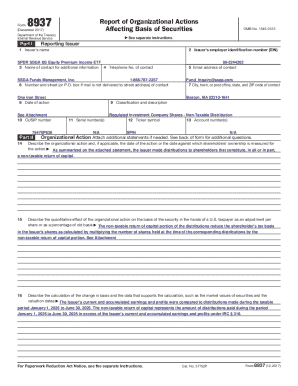

Get the free Farm Use Form - Ohio County Commission

Get, Create, Make and Sign farm use form

Editing farm use form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out farm use form

How to fill out farm use form

Who needs farm use form?

Farm use form: A comprehensive guide

Understanding the farm use form

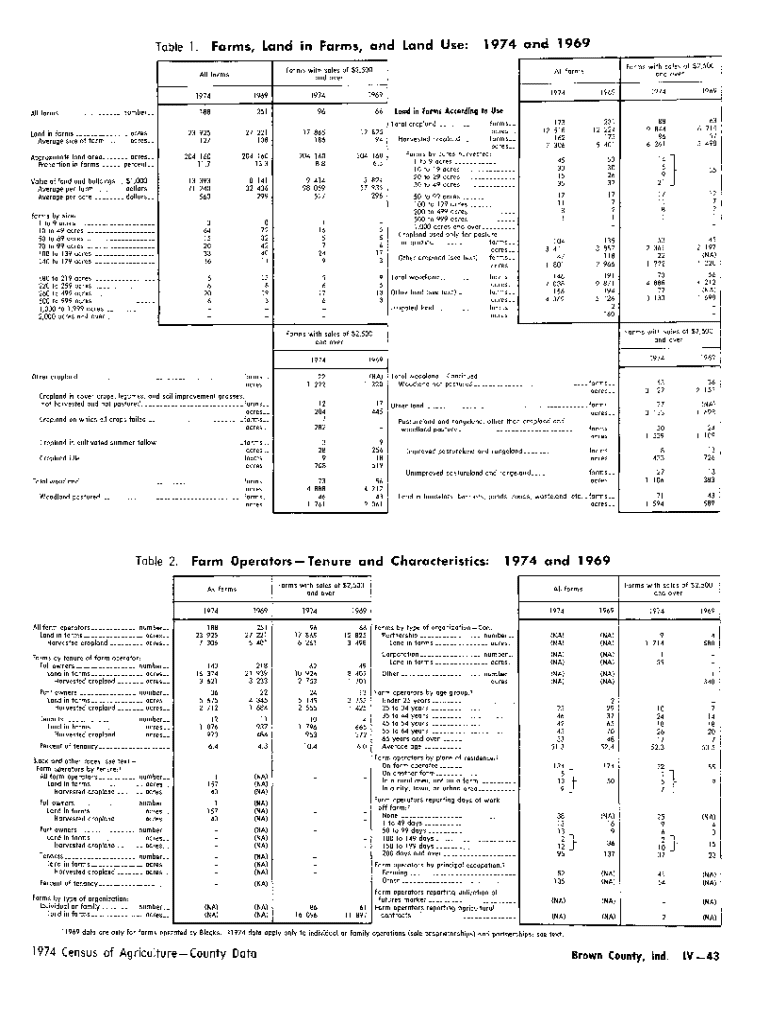

The farm use form is a crucial document utilized primarily by agricultural businesses and individual farmers to claim various exemptions and benefits associated with farming activities. Its main purpose is to validate that certain goods or properties are used for agricultural purposes, thereby qualifying for sales or property tax exemptions. For many, this form acts as a gateway to financial relief, enabling farmers to reinvest savings back into their operations.

Understanding the farm use form's importance cannot be overstated. It aids in reducing operational costs by alleviating tax burdens that can significantly impact the financial health of farming ventures. Moreover, it legitimizes agricultural activities, ensuring compliance with state and federal regulations. Common scenarios that necessitate the use of this form include purchasing farming equipment, land, and consumables at discounted tax rates as well as applying for financial assistance through government programs.

Types of farm use forms

Farm use forms vary widely depending on their intended use, with the key types being sales tax exemption forms and property tax exemption forms. Sales tax exemption forms enable farmers to purchase supplies and equipment without paying sales tax, while property tax exemption forms help reduce taxes on agricultural property deemed essential for farming.

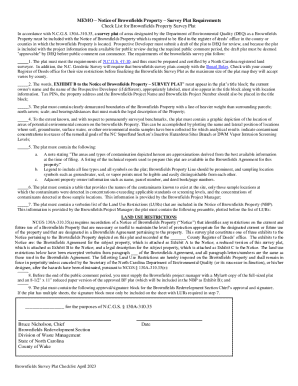

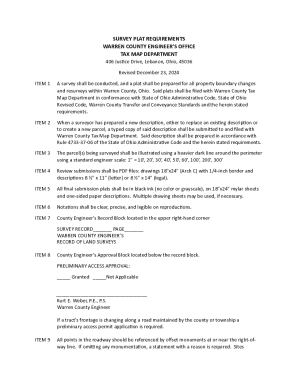

Different states may require specific forms with unique stipulations. For instance, some regions might necessitate additional supporting documentation or distinct application procedures. Key differences can include eligibility timelines and documentation needed to validate claims. Familiarizing yourself with your state's exact requirements is vital to ensure compliance and maximize benefits. Diligently reviewing local regulations can prevent delays or denials in exemption claims.

