Get the free Mississippi Department of Revenue: Home

Get, Create, Make and Sign mississippi department of revenue

How to edit mississippi department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mississippi department of revenue

How to fill out mississippi department of revenue

Who needs mississippi department of revenue?

Mississippi Department of Revenue Form – A Comprehensive How-to Guide

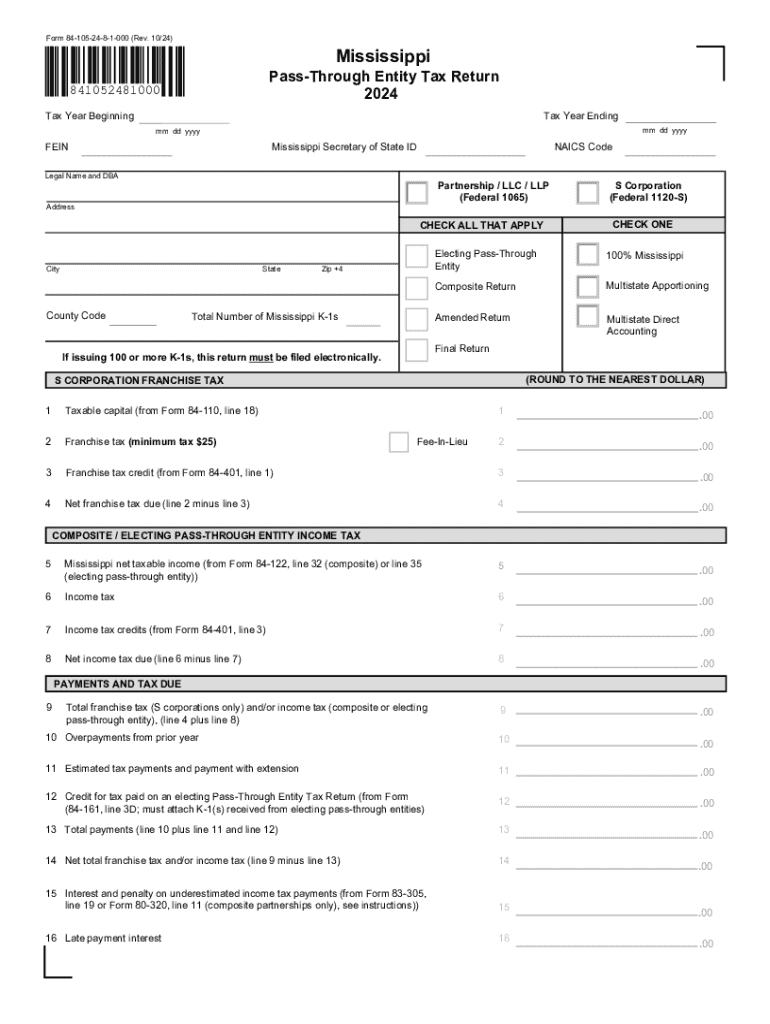

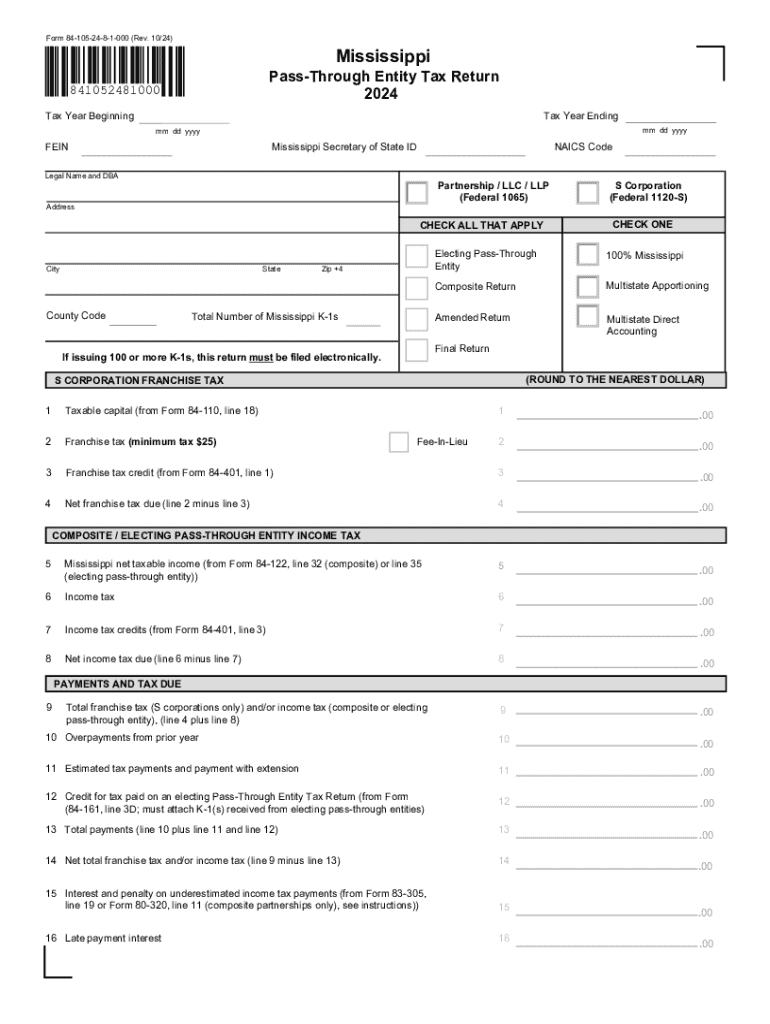

Overview of Mississippi Department of Revenue forms

The Mississippi Department of Revenue plays a crucial role in managing tax collections and ensuring compliance with state tax laws. Proper completion of forms is vital, as errors can lead to processing delays or financial penalties. Understanding the different types of forms available is essential for individuals and businesses alike.

Specific form insights: Mississippi Department of Revenue form

One of the key forms from the Mississippi Department of Revenue is the Income Tax Form, which is essential for both individuals and entities reporting their taxable income. The purpose of this form is to detail all earned income, deductions, and credits to accurately calculate tax liability.

Essentially, anyone who earns income in the state, whether resident or non-resident, needs to utilize this form. It is pivotal to adhere to the submission deadlines—typically April 15th for individuals and April 15th for businesses, ensuring compliance with state tax laws.

Detailed instructions for completing the Mississippi Department of Revenue form

Completing the Mississippi Department of Revenue form requires careful attention to detail. Here’s a step-by-step guide to ensure accuracy.

Breaking down the form section-by-section will help you highlight important areas to focus on. Watch out for common mistakes like miscalculating income or failing to include all relevant deductions.

To avoid errors, double-check your entries and consider utilizing tools like pdfFiller’s editing features to streamline the process.

Editing and customizing your form online

pdfFiller makes editing documents incredibly easy. It offers interactive tools that allow users to customize the Mississippi Department of Revenue form effortlessly.

By using these features, you can make sure your form is meticulously prepared for submission.

