Get the free I I 863

Get, Create, Make and Sign i i 863

Editing i i 863 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i i 863

How to fill out i i 863

Who needs i i 863?

The 863 Form: A Comprehensive How-to Guide

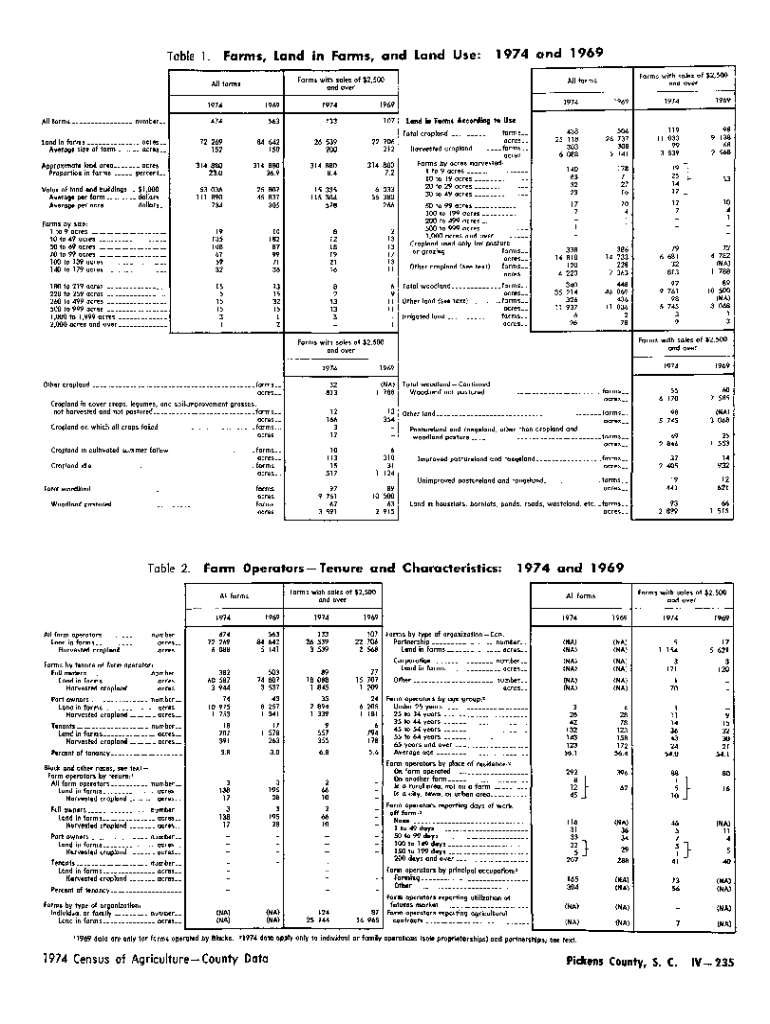

Understanding the 863 form

The I i 863 Form serves a specific and vital function within the landscape of forms and applications. Primarily, it is designed to collect crucial information related to personal and financial data, ensuring compliance with regulatory standards. Accurate completion of this form is not just a bureaucratic requirement; it plays a fundamental role in the validity of the data submitted, which can influence various outcomes for individuals and organizations. Understanding its purpose fully can alleviate many administrative challenges that arise during and after its submission.

Many individuals harbor misconceptions about the I i 863 form. Some believe it is purely a financial tool, while others consider it optional. In reality, this form is mandatory in specific contexts and is essential for ensuring accurate representation of data. The implications of neglecting to submit or improperly filling out this form can lead to significant legal ramifications and complications in processing applications.

Who needs to use the 863 form?

Identifying the target audience for the I i 863 form is essential for effective application. This form is pertinent to a variety of individuals and groups, from freelancers managing their financial matters independently to larger teams and organizations that require consolidated financial reporting. Since the form encapsulates both personal and organizational data, its relevance spans across multiple sectors and professions.

Specific scenarios where the I i 863 form becomes critical may include applying for financial assistance, tax submissions, or internal audits. Each instance demands precise data to ensure compliance with relevant laws and regulations. Therefore, understanding who should use the form helps to mitigate the potential for errors, ensuring that those responsible are aware of their obligations.

Overview of the 863 form structure

The I i 863 form comprises several key sections that dictate its use and information presented. Each part serves a unique purpose, contributing to the overall integrity of the data collected. The principal sections of the I i 863 form include Personal Information, Financial Data, and Supplemental Information, each providing insights into different facets of the submitter's background and financial status.

1. **Personal Information**: This section collects basic identifying details of the individual or entity submitting the form, such as name, address, date of birth, and contact information. 2. **Financial Data**: Perhaps the most consequential section, here, applicants must detail their financial status, including income, liabilities, assets, and other relevant financial metrics. 3. **Supplemental Information**: This section allows the submitter to provide any additional context that may be pertinent to their submission, serving as an opportunity to clarify nuances that raw data cannot convey. Each section's integrity is crucial as inaccuracies could lead to compliance issues or the rejection of applications.

Step-by-step instructions for filling out the 863 form

Before embarking on filling out the I i 863 form, preparation is key. Gathering required documents is a prudent first step. For personal information, documents such as identification and proof of residence are essential. For financial data, having access to recent bank statements, tax returns, and other financial records is critical. Tools and resources, including the I i 863 form itself and a reliable device with internet access, will be necessary.

