Get the free Campaign Finance Receipts & Expenditures Report Print this form ...

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts Expenditures Form

Understanding campaign finance forms

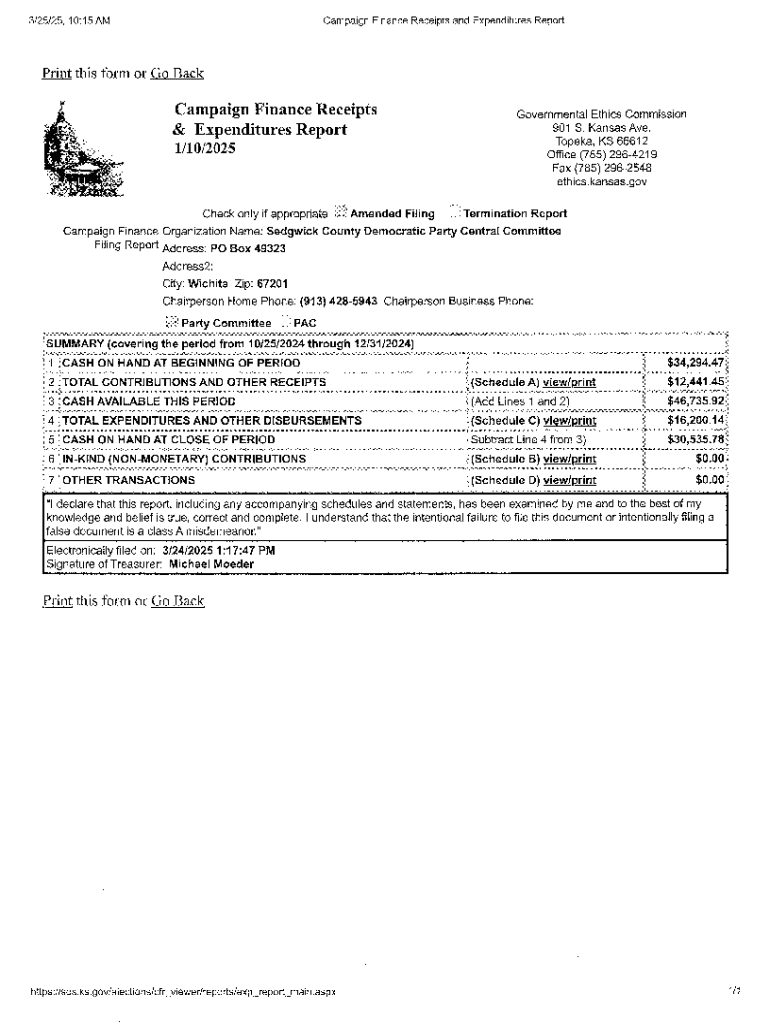

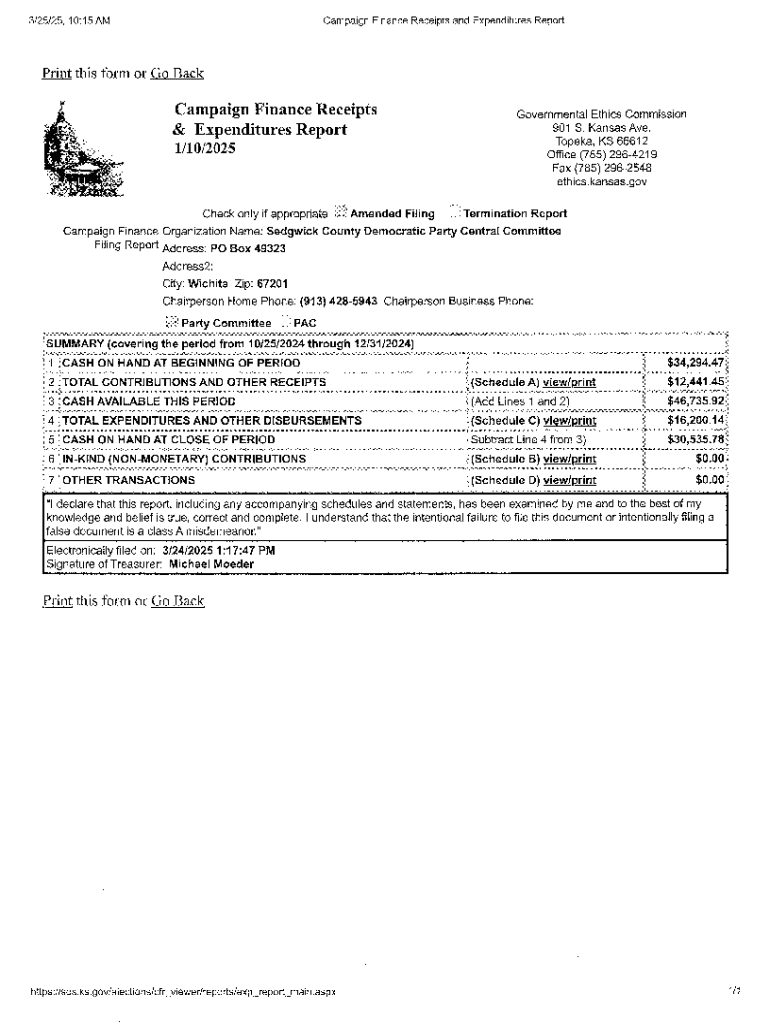

Campaign finance forms are essential for maintaining transparency in political campaigns. They serve as documents detailing the inflow of contributions (receipts) and the outflow of expenses (expenditures). These forms are crucial for ensuring compliance with laws set forth by federal and state authorities, making them a cornerstone of democratic processes.

Each campaign must accurately report its financial activity to demonstrate accountability to supporters and regulatory bodies. The specifics of what is included in these forms can vary, but they generally encompass two primary sections: receipts, which document how much money a campaign has raised, and expenditures, which detail how that money was spent.

Key components of campaign finance receipts and expenditures form

Understanding the key components of the campaign finance form is fundamental for candidates and their teams. The receipts section must categorize all incoming funds, while the expenditures section outlines all outgoing funds. Failure to report accurately can lead to legal repercussions.

Step-by-step guide to filling out the form

To effectively fill out the campaign finance receipts expenditures form, candidates should first prepare necessary information. This includes gathering financial data from various sources like online donation platforms and expense receipts, ensuring that the data adheres to established guidelines.

Common mistakes while filling out the receipts section include inaccurate recording of donation amounts and failing to categorize contributions correctly. Best practices for accurate reporting suggest double-checking each entry against bank statements.

When completing the expenditures section, itemizing expenses is crucial. Each entry should utilize appropriate codes and descriptions to provide clarity on how funds were utilized and justify each line item.

Interactive tools for managing campaign finance forms

Leveraging interactive tools can significantly streamline the creation and management of campaign finance forms. A platform like pdfFiller offers robust editing capabilities, allowing for efficient document creation and adjustments.

Maintaining your campaign finance records

Effective record-keeping is vital for any campaign's financial health. Campaign finance regulations require that records are maintained accurately and for a specified duration following the conclusion of a campaign. Proper organization of digital and physical copies is essential to ensure access to documents when needed.

