Get the free Income from farm-related sources before toxes and expensesfarms -

Get, Create, Make and Sign income from farm-related sources

How to edit income from farm-related sources online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income from farm-related sources

How to fill out income from farm-related sources

Who needs income from farm-related sources?

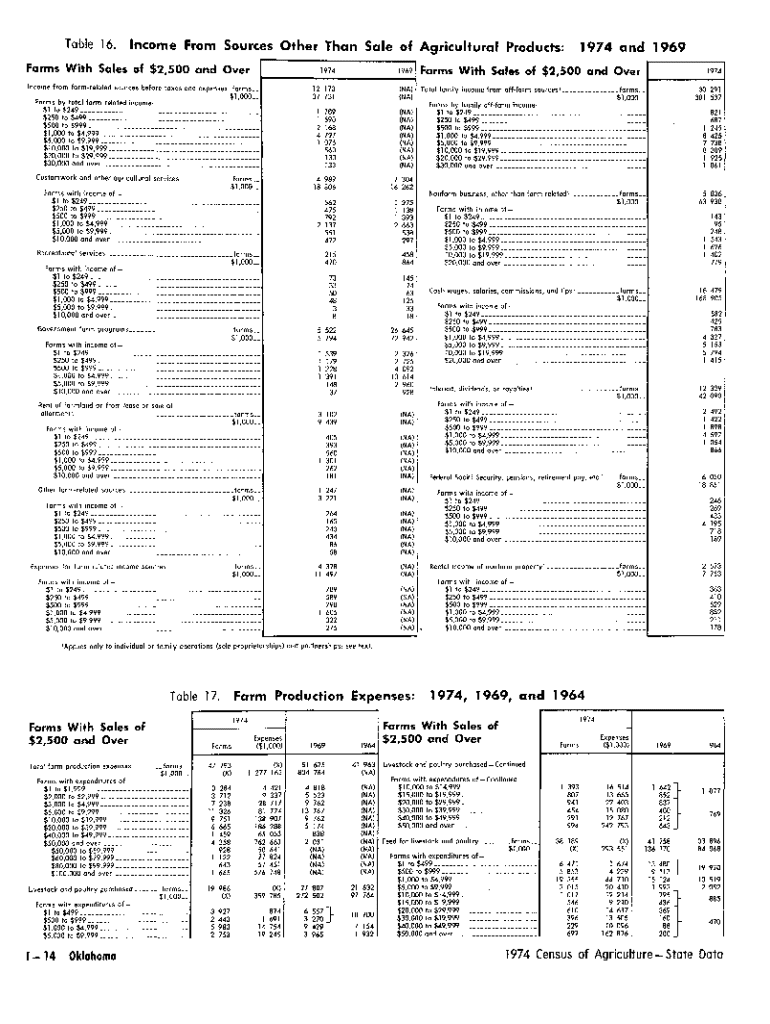

Comprehensive Guide to the Income from Farm-Related Sources Form

Understanding income from farm-related sources

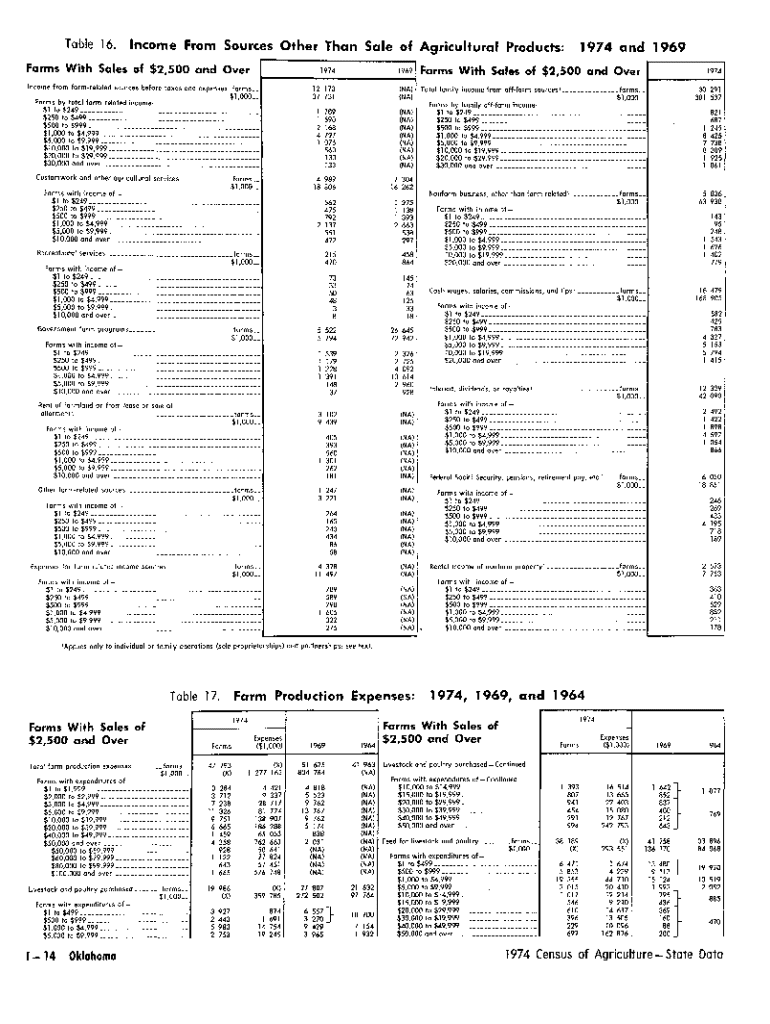

Farm-related income refers to any revenue generated from agricultural activities, which can encompass a wide range of sources. This includes both direct farm revenue as well as ancillary income that might arise from farm-related operations. Distinguishing between on-farm and off-farm income is crucial. On-farm income typically involves earnings directly linked to agricultural products, whereas off-farm income can come from activities like agritourism or selling produce at local markets.

