Get the free Tax FraudSouth Carolina Department of Revenue

Get, Create, Make and Sign tax fraudsouth carolina department

How to edit tax fraudsouth carolina department online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax fraudsouth carolina department

How to fill out tax fraudsouth carolina department

Who needs tax fraudsouth carolina department?

Tax Fraud: Understanding the South Carolina Department Form

Understanding tax fraud in South Carolina

Tax fraud in South Carolina refers to any illegal attempt to evade paying taxes owed to the state. This can involve various deceptive practices aimed at misleading tax authorities regarding a taxpayer's income, deductions, or credits. It's essential to comprehend the nuances of tax fraud, as this knowledge can empower taxpayers to protect themselves and their financial interests.

Common types of tax fraud can severely impact not just individuals, but also the state's economy. Key types include:

Reporting tax fraud is crucial. Not only does it protect your finances, but it also helps maintain the integrity of the tax system. Ignoring tax fraud can lead to severe penalties, including criminal charges.

The South Carolina tax fraud reporting process

Recognizing when to report tax fraud is vital. Signs indicating that you might be a victim include receiving unexpected tax documents or notifications from the South Carolina Department of Revenue about suspicious activity regarding your tax filings.

Situations requiring immediate action include:

Reporting tax fraud can be done through several methods, ensuring that you can choose the option that works best for you. You will typically need to gather required information such as your personal details, specific details about the suspected fraud, and any relevant documents.

You can submit a report in the following ways:

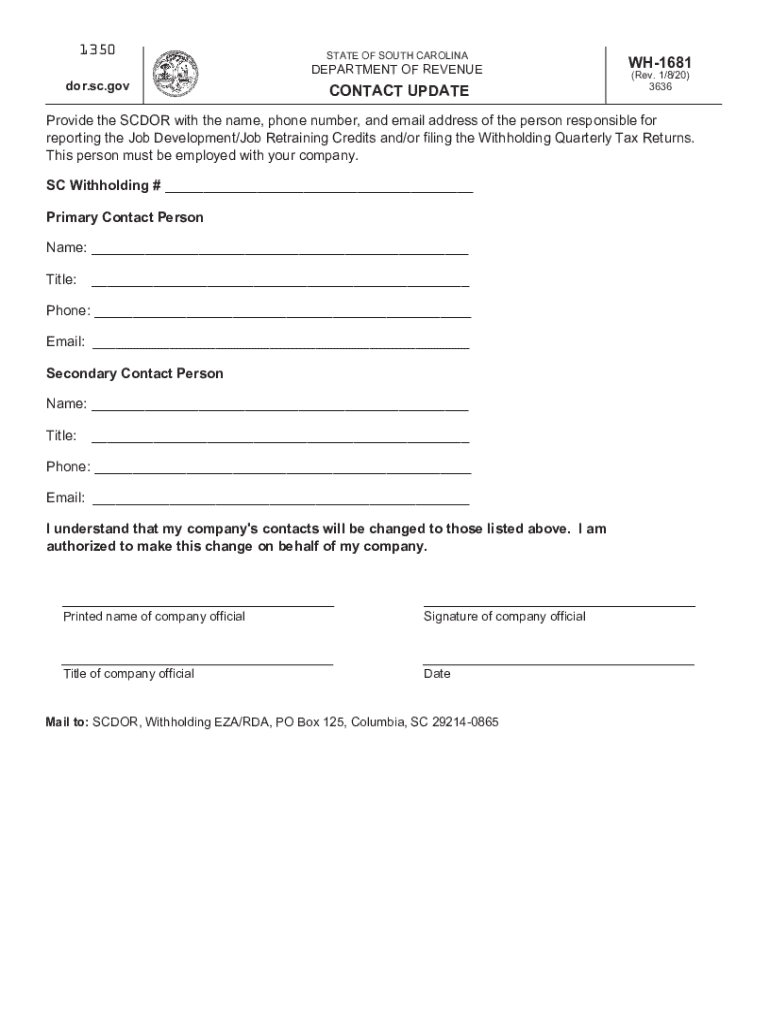

Tax fraud forms in South Carolina

When reporting tax fraud in South Carolina, several forms are relevant to your situation. The principal document for reporting suspected fraud is designed to gather specific information regarding the suspected violation.

Key forms include:

You can conveniently access these forms through the South Carolina Department of Revenue’s website. If you have difficulty locating them, you may also contact the department directly for assistance.

Filling out the tax fraud reporting form

Careful completion of the tax fraud reporting form is critical for ensuring that your report is taken seriously. Here is a section-by-section breakdown of how to complete the form effectively.

Avoid common mistakes such as providing incomplete information or neglecting to include supporting documents, as these can delay the investigation of your report.

Using pdfFiller can enhance your experience in handling these documents. You can easily edit the form online, utilize eSigning capabilities for rapid submission, and collaborate with others to gather necessary information.

After reporting tax fraud: What to expect

Once you have reported tax fraud, understanding the subsequent steps is crucial. The investigation process typically involves the South Carolina Department of Revenue thoroughly examining the details provided to ascertain the validity of the claims.

Timeframes can vary significantly based on the complexity of the case; you may receive updates throughout the investigation via the contact information provided.

To protect yourself after submitting a report, it’s wise to monitor your financial accounts closely for any unusual activity, such as unexpected withdrawals or unknown charges.

Consider enrolling in identity theft protection services, which can offer an additional layer of security against future incidents.

How pdfFiller enhances your experience

Finding a reliable, efficient way to manage your tax fraud reporting forms is essential, and pdfFiller is designed to empower users. This cloud-based platform enables seamless document management, making it easy to create, edit, and sign forms as needed.

Cloud-based access means you can work from anywhere, freeing you from traditional limitations. This flexibility is particularly beneficial when dealing with documents related to sensitive issues like tax fraud.

Furthermore, pdfFiller's collaborative features allow you to share documents with team members, ensuring that everyone involved in the process is equipped with the necessary information for effective reporting.

Frequently asked questions (FAQs) about tax fraud in South Carolina

Navigating tax fraud reporting can be complex, leading to common questions that many taxpayers have. For instance, if you’re uncertain whether to report, trust your instincts—if something seems off, it's better to investigate than to ignore.

Individuals often wonder about their anonymity when reporting fraud. While you can report anonymously, providing your contact information helps tax authorities follow up for more details if necessary.

Moreover, understanding the penalties that tax fraud perpetrators face can deter fraudulent behavior. Offenders may face substantial fines and even imprisonment, stressing the importance of honest tax practices.

Finally, it’s crucial to differentiate between myths and facts regarding tax fraud; being well-informed helps you stay vigilant and protect your financial interests.

Engaging with community efforts against tax fraud

Local initiatives to combat tax fraud are gaining momentum across South Carolina. Getting involved with organizations that focus on fighting fraud can help raise awareness and better inform the public on recognizing and reporting fraud.

Community resources for legal assistance in tax fraud cases are also available. Connecting with legal experts can provide invaluable support when navigating the complexities of a fraud case, ensuring that individuals have access to the best representation possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax fraudsouth carolina department?

Can I edit tax fraudsouth carolina department on an Android device?

How do I fill out tax fraudsouth carolina department on an Android device?

What is tax fraudsouth carolina department?

Who is required to file tax fraudsouth carolina department?

How to fill out tax fraudsouth carolina department?

What is the purpose of tax fraudsouth carolina department?

What information must be reported on tax fraudsouth carolina department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.