Get the free Homestead and Farm

Get, Create, Make and Sign homestead and farm

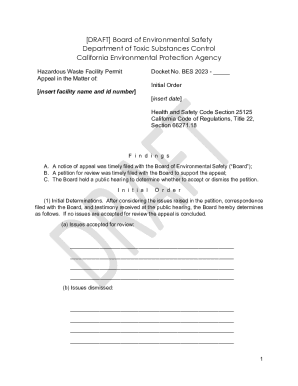

Editing homestead and farm online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homestead and farm

How to fill out homestead and farm

Who needs homestead and farm?

Complete Guide to the Homestead and Farm Form

Understanding the importance of the homestead and farm form

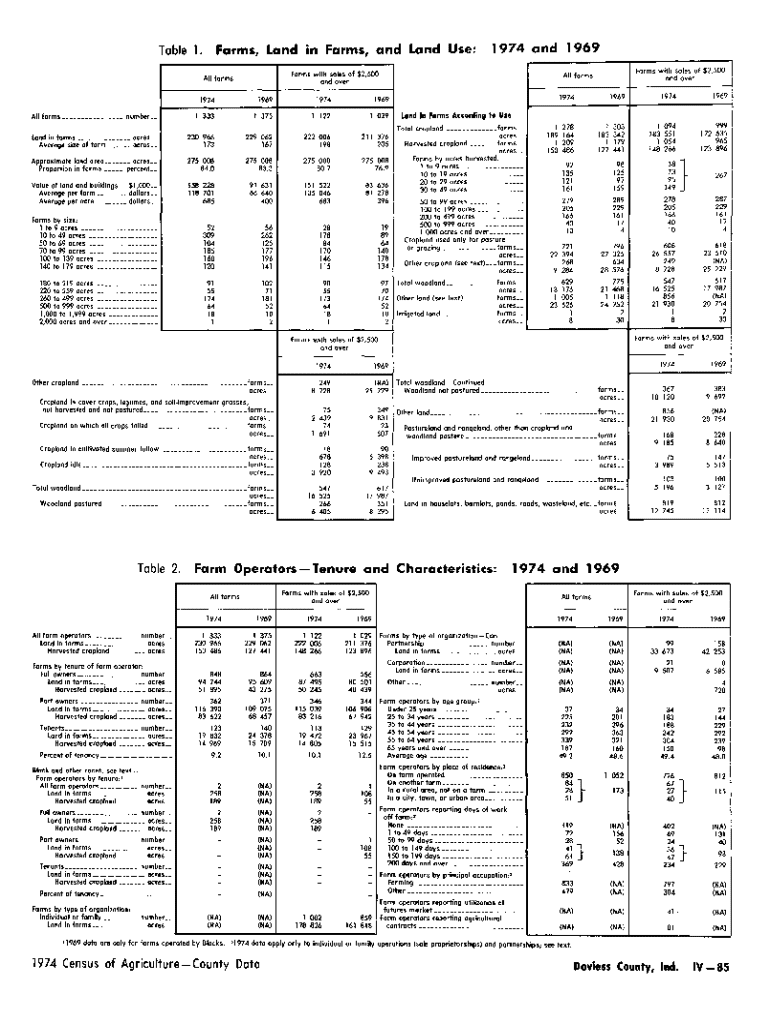

The Homestead and Farm Form is a crucial document for homeowners and farmers in securing financial benefits related to property taxation. Its primary purpose is to identify properties that qualify for homestead exemptions or property tax relief, thereby reducing the overall tax burden on eligible homeowners. This form is essential for individual property owners, including those who run farms, seeking to take advantage of state and federal tax benefits associated with homesteading.

It's worth noting that the completion of this form can lead to significant benefits. Tax savings and exemptions are among the primary advantages, which can free up capital for other necessary expenses or investments. Knowing the eligibility criteria can help individuals understand their potential for long-term financial security. This form is not just a bureaucratic hurdle; it’s an essential tool for sustainable agrarian living and property ownership.

Key components of the homestead and farm form

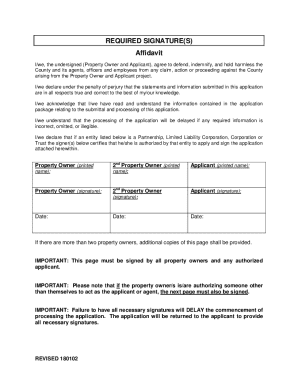

Successfully completing the Homestead and Farm Form hinges on understanding its key components. Each field has a specific purpose, and the information provided must be accurate to avoid delays or denials. Essential sections often include personal identification, property description, and any claims for special exemptions. Familiarizing yourself with these sections can save time and prevent common missteps.

Common pitfalls include incorrect property information and lack of supporting documentation. Homeowners should ensure they have the necessary documents such as proof of residence, tax ID numbers, and any related legal documents proving ownership. Addressing these key components will improve application outcomes and accelerate the process.