When you start filling out the form, follow these detailed instructions: - **Section 1: Personal Information**: Ensure names are spelled correctly, pay attention to accuracy in contact details, and double-check any identification numbers for correctness. Mistakes may lead to processing delays. - **Section 2: Financial Data**: Calculate your financial figures accurately, providing truthful representations of income and expenses. - **Section 3: Supplemental Information**: Include relevant notes or explanations that can contextualize the data presented, aiding reviewers in understanding your situation comprehensively.

Common errors to avoid when completing the 863 form

Completing the I i 863 form should be approached with diligence to avoid typical mistakes that can have serious implications. Common errors include incorrect data entry, such as misspelled names or wrong financial figures; these small mishaps can lead to much larger issues, including rejection of the form or delays in processing. Furthermore, omitting required information is another frequent mistake, which can significantly hinder the success of your submission.

To ensure the accuracy of your completed form, it's vital to double-check all entered data. This can be achieved by revisiting each section and confirming figures against original documents. Systematically running through a checklist of required information can also minimize the chance of omissions, allowing for a smoother submission process.

Editing and finalizing the 863 form

Once the initial draft of the I i 863 form is completed, the editing process becomes pivotal. pdfFiller offers robust editing tools that enable users to make necessary changes efficiently. These tools allow you to modify text, correct any inaccuracies, and ensure that all supplementary information is added correctly. Being able to view your changes in real time can be a game-changer; it allows for immediate adjustments and ensures you feel confident in the accuracy of the submitted form.

Best practices for final submission include thorough reviews of all sections before you finalize the form. Consider enlisting a second set of eyes to offer fresh insights or catch any remaining errors that may have slipped through your initial checks. Incorporate all feedback before you submit the form to ensure compliance and accuracy.

Sign and submit

A key component of the I i 863 form is the signature requirement. eSigning is a straightforward process using pdfFiller’s functionality. Users can sign the form digitally, ensuring that the submission is legally binding and valid. Following your signature, you will choose your submission method; options generally include online submissions, which are often preferred due to speed and reliability.

If you need to submit the form via mail, ensure you follow precise mailing instructions to avoid any delays. Check for the appropriate address, consider using certified mail options, and retain proof of your submission. Keeping records is essential for managing any potential inquiries post-submission.

Managing your 863 form post-submission

Post-submission, managing your I i 863 form effectively can alleviate potential stress down the line. Tracking the status of your submission is crucial; pdfFiller provides relevant tools to monitor ongoing processes easily. Users can access a dashboard to view updates and receive notifications when necessary changes occur regarding their submission.

If you need to retrieve your submitted form for any reason, whether for personal records or to review, pdfFiller has streamlined access methods, reducing effort and time spent searching. Additionally, if amendments or resubmissions are required, it's essential to understand the processes involved. Knowing when and how to resubmit is vital to maintain compliance and ensure continued accuracy.

Frequently asked questions about the 863 form

Many individuals have questions regarding the I i 863 form, particularly concerning its completion. One common query involves what to do if you forget to include information; in such cases, it’s advisable to contact the relevant authority promptly to disclose the oversight and understand whether a resubmission is necessary. Another frequent question explores the use of fillable PDF forms. The use of such forms, including interactive fields, is encouraged as they enhance usability and ensure accuracy.

For further assistance, contacting support can provide clarity on more complex inquiries or issues regarding the I i 863 form. Knowing where to find help is vital for first-time users or those needing clarification on entries, legal requirements, or submission nuances.

Leveraging pdfFiller for document management

Utilizing pdfFiller's extensive features can significantly enhance your experience with the I i 863 form and other document needs. Its cloud-based access allows users to manage documents from anywhere, ensuring that you can stay productive whether at home, in the office, or on the move. Collaboration tools further enable teams to work together seamlessly, allowing multiple users to view and edit documents concurrently, which enhances the overall workflow.

The benefits of using pdfFiller extend beyond just document creation. With robust document storage solutions and easy retrieval methods, managing and accessing forms like the I i 863 form becomes simplified. This ensures compliance, security, and, ultimately, the efficiency needed in today's fast-paced work environments.

Case studies: Success stories with the 863 form

Examining success stories can provide valuable lessons on the effective utilization of the I i 863 form. For instance, various organizations have successfully navigated compliance challenges using this form to streamline financial data submissions, resulting in increased accuracy and reduced processing times. Testimonials highlight how clients have turned what was once a cumbersome procedure into a streamlined process, earning commendations for their attention to detail and the reliability of their submissions.

The role of pdfFiller in these success stories cannot be understated. With its user-friendly interface and robust features, many have reported a dramatic decrease in the time spent on form management, allowing users to refocus efforts on core business activities. Documenting these experiences further illustrates the transformative power of leveraging effective tools in the administrative process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete i i 863 online?

How do I edit i i 863 online?

Can I create an electronic signature for the i i 863 in Chrome?

What is i i 863?

Who is required to file i i 863?

How to fill out i i 863?

What is the purpose of i i 863?

What information must be reported on i i 863?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.