Get the free medicaid compliant annuity planning intake form - Krause Group

Get, Create, Make and Sign medicaid compliant annuity planning

Editing medicaid compliant annuity planning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out medicaid compliant annuity planning

How to fill out medicaid compliant annuity planning

Who needs medicaid compliant annuity planning?

Understanding the Medicaid Compliant Annuity Planning Form

Understanding Medicaid compliant annuities

A Medicaid compliant annuity is a financial product specifically designed to provide a steady stream of income while helping individuals qualify for Medicaid benefits. These annuities are structured in such a way that they comply with Medicaid's regulations, protecting assets especially for long-term care needs. By converting a lump sum of money into a guaranteed income, individuals can preserve their wealth while meeting Medicaid's eligibility criteria.

These annuities serve a crucial role in comprehensive financial planning, particularly as Americans age and face increasing healthcare costs. Understanding how these instruments work and their alignment with Medicaid rules is essential for anyone planning for potential long-term care or nursing home expenses.

The role of annuities in Medicaid planning

Annuities play a vital role in Medicaid planning as they provide a structured way to secure income while complying with state regulations. There are various types of annuities suitable for this purpose: immediate annuities, which start payments right away; deferred annuities, which delay payments until a future date; and fixed or variable annuities, which offer different levels of risk and return.

Each type of annuity has its own set of features, and selecting the right one is crucial to achieving financial stability during times of need. Medicaid compliant annuities are designed to ensure that the income generated is exempt from being counted as an asset when determining Medicaid eligibility. This means not only do individuals receive regular payments but they also adhere to the necessary guidelines set forth by Medicaid.

