporting section where you need to input detailed figures based on your farm's revenue streams. 3. Next, complete the Expense Reporting section methodically, ensuring that you categorize each cost accurately. 4. Add any necessary disclosures or additional notes that may provide context to your reporting. 5. Finally, review the form for accuracy and completeness before submission.

Important dates and deadlines

Timeliness is critical when it comes to submitting the Liberty County Farm Revenue Form. Key submission dates are often outlined in the county’s regulatory framework, with the deadline typically falling at the end of the fiscal year. Late submissions can incur penalties, which can take a substantial toll on your farm's finances. It's essential to stay informed about these timelines and plan accordingly.

In general, farms may be subject to different reporting timelines based on their size or revenue levels. Larger entities with higher revenue may need to report quarterly, while smaller operations may only report annually. Understanding these nuances can help prevent any unintentional lapses in compliance.

Common mistakes to avoid

Filing the Liberty County Farm Revenue Form is straightforward, but errors can lead to complications such as financial discrepancies or penalties. Common pitfalls include omitting critical income sources, inaccurately categorizing expenses, and failing to provide required signatures. To minimize these risks, double-check that all income types are reported, especially government subsidies and grants that might be less obvious.

Further, ensure that your expenses are documented with receipts or ledgers, as this documentation may be required during audits. Additionally, don't neglect to take advantage of available resources such as checklists or guides provided by the county agricultural office, which can enhance the accuracy of your submissions.

eSigning and submitting the form

Utilizing digital tools can greatly simplify the process of completing and submitting the Liberty County Farm Revenue Form. pdfFiller is an excellent platform that provides users with an intuitive interface for filling, editing, and digitally signing the form. This not only saves time but also reduces the likelihood of errors that can occur when transferring information manually.

After completing your form, you have multiple submission options. You can choose to submit online via pdfFiller directly, mail a printed copy, or even deliver it in person to the designated county office. Each method has its advantages, so select the one that best fits your operational needs.

Collaborative tools and features

Many farms operate with a team, and collaboration is essential when preparing the Liberty County Farm Revenue Form. pdfFiller makes this easy by allowing users to share the form with stakeholders such as accountants, business partners, or family members before submission. This collaborative approach ensures that everyone involved in financial reporting has a say and can catch any potential errors.

Furthermore, pdfFiller offers features that enable tracking changes and comments, which is crucial for maintaining an accurate audit trail. As updates are made, you can easily see who made which changes, facilitating accountability and transparency throughout the process.

FAQs about the Liberty County Farm Revenue Form

Navigating the Liberty County Farm Revenue Form can come with questions. One common concern is what to do if you find yourself missing documentation. In such cases, it's best to draft a detailed note explaining the situation and provide estimates wherever possible to demonstrate good faith reporting. Another frequently asked question relates to how changes in income or expenses are treated; typically, any significant changes must be disclosed in the Additional Information section to maintain transparency.

Additionally, you may wonder if it’s possible to amend a submitted form. Yes, amendments can typically be made, and it's advised to follow the proper procedures outlined by Liberty County for doing so. Keeping accurate records and clear documentation will assist in this process.

Related forms and documents

While the Liberty County Farm Revenue Form is a primary document for financial reporting, there are other forms that may also be necessary for comprehensive agricultural operations. Common related forms include homestead applications for property tax exemptions and various state-level agricultural licenses. Each form serves a unique function and is essential in establishing eligibility for different benefits and programs available to farmers.

Accessing these forms via pdfFiller can streamline the management of your agricultural documentation, ensuring that all necessary paperwork is completed and submitted without hassle.

Conclusion and next steps

Completing the Liberty County Farm Revenue Form is a manageable yet vital task that can significantly affect the sustainability and profitability of your agricultural operations. Utilizing tools like pdfFiller not only simplifies the process of form filling and management but also enhances accuracy and efficiency in reporting. Embrace the digital age by leveraging cloud-based solutions that empower you in your documentation journey. With the right tools and a detailed understanding of the form's requirements, you can ensure your farm is in good standing with local regulations while paving the way for future growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send liberty county farm revenue for eSignature?

Can I create an electronic signature for signing my liberty county farm revenue in Gmail?

How do I complete liberty county farm revenue on an Android device?

What is liberty county farm revenue?

Who is required to file liberty county farm revenue?

How to fill out liberty county farm revenue?

What is the purpose of liberty county farm revenue?

What information must be reported on liberty county farm revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.