Utilizing tools like pdfFiller enhances tracking changes and collaborations across documents. Features such as version control are essential for maintaining a clear audit trail, providing transparency and accountability, which is especially important during audits or reviews.

Common challenges & solutions in campaign finance reporting

Navigating the complex landscape of campaign finance regulations can be daunting. Understanding the differences between federal and state requirements is crucial for compliance. Various resources, such as legal experts and state election offices, can offer clarity and guidance.

Addressing errors on your form promptly is critical; candidates should be familiar with the proper procedures for amending reports. Transparency about corrections can mitigate potential penalties.

Real-world examples of campaign finance forms in action

Analyzing case studies of successful campaigns illustrates the various approaches taken in managing finance forms. Successful fundraising efforts often showcase how meticulous reporting can enhance credibility with voters.

Conversely, lessons from missteps — such as failure to report large donations or improper categorization of expenditures — underscore the importance of diligent financial reporting and the success of maintaining compliance.

Frequently asked questions (FAQ) about campaign finance forms

Candidates often seek clarification on various aspects of filing, such as deadlines and compliance requirements. Utilizing available resources, including state election offices and campaign finance reform organizations, can help alleviate these concerns.

New candidates should understand the critical components of compliance and the potential ramifications for errors. Familiarizing oneself with commonly missed steps can greatly enhance the likelihood of successful reporting.

Conclusion: streamlining your campaign finance reporting

Leveraging tools like pdfFiller can significantly improve document management, offering a centralized solution for creating, editing, and signing campaign finance receipts expenditures forms. By utilizing these resources, candidates can focus on their campaigns while ensuring compliance and efficient reporting.

The key to successful campaign finance management is embracing available tools for easy access, gathering accurate data, and maintaining transparency in all financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find campaign finance receipts expenditures?

How do I fill out the campaign finance receipts expenditures form on my smartphone?

How do I edit campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.