Step-by-step instructions for completing the form

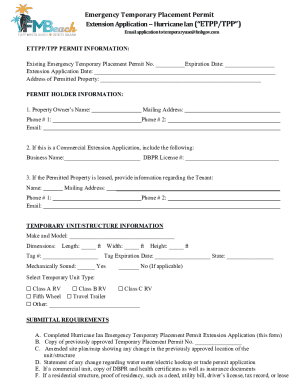

To effectively fill out the Homestead and Farm Form, an organized approach is essential. Start by gathering all necessary documents that substantiate your application. This checklist should include your property deed, tax identification number, and any occupant identification, thereby ensuring you have everything at hand as you proceed. If any documents are missing, reach out to local offices or digital platforms to acquire the needed paperwork promptly.

Next, begin filling out the form. Include comprehensive information regarding your property—size, type, and any specific conditions attached to your land ownership. Don’t forget to detail your personal information properly, including your domicile status. If you are applying for an exemption due to inherited land, provide documentation such as a will or trust agreement. Lastly, review your form thoroughly to eliminate any inaccuracies or oversights.

Editing and reviewing your form before submission is crucial to ensure accuracy. A second pair of eyes can help spot errors; common mistakes include incorrect names or identification numbers, which could result in rejection. Cross-check all fields to confirm you’ve adhered to the application guidelines.

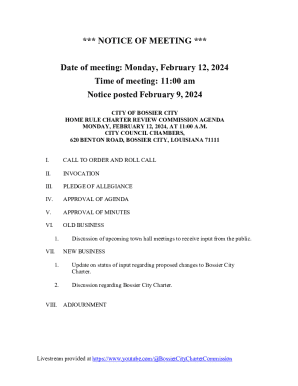

Managing your homestead and farm form application

Once your Homestead and Farm Form is completed, the next step is submission. Depending on your locality, forms can often be submitted online for efficiency, although paper applications are still accepted in many areas. Be mindful of key deadlines as missing these could delay your eligibility for tax relief. It’s prudent to confirm submission guidelines specific to your state or county to avoid unnecessary hassles.

Tracking your application can be done largely online in most regions. Many local governments provide portals to check the status of your form once submitted. If there’s an unexpected delay in processing, don't hesitate to contact the local tax office for clarification. Keeping lines of communication open will help ensure you remain well-informed throughout the process.

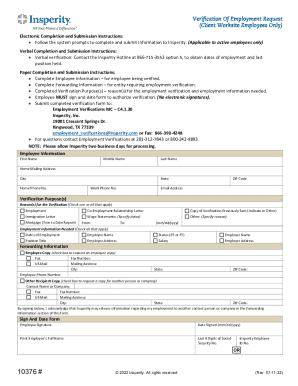

Utilizing pdfFiller for seamless document management

With pdfFiller, managing your Homestead and Farm Form becomes significantly easier. The platform's editing tools allow users to make adjustments to their documents before final submission. This feature is especially handy for checking errors and ensuring compliance with the necessary regulations. pdfFiller’s services enhance your document workflow, enabling you to make edits in real-time or access templates for various applications.

Utilizing pdfFiller’s eSignature feature simplifies signing your documents legally. The steps to apply your signature are clear, and the platform ensures that the process is compliant with relevant laws, instilling confidence that your application is valid and official. Furthermore, collaboration tools allow you to share your form with family members or business partners for their input or review. This collaborative approach ensures that all involved parties can contribute effectively to the submission.

Additional insights and updates

Staying updated on changes in homestead tax legislation is vital for every property owner. New laws and regulations can significantly impact eligibility and benefits associated with homesteading and farm operations. Acquaint yourself with local updates by visiting government websites or subscribing to newsletters focused on taxation issues in your area.

Consider engaging with local groups focused on agricultural support or property tax advocacy. These organizations often provide real-time assistance and can help amplify your voice regarding tax-related issues in your community.

Troubleshooting common issues

If your Homestead and Farm Form application is denied, this can understandably cause frustration. However, it is essential to know your options for appeal. Begin by understanding the reasons for rejection, which may include incomplete information or lack of eligibility proof. Once identified, you can reassess your application before submitting an appeal.

Common questions about the Homestead and Farm Form often arise among applicants. FAQs such as eligibility conditions, documentation requirements, and timelines for processing can usually be found on state tax department websites. Engaging with other homeowners and farmers who have gone through the process can also provide valuable insights and assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify homestead and farm without leaving Google Drive?

How can I get homestead and farm?

How do I edit homestead and farm on an iOS device?

What is homestead and farm?

Who is required to file homestead and farm?

How to fill out homestead and farm?

What is the purpose of homestead and farm?

What information must be reported on homestead and farm?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.