Eligibility criteria for completing the farm use form

To successfully fill out a farm use form, applicants must meet specific eligibility criteria. Generally, individuals involved in active farming operations, whether small-scale hobbyist farmers or larger agricultural businesses, are eligible. However, the precise requirements may differ depending on local laws and regulations.

Required documentation often includes proof of farming activities, such as receipts for purchases, tax records, or farm operation plans. Additionally, applicants may need to demonstrate income derived from farming, illustrating that the property in question is actively used for agricultural purposes. This could involve providing bookkeeping records or profit-and-loss statements detailing income from farm operations.

How to fill out the farm use form

Filling out the farm use form can seem daunting, but breaking it down into manageable steps simplifies the process. Start by entering your personal information, including your name, address, and contact details. Ensure this information is current to avoid confusion during processing.

When completing the form, accuracy is crucial. Common mistakes include miscalculating income or providing incomplete information about farming activities. To enhance your application, it's essential to include as much relevant information as possible. Attach supporting documents where applicable to substantiate your claims and reduce the likelihood of rejection.

Editing and customizing your farm use form

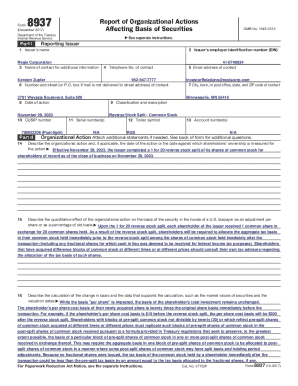

In today's digital age, you can easily customize your farm use form using tools like pdfFiller. With editing tools that allow you to modify fields and insert data seamlessly, the process becomes user-friendly and efficient. This cloud-based platform helps ensure that your documents reflect accurate and up-to-date information without physical paperwork hindrances.

Additionally, integrating signatures and initials is straightforward with pdfFiller’s eSigning feature. This means you can sign documents electronically, enhancing the speed of submissions and collaborations. The editing tools also facilitate easy adjustments even after initial completion, so you can respond swiftly to any changes in your circumstances or requirements.

Submitting your farm use form

Once your farm use form is complete, submitting it accurately is the next critical step. Methods of submission vary widely and may include online submissions via designated portals, mailing in physical copies, or delivering forms in person to the appropriate authority. Before submitting, double-check that all information is correct and all required documentation is attached.

Understanding submission deadlines is also vital. Different states have varying timelines during which the form must be submitted to take effect for a specific tax year. To avoid missing a deadline, abate submitted documents and keep records of your submission. Tracking your application status afterward can often be done online, providing peace of mind as you await approval.

Managing your farm use documentation

Efficient management of your farm use documentation is essential for operational success. Best practices involve organizing documents in an accessible manner, utilizing tools like pdfFiller for easy storage and retrieval of forms. Creating folders or categories based on type and year can streamline the process, ensuring you'll find necessary documents quickly, especially during audits or reviews.

Moreover, collaboration is made easy with pdfFiller, allowing teams to share and co-manage documents without geographical barriers. Using shared access can facilitate smooth operational flows, enabling all team members to stay informed about vital paperwork while reducing the risk of duplicate or conflicting submissions.

Frequently asked questions about the farm use form

Farmers often have questions regarding the farm use form, particularly in cases where applications are denied. If an application is deemed incomplete or incorrect, it’s crucial to identify the reasons for denial immediately. Typically, guidance will be provided by the reviewing authority on how to address issues, which might involve tweaking the information provided or submitting additional supporting documents.

Case studies: Successful use of the farm use form

Real-world examples illustrate the beneficial outcomes associated with the farm use form. Consider a small-scale vegetable farm that utilized the form to obtain a sales tax exemption for purchasing necessary equipment. This resulted in significant cost savings, which were then reinvested into the operation, enabling the farmer to expand their reach and improve product quality.

Interviews with successful applicants often reveal crucial insights and tips. These individuals emphasize the importance of precise completion of the form, thorough documentation, and early submission. Their experiences demonstrate that proper navigation through the farm use process can yield financial benefits and operational growth.

Interactive tools to assist with the farm use form process

A variety of interactive tools can significantly enhance your experience with the farm use form. For example, pdfFiller offers calculators to estimate potential tax savings based on local rates, as well as checklists to ensure all required steps are followed. These tools allow farmers to approach the filing process methodically, improving the likelihood of successful applications.

Additionally, leveraging technology for efficient document management can streamline workflows. Real-time support features, such as chat options and accessible help documents, empower users to resolve issues quickly, keeping submissions on track and promoting confidence amidst the paperwork involved.

Staying updated: Changes in legislation affecting the farm use form

Agricultural law is continuously evolving, and staying informed about changes in legislation affecting the farm use form is essential for all farmers. Recent updates may impact qualifying criteria, tax rates, and application processes. Engaging with local agricultural associations provides valuable insights and timely notifications regarding such legislative changes.

Regularly reviewing state and federal policies, subscribing to newsletters, and participating in community forums can help maintain awareness of new developments. Farmers should prioritize connecting with local government representatives or agricultural bodies to ensure compliance and explore any potential opportunities arising from legislative changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send farm use form to be eSigned by others?

How do I edit farm use form online?

How do I edit farm use form in Chrome?

What is farm use form?

Who is required to file farm use form?

How to fill out farm use form?

What is the purpose of farm use form?

What information must be reported on farm use form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.