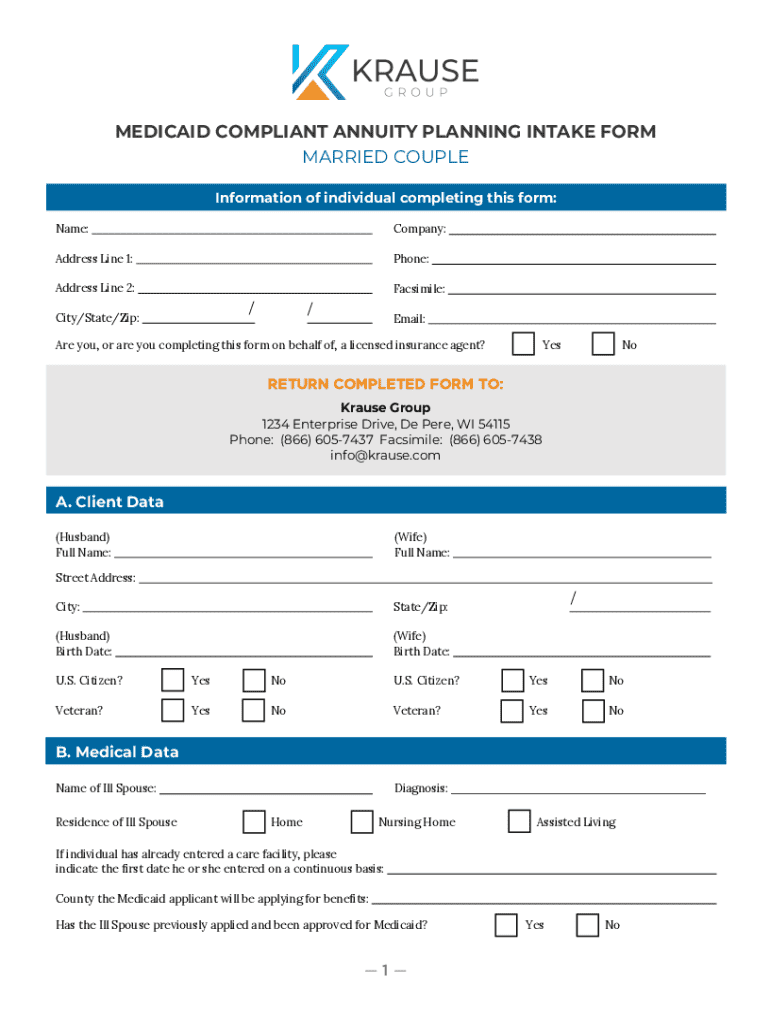

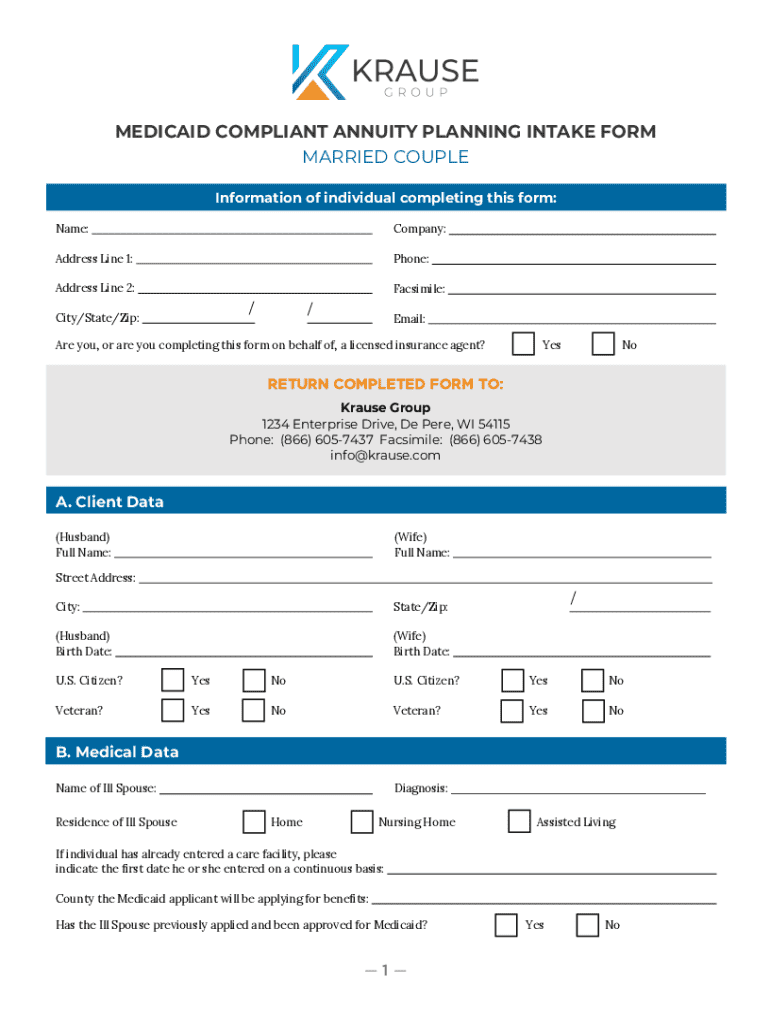

Overview of the Medicaid compliant annuity planning form

The Medicaid compliant annuity planning form is a critical document that helps individuals document their financial arrangements clearly and comprehensively. This form allows for a detailed breakdown of the annuity's terms, required under Medicaid regulations, ensuring that all relevant information is collected in a cohesive manner. By organizing this information, individuals can facilitate a smoother application process for Medicaid benefits.

Completing this form correctly is crucial, as it not only impacts eligibility but also the amount of assistance individuals may receive. The meticulous collection of information ensures that applicants avoid pitfalls that could result in delayed or denied benefits.

Step-by-step guide to completing the Medicaid compliant annuity planning form

Filling out the Medicaid compliant annuity planning form can be a straightforward task if approached methodically. Preparation is key, so gathering necessary documentation beforehand can simplify the process. Prepare a list of required documents, such as financial statements, previous Medicaid applications, and any other paperwork that illustrates your financial situation.

Beginning with personal information, ensure to provide your full name, address, and contact details. Next, provide a complete financial disclosure, including all income sources, assets, and debts you may have. Finally, detail the specifics of the annuity: its type, beneficiary designations, and payout structure.

After completing the form, carefully review each section for accuracy and completeness. Errors or omissions can lead to complications in the application process.

Tips for effective Medicaid compliant annuity planning

Collaborating with financial advisors is a prudent step when planning for Medicaid compliant annuities. These professionals bring deep knowledge of financial landscapes and Medicaid regulations that can greatly benefit the planning process. They can help guide you through the complexities of selecting the right annuity product that meets both personal financial goals and Medicaid compliance.

When engaging with advisors, expect to inquire about strategies, tax implications, and specific recommendations tailored to your circumstances. Additionally, staying informed about state regulations is paramount, as Medicaid can vary significantly by region. Resources such as official online state guides or contacting local Medicaid offices can provide valuable updates and changes.

Common challenges and how to overcome them

Navigating the complexities of financial planning, particularly with Medicaid compliant annuities, can present unique challenges. Individuals often face intricate financial scenarios that require personalized solutions. Examining various case studies can help illustrate how others have surmounted similar difficulties, providing valuable insights.

Another common hurdle lies in misunderstandings about annuity terms specifically concerning their income or withdrawal policies. Clarifying these terms with a financial expert can clear confusion and position one effectively within their available options.

Making the most of your Medicaid compliant annuity

The management of a Medicaid compliant annuity goes beyond initial setup; it requires continuous review and potential adjustments over time. Regular financial assessments allow individuals to adapt their plans based on evolving needs or changing Medicaid policies. Keeping track of both your financial landscape and any shifts in regulations can improve effectiveness.

Proactively anticipating potential changes in Medicaid policies helps prepare for necessary strategy adjustments down the line. As government regulations can shift, staying informed is crucial, and these adjustments can significantly affect long-term financial health.

Interactive tools and resources for Medicaid planning

Utilizing online resources can greatly enhance the understanding and efficacy of Medicaid compliant annuity planning. Online calculators to estimate annuity needs can help determine the coverage required to meet long-term care expenses effectively. These tools assist in bridging the gap between knowledge and practical application.

pdfFiller offers an array of educational materials, templates, and interactive tools aimed at empowering users in their Medicaid planning journey. The platform facilitates the seamless completion and management of necessary forms with its eSignature and document management features, providing a secure and efficient solution.

FAQs about Medicaid compliant annuities

When considering Medicaid compliant annuities, individuals often have numerous questions. Common inquiries include how these annuities work, their benefits, and potential drawbacks. A dedicated FAQ section can demystify the process, addressing concerns such as tax implications, the implications of asset transfers, and impacts on inheritances.

For further assistance, seeking guidance from local experts or reviewing official Medicaid resources can provide additional clarity and support throughout your planning journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the medicaid compliant annuity planning form on my smartphone?

How do I complete medicaid compliant annuity planning on an iOS device?

How do I fill out medicaid compliant annuity planning on an Android device?

What is medicaid compliant annuity planning?

Who is required to file medicaid compliant annuity planning?

How to fill out medicaid compliant annuity planning?

What is the purpose of medicaid compliant annuity planning?

What information must be reported on medicaid compliant annuity planning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.