Signing and submitting your Mississippi Department of Revenue form

Once you’ve completed the form, you have options for signing it. Utilizing electronic signatures offers many advantages, including convenience and a faster processing time.

Each method has its pros and cons, so choose based on your convenience and urgency.

Managing and storing your forms with pdfFiller

After submission, it's important to manage your forms effectively. pdfFiller provides plenty of features for document organization.

These tools provide peace of mind and make managing official documents less overwhelming.

Troubleshooting common issues

Errors can occur during the form completion process. If you find discrepancies or issues, first review the form for any mistakes.

Staying proactive and seeking help will alleviate potential frustrations.

Community resources and forums for further assistance

Community forums can be a great resource for addressing unique issues and gaining insights from others who have experience with Mississippi Department of Revenue forms.

Engaging with the community can provide valuable perspectives that enhance your document-handling techniques.

Frequently asked questions about Mississippi Department of Revenue forms

Many users have questions regarding the process of filing Mississippi Department of Revenue forms. Here are some common queries.

Being informed can reduce anxiety and improve compliance.

The benefits of using pdfFiller

Employing pdfFiller in your document processes offers numerous benefits. The ability to manage documents from anywhere enhances efficiency considerably.

Overall, pdfFiller empowers users to handle their documentation needs efficiently and securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mississippi department of revenue in Gmail?

How can I modify mississippi department of revenue without leaving Google Drive?

Can I sign the mississippi department of revenue electronically in Chrome?

What is Mississippi Department of Revenue?

Who is required to file Mississippi Department of Revenue?

How to fill out Mississippi Department of Revenue?

What is the purpose of Mississippi Department of Revenue?

What information must be reported on Mississippi Department of Revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.