Accurate reporting of farm income is vital not only for tax purposes but also for understanding the financial viability of a farming operation. Misreporting can lead to significant financial consequences, so farmers must be diligent in keeping track of their income.

Overview of the Income from Farm-Related Sources Form

The Income from Farm-Related Sources Form is a specific document designed for farmers to report income earned from their agricultural activities. This form is comprehensive, capturing various income sources to ensure accurate tax reporting. Key components include sections to document gross income from sales, along with any government payments or subsidies received throughout the year.

Farmers, whether operating independently or as part of a cooperative, are typically required to complete this form to ensure compliance with tax regulations.

Reporting profit or loss from farming

Understanding net farm income is essential for farmers, as it highlights the profitability of the agricultural operation. Net farm income is calculated by subtracting total expenses from gross income. This calculation ensures a clear picture of financial performance over the fiscal year.

Farm income can come from various sources, which should be categorized appropriately for reporting. Common reportable income types include:

Sample calculations for profit or loss should comprehensively address various income types and expenses to reflect the farm's financial reality accurately.

Identifying deductible farming expenses

Recognizing which farming expenses are deductible can substantially affect a farmer’s taxable income. Common deductible expenses often include operating expenses related to daily operations, equipment depreciation, interest on loans taken for buying equipment or land, and labor costs incurred to hire additional help during peak seasons.

Maintaining meticulous records is vital for documenting these expenses. Best practices include organizing receipts and invoices, creating an expense log, and regularly updating financial documents to streamline this process. When documenting expenses for potential audits, clear and detailed records can make a significant difference.

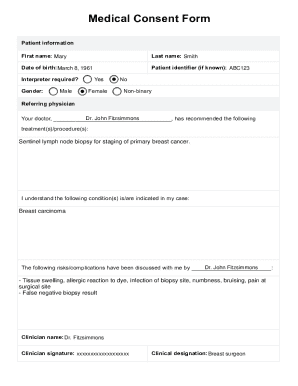

Completing the Income from Farm-Related Sources Form

Filling out the Income from Farm-Related Sources Form might seem daunting, but breaking it down into steps can simplify the process. First, gather all necessary documentation, including receipts, previous tax forms, and financial statements that reflect your income and expenses.

Next, input your gross income figures accurately into the designated sections, followed by entering any deductible expenses that you've categorized earlier. Finally, calculating your net income allows you to ascertain overall profitability.

For accuracy and efficiency, especially in larger operations, consider using digital tools like pdfFiller to streamline data entry. Avoid common pitfalls such as underreporting income, miscategorizing expenses, or forgetting to include all sources of revenue.

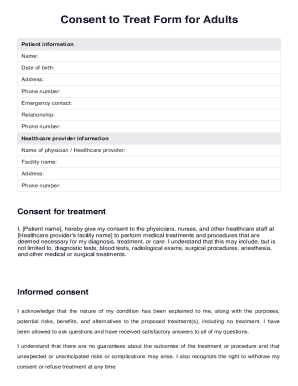

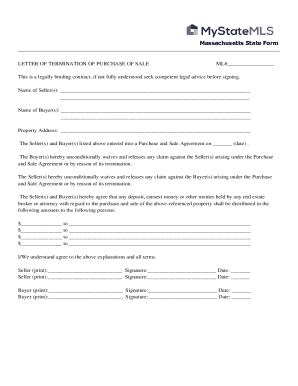

E-signing and submitting the form

The benefits of using electronic signatures for farm-related forms are numerous. Not only does it increase the speed of submission, but it also adds a level of convenience and security. Performing electronic signatures through platforms like pdfFiller facilitates a smoother signing process.

Once you’ve completed your form, you have options for submission: you can submit online directly through portal systems provided by tax offices or choose to mail in physical copies. Ensure you follow mailing instructions precisely to avoid delays.

Managing and storing form data

Once the Income from Farm-Related Sources Form has been submitted, securely storing this information becomes critical. Utilizing cloud-based solutions, such as those offered by pdfFiller, allows easy access to important documents while ensuring their safety.

Organizing forms for easy access, especially during tax season, can alleviate last-minute stress and confusion. Consider establishing a digital filing system to categorize your farm documents effectively to ensure compliance and readiness for any inquiries.

Frequently asked questions about farm income reporting

Fluctuating farm income year-to-year is common, and farmers should keep meticulous records over multiple years to average out their reports effectively. Understanding how fluctuations affect taxation requires insight into how farm income interacts with other financial elements on tax returns.

If an error occurs on the form after submission, it is essential to contact the tax authority immediately to rectify the mistake. They may have specific procedures to handle corrections, depending on the nature and severity of the error.

Key considerations when filing farm-related income forms

Filing deadlines for farm-related income forms can vary, so it's crucial to stay informed about specific dates to avoid penalties. Incomplete or inaccurate reporting could lead to audits or fines that can be detrimental to a farm's finances.

Knowing when to seek professional help from a tax advisor or accountant can save significant time and ensure compliance, particularly for more complex financial situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete income from farm-related sources online?

Can I create an eSignature for the income from farm-related sources in Gmail?

Can I edit income from farm-related sources on an iOS device?

What is income from farm-related sources?

Who is required to file income from farm-related sources?

How to fill out income from farm-related sources?

What is the purpose of income from farm-related sources?

What information must be reported on income from farm-related sources?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.